Tâche terminée

Spécifications

M15 Day Trade Strategy

How it works.

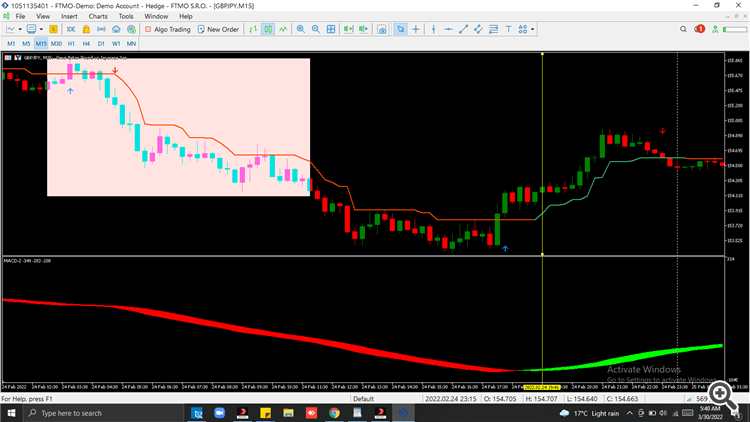

BUY CONDITION

The price (Candle body) must close above (Break Above) the Asian box, on M15 time frame.

If the box is broken with a wick, only enter after a candle body closes above the wick.

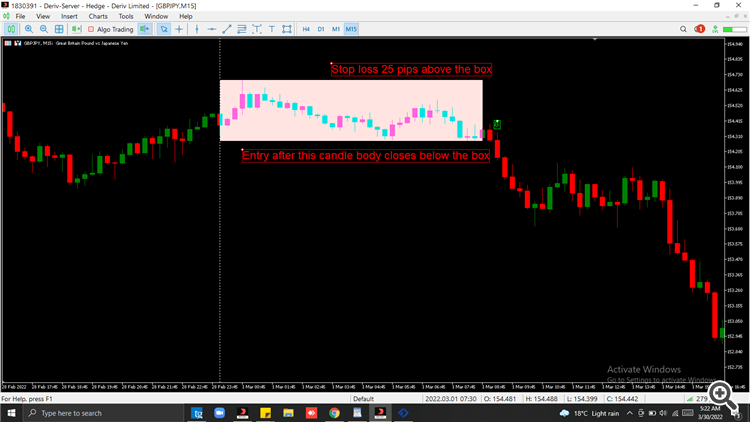

The Stop Loss should be about 25 pips below the box, and the risk should be calculated . ( The percentage risk should be left open for the trader to manually put it in) of the balance.

Option 1 for position size

When the position size(Lot size) is determined after risk calculation, it should be divided into 3 positions( Not equally).

Lot size= 0.4

The lot size will be divided as follows:

I will divide the lot size first into half (0.4/2) which will give me 0.2 and another 0.2. Then I will divide one 0.2 again by 2. So I will have 0.2, 0.1 and 0.1.

The first Take profit will be once the market get's to half of the pips risked. In this case, once the market gets to plus 80 pips, the first 2 positions ( 0.2 and 0.1 ) will close, and the other (0.1) position will be left to run.

When the market gets to a ratio of 1:1 risk to reward, the remaining open position should be put trailing stop loss at break even.

Option 2 for position size

The position size should be calculated as normal and only one position placed, stop loss and exit rules will be followed as well.

Option 3 for position size

The position size should be calculated as normal and only one position placed, stop loss and exit rules will be followed as well. Once the risk to reward ratio get's to 1:1, the EA should close half the position.

Only 2 entry signals can be entered per day-So if the buys, fail, one can enter sells but if this fails as well, no more trades for the day.

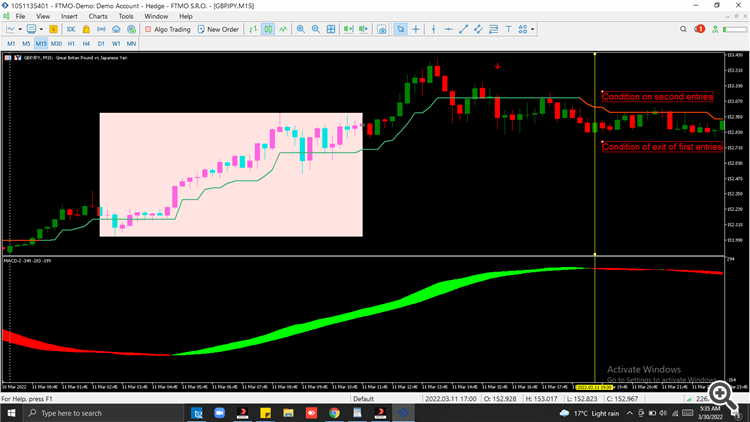

2nd position entry conditions.

If the buy trade is exited with a negative, in all positions or the one that was left to run, then we will enter a sell and the stop loss will be put on the most recent high 25pips away. The position size will be calculated , and the rules of the first take profit will also apply here. The exit conditions and trailing stop loss conditions will apply to this positions as well.

No trade should be entered after London session closes.

2. Exit when the stop loss is hit.

Trailing conditions

When the market gets to a ratio of 1:1 risk to reward, the remaining open position should be put trailing stop loss at break even.

SELL CONDITIONS

The price (Candle body) must close below Asian box, on M15 time frame.

If the box is broken with a wick, only enter after a candle body closes below the wick.

The lot size calculations should be followed as well.

Only 2 entry signals can be entered per day-So if the sells, fail, one can enter buys but if this fails as well, no more trades for the day.

2nd position entry conditions.

No trade should be entered after London session closes.

Exit conditions

2. Exit when the stop loss is hit.

Trailing conditions

When the market gets to a ratio of 1:1 risk to reward, the remaining open position should be put trailing stop loss at break even.

NB: IMPORTANT POINTS TO NOTE AGAIN

- For the first entry, we're only looking at the candle breaking above or below the Asian Box , with a candle body , then we enter with the opening of the next candle.

- If the box is broken with a wick, then we have to enter with a candle that closes above or below the wick, depending on the side it broke.

- Kindly put EA restrictions for me as well as make the indicators open to setting modification.

- If the trend continues to the next day and the previous trade is still running, let it continue running and let the robot still take the new trades of the day as per the buy or sell conditions, trailing conditions and exit when the exit conditions are met.

- Only 2 entry signals can be entered per day-So if the buys fail, the EA will enter sells but if this fails as well, no more trades to be entered for the day.

- When the market gets to a ratio of 1:1 risk to reward, the remaining open position should be put trailing stop loss at break even.

- The EA can only take a second trade, if the first trade exited with a negative.

- No trade should be entered after London Session closes.

- Only show the Asian box and leave the other sessions boxes.

- Only show the MACD cloud and mark the colors of the others as none.

Lot size Options

Kindly put an option that I can use which lot size rule to use.

- Option 1 for lot size.

For example: Position size calculation

The first Take profit will be once the market get's to half of the pips risked. In this case, once the market gets to plus 80 pips, the first 2 positions (0.3 and 0.15)will close, and the other one position will be left to run.

- Option 2 for lot size.

- Option 3 for position size

The position size should be calculated as normal and only one position placed, stop loss and exit rules will be followed as well. Once the risk to reward ratio get's to 1:1, the EA should close half the position