Sandis Smilts / Perfil

- Información

|

8+ años

experiencia

|

0

productos

|

0

versiones demo

|

|

0

trabajos

|

1

señales

|

195

suscriptores

|

Amigos

376

Solicitudes

Enviadas

Sandis Smilts

https://www.mql5.com/en/signals/723505

Self-evaluation and updates about the Signal are available on PDF published in this telegram group: https://t.me/FXSUMODiversifiedPortfolio

If there are any questions, feel free to approach me via PM! Sandis

Self-evaluation and updates about the Signal are available on PDF published in this telegram group: https://t.me/FXSUMODiversifiedPortfolio

If there are any questions, feel free to approach me via PM! Sandis

Sandis Smilts

Noticias sobre la señal FX SUMO Diversified Portfolio

Self-evaluation and updates about the Signal are available on PDF published in this telegram group: https://t.me/FXSUMODiversifiedPortfolio If there are any questions, feel free to approach me via PM! Sandis

Sandis Smilts

https://www.mql5.com/en/signals/723505

Self-evaluation and updates about the Signal are available on PDF published in this telegram group: https://t.me/FXSUMODiversifiedPortfolio

If there are any questions, feel free to approach me via PM! Sandis

Self-evaluation and updates about the Signal are available on PDF published in this telegram group: https://t.me/FXSUMODiversifiedPortfolio

If there are any questions, feel free to approach me via PM! Sandis

Sandis Smilts

https://www.mql5.com/en/signals/723505

Self-evaluation and updates about the Signal are available on PDF published in this telegram group: https://t.me/FXSUMODiversifiedPortfolio

If there are any questions, feel free to approach me via PM! Sandis

Self-evaluation and updates about the Signal are available on PDF published in this telegram group: https://t.me/FXSUMODiversifiedPortfolio

If there are any questions, feel free to approach me via PM! Sandis

Sandis Smilts

Noticias sobre la señal FX SUMO Diversified Portfolio

Self-evaluation and updates about the Signal are available on PDF published in this telegram group: https://t.me/FXSUMODiversifiedPortfolio if there are any questions, feel free to approach me via PM! Sandis

Sandis Smilts

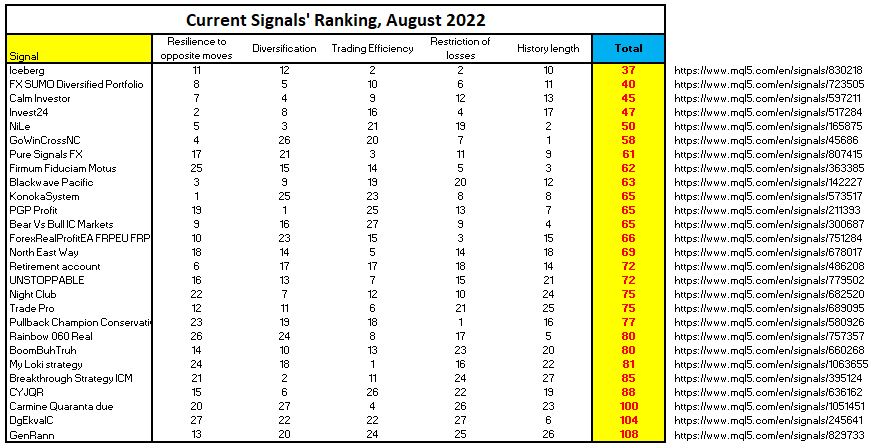

MQL5 signals' scoring for August has been updated, here are the final results. For more details or anything, feel free to PM me! Cheers, Sandis

Sandis Smilts

https://www.mql5.com/en/signals/723505

Oh, guys, -3.5% day, let the grilling begin! (sun)

What a damn day - there was a moment we were angry, then it became funny, and then we were laughing in full voice. Like, one can't make this sh1t up, literally cant. But ok, lets go through this point by point.

