RSI crossmarket

- Experts

- Yoan, Sylvain Biesuz

- Version: 2.93

- Mise à jour: 26 juillet 2023

- Activations: 20

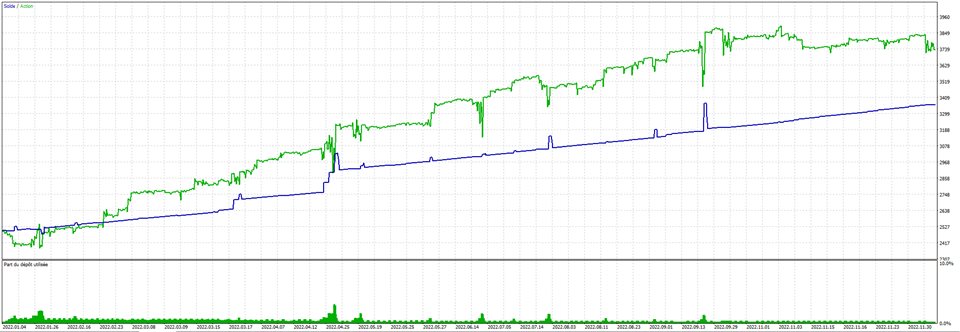

diversification to sleep well

Designed for the purpose of long-term portfolio management

The strategy uses a martingale approach and hedging, which helps to avoid staying with low drawdown.

As mentioned earlier, due to its relatively low average drawdown, it is designed to be used on allmost major and minor currency, index and commodities in the market.

you can vary the take profit from 0.01 to 0.5 with the basic settings

Forex Pairs accept : NZDUSD,AUDUSD,USDCHF,GBPUSD,USDSGD,USDCAD,EURUSD,AUDNZD,AUDCAD,AUDCHF,EURAUD,EURJPY,AUDJPY,EURGBP,EURCHF,EURNZD,EURCAD,CADCHF,GBPCHF,GBPJPY,GBPAUD,GBPNZD,CADJPY,NZDCHF,NZDCAD,NZDJPY

Commodities accept : XAGUSD, XPTUSD, XAUUSD

Index accept : US500, US30,F40,STOXX50,AUS200,JP225,UK100,DE40

It is not necessary to launch all the markets at the same time, build your own Portfolio in order to have one that suits you

- Time frame 5 min

- 1min OHLC friendly

update :

- Added anti-crash security, 2 stop orders at 5% of the open weekly to prevent strong impulses

- Modification to allow different modeling

- Modification momentum check

- Added long-term part for hedge short-term part

Very interesting and efficient robot on the different back tests of previous years. The developer is responsive and available to answer different questions and settings. Do not hesitate to contact him.