Real Quants Forex volatility catcher

- Experts

- Olesia Lukian

- Version: 3.5

Real Quants Forex Volatility Catcher for MT5

Introduction

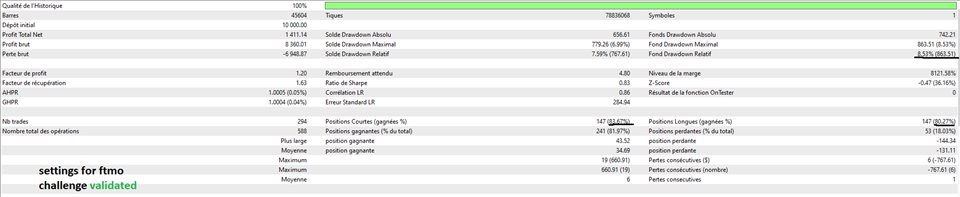

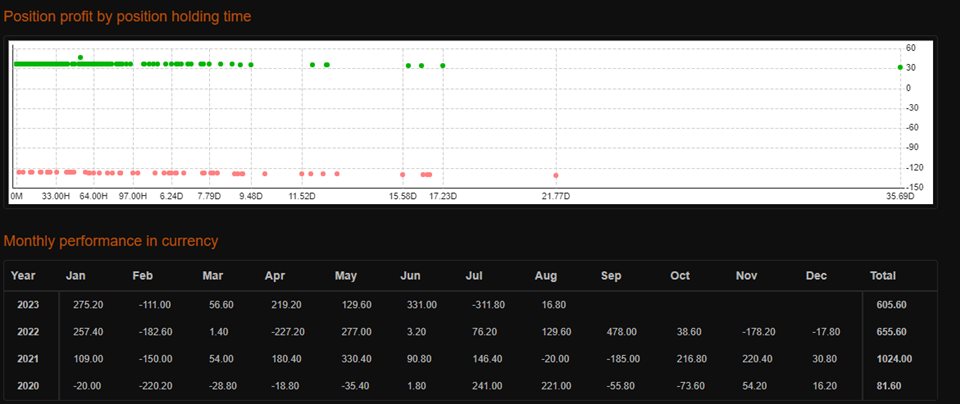

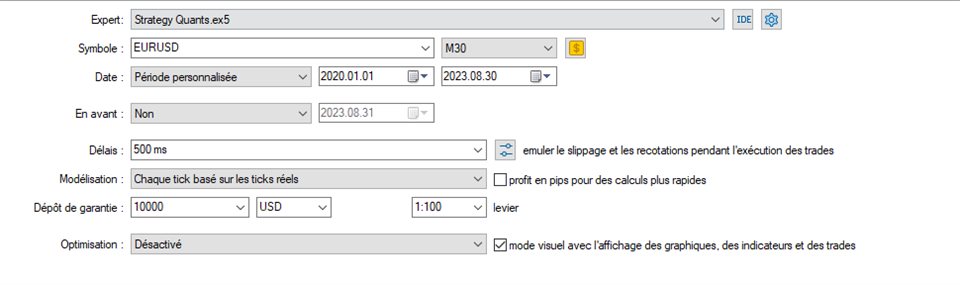

Real Quants Forex Volatility Catcher is a cutting-edge automated trading system designed specifically for MetaTrader 5. Developed through advanced machine learning and exhaustive data mining techniques, this system offers traders a robust strategy for navigating the complex terrains of the forex markets. With a commitment to rigorous testing that includes Monte Carlo simulations, walk-forward matrix optimization, and live execution validation, this strategy sets a new standard in trading system performance.

Key Features

-

Machine Learning & Data Mining: Utilizes complex algorithms and exhaustive data mining to create a top-tier trading strategy.

-

Multi-currency Compatibility: Effective on a mixed basket of 18 out of 20 minor and major forex pairs, giving you a diverse trading portfolio.

-

Live Execution Validation: Backed by rigorous verification through 20 live market trades, ensuring unmatched real-world effectiveness.

The Power of Data Mining

The bedrock of this strategy is data mining. This process allows the system to sift through immense volumes of data, revealing intricate patterns and relationships that traditional methods could easily overlook.

Advantages of Data Mining in Forex:

- Pattern Recognition: Identifies complex market behaviors often hidden from standard analysis.

- Risk Mitigation: Advanced predictive analytics offer enhanced risk management.

- Enhanced Profitability: By uncovering latent market trends, new profit-making opportunities become accessible.

