EA Fractals Alligator

- Experts

- Zafar Iqbal Sheraslam

- Version: 1.0

- Activations: 10

The EA Fractals Alligator strategy is a trading strategy popularized by Bill Williams, a famous trader and author of the book "Trading Chaos." It is a part of his broader trading system called the "Chaos Theory" and is based on the use of three moving averages, which he refers to as the "Alligator."

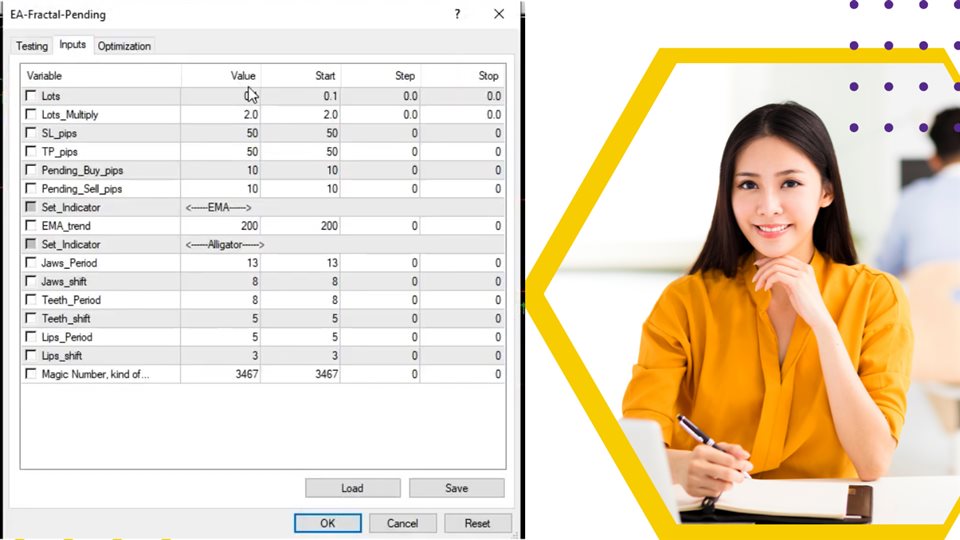

The Alligator consists of the following three moving averages:

-

Alligator's Jaw (Blue Line): This is a 13-period Smoothed Moving Average (SMA) moved 8 bars into the future.

-

Alligator's Teeth (Red Line): This is an 8-period Smoothed Moving Average (SMA) moved 5 bars into the future.

-

Alligator's Lips (Green Line): This is a 5-period Smoothed Moving Average (SMA) moved 3 bars into the future.

The strategy uses these moving averages to determine the state of the market and make trading decisions. Here's how it works:

1. Alligator Awakening: When the three lines are intertwined and close together, the Alligator is said to be "sleeping." This indicates a period of consolidation in the market, and traders should avoid making new trades.

2. Alligator Eating: When the Alligator lines start to spread apart, it is considered to be "awakening" and preparing to "eat." This is a signal that the market is trending, and traders should look for opportunities to enter trades in the direction of the trend.

-

Bullish Trend: If the Alligator's Lips (Green) crosses above the Teeth (Red) and both are above the Jaw (Blue), it's a signal to go long (buy).

-

Bearish Trend: If the Alligator's Lips (Green) crosses below the Teeth (Red) and both are below the Jaw (Blue), it's a signal to go short (sell).

3. Alligator Satiated: When the three lines start to converge again, it means the trend is losing momentum, and traders should consider exiting their positions or taking profits.

It's important to note that the Alligator strategy is a trend-following strategy, and it works best in trending markets. In choppy or sideways markets, it may generate false signals.

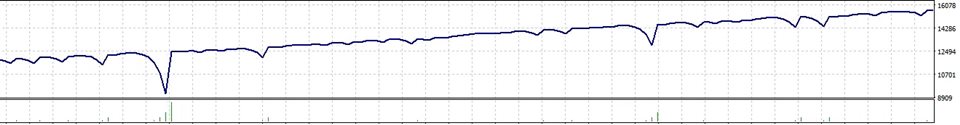

Traders often use additional technical analysis tools and risk management strategies in conjunction with the Alligator to make more informed trading decisions. As with any trading strategy, it's essential to practice risk management and use proper position sizing to protect your capital. Additionally, backtesting and demo trading can help you gain confidence in using the Alligator strategy before applying it to a live trading account.