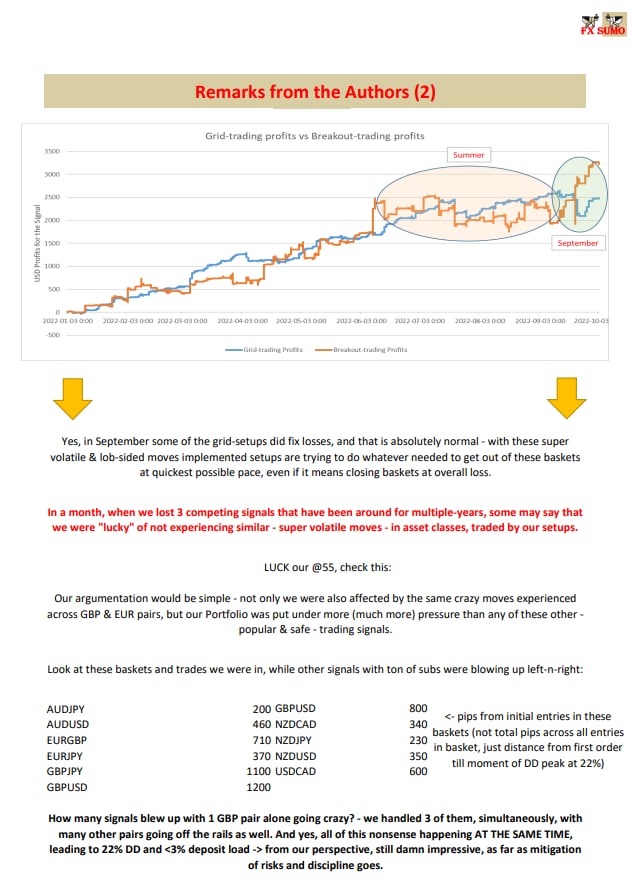

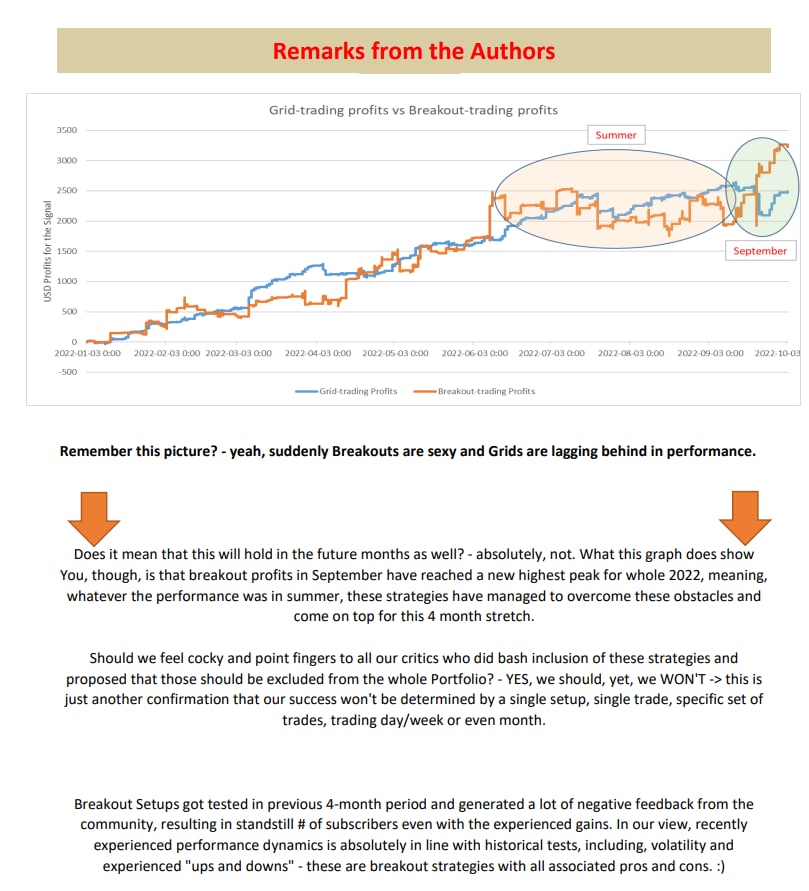

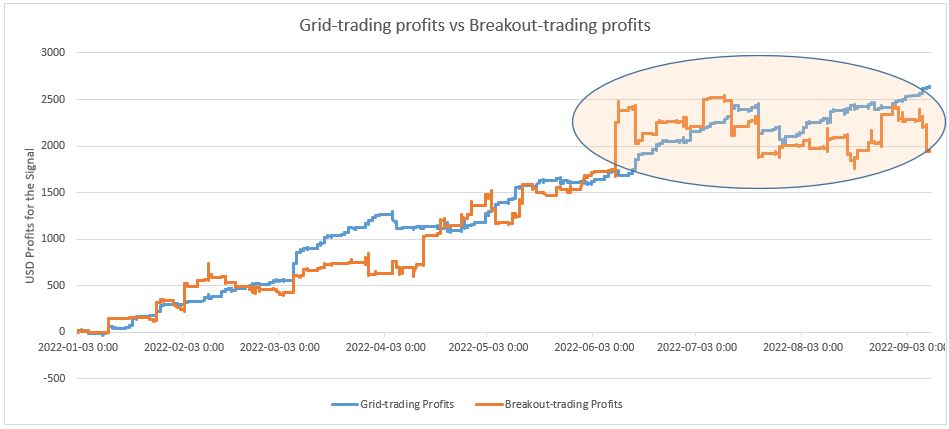

So first and foremost - what did cause this? - in short, EURUSD and super volatile zig-zag movements after ECB decision to increase rates by 0.5%. As most of You know, we do have in our "arsenal" quite many breakout setups, mainly, across EURUSD/GBPUSD/USDJPY & Gold. With our breakout setups, these do try to exploit breakouts at specific levels, and, if these breakouts are false and there is large enough retracement, the same setups do react on "false breakouts" and try to exploit the move on the other direction. Well, today EURUSD bounced in 150 pips range back-n-forth around breakout level, which was targeted by 3 different setups (small differences in between these breakout levels, but very similar range).

Our SLs got hit 15+ times, 3 of which on were on GOLD -> breakouts got kicked out, when trading on other direction our trades got kicked out, 3-4 times (breakout-false breakout-breakout-false breakout), all losses, absolutely amazing. Add stupidly high volatility and our setups were going crazy, trying to figure out on which side to ride this potential move -> market showed middle finger and after zig-zagging for 3 hours with huge distances just stayed in pre-ECB levels.

Unfortunately, this hasn't been first day of July when our breakout setups have let us down - the same happened 2 weeks ago, when on USDJPY & EURUSD the same setups failed multiple times on trying to catch either breakout or reversal of price move at certain level.

Some of our recent subscribers (greamfamily and Longsen) have suggested changing the setups of these breakout setups or removing them. Guys, let me assure You - these results are in line with historical backtests, there is nothing to worry about. In this month alone we have had more losses from these breakout strategies than the last 3 months combined -> if we can keep such month in overall Portfolio gains close to 0%, that's not the worst ending after all.;) Situations like this might happen once again, and even then - in long run, these setups should be profitable. Meanwhile, we are having other setups to cover for the apparent failure of breakout setups.

