Exness / Profile

The Exness brand is shared by several affiliated institutions offering multi-asset financial services, and which are licensed by CySEC (Cyprus), FCA (UK), FSA (Seychelles), FSC (BVI), CBCS (Curacao), FSCA (South Africa) and CMA (Kenya). Product features may differ. Exness Cyprus and Exness UK offer B2B services only.

Exness does not provide services to people residing in the US, Iran, Myanmar, North Korea, Europe, the UK and other locations.

We provide clients with accessible, transparent, reliable, and high-quality brokerage services using the latest technologies.

From our deep understanding of trader’s needs, we offer:

- *Deposits and withdrawals with 0% commission

- Technical support in 15 languages

- *Flexible Leverage

- *Spread starting at 0.0 pips

- No hidden commissions

- *Instant withdrawal

- Fast Execution

- 160+ currency pairs, metals, cryptocurrencies, energies, indices and stock CFDs.

Different features may apply depending on the region and account type.

With trading volumes consistently in the region of $500-600 billion per month, we have been repeatedly ranked among the top forex brokers.

*Terms and conditions apply.

--------------------------

Exness (SC) Ltd is authorized by the Financial Services Authority (FSA) in Seychelles (licence no. SD025). Exness (SC) Ltd is also authorised as an Over-The-Counter Derivatives Provider (ODP) by the Financial Sector Conduct Authority (FSCA) in South Africa. Exness (SC) Ltd operates under www.exness.com .

Exness (VG) Ltd is authorized by the Financial Services Commission (FSC) in the British Virgin Islands (licence no. SIBA/L/20/1133). Exness (VG) Ltd operates under www.exness.com .

Exness B.V. is authorized by the Central Bank of Curaçao and Sint Maarten (CBCS) (licence no. 0003LSI). Exness B.V. operates under www.exness.com .

Exness ZA (PTY) Ltd is authorised by the Financial Sector Conduct Authority (FSCA) in South Africa as a Financial Service Provider (FSP) with registration number 2020/234138/07 and FSP number 51024. Exness ZA (PTY) Ltd is not a market maker, or product issuer, and acts solely as an intermediary in terms of the FAIS Act. Exness ZA (PTY) Ltd operates under www.exness.co.za .

Exness (KE) Limited is registered in Kenya with registration number PVT-LRUDJJB and is regulated by the Capital Markets Authority in Kenya as a Non-dealing Online Foreign Exchange Broker under license number 162. Exness (KE) Limited operates under www.exness.ke .

Risk Warning: Our services relate to complex derivative products which are traded outside an exchange. These products come with a high risk of losing money rapidly due to leverage and thus are not appropriate for all investors. Under no circumstances shall Exness have any liability to any person or entity for any loss or damage in whole or part caused by, resulting from, or relating to any investing activity.

The information on this page does not constitute investment advice or a recommendation or a solicitation to engage in any investment activity.

Exness does not provide services to people residing in the US, Iran, Myanmar, North Korea, Europe, the UK and other locations.

We provide clients with accessible, transparent, reliable, and high-quality brokerage services using the latest technologies.

From our deep understanding of trader’s needs, we offer:

- *Deposits and withdrawals with 0% commission

- Technical support in 15 languages

- *Flexible Leverage

- *Spread starting at 0.0 pips

- No hidden commissions

- *Instant withdrawal

- Fast Execution

- 160+ currency pairs, metals, cryptocurrencies, energies, indices and stock CFDs.

Different features may apply depending on the region and account type.

With trading volumes consistently in the region of $500-600 billion per month, we have been repeatedly ranked among the top forex brokers.

*Terms and conditions apply.

--------------------------

Exness (SC) Ltd is authorized by the Financial Services Authority (FSA) in Seychelles (licence no. SD025). Exness (SC) Ltd is also authorised as an Over-The-Counter Derivatives Provider (ODP) by the Financial Sector Conduct Authority (FSCA) in South Africa. Exness (SC) Ltd operates under www.exness.com .

Exness (VG) Ltd is authorized by the Financial Services Commission (FSC) in the British Virgin Islands (licence no. SIBA/L/20/1133). Exness (VG) Ltd operates under www.exness.com .

Exness B.V. is authorized by the Central Bank of Curaçao and Sint Maarten (CBCS) (licence no. 0003LSI). Exness B.V. operates under www.exness.com .

Exness ZA (PTY) Ltd is authorised by the Financial Sector Conduct Authority (FSCA) in South Africa as a Financial Service Provider (FSP) with registration number 2020/234138/07 and FSP number 51024. Exness ZA (PTY) Ltd is not a market maker, or product issuer, and acts solely as an intermediary in terms of the FAIS Act. Exness ZA (PTY) Ltd operates under www.exness.co.za .

Exness (KE) Limited is registered in Kenya with registration number PVT-LRUDJJB and is regulated by the Capital Markets Authority in Kenya as a Non-dealing Online Foreign Exchange Broker under license number 162. Exness (KE) Limited operates under www.exness.ke .

Risk Warning: Our services relate to complex derivative products which are traded outside an exchange. These products come with a high risk of losing money rapidly due to leverage and thus are not appropriate for all investors. Under no circumstances shall Exness have any liability to any person or entity for any loss or damage in whole or part caused by, resulting from, or relating to any investing activity.

The information on this page does not constitute investment advice or a recommendation or a solicitation to engage in any investment activity.

