Voir comment télécharger gratuitement des robots de trading

Retrouvez-nous sur Telegram !

Rejoignez notre page de fans

Rejoignez notre page de fans

Vous avez aimé le script ? Essayez-le dans le terminal MetaTrader 5

- Publié par:

- Ralf Broszeit

- Vues:

- 41727

- Note:

- Publié:

- 2015.01.19 12:40

- Mise à jour:

- 2016.11.22 07:32

-

Besoin d'un robot ou d'un indicateur basé sur ce code ? Commandez-le sur Freelance Aller sur Freelance

This is a new version of KNUX Expert Advisor. It works with ADX, CCI, RVI and WPR indicators.

The Strategy works with Martingale. The Martingale Base was coded by Matus German. It will works on all time frames.

To optimize one proceeds as follows:

- Set only ADX Strategy to "true", the WPR-Strategy "false";

- Optimize "Main signal" settings and ADX Strategy settings;

- ADX Strategy set to "false" and WPR-Strategy on "true";

- Optimize "WPRSignal" Settings;

- Now, ADX Strategy and WPR Strategy set to "true" and lets Trade!!!

If you have a good set-file found, mail me and I gladly exchange with you set-Files.

If you know improvements, mail me and I'll try to fruition this.

If you find errors, mail me and I'll try to fix them.

FOR BACKTESTING YOU SHOULD HAVE A MODELLING QUALITY FROM 99.90% AND TEST IT ON EVERY TICK!!!

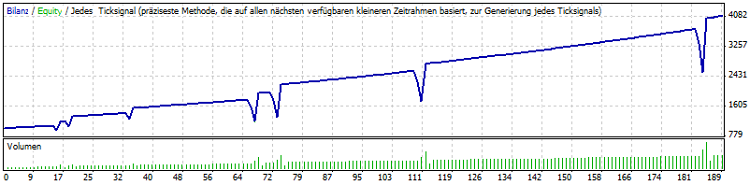

Strategy Tester Report

Knux_Martingale

XM.COM-Demo (Build 765)

| Symbol | EURJPY (Euro vs Japanise Yen) | ||||

| Periode | 1 Minute (M1) 2013.01.01 22:00 - 2014.12.26 21:59 (2013.01.01 - 2014.10.01) | ||||

| Modell | Jedes Ticksignal (präziseste Methode, die auf allen nächsten verfügbaren kleineren Zeitrahmen basiert) | ||||

| Parameter | MainSet="------ Main settings ------"; StopLoss=200; TakeProfit=8; MartingaleSet="------ Martingale settings ------"; lotsMultiplier=1.4; distanceMultiplier=1.4; Capital="=== Trade Lots Size ==="; ManualLots=0.1; AutoLot=true; Risk=15; MaxLot=100; MinLot=0.01; MainSignal="=== Main Signal Logic ==="; ADX_FilterPeriod=13; RVI_FilterPeriod=20; TimeShift=0; ADXSignal="=== ADX Signal Logic ==="; ADX_CrossPeriod=3; CCI_FilterPeriod=35; CCI_Level=175; WPRSignal="=== WPR Signal Logic ==="; WPR_Period=33; WPR_BuyRange=14; WPR_SellRange=14; WPR_ADXmaxLevel=21; WPR_ADXminLevel=5; Strategy_Mode="=== Strategy ==="; ADX_Strategy=true; WPR_Strategy=true; Times="=== Time Filters === "; TimeControl=false; TimeZone="Adjust ServerTimeZone if Required"; ServerTimeZone=1; TradingTimes="HourStopGMT > HourStartGMT"; HourStartGMT=7; HourStopGMT=22; DontTradeFriday="Dont Trade After FridayFinalHourGMT"; UseFridayFinalTradeTime=true; FridayFinalHourGMT=6; MenuSetting="------ Wiew settings ------"; showMenu=true; menuColor=Yellow; variablesColor=Red; font=10; Extras="=== Extra Settings ==="; MaxSlippage=3; Identification=35188; Auto_Ident=true; | ||||

| Balken im Test | 742254 | Ticks modelliert | 51527826 | Modellierungsqualität | 99.90% |

| Fehler in Charts-Anpassung | 0 | ||||

| Ursprüngliche Einlage | 1000.00 | Spread | Current (37) | ||

| Gesamt netto Profit | 3101.41 | Brutto Profit | 6846.57 | Brutto Loss | -3745.16 |

| Profit Faktor | 1.83 | Erwartetes Ergebnis | 16.41 | ||

| Drawdown absolut | 424.26 | Maximaler Drawdown | 1631.82 (43.54%) | Relative Drawdown | 69.23% (1295.54) |

| Trades gesamt | 189 | Short Positionen (gewonnen %) | 80 (91.25%) | Long Positionen (gewonnen %) | 109 (96.33%) |

| Profit Trades (% gesamt) | 178 (94.18%) | Loss Trades (% gesamtl) | 11 (5.82%) | ||

| Grösster | Profit Trade | 1503.49 | Loss Trade | -802.48 | |

| Durchschnitt | Profit Trade | 38.46 | Loss Trade | -340.47 | |

| Maximum | aufeinanderfolgende Gewinne (Profit in Geld) | 72 (1983.42) | Aufeinanderfolgende Verluste (Verlust in Geld) | 2 (-1207.56) | |

| Maximal | Aufeinanderfolgender Profit (Anzahl der Gewinne) | 1983.42 (72) | Aufeinanderfolgende Verluste (Anzahl der Verluste) | -1207.56 (2) | |

| Durchschnitt | aufeinanderfolgende Gewinne | 22 | aufeinanderfolgende Verluste | 2 | |

All In One Grab

All In One Grab

The indicator shows the information about indicator values and important levels.

Stohastic to CSV for MatLab

Stohastic to CSV for MatLab

This indicator exports the indicator values in CSV to use for MATLAB analysis with neural network, SVM, KNN, fuzzy.