If You, our beloved subscribers, are looking for reasons of low profitability, most of You will point in the direction of breakout setups (as those make visible losses); from our perspective, the main reason this month has been so hard in terms of profitability, is the fact that most of other grid-type trading setups have been unable to quickly close their baskets and fix profits. These other setups, which normally should compensate for any shenanigans with breakout setups, are stuck in different baskets, and as those are not closed, not enough profits are being generated to absorb all of this. Hopefully, we get out of those baskets, reduce floating DD and help to end this month in overall level above 0%.

In big picture, breakout EAs do influence our profitability, but do not carry fundamental risks for the whole portfolio. To be more precise, recently FX SUMO team felt much more uneasy when our DD climbed from 2.5% to 6% due to open baskets on grid-setups, rather than today when we have had 3.5% fixed loss from breakout strategies. Our first and main task towards our subscribers is and will remain preservation of capital. If we can earn something in between, that's always nice, but this signal is expected to be still around after months and years - can't do that if we ignore historical statistics of underlying setups. In the future, we won't be afraid to have losses fixed for us, and that's what we expect from our subscribers as well - trust in medium-term picture and understanding that neither 1 trading day, nor week, nor month will define the future of this project.

Do we feel influenced by the criticism we received today? - nah, really, its all good. We did expect that something like this will happen, and, we guess, its natural that people will tend to react more actively to any type of failure than positive outcome - in none of the past 180 days, when our performance was far beyond even our own expectations, there was so much interaction with our community. Sure, the timing of this happening is horrible - when, finally, our signal started to gain some serious traction, we have to deal with these shenanigans. On the other hand, the previous months were unexpectedly positive for us, and we did warn both our current and potential subscribers that based on historical statistics, there will be month (or even several) when we might face problems. Well, the time has arrived, we are facing some adversity, and hear us out - we.are.here. We are not hiding, not running, not dodging questions or criticism -> we are here, keep it all coming, this is part of the process, and we will enjoy this as much as we did enjoy bringing in our first subscriber.

