Conor Mcnamara / Perfil

- Información

|

1 año

experiencia

|

7

productos

|

4

versiones demo

|

|

0

trabajos

|

0

señales

|

0

suscriptores

|

I started learning C programming in 2010. From there I picked up many languages.

I have worked with MQL for just a year now. I pick up programming languages very quickly because I'm no stranger to programming.

I'm working on several indicator projects and EA concepts.

I have worked with MQL for just a year now. I pick up programming languages very quickly because I'm no stranger to programming.

I'm working on several indicator projects and EA concepts.

Conor Mcnamara

How can we calculate the trend change entry on time from extreme pivots?

- Zigzag algo extended to find when the leg stops moving

- When the leg stops moving, the trend change entry is taken from a non lagging moving average

- Now it is calculating only the moving average trend changes relating to pivots

- All other fleeting moving average trends are ignored

- Zigzag algo extended to find when the leg stops moving

- When the leg stops moving, the trend change entry is taken from a non lagging moving average

- Now it is calculating only the moving average trend changes relating to pivots

- All other fleeting moving average trends are ignored

Conor Mcnamara

Ha publicado el código Candle Pattern Recognition Unit

An indicator to detect and mark all popular candle patterns

403

Conor Mcnamara

Ha publicado el producto

Se trata de una media móvil única que no utiliza marcos temporales. El indicador calcula una media móvil simple (SMA) basándose en los precios de los últimos ticks en lugar de en las barras de plazos, lo que ofrece una forma directa de seguir las tendencias del mercado. Procesa un gran número de precios de tick hasta el último tick, utilizando sólo datos en tiempo real para sus cálculos. Una vez activo, el indicador se actualiza y recalcula sin depender de ninguna barra histórica. Respuesta del

Conor Mcnamara

Ha publicado el código Price Percentage Zigzag (No timeframes)

Zigzag which changes wave direction based on price percentage change on the asset

165

Conor Mcnamara

Ha publicado el código Bull Bear Volume

Un indicador que proporciona una visualización clara de la presión del volumen en cada lado del mercado

Compartir en las redes sociales · 1

149

373

Conor Mcnamara

Someone made a good code for a zigzag based on ATR rules instead of the traditional depth and backstep rules, but it's still lagging because of the fact that it keeps moving to find the ultimate extremum. My approach to make it truly non lagging was to focus more on the live trend, and only consider the local extremes after a new trend change, and this is what makes a non lagging zigzag. It is not true zigzag as people know it, but still is visually a zigzag

Mostrar todos los comentarios (8)

Yashar Seyyedin

2025.07.28

Strong trends are pretty rare. Those who trade them have to wait quite long for an opportunity.

Conor Mcnamara

2025.07.28

that's true because the market is generally sideways a lot of the time, and thankfully the ATR reveals this. Many interesting indicators have recruited the average true range formula..but the original ATR indicator is visual garbage to me...never really bothered looking at that plot

