Abdalla Mohamed Mahmoud Taha / Profile

- Information

|

7+ years

experience

|

0

products

|

0

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

my name Abdalla Mohamed, I have more than 11 years experience in forex market .

I am very professional scalping trader and I own research and studies on the pairs of the British pound

, i have signals providers at MT4 / MT5 , available through the MQL5.com Market.

I am very professional scalping trader and I own research and studies on the pairs of the British pound

, i have signals providers at MT4 / MT5 , available through the MQL5.com Market.

Abdalla Mohamed Mahmoud Taha

Added topic transfer ea from mt4 to mt5

can any one help me to make my mt4 ea work at mt5 ??????

Abdalla Mohamed Mahmoud Taha

Added topic when rank return again

dear if any signal make more than 50 % in the first month rank will disappear can any one tell me when rank will return ??

Share on social networks · 1

1

Abdalla Mohamed Mahmoud Taha

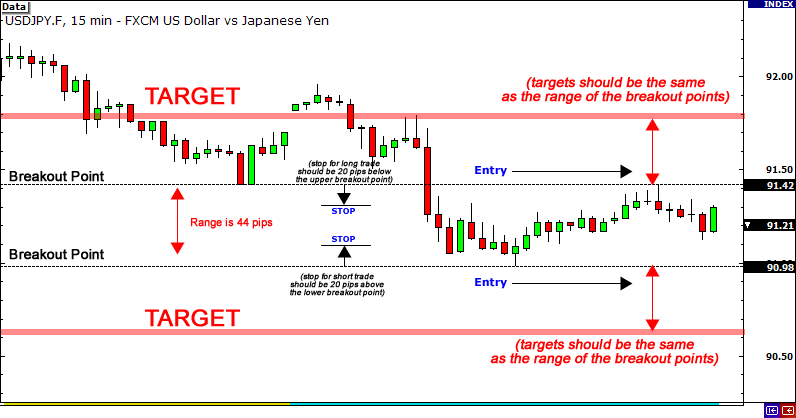

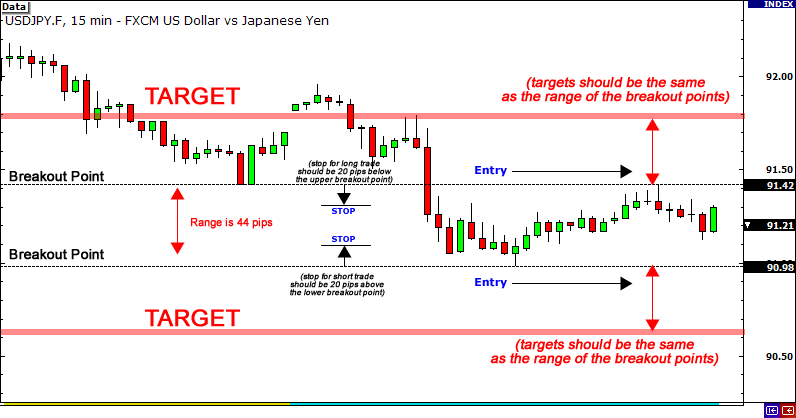

How to Trade the News Using the Straddle Trade Strategy

What if there was a way to make money quickly even if you had no idea whether the market would move up or down?

It’s possible as long as there is sufficient price volatility.

And when can you get this volatility? When news like economic data or central bank announcements is released!

The first thing to consider is which news reports to trade.

Earlier, we discussed the biggest moving news releases.

Ideally, you would want to only trade those reports because there is a high probability the market will make a big move after their release.

The next thing you should do is take a look at the range at least 20 minutes before the actual news release.

The high of that range will be your upper breakout point, and the low of that range will be your lower breakout point.

Note that the smaller the range is the more likely it is you will see a big move from the news report.

The breakout points will be your entry levels.

This is where you want to set your orders. Your stops should be placed approximately 20 pips below and above the breakout points, and your initial targets should be about the same as the range of the breakout levels.

Straddle Trade

This is known as a straddle trade.

You are looking to play BOTH sides of the trades.

It doesn’t matter which direction the price moves, the straddle strategy will have you positioned to take advantage of it.

Now that you’re prepared to enter the market in either direction, all you have to do is wait for the news to come out.

Sometimes you may get triggered in one direction only to find that you get stopped out because the price quickly reverses in the other direction.

However, your other entry will get triggered and if that trade wins, you should recoup your initial losses and come out with a small profit.

A best-case scenario would be that only one of your trades gets triggered and the price continues to move in your favor so that you don’t incur any losses.

Either way, if done correctly you should still end up positive for the day.

One thing that makes a non-directional bias approach attractive is that it eliminates any emotions.

You just want to profit when the move happens.

This allows you to take advantage of more trading opportunities because you will be triggered either way.

As most news events tend to have a limited impact on longer-term price action, setting realistic profit targets should help to increase the number of winning trades.

There are many more strategies for trading the news, but the concepts mentioned in this lesson should always be part of your routine whenever you are working out an approach to taking advantage of news report movements.

What if there was a way to make money quickly even if you had no idea whether the market would move up or down?

It’s possible as long as there is sufficient price volatility.

And when can you get this volatility? When news like economic data or central bank announcements is released!

The first thing to consider is which news reports to trade.

Earlier, we discussed the biggest moving news releases.

Ideally, you would want to only trade those reports because there is a high probability the market will make a big move after their release.

The next thing you should do is take a look at the range at least 20 minutes before the actual news release.

The high of that range will be your upper breakout point, and the low of that range will be your lower breakout point.

Note that the smaller the range is the more likely it is you will see a big move from the news report.

The breakout points will be your entry levels.

This is where you want to set your orders. Your stops should be placed approximately 20 pips below and above the breakout points, and your initial targets should be about the same as the range of the breakout levels.

Straddle Trade

This is known as a straddle trade.

You are looking to play BOTH sides of the trades.

It doesn’t matter which direction the price moves, the straddle strategy will have you positioned to take advantage of it.

Now that you’re prepared to enter the market in either direction, all you have to do is wait for the news to come out.

Sometimes you may get triggered in one direction only to find that you get stopped out because the price quickly reverses in the other direction.

However, your other entry will get triggered and if that trade wins, you should recoup your initial losses and come out with a small profit.

A best-case scenario would be that only one of your trades gets triggered and the price continues to move in your favor so that you don’t incur any losses.

Either way, if done correctly you should still end up positive for the day.

One thing that makes a non-directional bias approach attractive is that it eliminates any emotions.

You just want to profit when the move happens.

This allows you to take advantage of more trading opportunities because you will be triggered either way.

As most news events tend to have a limited impact on longer-term price action, setting realistic profit targets should help to increase the number of winning trades.

There are many more strategies for trading the news, but the concepts mentioned in this lesson should always be part of your routine whenever you are working out an approach to taking advantage of news report movements.

Abdalla Mohamed Mahmoud Taha

Set Trading Goals That Work!

Goals are important! Not only do they represent expectations and aspirations, goals also serve as a bridge from reality to the ideal.

The moment you set a goal, you face reality by acknowledging the need to address your shortcomings or maybe simply fulfill your desire to do better.

I mean, you wouldn’t set a goal of finishing a full marathon if you’ve already done it, right? Of course, achieving that goal would be possible if you put some work in your running in the first place.

By putting in a substantial amount of effort that consequently leads to progress, goals keep you grounded when you see that it’s the little things that can make a big difference in the long run.

Small things like adding a minute to your jogging routine, drinking only a cup of coffee instead of your usual two, or moving your stop loss a pip or two above breakeven could have huge rewards down the road.

You then become more aware of yourself and realize your strengths. In this aspect, goals keep you motivated as each step you take gives you a better glimpse of what you’ll be like if you push yourself a little further.

Imagining yourself achieving success gets you closer to the real thing! Just ask Arnold Schwarzenegger who credits his seven Mr. Universe titles to his workout routine which included him just standing in the corner, visualizing himself winning again.

However, proper goal-setting is not as easy as it sounds.

Some traders often become too preoccupied with their desired outcomes, such as making a truckload of pips or bouncing back from their losses, that they overlook the realistic aspect of these goals.

You have to think about whether your goals are achievable depending on your trade plan, your risk management, and even your own personality.