Exness

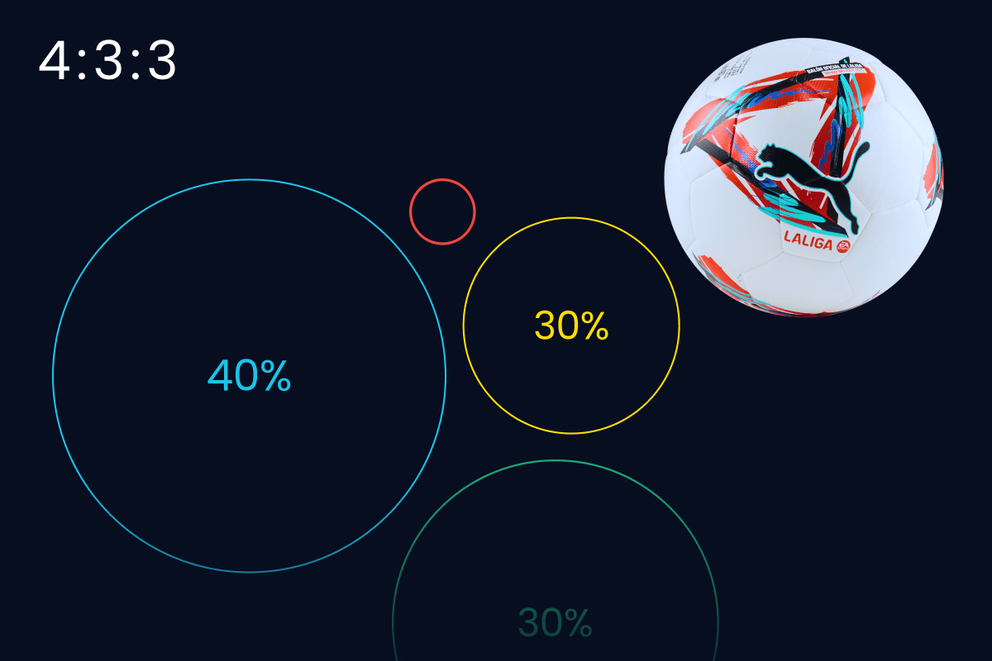

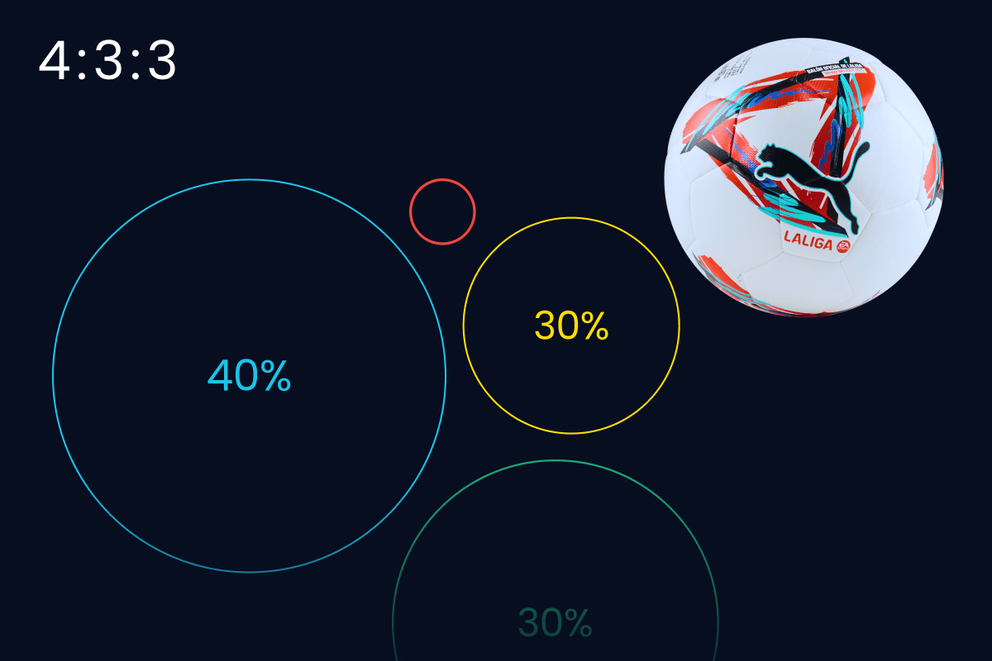

How football formations can help you find the perfect trading portfolio

Whether selecting a team formation for a particular match or selecting trading assets for a particular market, balancing aggression with risk management is a must.

Football formations

There are three common formations:

4-4-2: Four defenders, four midfielders, and two forwards.

4-3-3: Four defenders, three midfielders, and three forwards.

3-5-2: Three defenders, five midfielders, and two forwards.

Each formation has its strengths and weaknesses, and coaches choose the formation based on the team’s strategy and the opponent’s tactics.

Diversifying your portfolio

In trading, diversification means spreading your investments across different types of assets to reduce risk. Just like a balanced football team is important for winning, a diversified portfolio is key to trading. Here’s how you can relate football formations to your trading portfolio:

Follow this link for more: https://exness.social/3Y2NBzr

Whether selecting a team formation for a particular match or selecting trading assets for a particular market, balancing aggression with risk management is a must.

Football formations

There are three common formations:

4-4-2: Four defenders, four midfielders, and two forwards.

4-3-3: Four defenders, three midfielders, and three forwards.

3-5-2: Three defenders, five midfielders, and two forwards.

Each formation has its strengths and weaknesses, and coaches choose the formation based on the team’s strategy and the opponent’s tactics.

Diversifying your portfolio

In trading, diversification means spreading your investments across different types of assets to reduce risk. Just like a balanced football team is important for winning, a diversified portfolio is key to trading. Here’s how you can relate football formations to your trading portfolio:

