EA STO Stochastic Oscillator

- Experts

- Zafar Iqbal Sheraslam

- Version: 1.0

- Activations: 10

The Stochastic Oscillator EA is a popular technical indicator used in financial markets, particularly in trading and investing. It helps traders and analysts assess the momentum and potential reversal points of an asset's price. Here's a brief explanation of the Stochastic Oscillator, often referred to as the Stochastics or simply Stoch:

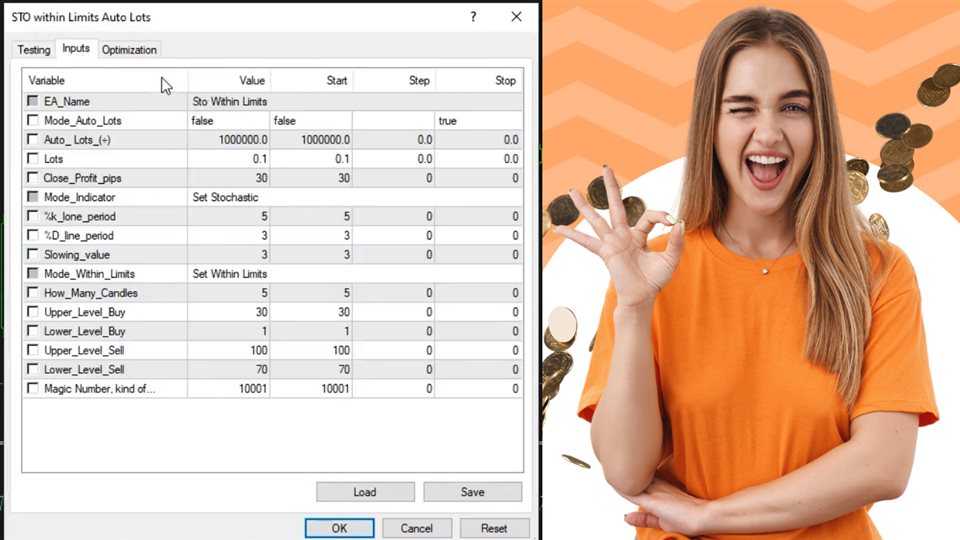

Definition: The Stochastic Oscillator is a momentum indicator that compares an asset's closing price to its price range over a specified period, typically 14 periods. The indicator consists of two lines: the %K line and the %D line.

Components:

-

%K Line: This is the faster line and represents the current closing price's position relative to the high-low range over the specified period. The formula for %K is:

%K = [(Closing Price - Lowest Low) / (Highest High - Lowest Low)] * 100

The %K line moves within a range of 0 to 100 and is sensitive to short-term price fluctuations.

-

%D Line: This is the slower, smoothed version of the %K line and is calculated by taking a simple moving average (SMA) of the %K values over a specific number of periods (usually 3). The formula for %D is:

%D = SMA(%K, 3)

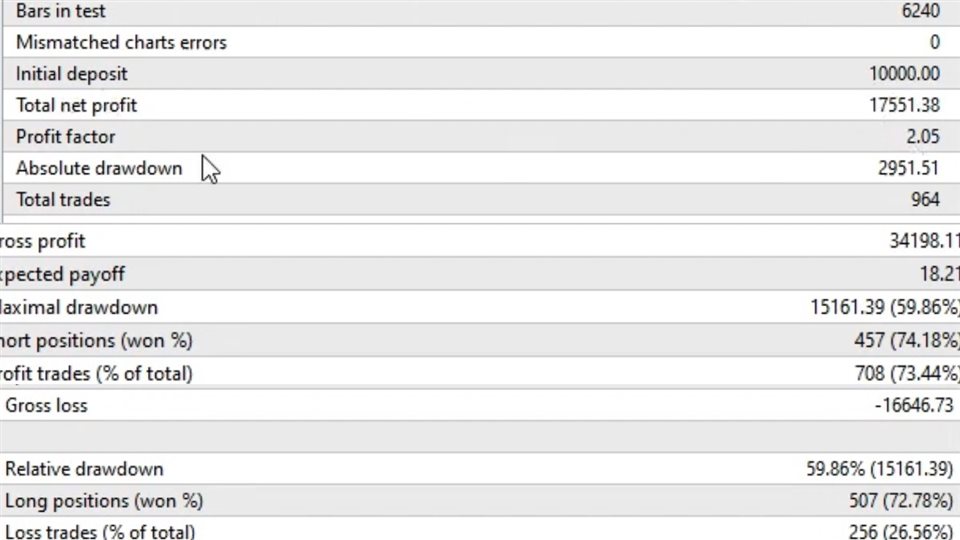

Interpretation: The Stochastic Oscillator provides signals to traders based on overbought and oversold conditions and potential bullish or bearish divergences.

-

Overbought: When the %K line rises above 80, it indicates that the asset is overbought, suggesting a potential downward reversal or correction.

-

Oversold: When the %K line falls below 20, it indicates that the asset is oversold, suggesting a potential upward reversal or bounce.

-

Bullish Divergence: When the price of the asset makes a lower low, but the Stochastic %K makes a higher low, it can signal a potential bullish reversal.

-

Bearish Divergence: When the price of the asset makes a higher high, but the Stochastic %K makes a lower high, it can signal a potential bearish reversal.

Traders often use Stochastic Oscillator signals in conjunction with other technical analysis tools and market information to make informed trading decisions.

It's important to note that the Stochastic Oscillator, like any technical indicator, has its limitations and should be used in conjunction with other forms of analysis and risk management techniques when making trading decisions.