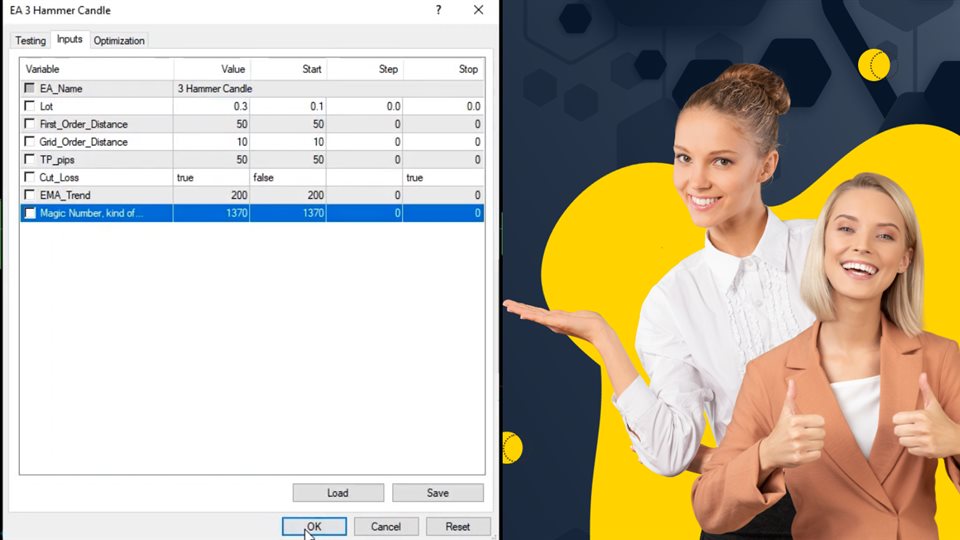

EA 3 Hammer Candlesticks

- Experts

- Zafar Iqbal Sheraslam

- Version: 1.0

- Activations: 10

The EA Three Hammer Candlesticks Strategy is a candlestick pattern-based trading strategy used in technical analysis to identify potential trend reversals in financial markets, particularly in stocks, forex, and commodities. The strategy focuses on three specific candlestick patterns: the Hammer, the Inverted Hammer, and the Shooting Star. These patterns can provide valuable information about market sentiment and potential price reversals.

Here's how the strategy works:

-

The Hammer:

- The Hammer is a bullish reversal pattern that forms after a downtrend.

- It consists of a small real body (the difference between the open and close prices) near the top of the candlestick, with a long lower shadow (the difference between the low and the open) and little to no upper shadow.

- The appearance of the Hammer suggests that sellers were initially in control but lost momentum, and buyers may be stepping in.

-

The Inverted Hammer:

- The Inverted Hammer is also a bullish reversal pattern but is found at the bottom of a downtrend.

- It looks similar to the Hammer but occurs after a downtrend and signals a potential reversal.

- It consists of a small real body near the top of the candlestick, a long upper shadow (the difference between the high and the close), and little to no lower shadow.

-

The Shooting Star:

- The Shooting Star is a bearish reversal pattern that appears at the top of an uptrend.

- It consists of a small real body near the bottom of the candlestick, a long upper shadow, and little to no lower shadow.

- The Shooting Star suggests that buyers initially had control but lost momentum, and sellers may be taking over.

Trading Strategy:

- To use this strategy, traders look for these candlestick patterns on a price chart. When they spot a Hammer, Inverted Hammer, or Shooting Star, they consider it a potential signal.

- A potential buy signal is generated when a Hammer or Inverted Hammer appears after a downtrend, suggesting a reversal. Traders may consider entering a long position.

- A potential sell signal is generated when a Shooting Star appears after an uptrend, suggesting a reversal. Traders may consider entering a short position.

It's important to note that while these patterns can provide valuable insights, they should not be used in isolation. Traders often use other technical indicators and analysis techniques to confirm their trading decisions and manage risk. Additionally, it's essential to consider the overall market context and not rely solely on candlestick patterns for trading decisions. Risk management and proper position sizing are crucial for successful trading with this strategy.