Rejoignez notre page de fans

- Vues:

- 136

- Note:

- Publié:

-

Besoin d'un robot ou d'un indicateur basé sur ce code ? Commandez-le sur Freelance Aller sur Freelance

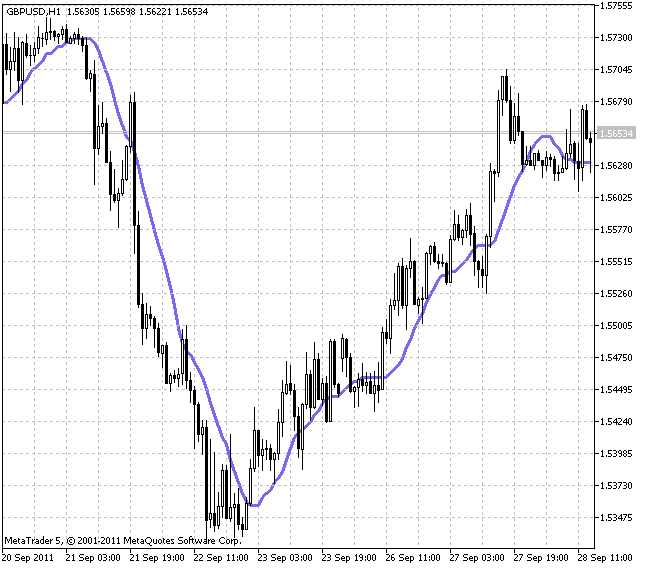

Dans cet indicateur, ses valeurs sont corrigées à l'aide de l'algorithme NRTR(Nick Rypock Trailing Reverse) pour rendre la moyenne mobile plus directionnelle.

L'Expert Advisor GODZILLA, qui a remporté la troisième place à l'Automated Trading Championship 2006, est basé sur l'algorithme NRTR. Automated Trading Championship 2006 était un système de trading breakout basé sur les relevés de cet indicateur.

Les algorithmes de calcul de moyenne peuvent être modifiés à l'aide de dix variantes possibles :

- SMA - moyenne mobile simple ;

- EMA - moyenne mobile exponentielle ;

- SMMA - moyenne mobile lissée ;

- LWMA - moyenne mobile linéaire pondérée ;

- JJMA - moyenne adaptative JMA ;

- JurX - moyenne ultralinéaire ;

- ParMA - moyenne parabolique ;

- T3 - lissage exponentiel multiple de Tillson ;

- VIDYA - calcul de la moyenne à l'aide de l'algorithme de Tushar Chande ;

- AMA - calcul de la moyenne à l'aide de l'algorithme de Perry Kaufman.

Il convient de noter que les paramètres Phase1 et Phase2 ont des significations très différentes selon les algorithmes de calcul de la moyenne. Pour JMA, il s'agit de la variable externe Phase, variant de -100 à +100. Pour T3, il s'agit du facteur de calcul de la moyenne multiplié par 100 pour une meilleure perception, pour VIDYA, il s'agit de la période de l'oscillateur CMO et pour AMA, il s'agit de la période de l'EMA lent. Dans les autres algorithmes, ces paramètres n'affectent pas le calcul de la moyenne. Pour AMA, la période de l'EMA rapide est fixe et égale à 2 par défaut. Le facteur de degré pour AMA est également égal à 2.

L'indicateur utilise les classes de la bibliothèque SmoothAlgorithms.mqh (copiez-les dans le répertoire terminal_data_terminal_directory\MQL5\Include), une description détaillée de leur utilisation a été publiée dans l'article "Averaging price series without additional buffers for intermediate calculations".

Paramètres d'entrée de l'indicateur :

//+-----------------------------------+ //|| Paramètres d'entrée de l'indicateur //+-----------------------------------+ input Smooth_Method MA_Method1=MODE_SMA; // Première méthode de lissage input int Length1=12; // Profondeur du premier lissage input int Phase1=15; // Premier paramètre de lissage //---- pour JJMA Phase1 varie dans l'intervalle -100 ... +100, affecte la qualité du processus transitoire ; //---- pour VIDIA la phase 1 est la période CMO, pour AMA c'est la période de ralentissement. input Smooth_Method MA_Method2=MODE_JJMA; // Deuxième méthode de lissage input int Length2= 5; // Profondeur du second lissage input int Phase2=15; // Deuxième paramètre de lissage //---- pour JJMA Phase2 varie dans l'intervalle -100 ... +100, affecte la qualité du processus transitoire ; //---- pour VIDIA la phase 2 est la période CMO, pour AMA c'est la période de ralentissement. input Applied_price_ IPC=PRICE_CLOSE; // Constante de prix /* l'indicateur est calculé à ce prix ( 1-CLOSE, 2-OPEN, 3-HIGH, 4-LOW, 5-MEDIAN, 6-TYPICAL, 7-WEIGHTED, 8-SIMPLE, 9-QUARTER, 10-TRENDFOLLOW, 11-0.5 * TRENDFOLLOW). */ input uint Step=30; // Taille des fluctuations plates //---- ce paramètre définit la taille des fluctuations considérées comme plates (pas d'échantillonnage numérique en points). input uint Max_DEV=55; // Limiter l'écart de prix par rapport à la X2MA qui ne modifie pas la valeur de la moyenne input int Shift=0; // Décalage horizontal de l'indicateur en barres input int PriceShift=0; // Décalage vertical de l'indicateur en points

Traduit du russe par MetaQuotes Ltd.

Code original : https://www.mql5.com/ru/code/573

ChartObjectsCopyPaste

ChartObjectsCopyPaste

Copier et coller les objets graphiques sélectionnés entre les graphiques via le presse-papiers de Windows sous forme de texte. Utilisez Ctrl+Q sur un graphique source, puis Ctrl+J sur un graphique cible.

iBeta

iBeta

Indicateur de covariance, de corrélation et de coefficient bêta de deux symboles.

Chasseur de résonance

Chasseur de résonance

Un système expert multidevises analysant les phénomènes de résonance sur des actifs financiers liés.

Momentum adaptatif lissé

Momentum adaptatif lissé

Adaptive Momentum du livre de John Ehlers "Cybernetic Analysis for Stocks and Futures : Cutting-Edge DSP Technology to Improve Your Trading" (Analyse cybernétique pour les actions et les contrats à terme : technologie DSP de pointe pour améliorer votre trading).