Follow this link for more: https://exness.social/3Y2NBzr

Exness

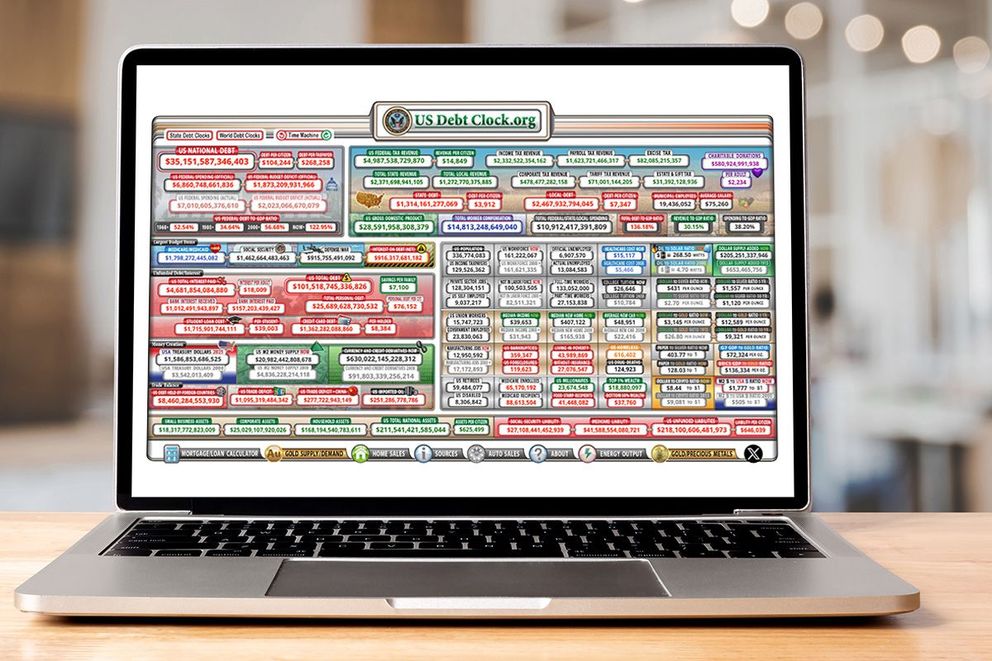

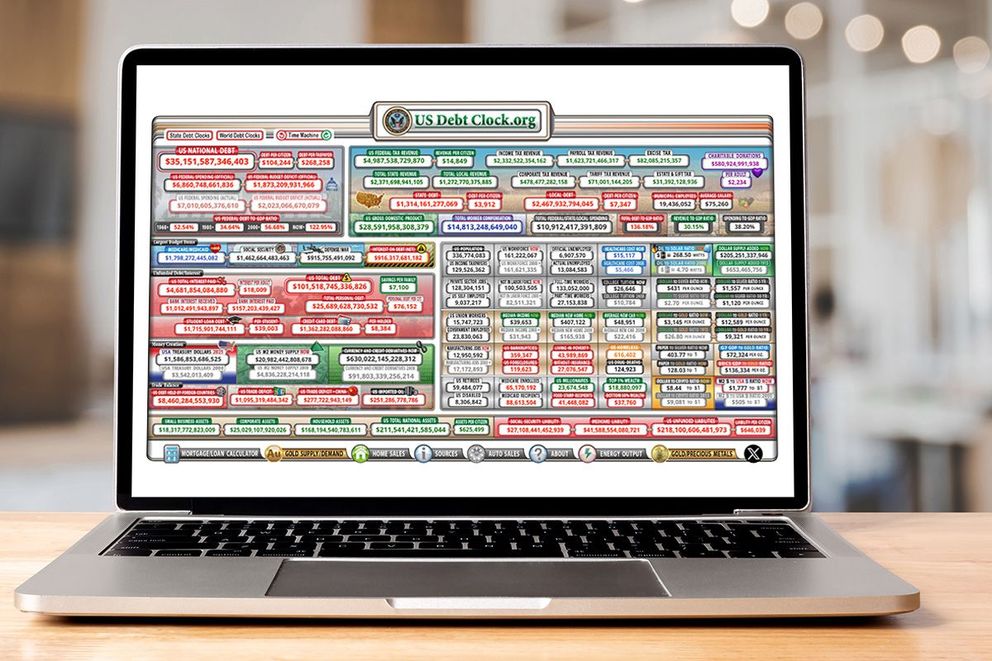

The upcoming release of the Consumer Price Index (CPI) data on Wednesday, September 11, 2024, has the attention of market participants across the globe, but will it reveal truth or another economic narrative?

This CPI economic indicator, which measures changes in the prices paid by consumers for a basket of goods and services, is widely watched for its potential implications on Federal Reserve policy and broader financial market trends.

Consensus expectations and potential impacts

The consensus points to a modest increase in the CPI for September, potentially similar to, or slightly lower than, the 0.6% increase seen in August. The focus is on the core CPI, which excludes volatile food and energy prices, as it is said to provide a clearer picture of underlying inflationary pressures.

Almost every statement suggests a positive near-term. Look at how optimistic the US Treasury gauges the US economy.

“Today, the global economy remains resilient—driven in large part by the United States’ remarkable economic performance. Instead of faltering, U.S. GDP grew by a robust 3.1 percent during 2023. And new data from just this morning shows growth of 2.8 percent in the second quarter of this year, affirming the path we’re on to steady growth and declining inflation.”

Janet Yellen - US Secretary of the Treasury (August 25, 2024)

But how grounded is the optimism? If the CPI figure aligns with market forecasts, the response may be relatively muted, as investors have already priced in the anticipated increase. However, a CPI reading exceeding expectations could trigger concerns about persistent inflation, potentially leading to a stock market decline, bond market sell-off, and US dollar appreciation as the Federal Reserve may be compelled to raise rates further.

Conversely, a CPI figure below expectations could suggest easing inflationary pressures, potentially resulting in a stock market rally, bond market rally, and US dollar depreciation as investors anticipate a less aggressive Fed policy.

Follow this link for more: https://exness.social/insights

This CPI economic indicator, which measures changes in the prices paid by consumers for a basket of goods and services, is widely watched for its potential implications on Federal Reserve policy and broader financial market trends.

Consensus expectations and potential impacts

The consensus points to a modest increase in the CPI for September, potentially similar to, or slightly lower than, the 0.6% increase seen in August. The focus is on the core CPI, which excludes volatile food and energy prices, as it is said to provide a clearer picture of underlying inflationary pressures.

Almost every statement suggests a positive near-term. Look at how optimistic the US Treasury gauges the US economy.

“Today, the global economy remains resilient—driven in large part by the United States’ remarkable economic performance. Instead of faltering, U.S. GDP grew by a robust 3.1 percent during 2023. And new data from just this morning shows growth of 2.8 percent in the second quarter of this year, affirming the path we’re on to steady growth and declining inflation.”