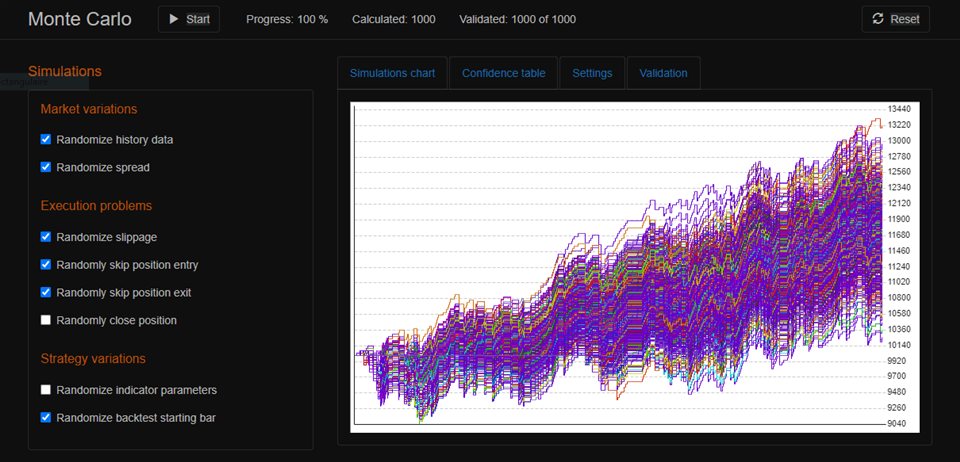

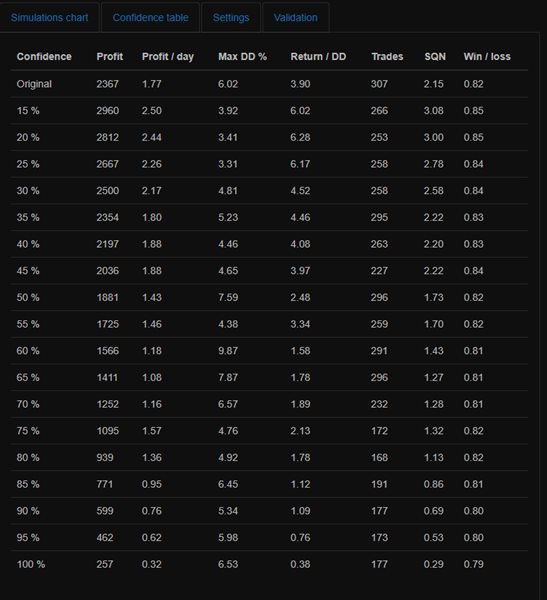

Comprehensive Monte Carlo Testing

Monte Carlo simulations were leveraged to affirm the system's robustness and resilience across various scenarios.

Parameters of Monte Carlo:

-

Randomized History Data: Protects against overfitting by testing the strategy on variable historical data.

-

Randomized Spread and Slippage: Offers more reliable tests against variables like slippage or higher commissions.

-

Random Entry and Exit Points: Ensures that the strategy isn't overly dependent on a few favorable trades.

-

Random Start Bar: Validates that the system works effectively when started at different points in the data set.

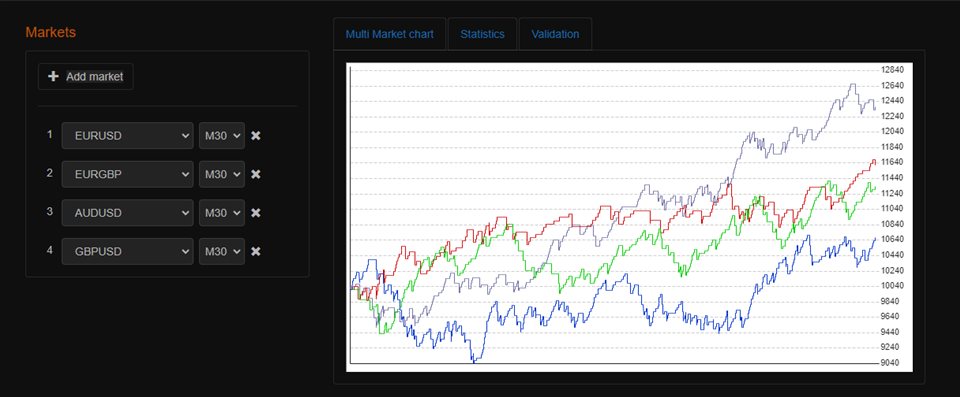

Multi-Currency Testing

Real Quants Forex Volatility Catcher stands out for its ability to adapt across different currency pairs. This feature allows traders to diversify their portfolios without losing effectiveness.

Highlights:

-

Core Pairs: Initially tested on less volatile major pairs like EUR/USD, USD/CAD, USD/CHF, and EUR/GBP.

-

Broad Scope: The strategy also excelled when tested against a mixed basket of 18 out of 20 minor and major forex pairs.

Walk-Forward Matrix and Adaptability

The strategy also scores highly on adaptability, courtesy of its positive walk-forward matrix testing. While this means the strategy can improve its value over time through optimization, users are advised to be careful during the optimization phase to avoid curve-fitting.

Market Conditions

The system has displayed robustness even under challenging market conditions, including events like the COVID-19 crisis.

Special Notes

- This system doesn't employ risky methods such as grid or Martingale and relies on fixed SL and TP. It's designed specifically for the EUR/USD 30-min chart.

Conclusion

Real Quants Forex Volatility Catcher sets a new bar in scientific rigor and adaptability within automated trading. Its solid data-mining foundation and meticulous testing parameters make it the go-to option for traders who are aiming for both consistent and diversified gains in the forex market.

This EA is a find here at mql5. Firstly, it is free and its creator also responds quickly. This EA is much better than many EAs that are ranked in the top positions of MQL5 and that are paid. You won't regret testing and using this excellent EA.