Conor Mcnamara

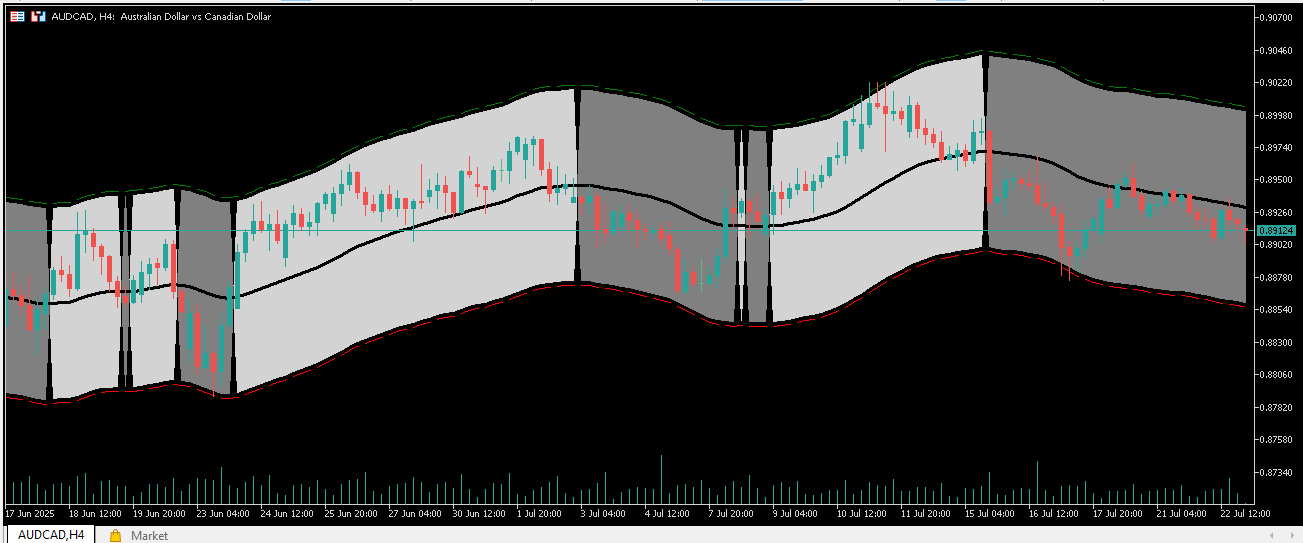

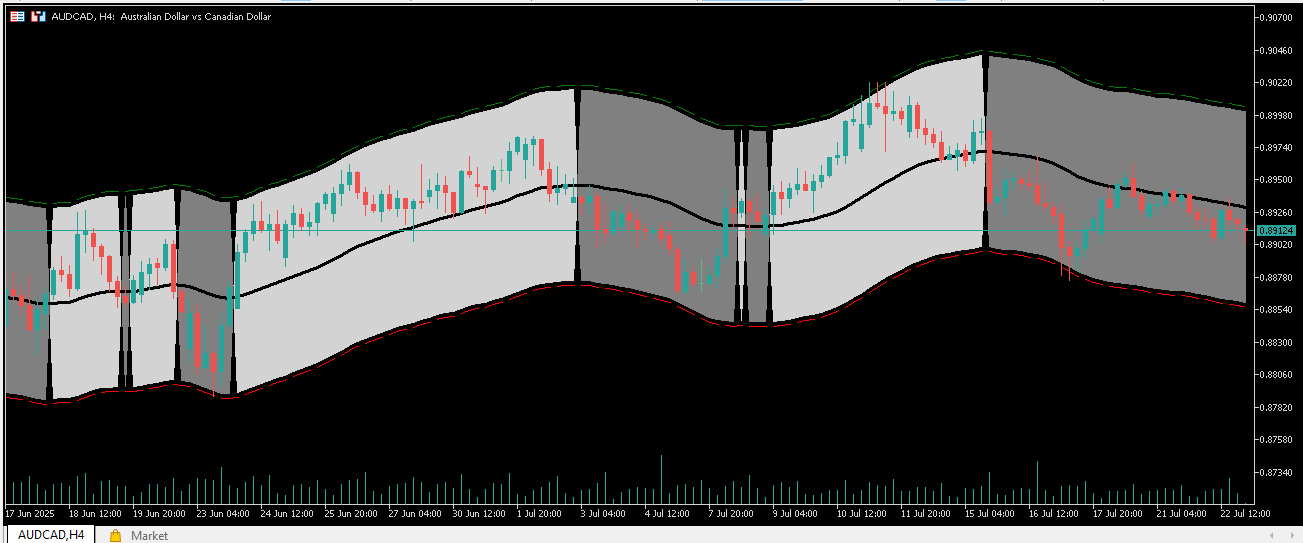

the NW estimator (using kernel regression) is a hidden gem that nobody talks about. You don't need to make arrows or anything, I made a filled envelope, and I know where a market is moving

Conor Mcnamara

I would describe automated trading trading as something that does work. But when you understand what trading is about... it's not more ideal than manual trading.

It is like a car driving by itself. Do you trust that a car will automate driving perfectly? Are you happy to sit in a car that drives without your control? This is exactly how I would describe automated trading.

It is like a car driving by itself. Do you trust that a car will automate driving perfectly? Are you happy to sit in a car that drives without your control? This is exactly how I would describe automated trading.