Janet Yellen - US Secretary of the Treasury (August 25, 2024)

But how grounded is the optimism? If the CPI figure aligns with market forecasts, the response may be relatively muted, as investors have already priced in the anticipated increase. However, a CPI reading exceeding expectations could trigger concerns about persistent inflation, potentially leading to a stock market decline, bond market sell-off, and US dollar appreciation as the Federal Reserve may be compelled to raise rates further.

Conversely, a CPI figure below expectations could suggest easing inflationary pressures, potentially resulting in a stock market rally, bond market rally, and US dollar depreciation as investors anticipate a less aggressive Fed policy.

Follow this link for more: https://exness.social/insights

Exness

What is the S&P 500 Index and why is it important in trading?

Exness trading expert Michael Stark dives into the pivotal world of the S&P 500 Index, a crucial barometer for the U.S. economy and a key player in the global trading landscape, decoding its behavior and its underlying trends.

The Standard and Poor’s 500, also known as the (S&P 500 or US500 index, is widely regarded as the most critical index. It tracks the performance of the 500 largest publicly listed companies on the New York Stock Exchange (NYSE) and NASDAQ stock exchange, as well as the Cboe BZX Exchange. The US500 serves as arguably the best single gauge for offering a comprehensive view of the market conditions for various industries and sectors, and for reflecting investors' confidence and future expectations.

Financial indices like the US500 are not merely numbers or abstract values; they are tracking tools that help investors make informed decisions. By analyzing their performance, investors can gauge general economic trends and assess their investments' risks and opportunities.

This article explores the world of the US500 to discover how it is composed and its unique importance compared to other indices like the Dow Jones and NASDAQ. We also look at the companies listed within this index and how their movements affect the broader market. Understanding the US500 is not only a fundamental step for any investor aiming to achieve success but also a gateway to understanding the deeper dynamics of global financial markets.

Follow this link for more: https://exness.social/insights

Exness trading expert Michael Stark dives into the pivotal world of the S&P 500 Index, a crucial barometer for the U.S. economy and a key player in the global trading landscape, decoding its behavior and its underlying trends.

The Standard and Poor’s 500, also known as the (S&P 500 or US500 index, is widely regarded as the most critical index. It tracks the performance of the 500 largest publicly listed companies on the New York Stock Exchange (NYSE) and NASDAQ stock exchange, as well as the Cboe BZX Exchange. The US500 serves as arguably the best single gauge for offering a comprehensive view of the market conditions for various industries and sectors, and for reflecting investors' confidence and future expectations.

Financial indices like the US500 are not merely numbers or abstract values; they are tracking tools that help investors make informed decisions. By analyzing their performance, investors can gauge general economic trends and assess their investments' risks and opportunities.

This article explores the world of the US500 to discover how it is composed and its unique importance compared to other indices like the Dow Jones and NASDAQ. We also look at the companies listed within this index and how their movements affect the broader market. Understanding the US500 is not only a fundamental step for any investor aiming to achieve success but also a gateway to understanding the deeper dynamics of global financial markets.

Follow this link for more: https://exness.social/insights

Exness

Carrying trading and how JPY is holding the global economy together

We’re seeing a lot of heavy-hitter investors switching to cash, and at the center of this sentiment shift is JPY.

Let’s explore JPY and carry trading for insights into trading the markets in the coming weeks.

What is carry trading?

Carry trading is when traders borrow money in a currency with low interest rates, like the Japanese Yen (JPY), and invest it in higher-yielding assets. This strategy works well when there’s a significant difference between the interest rates of two countries.

Why JPY is central to carry trading

The JPY has been a popular currency for carry trades because of Japan's long-standing low interest rates. Investors borrow in Yen at almost no cost and use that money to invest in assets elsewhere, where returns are much higher. This can include U.S. stocks, Mexican bonds, or even Japanese equities.

JPY’s role in global markets

When traders use Yen to fund investments, it adds liquidity to the global markets. This helps to support asset prices and contributes to economic growth worldwide. However, this system can be quite delicate, depending heavily on the Bank of Japan (BOJ)’s interest rate policies.

BOJ policy and Its global impact

Recently, a slight interest rate hike by the BOJ caused a significant move in the Yen, leading to the unwinding of many carry trades. This sell-off in global risk assets, including U.S. equities, shows just how crucial the JPY is in this trading strategy. Even a small change in Japanese rates can trigger widespread market reactions as traders rush to cover their positions.

The risks involved

Carry trading isn’t without risks. If the currency you borrow (like the Yen) suddenly strengthens, you could face steep losses. This happened recently when the BOJ’s rate hike led to a stronger Yen, causing a wave of sell-offs as trades were unwound.

Follow this link for more: https://exness.social/insights

We’re seeing a lot of heavy-hitter investors switching to cash, and at the center of this sentiment shift is JPY.

Let’s explore JPY and carry trading for insights into trading the markets in the coming weeks.

What is carry trading?

Carry trading is when traders borrow money in a currency with low interest rates, like the Japanese Yen (JPY), and invest it in higher-yielding assets. This strategy works well when there’s a significant difference between the interest rates of two countries.

Why JPY is central to carry trading

The JPY has been a popular currency for carry trades because of Japan's long-standing low interest rates. Investors borrow in Yen at almost no cost and use that money to invest in assets elsewhere, where returns are much higher. This can include U.S. stocks, Mexican bonds, or even Japanese equities.

JPY’s role in global markets

When traders use Yen to fund investments, it adds liquidity to the global markets. This helps to support asset prices and contributes to economic growth worldwide. However, this system can be quite delicate, depending heavily on the Bank of Japan (BOJ)’s interest rate policies.

BOJ policy and Its global impact

Recently, a slight interest rate hike by the BOJ caused a significant move in the Yen, leading to the unwinding of many carry trades. This sell-off in global risk assets, including U.S. equities, shows just how crucial the JPY is in this trading strategy. Even a small change in Japanese rates can trigger widespread market reactions as traders rush to cover their positions.