For those of You leaving those not-optimistic reviews - its all fine, just dont give up on us after week or 2, give us 2-3 months and then evaluate on how its going. The one thing we would hate to have - that people leave bad reviews, dont have enough patience to see us in our good months, and just lose their hope with us. The more time passes, the higher the chance that Your investment with us will bring overall profits - please, keep this in mind!:)

There is telegram group, in which You can ask any questions You might have or where You can continue with Your criticism towards our recent performance - https://t.me/FXSUMODiversifiedPortfolio - You are more than welcome to join!

Best of luck to all of us!

- FX SUMO team

Oh, guys, -3.5% day, let the grilling begin! (sun)

What a damn day - there was a moment we were angry, then it became funny, and then we were laughing in full voice. Like, one can't make this sh1t up, literally cant. But ok, lets go through this point by point.

So first and foremost - what did cause this? - in short, EURUSD and super volatile zig-zag movements after ECB decision to increase rates by 0.5%. As most of You know, we do have in our "arsenal" quite many breakout setups, mainly, across EURUSD/GBPUSD/USDJPY & Gold. With our breakout setups, these do try to exploit breakouts at specific levels, and, if these breakouts are false and there is large enough retracement, the same setups do react on "false breakouts" and try to exploit the move on the other direction. Well, today EURUSD bounced in 150 pips range back-n-forth around breakout level, which was targeted by 3 different setups (small differences in between these breakout levels, but very similar range).

Our SLs got hit 15+ times, 3 of which on were on GOLD -> breakouts got kicked out, when trading on other direction our trades got kicked out, 3-4 times (breakout-false breakout-breakout-false breakout), all losses, absolutely amazing. Add stupidly high volatility and our setups were going crazy, trying to figure out on which side to ride this potential move -> market showed middle finger and after zig-zagging for 3 hours with huge distances just stayed in pre-ECB levels.

Unfortunately, this hasn't been first day of July when our breakout setups have let us down - the same happened 2 weeks ago, when on USDJPY & EURUSD the same setups failed multiple times on trying to catch either breakout or reversal of price move at certain level.

Some of our recent subscribers (greamfamily and Longsen) have suggested changing the setups of these breakout setups or removing them. Guys, let me assure You - these results are in line with historical backtests, there is nothing to worry about. In this month alone we have had more losses from these breakout strategies than the last 3 months combined -> if we can keep such month in overall Portfolio gains close to 0%, that's not the worst ending after all.;) Situations like this might happen once again, and even then - in long run, these setups should be profitable. Meanwhile, we are having other setups to cover for the apparent failure of breakout setups.

If You, our beloved subscribers, are looking for reasons of low profitability, most of You will point in the direction of breakout setups (as those make visible losses); from our perspective, the main reason this month has been so hard in terms of profitability, is the fact that most of other grid-type trading setups have been unable to quickly close their baskets and fix profits. These other setups, which normally should compensate for any shenanigans with breakout setups, are stuck in different baskets, and as those are not closed, not enough profits are being generated to absorb all of this. Hopefully, we get out of those baskets, reduce floating DD and help to end this month in overall level above 0%.

In big picture, breakout EAs do influence our profitability, but do not carry fundamental risks for the whole portfolio. To be more precise, recently FX SUMO team felt much more uneasy when our DD climbed from 2.5% to 6% due to open baskets on grid-setups, rather than today when we have had 3.5% fixed loss from breakout strategies. Our first and main task towards our subscribers is and will remain preservation of capital. If we can earn something in between, that's always nice, but this signal is expected to be still around after months and years - can't do that if we ignore historical statistics of underlying setups. In the future, we won't be afraid to have losses fixed for us, and that's what we expect from our subscribers as well - trust in medium-term picture and understanding that neither 1 trading day, nor week, nor month will define the future of this project.

Do we feel influenced by the criticism we received today? - nah, really, its all good. We did expect that something like this will happen, and, we guess, its natural that people will tend to react more actively to any type of failure than positive outcome - in none of the past 180 days, when our performance was far beyond even our own expectations, there was so much interaction with our community. Sure, the timing of this happening is horrible - when, finally, our signal started to gain some serious traction, we have to deal with these shenanigans. On the other hand, the previous months were unexpectedly positive for us, and we did warn both our current and potential subscribers that based on historical statistics, there will be month (or even several) when we might face problems. Well, the time has arrived, we are facing some adversity, and hear us out - we.are.here. We are not hiding, not running, not dodging questions or criticism -> we are here, keep it all coming, this is part of the process, and we will enjoy this as much as we did enjoy bringing in our first subscriber.