Rajesh Kumar Nait

2025.07.09

Tesla drives automatically but i saw some instances of crash, It cant drive like human but there are ongonig advancement and continuous software updates (optimization ) which is making it more effective. Trading manually envolves emotion and no human is emotionless, Emotion causes errors.

Conor Mcnamara

2025.07.10

Emotional trading is trading without discipline, however even with discipline there is a huge amount of stress when someone is still in the stage of proving the strategy without trust in it.

Conor Mcnamara

There are many indicators on the codebase that are just proof of science or for data organization, but they're not suitable for trading signals. For "quant" trading, it's a layered combination of tools which makes something suitable for signals. Combine ADX, ATR, and an oscillator..and this gives a much more reliable trend

Conor Mcnamara

this wonder zigzag got a full optimization, but the code is not available

It can be provided for payment, and payment must be in the form of a briefcase of cash

The file will be provided to you on a floppy disk

It can be provided for payment, and payment must be in the form of a briefcase of cash

The file will be provided to you on a floppy disk

Conor Mcnamara

2025.07.05

there were some problems in the beta, they are fixed now It now has pivot modes "strict to pivots" and "strict to candle high/low" The pivot mode only concerns the trend change and instantly switches leg. The candle mode strictly connects legs to candle highest/lowest near the trend change

Conor Mcnamara

2025.07.05

both modes are identifying the new wave much faster than the old traditional zigzag

Conor Mcnamara

It would be helpful to have a table of algos which are profitable in automation, and which are not.

Some indicators are profitable sometimes, but can't survive all market conditions, which means the algorithm essentially isn't good enough for automation. It seems that with most of them, there's a problem. Parabolic sar for example will fail in ranging markets. Fractals is often after the fact, and not always giving true signals. Donchian channel and zigzag by itself is constantly repainting. RSI gives false signals if the market starts to trend in one direction.

Multitimeframe systems and systems that combine indicators are promising, but there are downsides to this as well (it will calculate fewer opportunities and miss out on many).

There's only a few algos left to be reliable for automation.

Some indicators are profitable sometimes, but can't survive all market conditions, which means the algorithm essentially isn't good enough for automation. It seems that with most of them, there's a problem. Parabolic sar for example will fail in ranging markets. Fractals is often after the fact, and not always giving true signals. Donchian channel and zigzag by itself is constantly repainting. RSI gives false signals if the market starts to trend in one direction.

Multitimeframe systems and systems that combine indicators are promising, but there are downsides to this as well (it will calculate fewer opportunities and miss out on many).

There's only a few algos left to be reliable for automation.

Conor Mcnamara

2025.07.02

It is true that every strategy can work with organized risk management, although what I'm hunting for is thr most reliable scalping system which provides frequent and safe entry opportunities. I found a few very good contenders which are far better than other trend following indicators

Conor Mcnamara

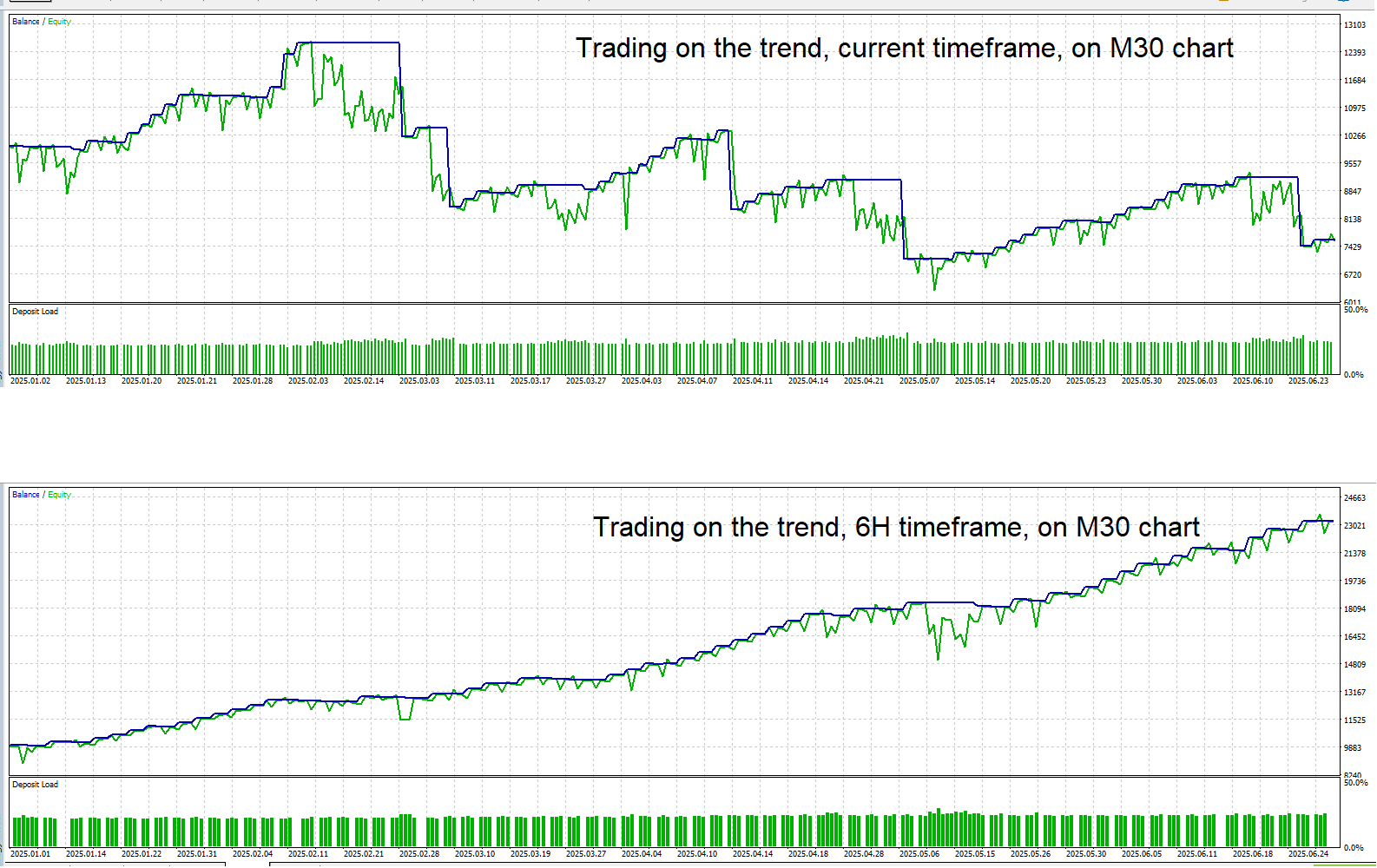

statistically, multi-timeframe trend shows much more positive results for quantitative trend indicators proving that it's not a fad

Mahdi Ebrahimzadeh

2025.07.05

hard word to understand for non-english people. thanks for explanation.

Conor Mcnamara

extreme risk is not a bad thing if the deposit meant nothing to you, and the fact of trading is that higher risk will always give a more fruitful profit over time. But I see so many EAs with no fail-safe features.

For example, let's say the user wants to take really high risk, and the account gained 30%. At least then you could implement a fail-safe where the deposit is protected and the EA can't fall below the original deposit after a certain account gain is reached. I coded these deposit protection features, because it's not logical to allow the expert to blow the account at a late point. It's very easy to code these things, there's no excuse not to have money management

For example, let's say the user wants to take really high risk, and the account gained 30%. At least then you could implement a fail-safe where the deposit is protected and the EA can't fall below the original deposit after a certain account gain is reached. I coded these deposit protection features, because it's not logical to allow the expert to blow the account at a late point. It's very easy to code these things, there's no excuse not to have money management

Rajesh Kumar Nait

2025.06.30

Extreme risk for me is like betting 2 for 1 profit or 3 for 1 profit but it should be done with small accounts only. Once you grow use position sizing to mitigate risk

Conor Mcnamara

In your EAs, do you create a time window for trading? or do you let the EA trade all hours and all sessions? and if you do create an hourly trading window, which hours do you let the EA trade?

Conor Mcnamara

2025.06.28

I saw in one EA this guy made a function to make the expert trade only a specific set of hours. It was this which made it profitable. I know for sure that trading less is a good risk management protocol. But if his way is the best way in forex...it's still questionable. I'll have to do more experiments on that

Conor Mcnamara

2025.06.28

he made the EA trade last hour of Tokyo session into the first two hours of London session. Apparently the last hour of a session is where institutions warm up for the opening of the next session, and liquidity increases

Conor Mcnamara

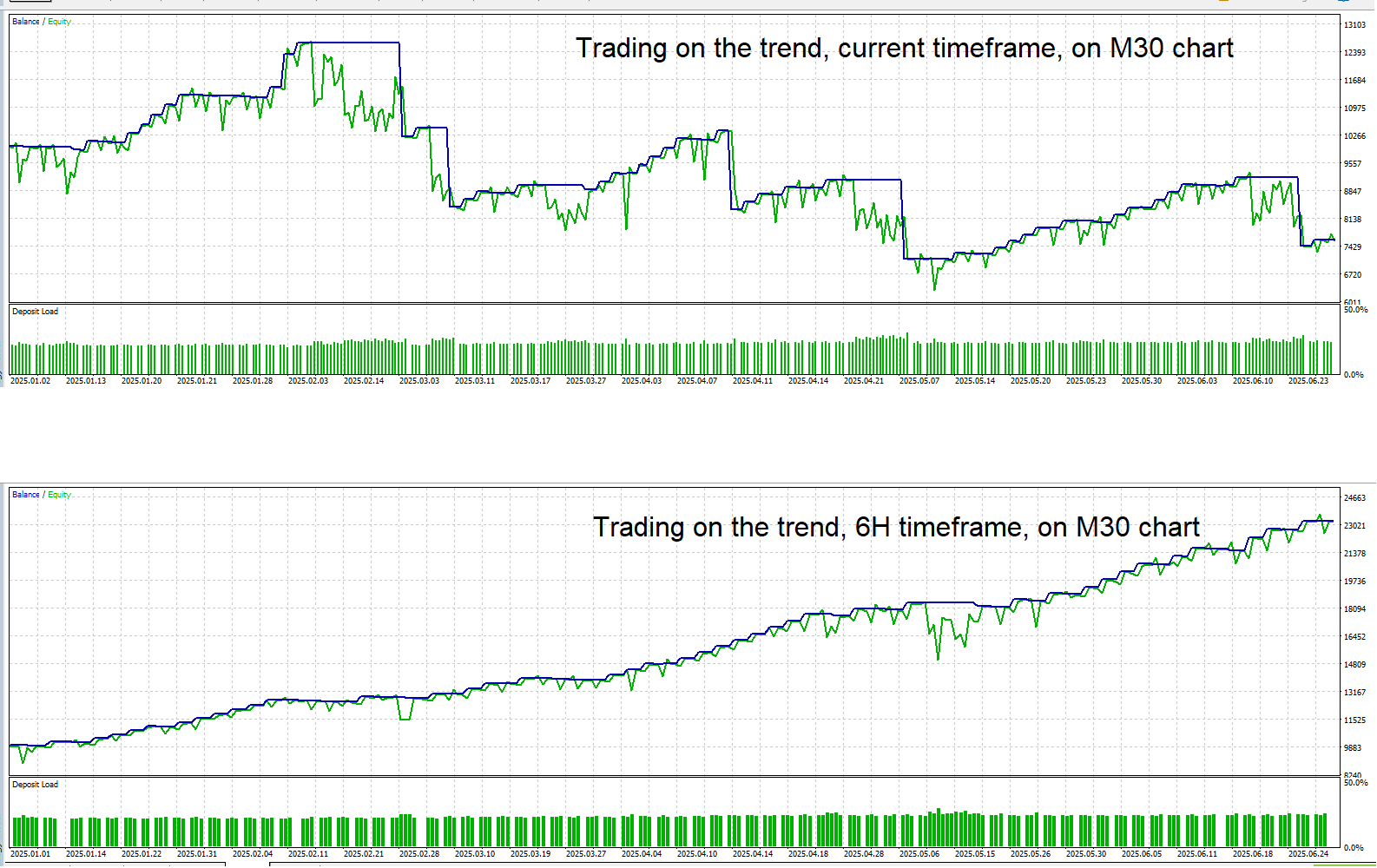

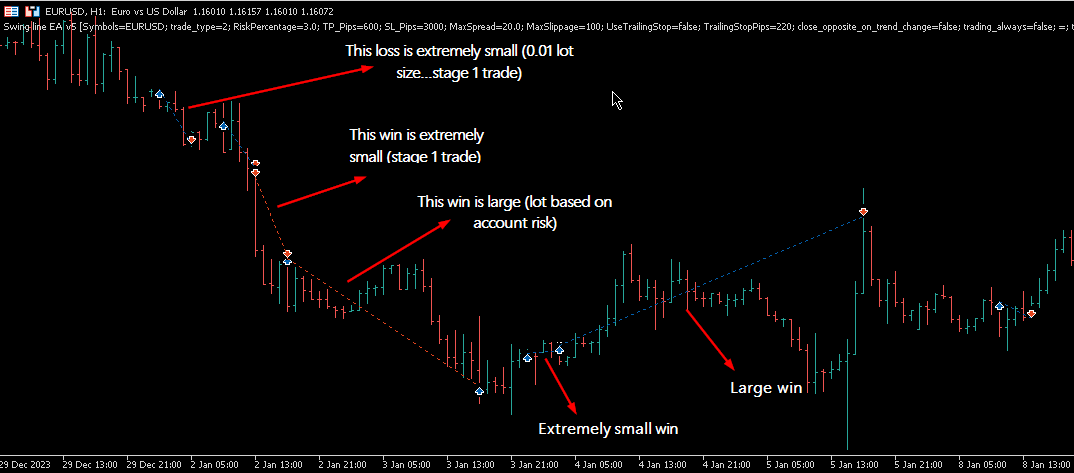

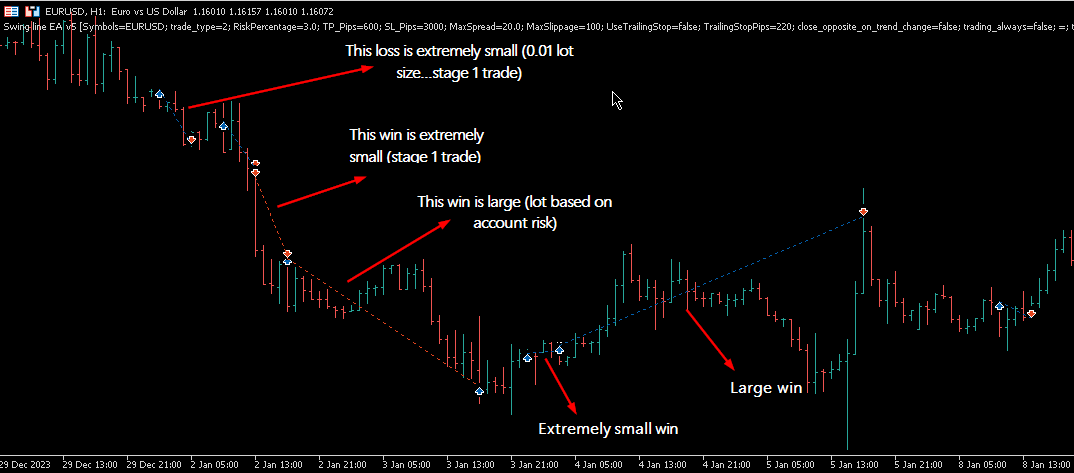

small backtest on the time where real ticks were available, this is trading on H1 chart with the trend following indicator on H12. Possible overfitting, and will not always be smooth. this is why we need either to supervise at times or else automate risk management such as a drawdown controller

Conor Mcnamara

some small discovery in mtf trend following indicators if anyone is interested

M5 chart timeframe likes the indicator to look at M15 or M20 for short term scalping

M20 chart timeframe likes the indicator to look at H8 for swing trades

H1 chart timeframe likes the indicator to look at H12 for swing trades

M5 chart timeframe likes the indicator to look at M15 or M20 for short term scalping

M20 chart timeframe likes the indicator to look at H8 for swing trades

H1 chart timeframe likes the indicator to look at H12 for swing trades

Conor Mcnamara

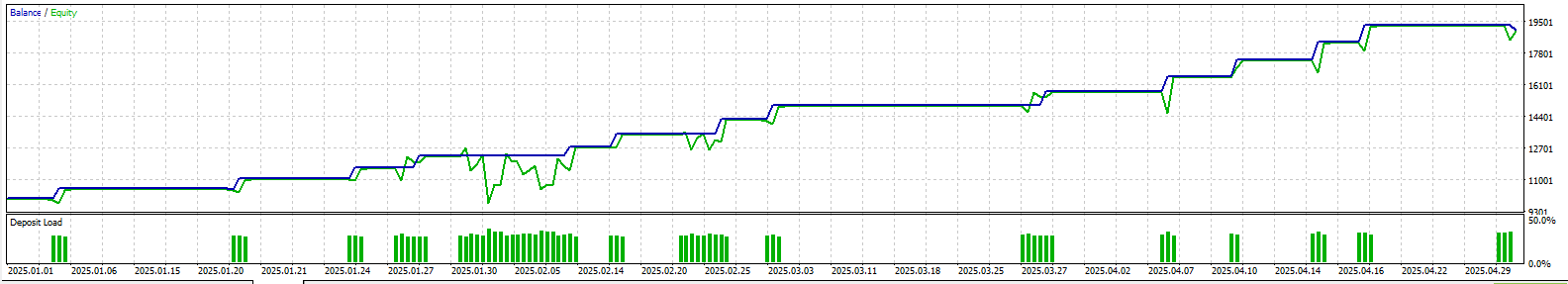

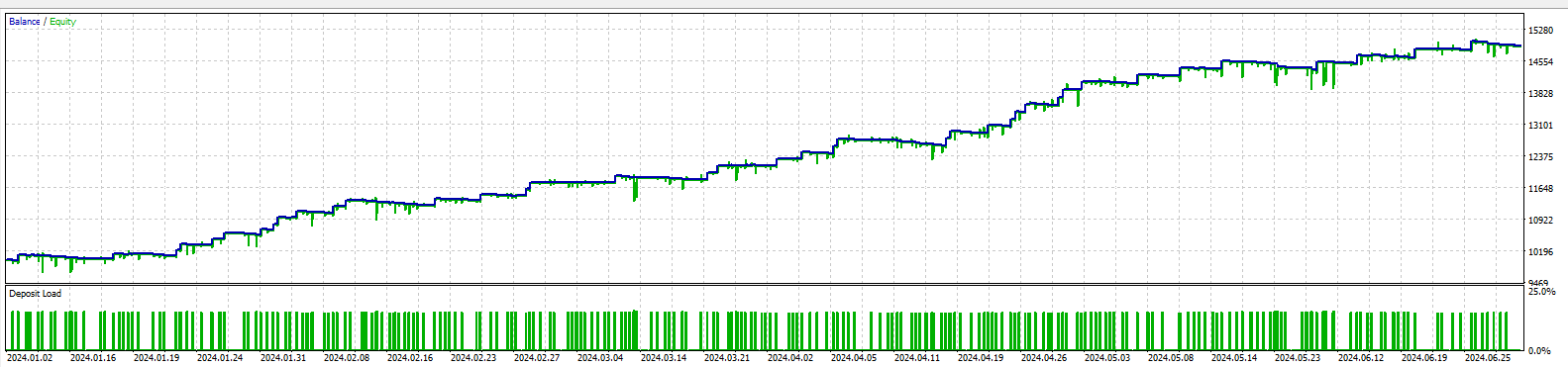

using the two-stage entry concept on M5 chart with the trend following indicator looking at M15 (MTF). Drawdown is 1%

Conor Mcnamara

because of the fact that indicator signals can sometimes be false, I developed a concept where the quality of the signal is first tested by the EA with 0.01 micro lot size before it executes a normal sized position (based on a risk % of the account). The PnL of the 0.01 lot size trade is examined... if the position was profitable, it makes another trade with bigger volume, if the position was unprofitable, it could mean that the indicator signal was false. This proved to be good in backtest. Instead of performing surgery on a weak trade, this basically pinpoints bad entries and cancels them

: