Rejoignez notre page de fans

- Publié par:

- Nikolay Kositsin

- Vues:

- 9294

- Note:

- Publié:

- 2011.09.27 13:08

- Mise à jour:

- 2016.11.22 07:32

-

Besoin d'un robot ou d'un indicateur basé sur ce code ? Commandez-le sur Freelance Aller sur Freelance

Real author:

John Tirone

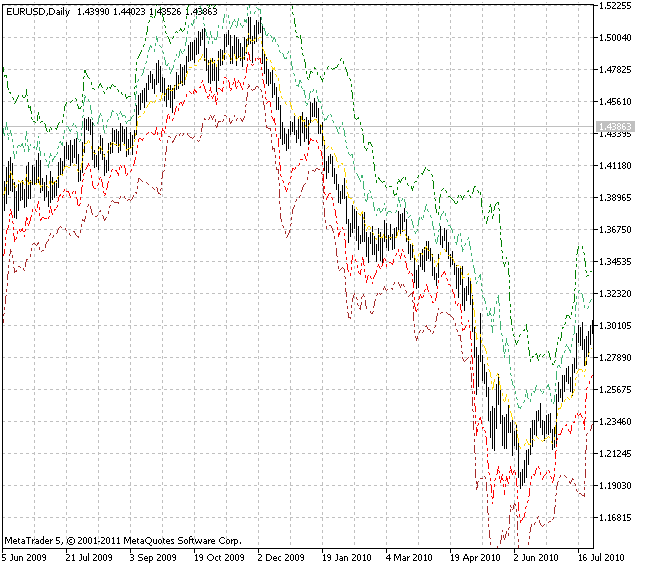

Tirone Levels are a series of several successively decreasing horizontal lines used to determine possible support and resistance areas on a price chart.

This technical analysis method is developed by John Tirone in his book "Classical Technical Analysis as a Powerful Trading Methodology". The system based on five Tirone levels is constructed using the Adjusted Mean method.

This method generates 5 often non-symmetrical lines.

- Adjusted average value (Adjusted Mean) is found at first;

- The next line is found by deducting the minimum from the Adjusted Mean multiplied by 2;

- The third line is the Adjusted mean itself (adjusted average);

- The next line is calculated by deducting the maximum from the Adjusted Mean multiplied by 2;

- The lowest line is calculated by deducting the minimum from the maximum and deducting this result from the Adjusted Mean.

The levels are calculated the following way:

Adjusted mean = (Hhigh+Llow+Close)/3

Tirone Level 1 = Adjusted Mean + (Hhigh-Llow)

Tirone Level 2 = 2 x Adjusted Mean - Llow

Tirone Level 3 = Adjusted mean

Tirone Level 4 = 2 x Adjusted Mean - Hhigh

Tirone Level 5 = Adjusted Mean - (Hhigh-Llow)

where:

- Hhigh (Highest High) - the highest price for a certain period, for example, 20 bars;

- Llow (Lowest Low) - the lowest value for a certain period, for example, 20 bars;

- Close - close price of a current bar.

Traduit du russe par MetaQuotes Ltd.

Code original : https://www.mql5.com/ru/code/458

Three Tirone Levels

Three Tirone Levels

The indicator consists of support and resistance levels based on a trading range for a certain period of time.

MyComment - new comments added without deleting existing ones.

MyComment - new comments added without deleting existing ones.

New comments added to a chart without deleting existing ones.

Variation Index

Variation Index

Variation Index shows if a trend or a flat movement is prevailing in the time series or random behaviour.

DailyPivotPoints

DailyPivotPoints

The DailyPivot Points indicator helps to compose a picture of market future movements, in distinct from the other tools that hang behind the market.