Trabajo finalizado

Tarea técnica

I need an expert programmer to do the following:

Requirement:

2. The EA able to open and close all ccy pairs trades base on the collected data in a single chart.

3. Open trade:

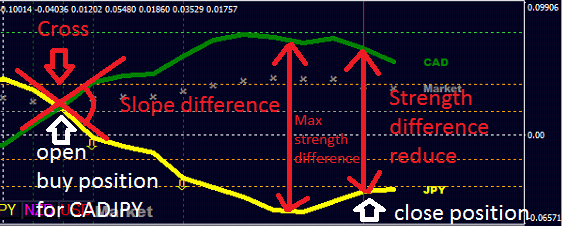

a) Cross: Base on “Open trade TimeFrame”, calculate 8 pair ccy strength difference between 2 ccy (e.g. AUD strength=0.03; USD strength=0.01; AUDUSD strength difference = 0.03-0.01=0.02) after each bar close and considered cross when the difference change from positive to negative and vice versa (e.g. strength difference change from 0.02 to -0.01, this is crossed). When cross, also need to check the strength slope difference between 2 ccy. Open a position if both 2 criteria (cross; strength slope difference) fulfill.

b) Cross and wait: Same as “Cross” but open trade after X minutes of cross. After X minutes, also need to check the strength slope difference between 2 ccy. Open a position if both 2 criteria (cross; strength slope difference) fulfill.

4. Close trade:

Once open a position, keep monitor the strength difference and close position base on below scenarios.

a) Cross: Base on “Close trade Timeframe”, calculate the maximum strength difference of the trade after each bar close and trigger the position to close trade once the strength difference crossed.

b) Strength reduce: Base on “Close trade Timeframe”, calculate the maximum strength difference of the trade after each bar close, once the current strength difference reduce X% against maximum strength, trigger the position to close trade. (e.g. If X% is 30%, when the maximum strength reached 0.1 and drop to 0.07, close the position)

Below is an example that open a “buy” position for CADJPY and close when the strength difference reduce in certain % from the max strength difference.

5. Input

General

• Magic number

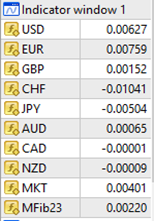

• Indicator windows name (Collect data from the specific indicator windows)

• ccy (allowed trade for ccy, separate by comma. e.g EURUSD,GBPUSD) (Default is 28 pairs CCY)

• lot size

• maximum spread (do not open position if spread is larger than max spread)

• Trade Friday (allow open position in Friday or not)

• Trade Sunday (allow open position in Sunday or not)

Open position strategy

• Open trade strategy (2 options: “Cross”, “Cross and wait”)

• Open trade Timeframe (options: M1,M5,M15,M30,H1,H4,D1,W1)

• Strength slope difference (when 2 ccy strength cross, check the strength slope difference that determine to open a trade or not, e.g. 30, open a position if two ccy slope difference larger than 30 degree)

• Wait period for “Cross and wait” (if “Cross and wait” selected. e.g 30, means wait 30 minutes and open trade if both Cross and Strength slope difference still fulfill the requirement)

Close position strategy

• Close trade (2 options: “Cross”, “Strength reduce”)

• Close trade Timeframe (options: M1,M5,M15,M30,H1,H4,D1,W1)

• Strength reduce (if “Strength reduce” selected. e.g. 30, means the strength difference reduce 30% from max difference trigger the position to close trade)