Rejoignez notre page de fans

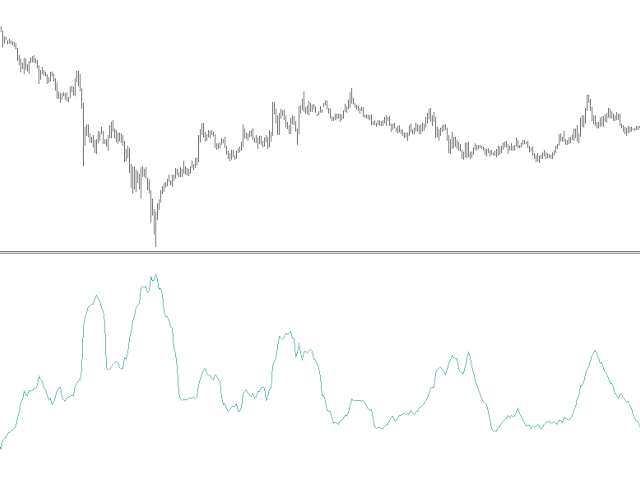

ATR without iATR() with smoothing Wilder by William210.mq5 - indicateur pour MetaTrader 5

- Vues:

- 89

- Publié:

- 2024.06.29 09:11

-

Besoin d'un robot ou d'un indicateur basé sur ce code ? Commandez-le sur Freelance Aller sur Freelance

Good morning.

If this code malfunctions for whatever reasons, forgetting or MQL5 upgrades, let me know so I can correct it, thank you

You can find all my multi timeFrame indicator codes or not, in CodeBase or on the Marketplace, free or purchasable, by searching for "William210".

Why this code?

The Average True Range (ATR) indicator, developed by J. Welles Wilder in 1978, allows traders to measure the volatility of an asset by averaging the largest True Ranges over a given period. This information is valuable for understanding price movements and identifying trading opportunities.

Remember that the original ATR indicator from 1978 did not include this smoothing.

Wilder Smoothing was later introduced and helps smooth out fluctuations in the ATR indicator, making it easier to analyze. This is a simple moving average applied to ATR values, usually over a 14-period period.

May this code help you

Don't forget to put a star and ask me as a friend to be the first to be notified when my code is published in codebase or the marketplace

I wrote other simple codes in CodeBase:

I offer many of these indicators in the Marketplace, search for me "William210"

Adaptative moving average using iama()

The ATR is very useful for other indicators, such as SuperTrend which I offer in the marketplace

Awesome oscillator without iao()

Bands bollinger using ibands()

Moving average using ima(), using the native functions SimpleMA(), ExponentialMA(), SmoothedMA(), LinearWeightedMA()

I offer many multi-timeframe smoothing options in the marketplace.

Simple average => EMA, SMA, EMA, SMMA, LWMA

Volume-weighted averages, VWMA, VEMA, EVWMA

double and more exponential Average, DEMA

Stochastic using istochastic()

If you have code ideas to help or serve as a basis, request it on this thread

Linear Regression Line (apply to)

Linear Regression Line (apply to)

Linear regression line with an option to be applied to another indicators

Linear Regression Line

Linear Regression Line

Linear Regression Line

ATR classic therefore without iATR by William210

ATR classic therefore without iATR by William210

This code does not trace the iatr() because the iatr() or this code is a more modern version. This code uses original smoothing, a kind of SMA and not wilder smoothing. The analysis of the two smoothings can suggest opportunities elsewhere

Bollinger Bands with pre outer band smoothing

Bollinger Bands with pre outer band smoothing

Bollinger Bands with controllable outer band smoothing (pre smoothing)