The risks involved

Carry trading isn’t without risks. If the currency you borrow (like the Yen) suddenly strengthens, you could face steep losses. This happened recently when the BOJ’s rate hike led to a stronger Yen, causing a wave of sell-offs as trades were unwound.

Follow this link for more: https://exness.social/insights

Exness

The news that sculpted sentiment for this week As we glance back at last week’s news, several significant events took place in the financial world, offering insights and setting the stage for what might come next this week.

Here's a summary of the most impactful developments in trading, economics, and global markets.

Federal Reserve and interest rate speculations

All eyes were on Federal Reserve Chair Jerome Powell as investors eagerly awaited his highly anticipated speech at an economic conference. The focus was on clues regarding the Fed's next moves, particularly how soon and how aggressively they might begin cutting interest rates. With the Fed’s benchmark interest rate sitting at a 23-year high, any hints about easing could have substantial implications for market strategies and economic outlooks.

Rising energy costs and economic impact

In the UK, the energy regulator Ofgem announced a 10% increase in the energy price cap starting in October. This change means that households will face higher energy bills as winter approaches, adding pressure on consumer spending. The increase is expected to ripple through the economy, potentially dampening consumer confidence and impacting overall economic activity during the colder months.

Mortgage market competition heats up

In Australia, the Commonwealth Bank of Australia made a bold move by cutting interest rates on select home loans for new customers. This decision reignited fears of a mortgage war, as other lenders might follow suit, leading to more aggressive competition in the housing market. Such competition could drive changes in lending practices, affecting both new borrowers and the broader real estate market.

Follow this link for more: https://exness.social/insights

Here's a summary of the most impactful developments in trading, economics, and global markets.

Federal Reserve and interest rate speculations

All eyes were on Federal Reserve Chair Jerome Powell as investors eagerly awaited his highly anticipated speech at an economic conference. The focus was on clues regarding the Fed's next moves, particularly how soon and how aggressively they might begin cutting interest rates. With the Fed’s benchmark interest rate sitting at a 23-year high, any hints about easing could have substantial implications for market strategies and economic outlooks.

Rising energy costs and economic impact

In the UK, the energy regulator Ofgem announced a 10% increase in the energy price cap starting in October. This change means that households will face higher energy bills as winter approaches, adding pressure on consumer spending. The increase is expected to ripple through the economy, potentially dampening consumer confidence and impacting overall economic activity during the colder months.

Mortgage market competition heats up

In Australia, the Commonwealth Bank of Australia made a bold move by cutting interest rates on select home loans for new customers. This decision reignited fears of a mortgage war, as other lenders might follow suit, leading to more aggressive competition in the housing market. Such competition could drive changes in lending practices, affecting both new borrowers and the broader real estate market.

Follow this link for more: https://exness.social/insights

Exness

Will global debt trigger a full recession in September?

In recent months, the financial world has been shaken by a series of events that signal the start of what could be the most significant global debt crisis in modern history.

The latest developments, particularly in Japan, have set the stage for what experts believe is the beginning of the global sovereign debt bubble's unraveling. As economic indicators continue to deteriorate and geopolitical tensions rise, the next 24 months could define the future of global finance.

The US Federal Reserve’s aggressive interest rate hikes, now at their highest level in 23 years, have rippled across the world, impacting economies far and wide. Japan, a key player in the global financial system, has been particularly hard hit. The Bank of Japan’s decision to maintain low interest rates while the Fed increased theirs led to a sharp depreciation of the yen, reaching levels not seen since the 1990s. This, coupled with Japan’s staggering debt-to-GDP ratio of 260%, has created a precarious situation that could have global consequences.

Follow this link for more: https://exness.social/4fviRhk

In recent months, the financial world has been shaken by a series of events that signal the start of what could be the most significant global debt crisis in modern history.

The latest developments, particularly in Japan, have set the stage for what experts believe is the beginning of the global sovereign debt bubble's unraveling. As economic indicators continue to deteriorate and geopolitical tensions rise, the next 24 months could define the future of global finance.

The US Federal Reserve’s aggressive interest rate hikes, now at their highest level in 23 years, have rippled across the world, impacting economies far and wide. Japan, a key player in the global financial system, has been particularly hard hit. The Bank of Japan’s decision to maintain low interest rates while the Fed increased theirs led to a sharp depreciation of the yen, reaching levels not seen since the 1990s. This, coupled with Japan’s staggering debt-to-GDP ratio of 260%, has created a precarious situation that could have global consequences.

Follow this link for more: https://exness.social/4fviRhk

Exness

AI stocks and the dot-com bubble: is history repeating?

There's talk about AI tech stock trends are leading to another bubble burst. Before you start shorting stocks, dig deeper with Exness Insights.

The excitement around artificial intelligence has supercharged a rally in specific US tech stocks. Traders and investors who jumped on the AI train early saw massive growth, in some cases over 700%. In general, anything directly connected to AI technology has been rocketing, but analysts are now seeing a parallel between the AI boom and the dot-com bubble.

Traders who shorted the crash that started in March of 2000 had the opportunity to make significant gains, profiting from the unexpected collapse of the biggest buzz on the planet. Most of us were caught by surprise and missed out, but this time, we will be watching and waiting.

Is such an incredible shorting opportunity on the horizon for AI asset traders? Let’s dig deeper.

Follow this link for more: https://exness.social/4fviRhk

There's talk about AI tech stock trends are leading to another bubble burst. Before you start shorting stocks, dig deeper with Exness Insights.

The excitement around artificial intelligence has supercharged a rally in specific US tech stocks. Traders and investors who jumped on the AI train early saw massive growth, in some cases over 700%. In general, anything directly connected to AI technology has been rocketing, but analysts are now seeing a parallel between the AI boom and the dot-com bubble.

Traders who shorted the crash that started in March of 2000 had the opportunity to make significant gains, profiting from the unexpected collapse of the biggest buzz on the planet. Most of us were caught by surprise and missed out, but this time, we will be watching and waiting.

Is such an incredible shorting opportunity on the horizon for AI asset traders? Let’s dig deeper.

Follow this link for more: https://exness.social/4fviRhk

Exness

Stock market freefall: Is it the end, or just the beginning?

The global stock market has been in a tailspin this last week, sparking the question: buy the dip or brace for impact?

The recent decline across indices has ignited a fierce debate between those who believe a catastrophic global crash is imminent and those who see it as a mere correction. Fear can trigger sentiment shifts, and the markets look very apprehensive. Let’s explore current market sentiment for some insights into where we are heading in the coming weeks.

The crash conspiracy

Whispers of a grand conspiracy fill the air as some analysts point to eerie parallels with past market crashes. They argue that the market is a house of cards, built on inflated tech valuations and propped up by manipulative investment firms. The sudden drop, they claim, is a carefully orchestrated maneuver to change the world order.

Are we really witnessing a meticulously planned financial apocalypse? Will the conspiracy theorists who are forecasting the great collapse have to wait until next year to hype up the doom and gloom, or is it really happening… right now? Should we start shorting Indices soon?

Follow this link for more: https://exness.social/4fviRhk

The global stock market has been in a tailspin this last week, sparking the question: buy the dip or brace for impact?

The recent decline across indices has ignited a fierce debate between those who believe a catastrophic global crash is imminent and those who see it as a mere correction. Fear can trigger sentiment shifts, and the markets look very apprehensive. Let’s explore current market sentiment for some insights into where we are heading in the coming weeks.

The crash conspiracy

Whispers of a grand conspiracy fill the air as some analysts point to eerie parallels with past market crashes. They argue that the market is a house of cards, built on inflated tech valuations and propped up by manipulative investment firms. The sudden drop, they claim, is a carefully orchestrated maneuver to change the world order.

Are we really witnessing a meticulously planned financial apocalypse? Will the conspiracy theorists who are forecasting the great collapse have to wait until next year to hype up the doom and gloom, or is it really happening… right now? Should we start shorting Indices soon?

Follow this link for more: https://exness.social/4fviRhk

Exness

Trading India's import tax gambit

In a bold move that's sent ripples through the tech industry, India has slashed import duties on mobile phones and critical components.

This isn't just about cheaper smartphones–it's a calculated strategy to transform India into a manufacturing powerhouse and lure global tech giants. Let's dive into the potential aftershocks this decision could trigger across international markets.

The smartphone battlefield

The tax cut is a golden ticket for Apple, potentially supercharging its profits on imported high-end iPhones. Could this be the push Apple needs to finally open stores in India? Watch for shifts in Apple's pricing strategy and market share in India's premium segment and keep a close eye on AAPL charts in the coming weeks.

Follow this link for more: https://exness.social/Insights

In a bold move that's sent ripples through the tech industry, India has slashed import duties on mobile phones and critical components.

This isn't just about cheaper smartphones–it's a calculated strategy to transform India into a manufacturing powerhouse and lure global tech giants. Let's dive into the potential aftershocks this decision could trigger across international markets.

The smartphone battlefield

The tax cut is a golden ticket for Apple, potentially supercharging its profits on imported high-end iPhones. Could this be the push Apple needs to finally open stores in India? Watch for shifts in Apple's pricing strategy and market share in India's premium segment and keep a close eye on AAPL charts in the coming weeks.

Follow this link for more: https://exness.social/Insights

Exness

Exness firefighting initiatives set to defend Cyprus against wildfires

Rural areas in Cyprus face increasing threats from devastating wildfires, risking the nation's natural landscapes. Following the fires of 2021 in Limassol and Larnaca, Exness pledged €300,000 to enhance the Department of Forests’ firefighting capabilities. We exceeded this commitment, ultimately doubling the donation, resulting in a comprehensive plan to combat this significant issue.

Ourresponse began with a donation of three state-of-the-art firetrucks and a pick-up truck equipped with a water pump, providing firefighters and communities with essential tools to swiftly respond to future threats. To restore ecosystems damaged by the wildfires, we also organized a tree-planting initiative, adding 400 trees to the affected areas.

Recognizing the need for proactive measures, we partnered with the Cyprus Institute of Technology to develop three innovative unmanned drones capable of detecting fires and alerting the Department of Forests at an early stage. To support the use of these drones, we then covers the costs of three drone operators for two years. This innovative approach to fire detection has the potential to revolutionize wildfire prevention. These efforts have earned Exness two Responsible Business Awards.

Follow this link for more: https://bit.ly/3ZjNVsO

Rural areas in Cyprus face increasing threats from devastating wildfires, risking the nation's natural landscapes. Following the fires of 2021 in Limassol and Larnaca, Exness pledged €300,000 to enhance the Department of Forests’ firefighting capabilities. We exceeded this commitment, ultimately doubling the donation, resulting in a comprehensive plan to combat this significant issue.

Ourresponse began with a donation of three state-of-the-art firetrucks and a pick-up truck equipped with a water pump, providing firefighters and communities with essential tools to swiftly respond to future threats. To restore ecosystems damaged by the wildfires, we also organized a tree-planting initiative, adding 400 trees to the affected areas.

Recognizing the need for proactive measures, we partnered with the Cyprus Institute of Technology to develop three innovative unmanned drones capable of detecting fires and alerting the Department of Forests at an early stage. To support the use of these drones, we then covers the costs of three drone operators for two years. This innovative approach to fire detection has the potential to revolutionize wildfire prevention. These efforts have earned Exness two Responsible Business Awards.

Follow this link for more: https://bit.ly/3ZjNVsO

Exness

Exness investment wallet: Unique advantage for traders

Exness is constantly looking for ways to innovate and elevate our traders' experience and conditions, and one recent release has already received positive feedback from traders and managers. Our investment wallet, designed to streamline your investments in Social Trading (ST) and Portfolio Management (PIM), is available to Exness traders now. Let’s explore the Exness wallet and its advantages.

Follow this link for more: https://bit.ly/3ZjNVsO

Exness is constantly looking for ways to innovate and elevate our traders' experience and conditions, and one recent release has already received positive feedback from traders and managers. Our investment wallet, designed to streamline your investments in Social Trading (ST) and Portfolio Management (PIM), is available to Exness traders now. Let’s explore the Exness wallet and its advantages.

Follow this link for more: https://bit.ly/3ZjNVsO

Exness

Exness welcomes new LATAM Team Pro members

Our Team Pro Members have been gaining huge popularity with traders from all over the world, and we are adding two new powerhouse traders to the list.

Adrian Emilio Nardelli and Bran Desalcedo, both celebrated for their exceptional trading skills and profound understanding of financial markets, will serve as brand ambassadors and mentors. Their role involves sharing their extensive knowledge and experience with aspiring traders across LATAM. The trading community can anticipate a wealth of informative and educational content, including market analysis and success stories.

Follow this link for more: https://bit.ly/Latam-Team-Pro

Our Team Pro Members have been gaining huge popularity with traders from all over the world, and we are adding two new powerhouse traders to the list.

Adrian Emilio Nardelli and Bran Desalcedo, both celebrated for their exceptional trading skills and profound understanding of financial markets, will serve as brand ambassadors and mentors. Their role involves sharing their extensive knowledge and experience with aspiring traders across LATAM. The trading community can anticipate a wealth of informative and educational content, including market analysis and success stories.

Follow this link for more: https://bit.ly/Latam-Team-Pro

Exness

Exness Fintech Scholarship empowers bright minds

At Exness, we believe that technology drives the future, and nurturing the next generation of tech talent is crucial. We firmly believe in the transformative power of technology and its impact on the world’s economies and people's lives. Through the Exness Fintech Scholarships, we actively turn this vision into reality by providing exceptional students the opportunity to pursue STEM (science, technology, engineering, and mathematics) courses at top-tier institutions like Cambridge University.

The Exness Fintech Scholarships program recognizes academic excellence and offers promising minds with financial difficulties a gateway to fulfilling their educational goals. Currently, our initiative empowers 53 students from Cyprus, South Africa, and Kenya. It not only helps them realize their educational aspirations but also pursue careers in the global tech sector.

Follow this link for more: https://bit.ly/exness-fintech

At Exness, we believe that technology drives the future, and nurturing the next generation of tech talent is crucial. We firmly believe in the transformative power of technology and its impact on the world’s economies and people's lives. Through the Exness Fintech Scholarships, we actively turn this vision into reality by providing exceptional students the opportunity to pursue STEM (science, technology, engineering, and mathematics) courses at top-tier institutions like Cambridge University.

The Exness Fintech Scholarships program recognizes academic excellence and offers promising minds with financial difficulties a gateway to fulfilling their educational goals. Currently, our initiative empowers 53 students from Cyprus, South Africa, and Kenya. It not only helps them realize their educational aspirations but also pursue careers in the global tech sector.

Follow this link for more: https://bit.ly/exness-fintech

Exness

What is Surf Investment? Indicators Used In Scalping Investing

People who are just starting to learn a complex and interesting "profession" like stock trading often have a lot of questions. Most start looking for advice online, which instruments are worth trading, etc. or ready-made strategies. Because of poor theoretical foundation and zero experience, one cannot judge the gist of the truth from the incoming information, leading to sad consequences. They go to the trading floor and start investing, increasing their broker's commission income or buying shares of companies they know nothing about. It is not uncommon for ambitious people to rush into the derivatives market at once and things can go very wrong.

Instead of immediately looking for the “ideal trading style” or copying a questionable trading strategy, you need to first determine which type of trading suits you better and what that strategy is all about. What. One of the most popular trading styles in the market today is scalping.

In this article, we will answer the question of what scalping is and how it is applied. You will also learn about the advantages and disadvantages of this trading style as well as what indicators can be used to maximize your trading results.

Follow this link for more: https://bit.ly/3ZjNVsO

People who are just starting to learn a complex and interesting "profession" like stock trading often have a lot of questions. Most start looking for advice online, which instruments are worth trading, etc. or ready-made strategies. Because of poor theoretical foundation and zero experience, one cannot judge the gist of the truth from the incoming information, leading to sad consequences. They go to the trading floor and start investing, increasing their broker's commission income or buying shares of companies they know nothing about. It is not uncommon for ambitious people to rush into the derivatives market at once and things can go very wrong.

Instead of immediately looking for the “ideal trading style” or copying a questionable trading strategy, you need to first determine which type of trading suits you better and what that strategy is all about. What. One of the most popular trading styles in the market today is scalping.

In this article, we will answer the question of what scalping is and how it is applied. You will also learn about the advantages and disadvantages of this trading style as well as what indicators can be used to maximize your trading results.

Follow this link for more: https://bit.ly/3ZjNVsO

Exness

What is the Hawkish Policy? The Difference Between Hawkish And Dovish

In the world of finance and trading, terms like “hawkish” and “dovish” are often used to describe the views of state banks and policymakers. Understanding these terms is essential for traders and investors as they can have a significant impact on market sentiment and asset prices.

In this article, we will explain the meaning of the word "hawkish" and what it means for trading. Additionally, we will compare it with the opposite view, " dovish ", and discuss how traders can navigate the actions of state banks to make informed trading decisions.

Follow this link for more: https://bit.ly/3ZjNVsO

In the world of finance and trading, terms like “hawkish” and “dovish” are often used to describe the views of state banks and policymakers. Understanding these terms is essential for traders and investors as they can have a significant impact on market sentiment and asset prices.

In this article, we will explain the meaning of the word "hawkish" and what it means for trading. Additionally, we will compare it with the opposite view, " dovish ", and discuss how traders can navigate the actions of state banks to make informed trading decisions.

Follow this link for more: https://bit.ly/3ZjNVsO

Exness

Exness, the Forex Traders Summit 2024 Official Sponsor, celebrates a successful participation

Exness, one of the world’s largest brokers, reflects on the successful partnership and participation in the Forex Traders Summit Dubai 2024. The event, held between 19 and 20 May,

provided a platform where industry professionals and enthusiasts could network, gain insights, and share knowledge on current and future trends.