For those of You leaving those not-optimistic reviews - its all fine, just dont give up on us after week or 2, give us 2-3 months and then evaluate on how its going. The one thing we would hate to have - that people leave bad reviews, dont have enough patience to see us in our good months, and just lose their hope with us. The more time passes, the higher the chance that Your investment with us will bring overall profits - please, keep this in mind!:)

There is telegram group, in which You can ask any questions You might have or where You can continue with Your criticism towards our recent performance - https://t.me/FXSUMODiversifiedPortfolio - You are more than welcome to join!

Best of luck to all of us!

- FX SUMO team

Sandis Smilts

Hey and welcome onboard!

Don't know whether the part of "stable profit and low DD" will always be true, but what we want to show to both our existent and potential subscribers - that we have done our homework and have analyzed as much of available information as possible.

Past cannot guarantee future results, however, we are constantly learning and adapting - both with used setups in the Portfolio and with the ways of how we are analyzing our own performance! :)

For those of You that haven't seen this self-evaluation PDF, it can be found on our telegram group: https://t.me/FXSUMODiversifiedPortfolio

The upcoming self-evaluation document will include some new information matrices, giving new perspectives on how to analyze our, as well as performance of others.

Best of luck to all of us,

Sandis

Don't know whether the part of "stable profit and low DD" will always be true, but what we want to show to both our existent and potential subscribers - that we have done our homework and have analyzed as much of available information as possible.

Past cannot guarantee future results, however, we are constantly learning and adapting - both with used setups in the Portfolio and with the ways of how we are analyzing our own performance! :)

For those of You that haven't seen this self-evaluation PDF, it can be found on our telegram group: https://t.me/FXSUMODiversifiedPortfolio

The upcoming self-evaluation document will include some new information matrices, giving new perspectives on how to analyze our, as well as performance of others.

Best of luck to all of us,

Sandis

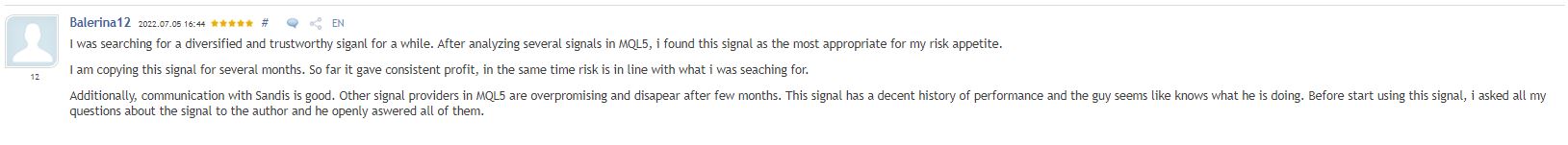

Sandis Smilts

Thanks for the kind words - we are doing whatever we can to please our subscribers and meet the expectations!

Communication with both existing and potential subscribers is key to our success, we will try to do our best irrespective of amount of questions/feedback that we are going to receive!

Signal: https://www.mql5.com/en/signals/723505

Telegram group: https://t.me/FXSUMODiversifiedPortfolio

Sandis

Communication with both existing and potential subscribers is key to our success, we will try to do our best irrespective of amount of questions/feedback that we are going to receive!

Signal: https://www.mql5.com/en/signals/723505

Telegram group: https://t.me/FXSUMODiversifiedPortfolio

Sandis

Sandis Smilts

2 year anniversary/10' 000-th trade delayed celebrations for our signal (https://www.mql5.com/en/signals/723505) are here!

Our self-evaluation analysis has been updated and it can be found in this telegram group: https://t.me/FXSUMODiversifiedPortfolio

Currently our signal is being followed by a grand total of 8 individuals - 4 on MQL5 and 4 on Signalstart. These numbers are growing at relatively slow pace and have been like this for months - we do expect these to climb as our performance continues to impress both us and our current subscribers.

For last few months our team has been unable to find any new strategies that could be implemented in the Portfolio - goes to tell You about the standards we have set for any new inclusions. On the other hand, the latest strong performance by existing strategies has not put real pressure on us to find anything right away, which has helped a lot when analyzing these options with clear heads!

- Sandis

Our self-evaluation analysis has been updated and it can be found in this telegram group: https://t.me/FXSUMODiversifiedPortfolio

Currently our signal is being followed by a grand total of 8 individuals - 4 on MQL5 and 4 on Signalstart. These numbers are growing at relatively slow pace and have been like this for months - we do expect these to climb as our performance continues to impress both us and our current subscribers.

For last few months our team has been unable to find any new strategies that could be implemented in the Portfolio - goes to tell You about the standards we have set for any new inclusions. On the other hand, the latest strong performance by existing strategies has not put real pressure on us to find anything right away, which has helped a lot when analyzing these options with clear heads!

- Sandis

Sandis Smilts

https://t.me/FXSUMODiversifiedPortfolio

Discussion group devoted to the one and only - FX SUMO Diversified Portfolio ( https://www.mql5.com/en/signals/723505 )

Discussion group devoted to the one and only - FX SUMO Diversified Portfolio ( https://www.mql5.com/en/signals/723505 )

Sandis Smilts

Update about our Signal (https://www.mql5.com/en/signals/723505):

Do we really have AUDJPY short open from price level ~1300 pips below current price (~15% growth in value)? - Yes, we do;

Have we taken any additional positions to average the price down? - Nah, chilling.

What is our current drawdown? - somewhere below 2%, obviously we have other positions in loss as well.

Ah, and today we managed to close GBPUSD basket ~530 pips below initial entry, got tested on this one as well.

Funny times.

S.

Do we really have AUDJPY short open from price level ~1300 pips below current price (~15% growth in value)? - Yes, we do;

Have we taken any additional positions to average the price down? - Nah, chilling.

What is our current drawdown? - somewhere below 2%, obviously we have other positions in loss as well.

Ah, and today we managed to close GBPUSD basket ~530 pips below initial entry, got tested on this one as well.

Funny times.

S.

Sandis Smilts

Hey all,

https://www.mql5.com/en/signals/723505

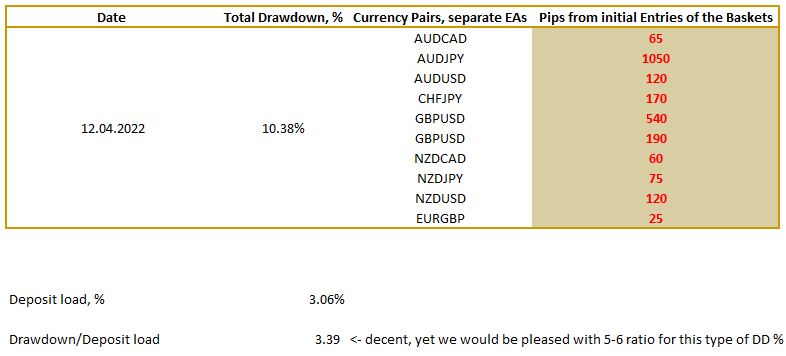

As some of You might have seen, today we closed substantial number of trades in losses.

Before today’s US CPI news, multiple of our grid-type trading algos had stuck across various pairs, mainly, USDCAD. Actually, the accumulated trading amounts were the highest in months, which made us feel somewhat uncomfortable with the underlying risks. Is there something wrong in the settings or have the trading conditions changed considerably? – nah, we can still tolerate all the usual shenanigans with volatility, yet, here we had couple of unlucky situations were we could have closed the baskets lot earlier, however, price level didn’t reach the needed targets and missed a few pips.

What can we say? – losses are part of trading and, as You have seen from our reports, the amount of active-SL using EAs have increased over the last months. Yes, even more than half of our grid-type EAs have loss-recognition functions, not visibly shown to subscribers. We remain confident in closing positions in loss, as our primary obligation towards subscribers remain to be capital preservation.

Some of You are attracted to substantial gains we were able to make in the previous months, however, its very clear for us (as it should be for You as well) that these won’t be maintained in the future and Q1 has been the positive outlier for our signal. There is actually no way on how we could maintain this type of growth while somewhat limiting drawdown, therefore, setbacks in growth curve are expected and WILL happen in the future. We still do target 3-5% monthly growth in the future and will do whatever it takes to provide reasonable investment opportunity with limited downside and risks.

As for April, our current growth stands at negative 0.5%, which isn’t perfect, although that’s not a hole we couldn’t get out. Our expectations for April remain in 3-5% positive growth area, and we do expect to come close to this.

Here is the breakdown of opened trades that generated ~10% DD before US CPI news:

Thanks for Your trust!