Another reason why some traders fail to achieve their goals is the lack of concrete follow through. It’s not enough to set a particular weekly profit target, think happy thoughts, and expect it to magically become a reality.

Keep in mind that goals must be accompanied by specific steps to attain it, must be realistic, and must be action-oriented.

To facilitate this, one must also figure out which type of goal to aim for.

For beginner traders, it would be wise to set out on goals that focus on the process, as opposed to the outcome.

These types of goals help reinforce and shape your trading skills, so that you learn to trade properly. Whether or not you end up in a loss doesn’t matter – the point is that you trade the right way and focus on the process.

Examples of such process goals can pertain to certain aspects of trading like risk management (choosing the correct lot size) and execution (closing trades when they hit your stop loss). In the long run, it will be highly beneficial to your development as a trader.

On the other hand, if you are a more experienced trader, having outcome-oriented goals may prove to be more effective. Having a monetary or pip target can help remind you of what must be done in order to achieve the goal.

Remember though, you must first have the necessary skills and experience to actually know what process you must go through in order to hit your target.

No matter which type of goal you decide to choose, the goal should help you improve as a trader. The purpose of a goal is not only for you to achieve it; it should breed motivation, learning, and confidence.

By setting goals and striving to achieve them, you can accelerate your forex trading development exponentially.

Goals are important! Not only do they represent expectations and aspirations, goals also serve as a bridge from reality to the ideal.

The moment you set a goal, you face reality by acknowledging the need to address your shortcomings or maybe simply fulfill your desire to do better.

I mean, you wouldn’t set a goal of finishing a full marathon if you’ve already done it, right? Of course, achieving that goal would be possible if you put some work in your running in the first place.

By putting in a substantial amount of effort that consequently leads to progress, goals keep you grounded when you see that it’s the little things that can make a big difference in the long run.

Small things like adding a minute to your jogging routine, drinking only a cup of coffee instead of your usual two, or moving your stop loss a pip or two above breakeven could have huge rewards down the road.

You then become more aware of yourself and realize your strengths. In this aspect, goals keep you motivated as each step you take gives you a better glimpse of what you’ll be like if you push yourself a little further.

Imagining yourself achieving success gets you closer to the real thing! Just ask Arnold Schwarzenegger who credits his seven Mr. Universe titles to his workout routine which included him just standing in the corner, visualizing himself winning again.

However, proper goal-setting is not as easy as it sounds.

Some traders often become too preoccupied with their desired outcomes, such as making a truckload of pips or bouncing back from their losses, that they overlook the realistic aspect of these goals.

You have to think about whether your goals are achievable depending on your trade plan, your risk management, and even your own personality.

Another reason why some traders fail to achieve their goals is the lack of concrete follow through. It’s not enough to set a particular weekly profit target, think happy thoughts, and expect it to magically become a reality.

Keep in mind that goals must be accompanied by specific steps to attain it, must be realistic, and must be action-oriented.

To facilitate this, one must also figure out which type of goal to aim for.

For beginner traders, it would be wise to set out on goals that focus on the process, as opposed to the outcome.

These types of goals help reinforce and shape your trading skills, so that you learn to trade properly. Whether or not you end up in a loss doesn’t matter – the point is that you trade the right way and focus on the process.

Examples of such process goals can pertain to certain aspects of trading like risk management (choosing the correct lot size) and execution (closing trades when they hit your stop loss). In the long run, it will be highly beneficial to your development as a trader.

On the other hand, if you are a more experienced trader, having outcome-oriented goals may prove to be more effective. Having a monetary or pip target can help remind you of what must be done in order to achieve the goal.

Remember though, you must first have the necessary skills and experience to actually know what process you must go through in order to hit your target.

No matter which type of goal you decide to choose, the goal should help you improve as a trader. The purpose of a goal is not only for you to achieve it; it should breed motivation, learning, and confidence.

By setting goals and striving to achieve them, you can accelerate your forex trading development exponentially.

Abdalla Mohamed Mahmoud Taha

GBP Weekly Forecast – Brexit Negotiations to Keep the Pound Supported?

Pound bulls remain optimistic that a Brexit deal could be reached. Will we see concrete developments this week?

Check out the top catalysts that might influence your pound trades:

Inflation numbers (Oct 21, 6:00 am GMT)

Dining discounts helped drag consumer prices near their five-year lows in August

The weakness was mostly expected, so traders focused on the risk rally ahead of the Fed’s policy statement

Analysts see the monthly prices rising by 0.3% in September, while the annual figure could remain at a 0.2% growth

Subdued prices can fan discussions of more QE or negative interest rates from the Bank of England (BOE)

Other lower-tier economic releases

Public borrowing (Oct 21, 6:00 am GMT) to clock in at 42.4B vs. 35.9B in September

CBI industrial order trends (Oct 22, 10:00 am GMT) to improve from -48 to -42 in October

GfK consumer confidence (Oct 22, 11:01 pm GMT) seen weakening from -25 to -28 in October

Retail sales (Oct 23, 6:00 am GMT) to see a 1.3% dip (from 0.8% growth) in September

Annualized retail sales could slow down from 2.8% to 1.0%

Manufacturing PMI (Oct 23, 8:30 am GMT) could show manufacturing slowdown (from 54.1 to 53.2) in October

Services PMI (Oct 23, 8:30 am GMT) to print at 53.4 after a 56.1 reading in September

Brexit updates

Ongoing Brexit negotiations should keep the pound somewhat supported throughout the week

U.K. PM Boris Johnson has so far kept the door open for negotiations after his self-imposed October 15 deadline

Bloomberg has reported that U.K. policymakers could take out controversial parts of the Internal Market Bill

Any hints of PM Johnson pulling the plug on negotiations could weigh on the pound

Technical snapshot

The pound has lost value against all of its major counterparts except the Aussie in the last seven days

GBP weakened the most against the dollar, yen, and the Kiwi

Pound bulls remain optimistic that a Brexit deal could be reached. Will we see concrete developments this week?

Check out the top catalysts that might influence your pound trades:

Inflation numbers (Oct 21, 6:00 am GMT)

Dining discounts helped drag consumer prices near their five-year lows in August

The weakness was mostly expected, so traders focused on the risk rally ahead of the Fed’s policy statement

Analysts see the monthly prices rising by 0.3% in September, while the annual figure could remain at a 0.2% growth

Subdued prices can fan discussions of more QE or negative interest rates from the Bank of England (BOE)

Other lower-tier economic releases

Public borrowing (Oct 21, 6:00 am GMT) to clock in at 42.4B vs. 35.9B in September

CBI industrial order trends (Oct 22, 10:00 am GMT) to improve from -48 to -42 in October

GfK consumer confidence (Oct 22, 11:01 pm GMT) seen weakening from -25 to -28 in October

Retail sales (Oct 23, 6:00 am GMT) to see a 1.3% dip (from 0.8% growth) in September

Annualized retail sales could slow down from 2.8% to 1.0%

Manufacturing PMI (Oct 23, 8:30 am GMT) could show manufacturing slowdown (from 54.1 to 53.2) in October

Services PMI (Oct 23, 8:30 am GMT) to print at 53.4 after a 56.1 reading in September

Brexit updates

Ongoing Brexit negotiations should keep the pound somewhat supported throughout the week

U.K. PM Boris Johnson has so far kept the door open for negotiations after his self-imposed October 15 deadline

Bloomberg has reported that U.K. policymakers could take out controversial parts of the Internal Market Bill

Any hints of PM Johnson pulling the plug on negotiations could weigh on the pound

Technical snapshot

The pound has lost value against all of its major counterparts except the Aussie in the last seven days

GBP weakened the most against the dollar, yen, and the Kiwi

Abdalla Mohamed Mahmoud Taha

Turn Your Trading Weaknesses into Strengths

Suppose you’ve just experienced a huge losing streak. What will you likely do next? Are you the type of trader who becomes so depressed that you are unable to take clear forex trading signals, or are you the type of trader who’s able to easily shrug it off?

No matter how long you have been trading, there is always the risk of experiencing performance anxiety.

When things do not go your way, there is a chance that you’ll become overly pessimistic and see the situation as a sign that you are a failure. As a result, your trading performance dwindles even more, eventually leading you to quit.

This is obviously a problem. But like all problems, there is also a solution. Instead of focusing your weaknesses, look at it under a new light – a process called positive reevaluation.

For illustrative purposes, let’s take a trader who has a habit of using stops that are way too tight because he’s afraid of losing too much.

As of late, he’s getting stopped out a lot and ends up with a long losing streak. This makes him even more terrified of putting trades on and losing more money. He now finds himself stuck in a very vicious cycle that’s freezing him up.

You could say that this forex trader’s attitude towards trading is negative, but through the process of positive reevaluation, he can actually use this underlying weakness as a strength.

Rather than focusing on the fear of losing, the trader can use this fear to positively reevaluate his trading and see it as a position-sizing problem. He can cut down on his position sizes so he can take even smaller risks while at the same time widening his stops.

If you can twist a perceived negative thought, tendency, or trait into a positive one, you can get it to work for you rather than against you.

Let’s say that as a trader, you’re easily overcome with emotion when your trade starts to go against you. As a result, you tend to widen your stop when your forex trade is losing.

A bit of positive reevaluation can help you shift focus away from how this tendency holds you back and towards how it can help you.

Since you know that these emotions sprout when market conditions become unfavorable for your trade, when you find yourself wanting to widen your stops, you can actually use it as a signal to cut losses or trim your position.

Basically, instead of letting it take over you, you end up using your emotions as a signal to make better trading decisions.

So you see, looking at a problem from a different angle can go a long way in helping you improve your forex trading. It can offer you new insights on how to approach a problem, and heck, it can even help you turn your perceived weaknesses into strengths!

Suppose you’ve just experienced a huge losing streak. What will you likely do next? Are you the type of trader who becomes so depressed that you are unable to take clear forex trading signals, or are you the type of trader who’s able to easily shrug it off?

No matter how long you have been trading, there is always the risk of experiencing performance anxiety.

When things do not go your way, there is a chance that you’ll become overly pessimistic and see the situation as a sign that you are a failure. As a result, your trading performance dwindles even more, eventually leading you to quit.

This is obviously a problem. But like all problems, there is also a solution. Instead of focusing your weaknesses, look at it under a new light – a process called positive reevaluation.

For illustrative purposes, let’s take a trader who has a habit of using stops that are way too tight because he’s afraid of losing too much.

As of late, he’s getting stopped out a lot and ends up with a long losing streak. This makes him even more terrified of putting trades on and losing more money. He now finds himself stuck in a very vicious cycle that’s freezing him up.

You could say that this forex trader’s attitude towards trading is negative, but through the process of positive reevaluation, he can actually use this underlying weakness as a strength.

Rather than focusing on the fear of losing, the trader can use this fear to positively reevaluate his trading and see it as a position-sizing problem. He can cut down on his position sizes so he can take even smaller risks while at the same time widening his stops.

If you can twist a perceived negative thought, tendency, or trait into a positive one, you can get it to work for you rather than against you.

Let’s say that as a trader, you’re easily overcome with emotion when your trade starts to go against you. As a result, you tend to widen your stop when your forex trade is losing.

A bit of positive reevaluation can help you shift focus away from how this tendency holds you back and towards how it can help you.

Since you know that these emotions sprout when market conditions become unfavorable for your trade, when you find yourself wanting to widen your stops, you can actually use it as a signal to cut losses or trim your position.

Basically, instead of letting it take over you, you end up using your emotions as a signal to make better trading decisions.

So you see, looking at a problem from a different angle can go a long way in helping you improve your forex trading. It can offer you new insights on how to approach a problem, and heck, it can even help you turn your perceived weaknesses into strengths!

Abdalla Mohamed Mahmoud Taha

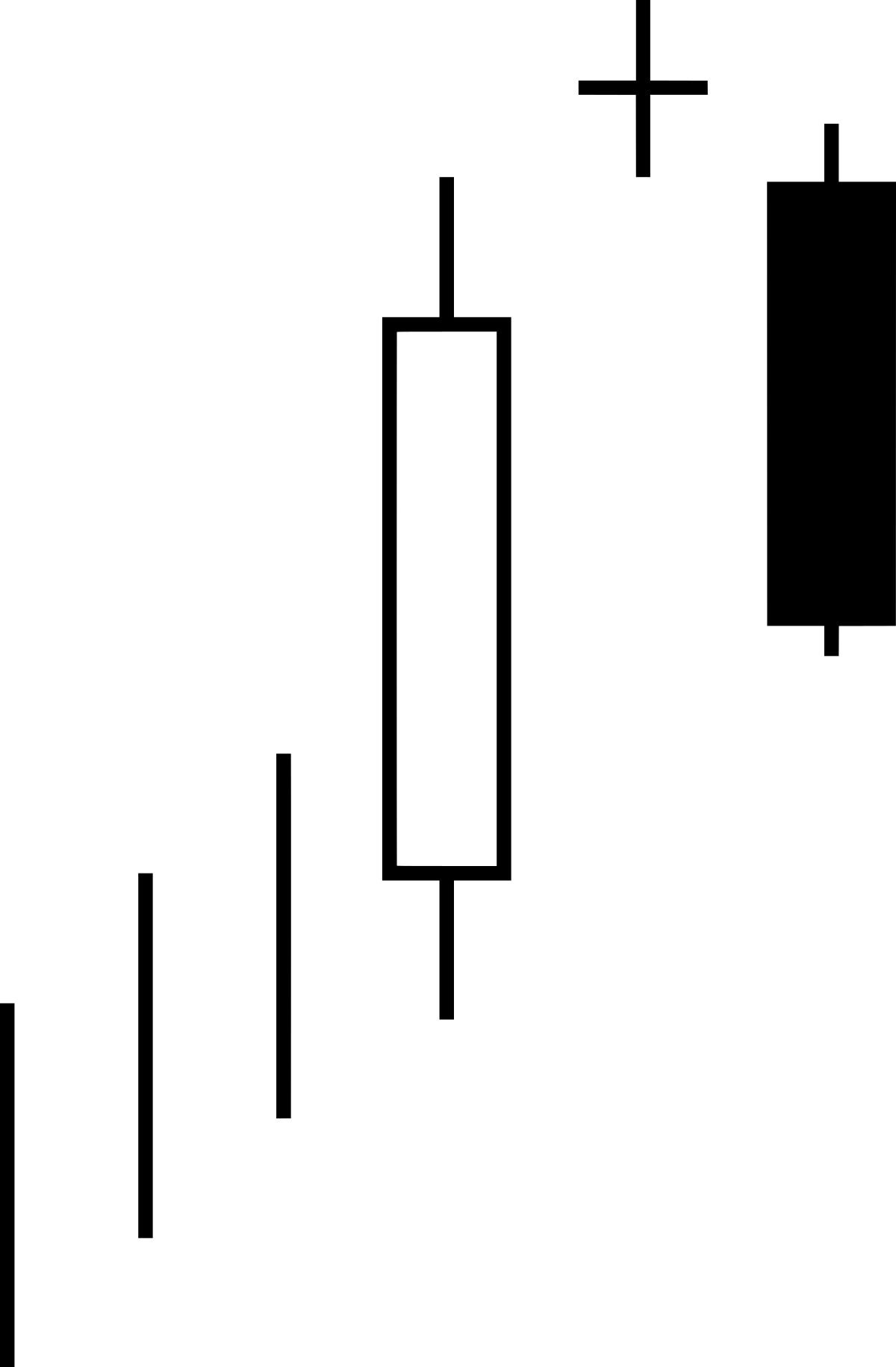

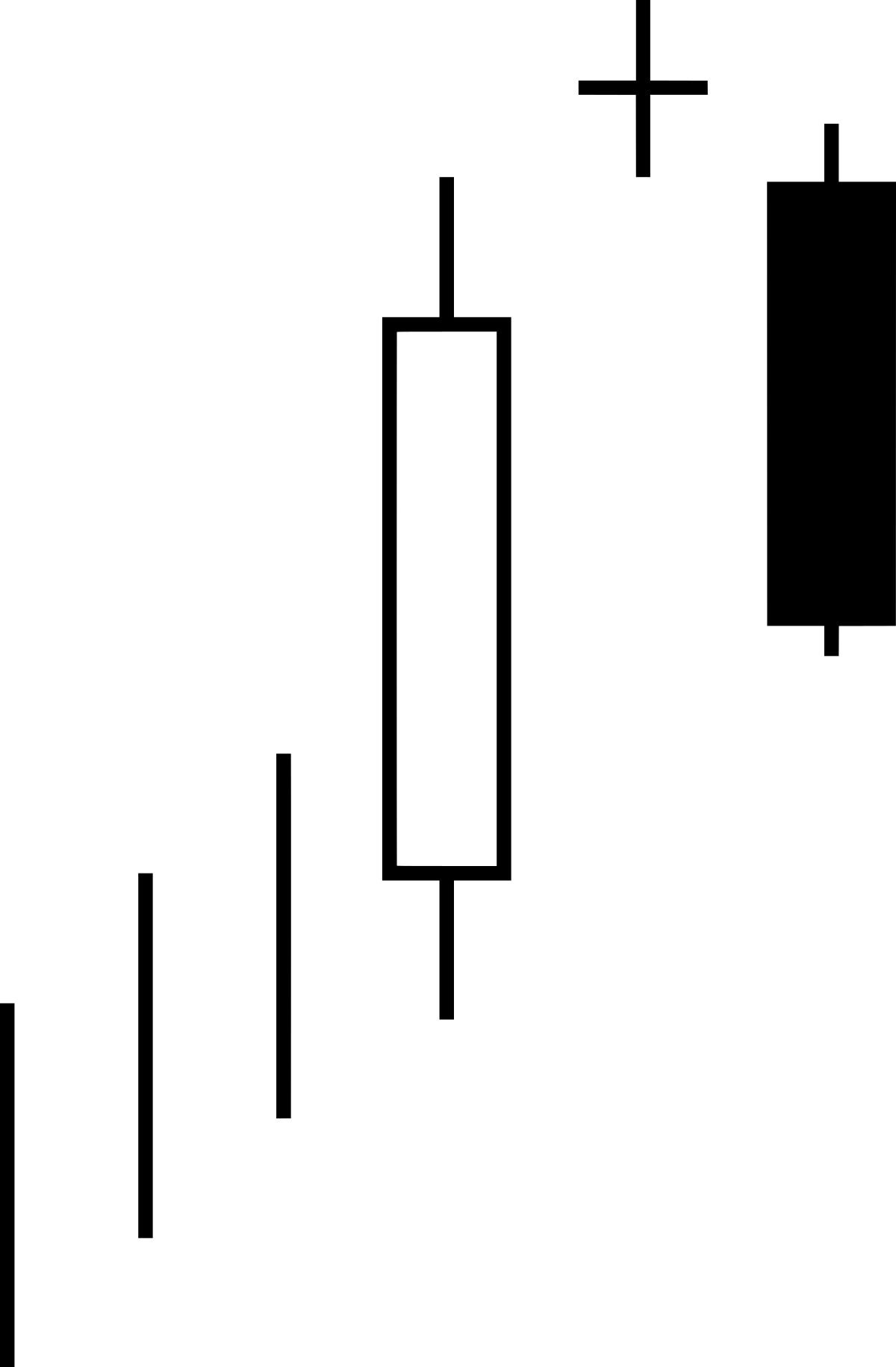

Evening Doji Star

An Evening Doji Star consists of a long bullish candle, followed by a Doji that gaps up, then a third bearish candle that gaps down and closes well within the body of the first candle.

An Evening Doji Star is a three candle bearish reversal pattern similar to the Evening Star.

The only difference is that the Evening Doji Star needs to be a Doji candle for the second candle

To identify an Evening Doji Star pattern, look for the following criteria:

The first candle should be a tall white candle in an upward price trend.

The second candle should be a doji whose body gaps above the first and third candles. Shadows are ignored.

The third candle is a tall black candle that closes at or below the midpoint of the first candle

Meaning

This Evening Doji Star acts as a bearish reversal of the upward price trend because price rises into the pattern and breaks out downward.

A downward breakout occurs when price closes below the bottom of the three-candlestick pattern.

Since the price in the last candle is already near the low, a downward breakout is expected.

An Evening Doji Star consists of a long bullish candle, followed by a Doji that gaps up, then a third bearish candle that gaps down and closes well within the body of the first candle.

An Evening Doji Star is a three candle bearish reversal pattern similar to the Evening Star.

The only difference is that the Evening Doji Star needs to be a Doji candle for the second candle

To identify an Evening Doji Star pattern, look for the following criteria:

The first candle should be a tall white candle in an upward price trend.

The second candle should be a doji whose body gaps above the first and third candles. Shadows are ignored.

The third candle is a tall black candle that closes at or below the midpoint of the first candle

Meaning

This Evening Doji Star acts as a bearish reversal of the upward price trend because price rises into the pattern and breaks out downward.

A downward breakout occurs when price closes below the bottom of the three-candlestick pattern.

Since the price in the last candle is already near the low, a downward breakout is expected.

Abdalla Mohamed Mahmoud Taha

Is it always right to start with a demo account?

I have seen hundreds of posts recommending that everyone starts with a demo account until they can prove they have an edge and can trade profitably. Some members have even been trading on a demo account for more than two years - you can get a diploma spending two years on an education. The reason I ask is that most members do not consider the opportunity cost of the time each of us spends learning this subject of trading in general, or Forex trading in particular. For sure, most members will spend a minimum of 200 hours (that is only 5 x 40 hour weeks) trying to learn how to be profit-making, but when all that time is spent on a demo account, I am challenging whether it is money well saved instead of money well spent.

I will elaborate. If you earn $25 an hour and you have spent 200 hours doing the School of Pipsology, setting up a broker account, making an outline and detailed trading strategy, then a plan, then opening the demo account and placing a minimum of 200 trades to calculate your edge and theoretical profit, it has cost you $25 x 200 = $5,000 in lost opportunity cost. When you look at it that way, would it not be equally smart to allocate just 10% of that opportunity cost and open a $500 trading account, be really careful and just trade at 1/2% of bank and know that your trading plan, trade journal, entry logs, exit reasons and trade management can all be improved in parallel instead of waiting two years to find out if this is really for you?

I have seen hundreds of posts recommending that everyone starts with a demo account until they can prove they have an edge and can trade profitably. Some members have even been trading on a demo account for more than two years - you can get a diploma spending two years on an education. The reason I ask is that most members do not consider the opportunity cost of the time each of us spends learning this subject of trading in general, or Forex trading in particular. For sure, most members will spend a minimum of 200 hours (that is only 5 x 40 hour weeks) trying to learn how to be profit-making, but when all that time is spent on a demo account, I am challenging whether it is money well saved instead of money well spent.

I will elaborate. If you earn $25 an hour and you have spent 200 hours doing the School of Pipsology, setting up a broker account, making an outline and detailed trading strategy, then a plan, then opening the demo account and placing a minimum of 200 trades to calculate your edge and theoretical profit, it has cost you $25 x 200 = $5,000 in lost opportunity cost. When you look at it that way, would it not be equally smart to allocate just 10% of that opportunity cost and open a $500 trading account, be really careful and just trade at 1/2% of bank and know that your trading plan, trade journal, entry logs, exit reasons and trade management can all be improved in parallel instead of waiting two years to find out if this is really for you?

Abdalla Mohamed Mahmoud Taha

3 Factors That Can Control Your Risk Exposure

Have you ever had trouble telling when you should cut a loss?

You might have experienced the markets going against your trade and then suddenly you’re praying to your trading that price would turn.

Then, when you (or your account) have reached your pain threshold, you either end up closing at the top or bottom or you decide that you’ve “learned” from the last time you closed a losing trade and opt to “wait it out” until your account cries uncle.

If the scenario above sounds familiar to you, don’t worry. The problem is much more common than you think.

It also tells us one important thing:

Your risk exposure is bigger than your risk tolerance.

A lot of traders spend most of their time finding out what to trade and where to enter, but only give a passing thought to the amount that they risk and when and where to exit a trade.

The problem with this habit is that you could be unintentionally sabotaging your trade by exposing yourself to more risk than you can handle.

A thrill-seeker, for example, would have a different risk tolerance than that of an introvert who can only stand volatility in small doses.

Unless you’re trading a big account or you already know just how much risk per trade fits your trading personality, then it’s likely that you’ll end up taking more risk than you’re comfortable with.

As a result, your decision-making processes are compromised by your fear of being wrong and you end up making newbie mistakes.

Nobody likes to lose. But the markets are random and you are only human. You will be wrong a lot of times and losses will happen frequently.

So if you can’t control how many times you’ll be on the wrong side of the trade, then the least you could do is to CONTROL YOUR RISK.

There are dozens of factors affecting risk exposure, but let’s concentrate on three that we can easily control:

1. Position size

Large position sizes lead to large volatility in your profit/loss statement. A single pip movement would mean more to a bigger position than a smaller one.

If you trade big position sizes, then you’re more likely to worry about making a dent on your account than how you’re executing your trading plan.

Your position size per trade should reflect your confidence, either in yourself or in your trade idea. Choose a size that’s big enough to matter, but small enough so that you won’t mind if it ends up as a loss.

If you’re not too sure about your trade idea or if you’re already dealing with a lot of trading psychology issues, then it’s best to start small and work your way up.

2. Holding period

A trader–let’s call him Jack–once told me that a long-term trade is just another term for a short-term trade that’s currently in the red. Not surprisingly, Jack is no longer trading. See, the longer you hold on to your trade, the more volatility it gets exposed to.

Remember that a longer holding period is equivalent to an increased position size, as it exposes a trade to a wider range of possible price movements.

Set a time limit for your trades and be firm with your schedule. When you hold on to a trade for longer than you initially planned, then you’ll subject your open position to more catalysts than you’ve prepared for, making you more vulnerable to making emotional decisions and classic trading mistakes.

3. Stop loss

Some traders make up for trading large position sizes by placing tight stops. Others tend to adjust their initial stops, use wide stops, or ignore the idea of stop losses altogether.

The first scenario exposes your account to death by a thousand cuts, while the second strategy makes your account vulnerable to a small number of trades that could wipe out your profits.

Remember that stop loss is your friend. It tells you when you’re wrong and, since you’ll be wrong often, it’s better that you get used to having a proverbial canary in a coal mine.

I’m not saying you shouldn’t use the strategies above. They’re popular for a reason, after all. Just make sure that your stop-loss strategy fits your trading personality and that, at the end of the day, your winners are still bigger than your losers.

In forex trading, being able to trade for another day is more important than getting winning streaks. After all, it’s tough to win a game if you’re knocked out of it.

Learn to control your risk exposure and you’ll be one step closer to becoming consistently profitable.

Have you ever had trouble telling when you should cut a loss?

You might have experienced the markets going against your trade and then suddenly you’re praying to your trading that price would turn.

Then, when you (or your account) have reached your pain threshold, you either end up closing at the top or bottom or you decide that you’ve “learned” from the last time you closed a losing trade and opt to “wait it out” until your account cries uncle.

If the scenario above sounds familiar to you, don’t worry. The problem is much more common than you think.

It also tells us one important thing:

Your risk exposure is bigger than your risk tolerance.

A lot of traders spend most of their time finding out what to trade and where to enter, but only give a passing thought to the amount that they risk and when and where to exit a trade.

The problem with this habit is that you could be unintentionally sabotaging your trade by exposing yourself to more risk than you can handle.

A thrill-seeker, for example, would have a different risk tolerance than that of an introvert who can only stand volatility in small doses.

Unless you’re trading a big account or you already know just how much risk per trade fits your trading personality, then it’s likely that you’ll end up taking more risk than you’re comfortable with.

As a result, your decision-making processes are compromised by your fear of being wrong and you end up making newbie mistakes.

Nobody likes to lose. But the markets are random and you are only human. You will be wrong a lot of times and losses will happen frequently.

So if you can’t control how many times you’ll be on the wrong side of the trade, then the least you could do is to CONTROL YOUR RISK.

There are dozens of factors affecting risk exposure, but let’s concentrate on three that we can easily control:

1. Position size

Large position sizes lead to large volatility in your profit/loss statement. A single pip movement would mean more to a bigger position than a smaller one.

If you trade big position sizes, then you’re more likely to worry about making a dent on your account than how you’re executing your trading plan.

Your position size per trade should reflect your confidence, either in yourself or in your trade idea. Choose a size that’s big enough to matter, but small enough so that you won’t mind if it ends up as a loss.

If you’re not too sure about your trade idea or if you’re already dealing with a lot of trading psychology issues, then it’s best to start small and work your way up.

2. Holding period

A trader–let’s call him Jack–once told me that a long-term trade is just another term for a short-term trade that’s currently in the red. Not surprisingly, Jack is no longer trading. See, the longer you hold on to your trade, the more volatility it gets exposed to.

Remember that a longer holding period is equivalent to an increased position size, as it exposes a trade to a wider range of possible price movements.

Set a time limit for your trades and be firm with your schedule. When you hold on to a trade for longer than you initially planned, then you’ll subject your open position to more catalysts than you’ve prepared for, making you more vulnerable to making emotional decisions and classic trading mistakes.

3. Stop loss

Some traders make up for trading large position sizes by placing tight stops. Others tend to adjust their initial stops, use wide stops, or ignore the idea of stop losses altogether.

The first scenario exposes your account to death by a thousand cuts, while the second strategy makes your account vulnerable to a small number of trades that could wipe out your profits.

Remember that stop loss is your friend. It tells you when you’re wrong and, since you’ll be wrong often, it’s better that you get used to having a proverbial canary in a coal mine.

I’m not saying you shouldn’t use the strategies above. They’re popular for a reason, after all. Just make sure that your stop-loss strategy fits your trading personality and that, at the end of the day, your winners are still bigger than your losers.

In forex trading, being able to trade for another day is more important than getting winning streaks. After all, it’s tough to win a game if you’re knocked out of it.

Learn to control your risk exposure and you’ll be one step closer to becoming consistently profitable.

Abdalla Mohamed Mahmoud Taha

3 Trading Stats You Should Track in Your Forex Journal

Every good trader will tell you that keeping a trading journal is as important as the shirt on your back, if not more important. But what some newbies fail to realize is that’s just the beginning.

Keeping track of your trading performance is much more than just looking at the profit and loss statement that you see at the bottom of the “account” tab on your screen and saying, “Okay, I’m trading well.”

It also means looking at the nitty-gritty details to know how you are trading over time by tracking your improvement and development as a trader.

forex statsAs I’ve said in the past, you should always treat your trading like a business. After all, money – YOUR hard earned money – is on the line.

Just like any business owner, you’re not only concerned about how much profits you’re making, but also exactly how you’re making it and what you can do to improve to make even more money.

Take a restaurant, for example. A good restaurant manager wants to determine the busiest hours so that he can hire more waiters to handle the workload. He also takes note of which items on the menu are the best-sellers.

Analyzing small details this like these can help the manager increase profits by efficiently scheduling his staff, better manage the inventory, and determine how to price a particular dish.

So what are the forex stats you should take note of?

Reward-to-Risk Ratio

As its name implies, the reward-to-risk ratio or R:R compares how much you stand to gain on a trade to how much you’re putting on the line.

Ideal reward-to-risk ratios can go from 1:1 to 2:1 or as much as 10:1, depending on the trader and the type of setups being taken.

The bottom line is that you have to ensure that your potential reward is at the very least equal to what you’re risking on that trade for it to be worth taking. That way, you can be able to erase two or three losses with a single win and not the other way around.

Win Percentage

Another good statistic to keep track of is your win percentage, as this shows whether you’re actually making playing the odds in your favor and catching more wins than losses.

Aiming for a win percentage above 50% could remind you to take high-probability forex setups and could prevent you from taking too many so-so trades that can drag this stat down.

Of course it also helps to make sure that your wins are greater than your losses in order to have positive expectancy. Even if you score more winning trades than losing ones, if you make only 0.05% on each win and give up a full 1% of your account on each loss, then a high win percentage wouldn’t mean much!

Trading Mistakes

Last on my line up are the trading mistakes you’ve made. Yep, I know, it’s not that easy to admit that you’ve made some errors or deviated from your trade plan at times, but keeping track of these mistakes should help you become a more disciplined trader.

Remember that a winning trade can either be a good or bad one, depending on how you’ve played it. If you ended up winning a trade by closing way too early instead of sticking to the plan, this could be counted as a mistake if you’ve ended up leaving profits on the table when price eventually hit your target.

Similarly, a losing trade can still count as a good one if you’ve practiced proper risk management and cut your losses when price action turned against you.

Missing a valid forex trade setup that fits your plan could also be chalked up as a mistake if you’ve hesitated or if you were feeling distracted then. If you’re able to track how many could’ve-been-profitable trades you’ve missed, then you could use this as a reminder to be more focused or more confident next time.

Recording how you make your trading decisions can give you better insights on how you react to market uncertainties and what kind of steps you can take to handle your emotions better.

Not only can you use the data you’ve gathered to gauge your trading performance, but you can use it to discover any psychological trading issues you may have and also to make appropriate changes to your trading style.

For instance, if you’ve realized that you’ve made majority of your trading mistakes while trading news releases, you could consider making adjustments to your strategy to come up with a plan that lets you ride the follow-through instead of the initial volatile reaction to a report.

Or if you’ve noticed that most of your losses come from trading breakouts, then you could remind yourself to risk a smaller portion of your account for these particular setups or to focus more on trend or range trades.

Keeping score is crucial if you want to be a serious trader. The more you know about what you’re doing and how you’re doing it, the easier it is for you to adjust and expand on the things you are good at and address your weaknesses.

Every good trader will tell you that keeping a trading journal is as important as the shirt on your back, if not more important. But what some newbies fail to realize is that’s just the beginning.

Keeping track of your trading performance is much more than just looking at the profit and loss statement that you see at the bottom of the “account” tab on your screen and saying, “Okay, I’m trading well.”

It also means looking at the nitty-gritty details to know how you are trading over time by tracking your improvement and development as a trader.

forex statsAs I’ve said in the past, you should always treat your trading like a business. After all, money – YOUR hard earned money – is on the line.

Just like any business owner, you’re not only concerned about how much profits you’re making, but also exactly how you’re making it and what you can do to improve to make even more money.

Take a restaurant, for example. A good restaurant manager wants to determine the busiest hours so that he can hire more waiters to handle the workload. He also takes note of which items on the menu are the best-sellers.

Analyzing small details this like these can help the manager increase profits by efficiently scheduling his staff, better manage the inventory, and determine how to price a particular dish.

So what are the forex stats you should take note of?

Reward-to-Risk Ratio

As its name implies, the reward-to-risk ratio or R:R compares how much you stand to gain on a trade to how much you’re putting on the line.

Ideal reward-to-risk ratios can go from 1:1 to 2:1 or as much as 10:1, depending on the trader and the type of setups being taken.

The bottom line is that you have to ensure that your potential reward is at the very least equal to what you’re risking on that trade for it to be worth taking. That way, you can be able to erase two or three losses with a single win and not the other way around.

Win Percentage

Another good statistic to keep track of is your win percentage, as this shows whether you’re actually making playing the odds in your favor and catching more wins than losses.

Aiming for a win percentage above 50% could remind you to take high-probability forex setups and could prevent you from taking too many so-so trades that can drag this stat down.

Of course it also helps to make sure that your wins are greater than your losses in order to have positive expectancy. Even if you score more winning trades than losing ones, if you make only 0.05% on each win and give up a full 1% of your account on each loss, then a high win percentage wouldn’t mean much!

Trading Mistakes

Last on my line up are the trading mistakes you’ve made. Yep, I know, it’s not that easy to admit that you’ve made some errors or deviated from your trade plan at times, but keeping track of these mistakes should help you become a more disciplined trader.

Remember that a winning trade can either be a good or bad one, depending on how you’ve played it. If you ended up winning a trade by closing way too early instead of sticking to the plan, this could be counted as a mistake if you’ve ended up leaving profits on the table when price eventually hit your target.

Similarly, a losing trade can still count as a good one if you’ve practiced proper risk management and cut your losses when price action turned against you.

Missing a valid forex trade setup that fits your plan could also be chalked up as a mistake if you’ve hesitated or if you were feeling distracted then. If you’re able to track how many could’ve-been-profitable trades you’ve missed, then you could use this as a reminder to be more focused or more confident next time.

Recording how you make your trading decisions can give you better insights on how you react to market uncertainties and what kind of steps you can take to handle your emotions better.

Not only can you use the data you’ve gathered to gauge your trading performance, but you can use it to discover any psychological trading issues you may have and also to make appropriate changes to your trading style.

For instance, if you’ve realized that you’ve made majority of your trading mistakes while trading news releases, you could consider making adjustments to your strategy to come up with a plan that lets you ride the follow-through instead of the initial volatile reaction to a report.

Or if you’ve noticed that most of your losses come from trading breakouts, then you could remind yourself to risk a smaller portion of your account for these particular setups or to focus more on trend or range trades.

Keeping score is crucial if you want to be a serious trader. The more you know about what you’re doing and how you’re doing it, the easier it is for you to adjust and expand on the things you are good at and address your weaknesses.

Abdalla Mohamed Mahmoud Taha

The Best Forex Signals 28/9/2020

2- A VERY STRONG BUY TREND POSITION AT EURNZD 4H

BY STRATEGY CALL ( elliott 3wave)

ORDER IS BUY NOW AT 1.7760

TP 150 PIP - SL 50 PIP

https://www.mql5.com/en/signals/author/abdalla

2- A VERY STRONG BUY TREND POSITION AT EURNZD 4H

BY STRATEGY CALL ( elliott 3wave)

ORDER IS BUY NOW AT 1.7760

TP 150 PIP - SL 50 PIP

https://www.mql5.com/en/signals/author/abdalla

Abdalla Mohamed Mahmoud Taha

The Best Forex Signals 28/9/2020

1- A VERY STRONG SELL TREND POSITION at UsdJpy 1D

BY STRATEGY CALL ( SYSTEM 1 )

ORDER IS sell NOW AT 105.58

TP 100 PIP - SL 30 PIP

https://www.mql5.com/en/signals/author/abdalla

1- A VERY STRONG SELL TREND POSITION at UsdJpy 1D

BY STRATEGY CALL ( SYSTEM 1 )

ORDER IS sell NOW AT 105.58

TP 100 PIP - SL 30 PIP

https://www.mql5.com/en/signals/author/abdalla

Abdalla Mohamed Mahmoud Taha

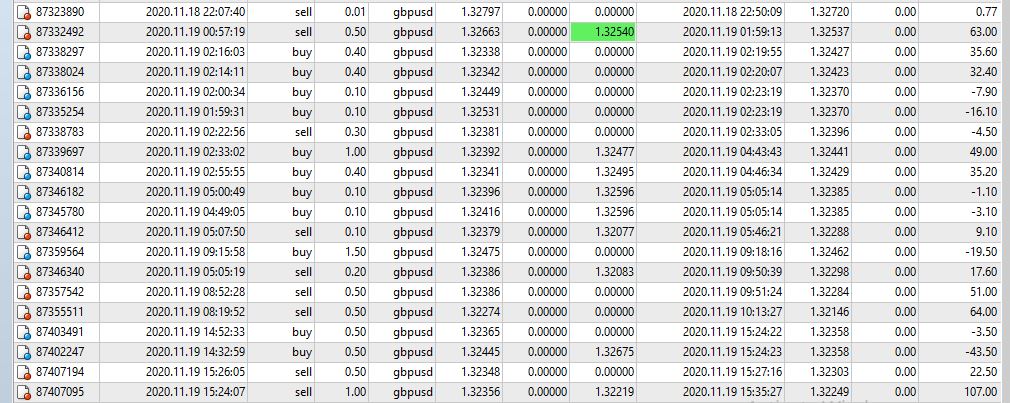

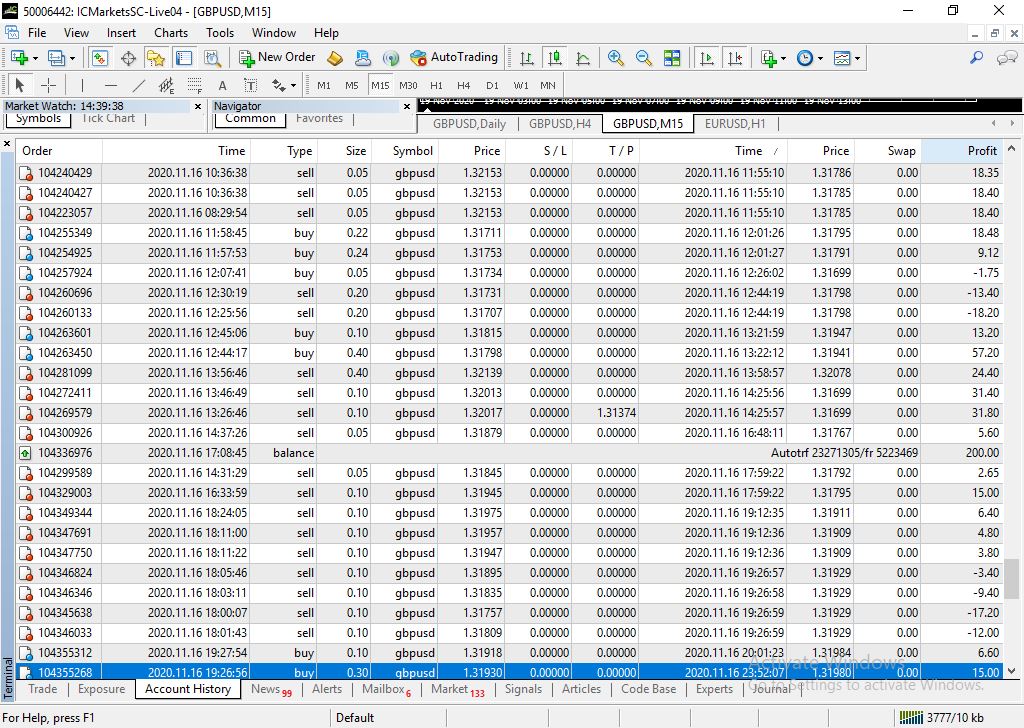

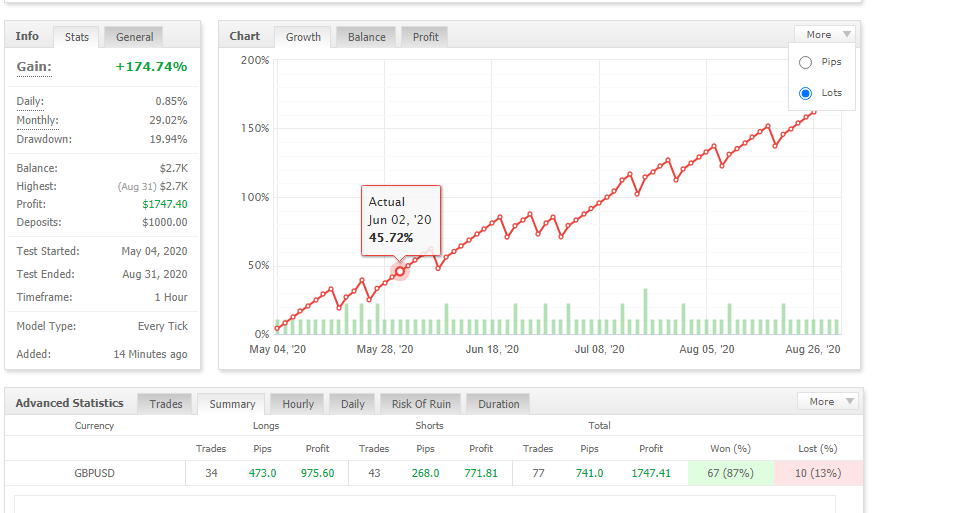

More accurate follow-up to Express results: GbpUsd Extra Profit

According to myfxbook website

…/gbpusd-extra-profit/268441

Note the link in order to open right and enter you on the Express and don't enter you on the home page, you must copy it yourself, put it in the address bar and delete any increase after 268441

BackTest was made for the Expert results from the beginning of May to the end of August and the results were as shown as follows:

77 deals were opened 67 deals achieved goal and only 10 deals lost that is, the percentage of the winning deals is 87 % and the loss is 13 % knowing you never lost two consecutive deals and this is proof of Power of entry zone...

Total profits 175 % and maximum drewdown 19 %

After making Pac Test for the four months, I discovered that profits are much greater if we increase the size of the entry point after increasing capital due to last month's profits, I mean if one who doesn't withdraw his profits will make much greater profit the following months

The features of the Express

1-average monthly earnings from 30 % to 50 % and the advantage is that there is no big difference in the percentage of profits between one month and one month means you will not find a month 5 % and another month 45 %

Here are the results of the last four months in case the entry point increased after the balance increased to the previous month

May 37.4 %

june 43.7 %

jul 27.1 %

aug 50 %

It is higher than the percentage of the site because the point does not increase between each month and another month

There is no big difference between floating losses and losses achieved because all transactions have fixed almonds.

Express completely eliminates the defects of the psychological worker, which is one of the main reasons for our losses in the market

4-The method of working myself was hand tested on real accounts from the first January until the first week of March and made excellent profits before Corona started and lost all profits due to other reasons that have nothing to do with Express.

5-Express is very safe and can reduce risk to make it for what you want and as shown on the Express page on the website and as shown in the picture according to myfxbook data and analysis you need 19 consecutive loss transactions even You lose all balance knowing that in the last 77 transactions you never lose two consecutive deals

- Also, data says that you may lose 30 % of your balance is less than 1 %

6-Express shows in the regularity of profits on an escalating basis and losses are also distributed on a semi-regular basis, so you find that every working day per week has a share of about two losses except Thursday.

7-Express provides you with the effort of following up, anxiety and stress, you can reduce the risk for the percentage that makes you reassured throughout the month and follow up on operations results at distancing periods, it is a safe investment.

In conclusion, previous results don't necessarily reflect on the future so if you want to follow up on September's Express results, this is the follow-up data

…/gbpusd-extra-profit-exp…/7052190…

According to myfxbook website

…/gbpusd-extra-profit/268441

Note the link in order to open right and enter you on the Express and don't enter you on the home page, you must copy it yourself, put it in the address bar and delete any increase after 268441

BackTest was made for the Expert results from the beginning of May to the end of August and the results were as shown as follows:

77 deals were opened 67 deals achieved goal and only 10 deals lost that is, the percentage of the winning deals is 87 % and the loss is 13 % knowing you never lost two consecutive deals and this is proof of Power of entry zone...

Total profits 175 % and maximum drewdown 19 %

After making Pac Test for the four months, I discovered that profits are much greater if we increase the size of the entry point after increasing capital due to last month's profits, I mean if one who doesn't withdraw his profits will make much greater profit the following months

The features of the Express

1-average monthly earnings from 30 % to 50 % and the advantage is that there is no big difference in the percentage of profits between one month and one month means you will not find a month 5 % and another month 45 %

Here are the results of the last four months in case the entry point increased after the balance increased to the previous month

May 37.4 %

june 43.7 %

jul 27.1 %

aug 50 %

It is higher than the percentage of the site because the point does not increase between each month and another month

There is no big difference between floating losses and losses achieved because all transactions have fixed almonds.

Express completely eliminates the defects of the psychological worker, which is one of the main reasons for our losses in the market

4-The method of working myself was hand tested on real accounts from the first January until the first week of March and made excellent profits before Corona started and lost all profits due to other reasons that have nothing to do with Express.

5-Express is very safe and can reduce risk to make it for what you want and as shown on the Express page on the website and as shown in the picture according to myfxbook data and analysis you need 19 consecutive loss transactions even You lose all balance knowing that in the last 77 transactions you never lose two consecutive deals

- Also, data says that you may lose 30 % of your balance is less than 1 %

6-Express shows in the regularity of profits on an escalating basis and losses are also distributed on a semi-regular basis, so you find that every working day per week has a share of about two losses except Thursday.

7-Express provides you with the effort of following up, anxiety and stress, you can reduce the risk for the percentage that makes you reassured throughout the month and follow up on operations results at distancing periods, it is a safe investment.

In conclusion, previous results don't necessarily reflect on the future so if you want to follow up on September's Express results, this is the follow-up data

…/gbpusd-extra-profit-exp…/7052190…

Abdalla Mohamed Mahmoud Taha

السلام عليكم ورحمة الله وبركاته

مقال أعجبنى بعنوان ( لا تقارن نفسك بتجار الفوركس الآخرين )

منذ العصور ، اخترع الفرسان الغمامات للحفاظ على تركيز خيولهم في عملهم. الستارة عبارة عن قطع من الجلد متصلة بلجام الحصان تمنعه من رؤية أي شيء باستثناء ما أمامه.

بدون الغمامات ، يمكن للحصان أن يرى خلفه بالكامل تقريبًا دون أن يدير رأسه ويمكن أن يفزع بسهولة بالحركة أو الأشياء التي لا يتعرف عليها. من خلال تقليل عوامل الإلهاء ، يصبح الحصان أكثر موثوقية ويركز بشكل أفضل على إنجاز المهمة.

بصفتي متداولًا ، وجدت أنه كلما بدأت في مقارنة أداء التداول الخاص بي مع متداولي الفوركس الآخرين ، كان أدائي عادة يزداد سوءًا. أدى هذا "الإلهاء" عادةً إلى خسائر لكل من حساب التداول الخاص بي

لا تقارن نفسك بالآخرين. من المغري في العالم التنافسي الحديث أن تسأل باستمرار " كيف أفعل؟ "وقياس نجاحك بناءً على أداء باقي أقرانك.

لقول أسهل من الفعل ، لكن يجب ألا تسمح لمدى أدائك الجيد مقارنة بالآخرين بالتأثير على شعورك تجاه قيمتك الداخلية ومشاعر النجاح في الحياة.

المقارنات غير مجدية. قم بتشغيل السباق الخاص بك.

يمكنك وحدك صقل مهاراتك في تداول العملات الأجنبية. ما يصلح للآخرين قد لا يناسبك بالضرورة. يجب أن تجد وسيلة لوحدك، واحد يطابق المهارات التجارية الخاصة بك و شخصية .

تذكر أن المقارنات ستجعلك تشعر بالإحباط وتشتت انتباهك عن شق طريقك نحو الربحية.

لا تعتقد أنك تحاول التغلب على الآخرين إلى خط نهاية وهمي. الأشخاص الذين يحققون أشياء عظيمة يعملون بشكل مستقل وبشروطهم الخاصة. إنهم لا يهتمون بما يفعله الآخرون. إنهم يتبعون جدولهم الزمني الخاص ، وشغفهم الخاص ، ويبحثون في الداخل عن المكان الذي يتجهون إليه بعد ذلك.

لاحظ كيف قلت داخليًا وليس خارجيًا. إنهم ينظرون إلى الداخل إلى أين يذهبون بعد ذلك.

طريقة أدائك لا علاقة لها بأداء الآخرين. كل المقارنات ستفعل هي تعذيبك. ستشعر بالغيرة أو الحسد.

عندما ترى أن أداءك سيئًا نسبيًا مقارنة بزملائك من المتداولين ، فمن المحتمل أن تفكر في أفكار مشتتة للانتباه مثل ، " لماذا لا يمكنني القيام بذلك أيضًا؟ "أو" يجب ألا أكون تاجر فوركس جيدًا كما كنت أعتقد. "

للحفاظ على الدافع ، ركز على تحسين سجل أدائك السابق ، بدلاً من النظر إلى أداء المتداولين الآخرين.

لا تعرف عادةً العوامل التي أدت إلى إنشاء سجلات الأداء الخاصة بهم ، لذا فإن المقارنات يمكن أن تضلل وتعيقك فقط. يمكن أن يكونوا في خط محظوظ أو لديهم مستشار يقف خلفهم مباشرة في كل تجارة فوركس يقدم المشورة.

ضع "الغمامات" الخاصة بك على. لا تنظر إلى سجل أي شخص آخر غيرك. لكل شخص منحنى تعليمي مختلف.

ابدأ فى سباقك الخاص وانتهى منه بالسرعة التي تريدها.

مقال أعجبنى بعنوان ( لا تقارن نفسك بتجار الفوركس الآخرين )

منذ العصور ، اخترع الفرسان الغمامات للحفاظ على تركيز خيولهم في عملهم. الستارة عبارة عن قطع من الجلد متصلة بلجام الحصان تمنعه من رؤية أي شيء باستثناء ما أمامه.

بدون الغمامات ، يمكن للحصان أن يرى خلفه بالكامل تقريبًا دون أن يدير رأسه ويمكن أن يفزع بسهولة بالحركة أو الأشياء التي لا يتعرف عليها. من خلال تقليل عوامل الإلهاء ، يصبح الحصان أكثر موثوقية ويركز بشكل أفضل على إنجاز المهمة.

بصفتي متداولًا ، وجدت أنه كلما بدأت في مقارنة أداء التداول الخاص بي مع متداولي الفوركس الآخرين ، كان أدائي عادة يزداد سوءًا. أدى هذا "الإلهاء" عادةً إلى خسائر لكل من حساب التداول الخاص بي

لا تقارن نفسك بالآخرين. من المغري في العالم التنافسي الحديث أن تسأل باستمرار " كيف أفعل؟ "وقياس نجاحك بناءً على أداء باقي أقرانك.

لقول أسهل من الفعل ، لكن يجب ألا تسمح لمدى أدائك الجيد مقارنة بالآخرين بالتأثير على شعورك تجاه قيمتك الداخلية ومشاعر النجاح في الحياة.

المقارنات غير مجدية. قم بتشغيل السباق الخاص بك.

يمكنك وحدك صقل مهاراتك في تداول العملات الأجنبية. ما يصلح للآخرين قد لا يناسبك بالضرورة. يجب أن تجد وسيلة لوحدك، واحد يطابق المهارات التجارية الخاصة بك و شخصية .

تذكر أن المقارنات ستجعلك تشعر بالإحباط وتشتت انتباهك عن شق طريقك نحو الربحية.

لا تعتقد أنك تحاول التغلب على الآخرين إلى خط نهاية وهمي. الأشخاص الذين يحققون أشياء عظيمة يعملون بشكل مستقل وبشروطهم الخاصة. إنهم لا يهتمون بما يفعله الآخرون. إنهم يتبعون جدولهم الزمني الخاص ، وشغفهم الخاص ، ويبحثون في الداخل عن المكان الذي يتجهون إليه بعد ذلك.

لاحظ كيف قلت داخليًا وليس خارجيًا. إنهم ينظرون إلى الداخل إلى أين يذهبون بعد ذلك.

طريقة أدائك لا علاقة لها بأداء الآخرين. كل المقارنات ستفعل هي تعذيبك. ستشعر بالغيرة أو الحسد.

عندما ترى أن أداءك سيئًا نسبيًا مقارنة بزملائك من المتداولين ، فمن المحتمل أن تفكر في أفكار مشتتة للانتباه مثل ، " لماذا لا يمكنني القيام بذلك أيضًا؟ "أو" يجب ألا أكون تاجر فوركس جيدًا كما كنت أعتقد. "

للحفاظ على الدافع ، ركز على تحسين سجل أدائك السابق ، بدلاً من النظر إلى أداء المتداولين الآخرين.

لا تعرف عادةً العوامل التي أدت إلى إنشاء سجلات الأداء الخاصة بهم ، لذا فإن المقارنات يمكن أن تضلل وتعيقك فقط. يمكن أن يكونوا في خط محظوظ أو لديهم مستشار يقف خلفهم مباشرة في كل تجارة فوركس يقدم المشورة.

ضع "الغمامات" الخاصة بك على. لا تنظر إلى سجل أي شخص آخر غيرك. لكل شخص منحنى تعليمي مختلف.

ابدأ فى سباقك الخاص وانتهى منه بالسرعة التي تريدها.

Abdalla Mohamed Mahmoud Taha

بسم الله

شغل الاكسبيرتات من اول سبتمبر حتى الان

…/gbpusd-extra-profit-expe…/7052190

😍😍

بيانات المنصة متاحة لفترة محدودة جدا

9305824

iFmYiNx9

MetaTrader server FBS-Demo

شغل الاكسبيرتات من اول سبتمبر حتى الان

…/gbpusd-extra-profit-expe…/7052190

😍😍

بيانات المنصة متاحة لفترة محدودة جدا

9305824

iFmYiNx9

MetaTrader server FBS-Demo

: