EA CCI Indicator

- Experts

- Zafar Iqbal Sheraslam

- Version: 1.0

- Activations: 10

Certainly, I can explain a trading strategy using the EA of Commodity Channel Index (CCI) indicator. The CCI is a popular technical analysis tool used by traders to identify potential trend reversals, overbought, or oversold conditions in a market. Here's a basic CCI indicator strategy:

Strategy Overview: The CCI indicator oscillates around a zero line, providing signals based on its position relative to this line. This strategy involves using CCI to identify potential trend reversals and overbought/oversold conditions.

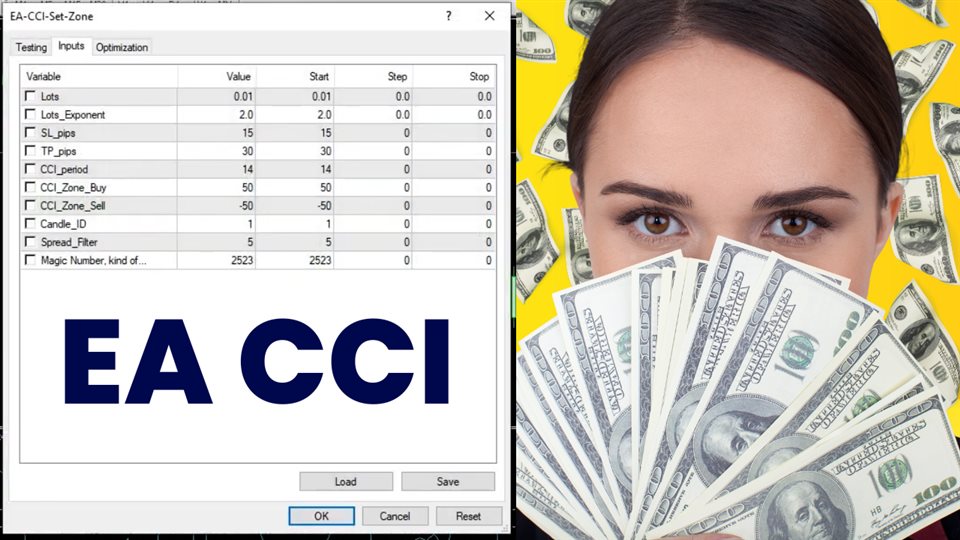

Indicators Used:

- Commodity Channel Index (CCI): Usually, traders use a period of 14 for CCI, but you can adjust it based on your preference and the asset you're trading.

Trading Rules:

1. Overbought and Oversold Conditions:

- When CCI crosses above +100, it suggests an overbought condition, indicating that the price may be due for a downward correction. Consider this a potential sell signal.

- When CCI crosses below -100, it suggests an oversold condition, indicating that the price may be due for an upward correction. Consider this a potential buy signal.

2. Trend Reversal:

- Look for divergences between the CCI indicator and the price chart. If the CCI makes higher highs while the price makes lower highs (bullish divergence), or if the CCI makes lower lows while the price makes higher lows (bearish divergence), it can signal a potential trend reversal.

3. Confirmation:

- Don't rely solely on CCI signals; use additional confirmation tools such as candlestick patterns, support and resistance levels, or other technical indicators.

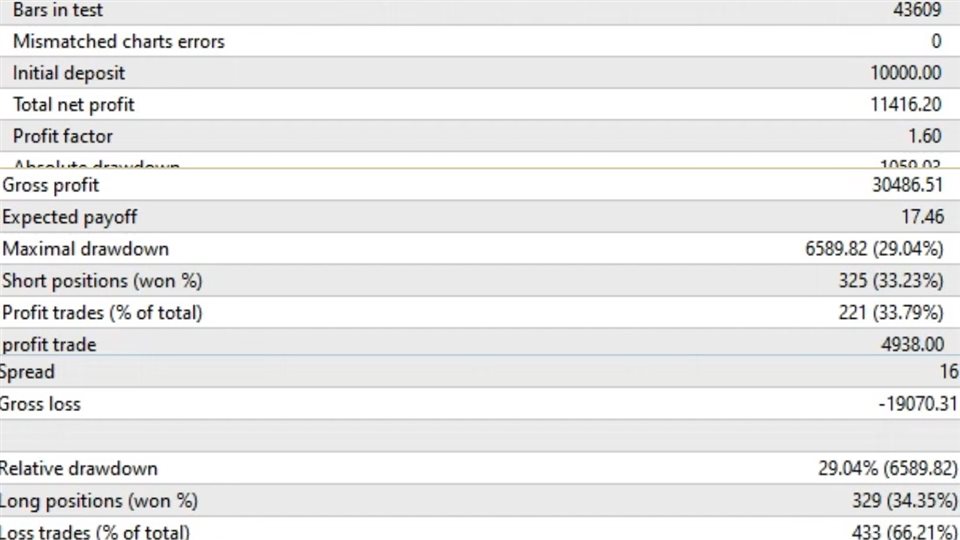

4. Risk Management:

- Set stop-loss orders to limit potential losses.

- Use proper position sizing to manage risk. Avoid risking more than a certain percentage of your trading capital on a single trade.

5. Exit Strategy:

- Determine your exit strategy based on your trading goals. It could be a fixed target price, a trailing stop, or another indicator signal.

Example: Let's say you're trading a stock. When the CCI crosses above +100 and you observe a bearish divergence between the CCI and the price chart, this could be a strong signal to sell. Conversely, when CCI crosses below -100 and you observe a bullish divergence, it could be a good signal to buy.

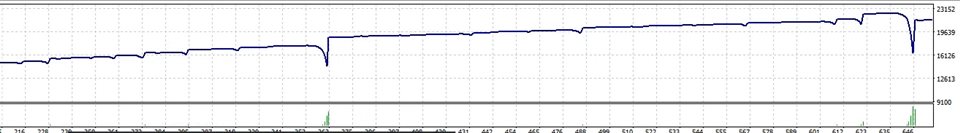

Remember that no trading strategy is foolproof, and it's essential to practice risk management and use proper analysis to make informed decisions. Additionally, historical performance does not guarantee future results, so always conduct thorough research and consider other factors when trading.