S.

https://www.mql5.com/en/signals/723505

As some of You might have seen, today we closed substantial number of trades in losses.

Before today’s US CPI news, multiple of our grid-type trading algos had stuck across various pairs, mainly, USDCAD. Actually, the accumulated trading amounts were the highest in months, which made us feel somewhat uncomfortable with the underlying risks. Is there something wrong in the settings or have the trading conditions changed considerably? – nah, we can still tolerate all the usual shenanigans with volatility, yet, here we had couple of unlucky situations were we could have closed the baskets lot earlier, however, price level didn’t reach the needed targets and missed a few pips.

What can we say? – losses are part of trading and, as You have seen from our reports, the amount of active-SL using EAs have increased over the last months. Yes, even more than half of our grid-type EAs have loss-recognition functions, not visibly shown to subscribers. We remain confident in closing positions in loss, as our primary obligation towards subscribers remain to be capital preservation.

Some of You are attracted to substantial gains we were able to make in the previous months, however, its very clear for us (as it should be for You as well) that these won’t be maintained in the future and Q1 has been the positive outlier for our signal. There is actually no way on how we could maintain this type of growth while somewhat limiting drawdown, therefore, setbacks in growth curve are expected and WILL happen in the future. We still do target 3-5% monthly growth in the future and will do whatever it takes to provide reasonable investment opportunity with limited downside and risks.

As for April, our current growth stands at negative 0.5%, which isn’t perfect, although that’s not a hole we couldn’t get out. Our expectations for April remain in 3-5% positive growth area, and we do expect to come close to this.

Here is the breakdown of opened trades that generated ~10% DD before US CPI news:

Thanks for Your trust!

S.

Sandis Smilts

2022.04.12

lol, jokes, talked specifically about USDCAD, yet, that's not depicted in the table above. one could add additional line with USDCAD basket being 220 pips away from initial entries. won't change the table, will leave it there. cheers to all!:)

Sandis Smilts

FX SUMO DIVERSIFIED PORTFOLIO - https://www.mql5.com/en/signals/723505

As it turns out, our signal service is among the 7 highest ranked on PSYQUATION platform. Signals there are ranked based on unique evaluation system, developed by the creators of the platform.

https://app.psyquation.com/en/leaderboard?page-size=50

We do hope to see You onboard and witness our performance Yourselves.

For more info, PM me or join our discussion group:

https://t.me/FXSUMODiversifiedPortfolio

As it turns out, our signal service is among the 7 highest ranked on PSYQUATION platform. Signals there are ranked based on unique evaluation system, developed by the creators of the platform.

https://app.psyquation.com/en/leaderboard?page-size=50

We do hope to see You onboard and witness our performance Yourselves.

For more info, PM me or join our discussion group:

https://t.me/FXSUMODiversifiedPortfolio

Sandis Smilts

Hey all!

FX SUMO Diversified Portfolio has already 4 investors across MQL5 and Signalstart platforms - join the adventure and our hunt for pips!

Link to the signal: https://www.mql5.com/en/signals/723505

Cheers!

FX SUMO Diversified Portfolio has already 4 investors across MQL5 and Signalstart platforms - join the adventure and our hunt for pips!

Link to the signal: https://www.mql5.com/en/signals/723505

Cheers!

Sandis Smilts

Hey, all!

Quick update about our Signal (https://www.mql5.com/en/signals/723505):

We are adding 9 more setups to the Portfolio, increasing the underlying amount of setups from 62 to 71.

As You can see from the added image, all 9 setups are employing loss-recognition functions, yet, have historically shown effective (growth/dd) trading performance. This should help us to maintain relative growth in historical levels, while further decreasing equity drawdown in the future.

Hope all plays out as expected, but as far as numbers and testing goes - we have done our homework and positive results are expected.

Cheers and best of luck to all of us!

Sandis

Quick update about our Signal (https://www.mql5.com/en/signals/723505):

We are adding 9 more setups to the Portfolio, increasing the underlying amount of setups from 62 to 71.

As You can see from the added image, all 9 setups are employing loss-recognition functions, yet, have historically shown effective (growth/dd) trading performance. This should help us to maintain relative growth in historical levels, while further decreasing equity drawdown in the future.

Hope all plays out as expected, but as far as numbers and testing goes - we have done our homework and positive results are expected.

Cheers and best of luck to all of us!

Sandis

Sandis Smilts

https://www.mql5.com/en/signals/723505

100 weeks / 164% cumulative growth/ 8330 trades

Allow us to take care of Your investments while You enjoy Your rest! :)

100 weeks / 164% cumulative growth/ 8330 trades

Allow us to take care of Your investments while You enjoy Your rest! :)

Sandis Smilts

Good evening!

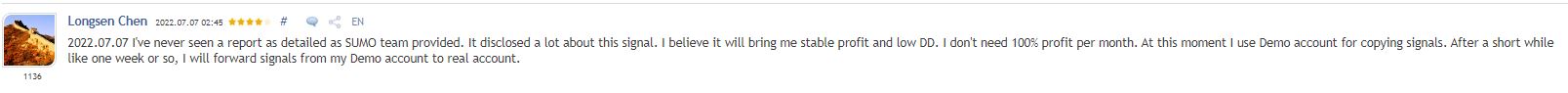

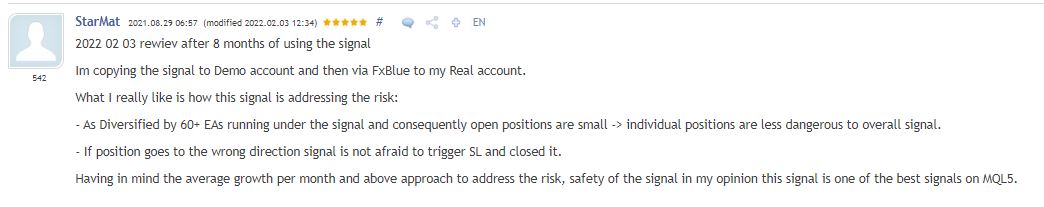

We just (yeah, only now) came across this review left by one of our subscribers a few days ago.

8 months, huh? - well, we are happy that we have managed to full-fill the expectations and You have joined this ride with us. There have definitely been some bumps, but, hey, those are just part of the process. We do believe that there are not many consistent subscribers (especially on Mql5) that stay with the same signal for prolonged period of time, therefore, seeing one of such in Your person and following specifically our signal makes us even more pleased. :)

The idea about copying the signal to demo account and afterwards adjusting Your risks is an interesting one. We would love to see the amount of capital behind Your investment (just for analytical purposes and better understanding our investors' profile), so if You ever find the urge to share that info - drop us a message.

We absolutely love the fact that You are valuing our efforts to keep DD in check. Yes, there are still plenty of setups that dont use active SLs, however, our latest included setups all have loss-preventing systems in place, allowing us to somewhat limit DD by equity. As You might have seen in late 2021, this can cause our growth to be even negative for an entire month(s), however, these activities in long-run should help to smoothen out DD curve and provide positive effects on overall profitability of the portfolio.

If You have any other questions/ideas/takes on how our performance could be further improved, feel free to update Your review.:)

For the fellow subscribers - would love to hear about Your experiences as well, feel free to share that with us (and everyone else)

You are always welcome to join our Telegram group here https://t.me/FXSUMODiversifiedPortfolio

Cheers!

S.

We just (yeah, only now) came across this review left by one of our subscribers a few days ago.

8 months, huh? - well, we are happy that we have managed to full-fill the expectations and You have joined this ride with us. There have definitely been some bumps, but, hey, those are just part of the process. We do believe that there are not many consistent subscribers (especially on Mql5) that stay with the same signal for prolonged period of time, therefore, seeing one of such in Your person and following specifically our signal makes us even more pleased. :)

The idea about copying the signal to demo account and afterwards adjusting Your risks is an interesting one. We would love to see the amount of capital behind Your investment (just for analytical purposes and better understanding our investors' profile), so if You ever find the urge to share that info - drop us a message.

We absolutely love the fact that You are valuing our efforts to keep DD in check. Yes, there are still plenty of setups that dont use active SLs, however, our latest included setups all have loss-preventing systems in place, allowing us to somewhat limit DD by equity. As You might have seen in late 2021, this can cause our growth to be even negative for an entire month(s), however, these activities in long-run should help to smoothen out DD curve and provide positive effects on overall profitability of the portfolio.

If You have any other questions/ideas/takes on how our performance could be further improved, feel free to update Your review.:)

For the fellow subscribers - would love to hear about Your experiences as well, feel free to share that with us (and everyone else)

You are always welcome to join our Telegram group here https://t.me/FXSUMODiversifiedPortfolio

Cheers!

S.

: