EA Macd Martingale

- Experts

- Zafar Iqbal Sheraslam

- Version: 1.0

- Activations: 10

Creating a trading strategy using the Moving Average Convergence Divergence (MACD) indicator can be a powerful tool for traders looking to identify trends and potential entry/exit points in the financial markets. Here's a simple MACD-based trading strategy:

Strategy Name: MACD Trend-Following Strategy

Timeframe: This strategy can be applied to various timeframes, but it's commonly used on daily or 4-hour charts.

Indicators:

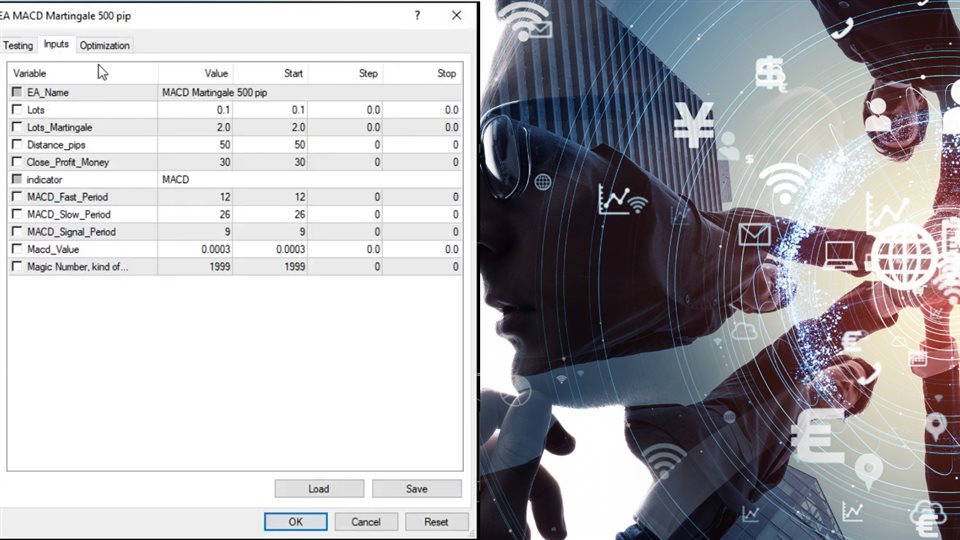

- MACD (Moving Average Convergence Divergence): This consists of three components - the MACD line, the signal line, and the histogram. You can use the default settings (usually 12, 26, 9) or adjust them based on your preference.

Entry Rules:

- Bullish Signal: Look for a bullish crossover when the MACD line crosses above the signal line. This suggests a potential uptrend is starting.

- Bearish Signal: Look for a bearish crossover when the MACD line crosses below the signal line. This suggests a potential downtrend is starting.

Exit Rules:

-

Bullish Exit: There are several ways to exit a long position:

- When the MACD line crosses below the signal line, indicating a potential trend reversal.

- When the MACD histogram starts to decline, suggesting weakening bullish momentum.

- Implement a trailing stop loss to protect profits and ride the trend as long as possible.

-

Bearish Exit: There are several ways to exit a short position:

- When the MACD line crosses above the signal line, indicating a potential trend reversal.

- When the MACD histogram starts to rise, suggesting weakening bearish momentum.

- Implement a trailing stop loss to protect profits and ride the trend as long as possible.

Risk Management:

- Use proper risk management techniques like setting stop-loss orders to limit potential losses.

- Calculate your position size based on your risk tolerance and the distance to your stop-loss level.

Additional Tips:

- Consider using other technical and fundamental analysis tools to confirm MACD signals.

- Avoid trading in choppy or sideways markets, as MACD is most effective in trending markets.

- Regularly review and adapt your strategy to changing market conditions.

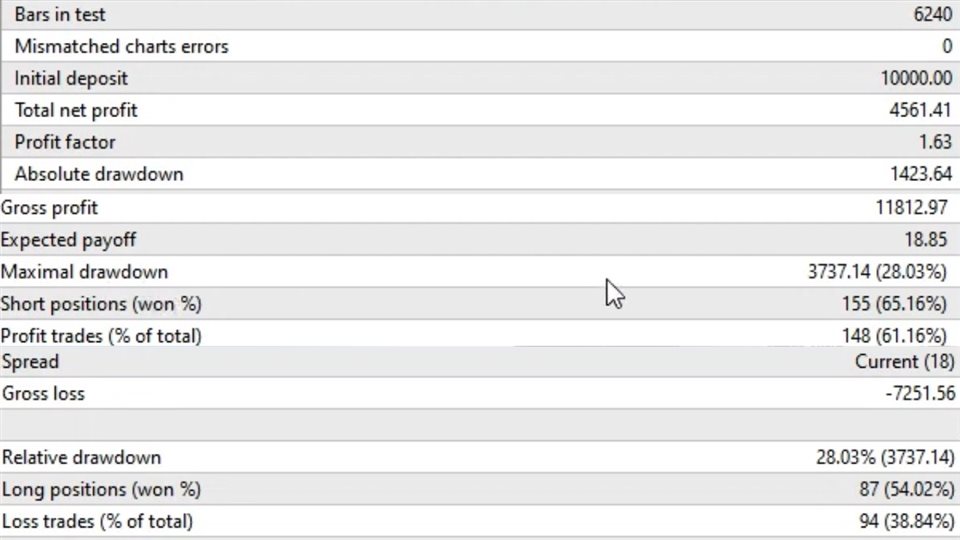

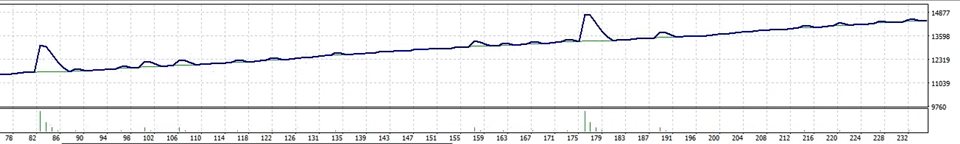

Remember that no trading strategy is foolproof, and there is always a risk of losing capital in the financial markets. It's essential to practice responsible risk management and backtest your strategy on historical data before implementing it with real money. Additionally, consider using a demo account to gain experience and confidence with your MACD-based strategy before trading live.