Attendees flocked to the Exness booth to engage with the company's expert team, explore its cutting-edge trading platform, and learn about the distinctive features that set Exness apart. The event's participants also had the opportunity to gain valuable insights into current market conditions and outlooks for the future through Wael Makarem's interesting panel discussion.

Mohammad Ammer, Exness Regional Commercial Director, commented, “The Summit was a resounding success, and we couldn’t be happier to be part of it as participants and as its Official Sponsor. Connecting with our B2B clients and other attendees was a unique experience for us, and we look forward to the next summit to continue strengthening our relationship with them.”

Exness uses a combination of technology and ethics to raise the industry benchmark and create favorable conditions for traders. It offers clients a frictionless trading experience through its superior proprietary platform and unique market protections and allows traders to experience how the markets should be.

Exness, one of the world’s largest brokers, reflects on the successful partnership and participation in the Forex Traders Summit Dubai 2024. The event, held between 19 and 20 May,

provided a platform where industry professionals and enthusiasts could network, gain insights, and share knowledge on current and future trends.

Attendees flocked to the Exness booth to engage with the company's expert team, explore its cutting-edge trading platform, and learn about the distinctive features that set Exness apart. The event's participants also had the opportunity to gain valuable insights into current market conditions and outlooks for the future through Wael Makarem's interesting panel discussion.

Mohammad Ammer, Exness Regional Commercial Director, commented, “The Summit was a resounding success, and we couldn’t be happier to be part of it as participants and as its Official Sponsor. Connecting with our B2B clients and other attendees was a unique experience for us, and we look forward to the next summit to continue strengthening our relationship with them.”

Exness uses a combination of technology and ethics to raise the industry benchmark and create favorable conditions for traders. It offers clients a frictionless trading experience through its superior proprietary platform and unique market protections and allows traders to experience how the markets should be.

Exness

Is it the end of Google search?

You may have heard that more and more people are turning away from Google as their search provider and choosing Microsoft’s Bing. These rumors began to appear after Google’s Bard/Gemini released some rather embarrassing AI-generated images that caused the stock to plummet.

Before the controversy, GOOGL was holding at $144 (USD), but within a week the stock tumbled -7.64% to $133. Did this mark the beginning of the end? Is it the end for Google search?

Google search is far from ending. In 2024, Google’s share of the global search engine market was 91.5%, a slight increase from 2023, where Google held around 81.95% of the market.

As for GOOGL, after the brief bear market, the bulls took over and the stock price rocketed to $172, an all-time high for Alphabet Inc. Google is not only surviving the embarrassment of Q1, it continues to grow, and it has big plans for the future. Let’s explore Google and the potential trading opportunities on the horizon.

Follow this link for more: https://bit.ly/3ZjNVsO

You may have heard that more and more people are turning away from Google as their search provider and choosing Microsoft’s Bing. These rumors began to appear after Google’s Bard/Gemini released some rather embarrassing AI-generated images that caused the stock to plummet.

Before the controversy, GOOGL was holding at $144 (USD), but within a week the stock tumbled -7.64% to $133. Did this mark the beginning of the end? Is it the end for Google search?

Google search is far from ending. In 2024, Google’s share of the global search engine market was 91.5%, a slight increase from 2023, where Google held around 81.95% of the market.

As for GOOGL, after the brief bear market, the bulls took over and the stock price rocketed to $172, an all-time high for Alphabet Inc. Google is not only surviving the embarrassment of Q1, it continues to grow, and it has big plans for the future. Let’s explore Google and the potential trading opportunities on the horizon.

Follow this link for more: https://bit.ly/3ZjNVsO

Exness

Is the Chinese economy in trouble?

Once again, Western media is suggesting that the Chinese economy is failing, and global market sentiment is already pulling the strings of influence on several China-related assets, but is the Chinese economy in trouble or is it simply propaganda intended to lead Asian market investors back to the West?

Let’s dig a little deeper into the claims of China’s weakening economy and see if the current pessimistic headlines will be here today… gone tomorrow.

Follow this link for more: https://bit.ly/3ZjNVsO

Once again, Western media is suggesting that the Chinese economy is failing, and global market sentiment is already pulling the strings of influence on several China-related assets, but is the Chinese economy in trouble or is it simply propaganda intended to lead Asian market investors back to the West?

Let’s dig a little deeper into the claims of China’s weakening economy and see if the current pessimistic headlines will be here today… gone tomorrow.

Follow this link for more: https://bit.ly/3ZjNVsO

Exness

Is the stock market dying or evolving?

We all know how the stock market is super-susceptible to rumors and speculation, but is a crash really on the horizon or is it merely fearmongering? The only way a crash can start is if market sentiment is strongly shifted to a negative, so let’s explore what we know so far and see if it is enough to sway sentiment.

Follow this link for more: https://bit.ly/3ZjNVsO

We all know how the stock market is super-susceptible to rumors and speculation, but is a crash really on the horizon or is it merely fearmongering? The only way a crash can start is if market sentiment is strongly shifted to a negative, so let’s explore what we know so far and see if it is enough to sway sentiment.

Follow this link for more: https://bit.ly/3ZjNVsO

Exness

How US rate cuts are misleading traders

As an avid trader and financial journalist, I've been growing more and more concerned with interest rate and inflation reports coming from the US over the last two years. My deep-dive research has revealed layers of conflicting signals that are seldom covered in the morning financial news. If you are forecasting based on the optimism of Fed Chair Jerome Powell, then you might be basing your trading decisions on falsehoods.

So what is the reality of trading rate cuts, and what do rate cuts indicate?

Follow this link for more: https://bit.ly/USratecuts

As an avid trader and financial journalist, I've been growing more and more concerned with interest rate and inflation reports coming from the US over the last two years. My deep-dive research has revealed layers of conflicting signals that are seldom covered in the morning financial news. If you are forecasting based on the optimism of Fed Chair Jerome Powell, then you might be basing your trading decisions on falsehoods.

So what is the reality of trading rate cuts, and what do rate cuts indicate?

Follow this link for more: https://bit.ly/USratecuts

: