Rejoignez notre page de fans

- Vues:

- 6144

- Note:

- Publié:

- 2018.09.12 18:03

-

Besoin d'un robot ou d'un indicateur basé sur ce code ? Commandez-le sur Freelance Aller sur Freelance

Original definition :

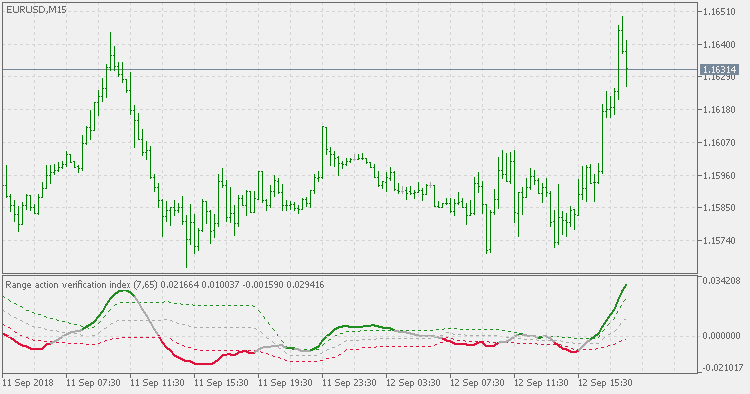

The Chande's Range Action Verification Index (RAVI) indicator was developed by Tushar Chande. As the ADX indicator, the RAVI is used to identify whether a market or security is trending. The RAVI indicator is calculated using moving averages of different lengths. The first one is a short moving average with a lookback period of 7 bars. The second one is a long moving average with a lookback period of 65 bars. The indicator returns a percentage value. Above a certain threshold, the market is considered trending.

Interpretation:

The market is considered trending if the RAVI value is above 3%. Otherwise, the market is consolidating

Changes :

Due to its nature, the levels mentioned in the original description are largely arbitrary and in some cases will never be reached (depending on symbol and time frame). This version is using levels that are adjusted to the value and that way it makes the indicator work the same on any symbol and any time frame

Usage :

All the usual : using color changes for trend start and possible re-entries

RSI adaptive EMA - floating levels

RSI adaptive EMA - floating levels

RSI adaptive EMA - floating levels

RSI adaptive EMA ribbon

RSI adaptive EMA ribbon

RSI adaptive EMA ribbon

Kaufman ama - with floating levels

Kaufman ama - with floating levels

Kaufman ama - with floating levels

Support and Resistance Trader

Support and Resistance Trader

Expert adviser scans past 500 closing bars and looks for common closing regions as entries.