Abdalla Mohamed Mahmoud Taha / Profile

- Information

|

7+ years

experience

|

0

products

|

0

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

my name Abdalla Mohamed, I have more than 11 years experience in forex market .

I am very professional scalping trader and I own research and studies on the pairs of the British pound

, i have signals providers at MT4 / MT5 , available through the MQL5.com Market.

I am very professional scalping trader and I own research and studies on the pairs of the British pound

, i have signals providers at MT4 / MT5 , available through the MQL5.com Market.

Abdalla Mohamed Mahmoud Taha

How to Accept Trading Losses Constructively

Losing is an inevitable part of trading — so you might as well learn how to handle it.

Just like in life, forex trading comes with its ups and downs. Many traders, especially beginners, find it easy to stay motivated when they’re winning, but once the losses start adding up, they often become discouraged.

Approaching trading with the mindset that losing is unacceptable can be both unrealistic and harmful.

The truth is, losses aren’t just unavoidable — they’re actually a crucial part of your growth as a trader. If you’re not mentally prepared to lose, your chances of long-term success in the forex market are slim to none.

If you struggle with the idea of “acceptable losses,” here’s a helpful way to shift your mindset: think of losing as a close and loyal friend — one who’s always by your side.

A true friend tells you the hard truths, even when they’re uncomfortable to hear. They don’t sugarcoat things just to spare your feelings.

Sometimes they criticize you or call you out on your mistakes, but at the end of the day, you know it’s because they care and want to see you succeed.

Just like with your real-life friends, you should listen carefully to what your losses are trying to tell you. Each loss has a lesson — if you’re willing to learn from it, you’ll become a better trader over time.

The most successful traders understand this well. They know they could lose 100 trades in a month and still keep moving forward because they view every loss as a valuable learning experience.

They accept that losing isn’t failure — it’s simply part of the business.

So, embrace your friendship with losses. Learn to smile when they come, because each loss is another opportunity to improve, refine your skills, and grow into a more resilient, successful trader.

Losing is an inevitable part of trading — so you might as well learn how to handle it.

Just like in life, forex trading comes with its ups and downs. Many traders, especially beginners, find it easy to stay motivated when they’re winning, but once the losses start adding up, they often become discouraged.

Approaching trading with the mindset that losing is unacceptable can be both unrealistic and harmful.

The truth is, losses aren’t just unavoidable — they’re actually a crucial part of your growth as a trader. If you’re not mentally prepared to lose, your chances of long-term success in the forex market are slim to none.

If you struggle with the idea of “acceptable losses,” here’s a helpful way to shift your mindset: think of losing as a close and loyal friend — one who’s always by your side.

A true friend tells you the hard truths, even when they’re uncomfortable to hear. They don’t sugarcoat things just to spare your feelings.

Sometimes they criticize you or call you out on your mistakes, but at the end of the day, you know it’s because they care and want to see you succeed.

Just like with your real-life friends, you should listen carefully to what your losses are trying to tell you. Each loss has a lesson — if you’re willing to learn from it, you’ll become a better trader over time.

The most successful traders understand this well. They know they could lose 100 trades in a month and still keep moving forward because they view every loss as a valuable learning experience.

They accept that losing isn’t failure — it’s simply part of the business.

So, embrace your friendship with losses. Learn to smile when they come, because each loss is another opportunity to improve, refine your skills, and grow into a more resilient, successful trader.

Abdalla Mohamed Mahmoud Taha

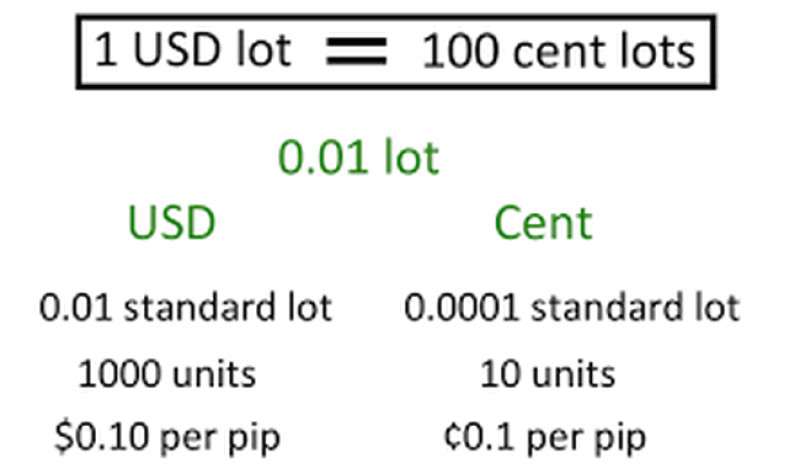

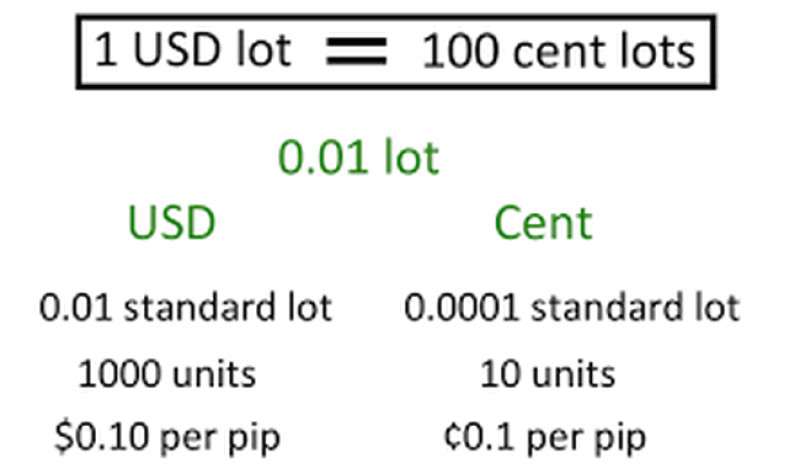

What Are Cent Accounts in Forex?

Cent accounts in forex are a type of account that allows traders to trade with very small amounts of money. In a cent account, the value of each pip (point) is based on cents rather than dollars. This means that if you have a cent account, each price movement in the market will affect your balance less compared to a standard dollar-based account.

Key Features of Cent Accounts:

Smaller Lot Size: In a cent account, trades are made with very small lot sizes. For example, a standard lot in a cent account might be 0.01 of a standard lot (also called a micro lot).

Lower Minimum Deposit: The minimum deposit required for a cent account is typically lower than that of a regular account, making it an attractive option for beginners.

Reduced Risk: Since the trade sizes are smaller, traders can reduce their risk significantly compared to using a standard dollar-based account. For instance, if the market moves by 10 pips, the loss or gain will be much lower in a cent account.

Ideal for Beginners: Cent accounts are commonly used by novice traders who want to practice and learn trading in a real market environment without risking large amounts of capital.

How a Cent Account Works:

If you have a cent account with a balance of $100, this is equivalent to having 10,000 cents (or 10,000 units of currency).

In standard accounts, if you trade one standard lot (1.0 lot), a 1-pip movement in the market equals $10. In a cent account, however, the same 1-pip movement would be worth only 0.10 cents.

Example:

Let’s say the EUR/USD pair moves by 10 pips:

In a standard account, your profit or loss would be = 10 pips × $1 (per pip) = $10.

In a cent account, your profit or loss would be = 10 pips × 0.10 cents (per pip) = 1 cent.

Benefits:

Learning with Lower Risk: Cent accounts are great for beginners who want to test trading strategies without exposing themselves to significant losses.

Better Capital Management: Traders can practice money management and position sizing with smaller trades.

Drawbacks:

Lower Profit Potential: Since the trade sizes are smaller, profits will also be smaller compared to standard accounts.

Higher Trading Costs: Some brokers may charge higher spreads or commissions on cent accounts.

In Summary:

Cent accounts offer a great way for beginner traders to enter the forex market without risking large amounts of money. They allow for smaller trade sizes, lower minimum deposits, and reduced risk, making them ideal for practicing trading strategies and learning how the forex market works. However, profits will be smaller, and there may be some additional costs to consider, such as higher spreads or commissions.

Cent accounts in forex are a type of account that allows traders to trade with very small amounts of money. In a cent account, the value of each pip (point) is based on cents rather than dollars. This means that if you have a cent account, each price movement in the market will affect your balance less compared to a standard dollar-based account.

Key Features of Cent Accounts:

Smaller Lot Size: In a cent account, trades are made with very small lot sizes. For example, a standard lot in a cent account might be 0.01 of a standard lot (also called a micro lot).

Lower Minimum Deposit: The minimum deposit required for a cent account is typically lower than that of a regular account, making it an attractive option for beginners.

Reduced Risk: Since the trade sizes are smaller, traders can reduce their risk significantly compared to using a standard dollar-based account. For instance, if the market moves by 10 pips, the loss or gain will be much lower in a cent account.

Ideal for Beginners: Cent accounts are commonly used by novice traders who want to practice and learn trading in a real market environment without risking large amounts of capital.

How a Cent Account Works:

If you have a cent account with a balance of $100, this is equivalent to having 10,000 cents (or 10,000 units of currency).

In standard accounts, if you trade one standard lot (1.0 lot), a 1-pip movement in the market equals $10. In a cent account, however, the same 1-pip movement would be worth only 0.10 cents.

Example:

Let’s say the EUR/USD pair moves by 10 pips:

In a standard account, your profit or loss would be = 10 pips × $1 (per pip) = $10.

In a cent account, your profit or loss would be = 10 pips × 0.10 cents (per pip) = 1 cent.

Benefits:

Learning with Lower Risk: Cent accounts are great for beginners who want to test trading strategies without exposing themselves to significant losses.

Better Capital Management: Traders can practice money management and position sizing with smaller trades.

Drawbacks:

Lower Profit Potential: Since the trade sizes are smaller, profits will also be smaller compared to standard accounts.

Higher Trading Costs: Some brokers may charge higher spreads or commissions on cent accounts.

In Summary:

Cent accounts offer a great way for beginner traders to enter the forex market without risking large amounts of money. They allow for smaller trade sizes, lower minimum deposits, and reduced risk, making them ideal for practicing trading strategies and learning how the forex market works. However, profits will be smaller, and there may be some additional costs to consider, such as higher spreads or commissions.

Abdalla Mohamed Mahmoud Taha

Losses after losses… after losses! Here’s how this experienced UK trader bounced back from losing trades!

Tell us a little about yourself. Where are you from? What are your hobbies?

My name is John, and I’m originally from the UK. My hobbies include diving deep into philosophy, politics, and history, and I enjoy reading about these subjects. I also have a passion for learning new languages, and I’m currently working through the challenges of Mandarin. Fitness is another area I try to stay on top of, although I’m not always consistent—though I try!

How did you first get into Forex trading? What were you doing before?

My journey into Forex trading started after I made some money from a property investment a while back and was looking for a new place to invest. I stumbled across an advertisement for Financial Spreadbetting in Investors Chronicle, which piqued my interest. I enrolled in a small course, opened an account with CMC Markets, and that’s when I got hooked.

Before I started trading, I worked in the hospitality industry, which I gradually grew to despise. I was looking for an escape and noticed that many of my colleagues had careers in London’s financial district. I realized they didn’t seem any smarter than me, and it gave me the confidence to seek a similar line of work.

You’ve been trading Forex and CFDs since 2003. What did you focus on during your first three years?

In my early years, I primarily focused on trading silver. I truly believed it was set to skyrocket and was a big supporter of the precious metals market. I still find success with gold and silver, especially during those rare parabolic price movements. However, my focus has since shifted.

Throughout my trading career, I’ve explored many different areas, from day trading to Forex, indices (which remains a favorite), oil, and even various technical strategies. There’s been a lot of experimentation, but each phase taught me valuable lessons.

Can you walk us through a typical day in your life as a trader?

I tend to wake up early since I live in Thailand for most of the year. The cooler mornings help me start my day at around 4 or 5 AM. I like to fill my mind with something uplifting, often reading books on spirituality or metaphysics, or I’ll meditate.

Afterward, I catch up on the latest global events, particularly political updates from the UK. The markets don’t really heat up until around 2 PM, but I also keep an eye on what’s happening in China.

My primary trading schedule involves checking the charts at 12 PM and 8 PM since I work with 8-hour charts. I follow specific price action strategies, so I need to be present after each session. The rest of my time is spent learning or working on my new trading blog.

What has been your biggest challenge in Forex trading? How did you overcome it?

The biggest hurdle was figuring out my identity as a trader. I went through countless changes in trading methods, constantly flipping between strategies. The turning point came when I decided to stop trading short positions—this was a game-changer for me.

For years, I suffered greater losses from shorting than any other trades, but I’d also occasionally hit big wins, which only kept me attached to that side of trading. Eventually, when I stopped, my profits soared, and my trading improved dramatically. I simply couldn’t handle both sides of the market.

How has trading impacted your life and what has it taught you?

Trading has transformed me in ways beyond money. It has taught me resilience, patience, and how to embrace a more stoic mindset. Over the years, I’ve become a more confident and effective person.

Trading forces you to confront your inner challenges—it’s a battle with yourself. But when you come through it, you emerge as a completely changed individual.

What advice would you give to someone just starting in the market?

My advice for beginners is to fully understand your initial incompetence. In the beginning, you’re essentially cannon fodder for the market, and recognizing this reality helps prevent overconfidence.

Read classics like Market Wizards and Reminiscences of a Stock Operator at least once a year. Also, dive into books on performance psychology like those by Brett Steenbarger and Mark Douglas. And above all, don’t believe that trading more means making more money—focus on quality, not quantity.

How do you deal with the stress of a losing trade?

I used to handle losing trades with a beer—though that didn’t turn out well! Over time, I’ve learned to accept losses as part of the process. I once had a streak of 50 consecutive losing trades, so a single loss now doesn’t bother me as much.

In my earlier days, I had a scarcity mindset, but over time, I adopted a mindset of abundance. This shift made losses feel less significant and helped me become a better trader.

If you could recommend one book and one movie to a trader, what would they be?

For a book, I’d recommend Enhancing Trading Performance by Brett Steenbarger. It profoundly changed my approach to trading and my understanding of the learning process.

For a movie, I’d go with The Big Short. It’s a great illustration of how flawed trading purely on fundamentals can be. The protagonist is right in theory but struggles with timing, which nearly costs him everything—until the market catches on.

What activities do you enjoy when you’re not trading?

When I’m not trading, I enjoy spending time outside the city in Chiang Mai. There are so many great spots for motorbiking, trekking, and walking. It’s incredibly peaceful, and I find that it helps me recharge.

Tell us a little about yourself. Where are you from? What are your hobbies?

My name is John, and I’m originally from the UK. My hobbies include diving deep into philosophy, politics, and history, and I enjoy reading about these subjects. I also have a passion for learning new languages, and I’m currently working through the challenges of Mandarin. Fitness is another area I try to stay on top of, although I’m not always consistent—though I try!

How did you first get into Forex trading? What were you doing before?

My journey into Forex trading started after I made some money from a property investment a while back and was looking for a new place to invest. I stumbled across an advertisement for Financial Spreadbetting in Investors Chronicle, which piqued my interest. I enrolled in a small course, opened an account with CMC Markets, and that’s when I got hooked.

Before I started trading, I worked in the hospitality industry, which I gradually grew to despise. I was looking for an escape and noticed that many of my colleagues had careers in London’s financial district. I realized they didn’t seem any smarter than me, and it gave me the confidence to seek a similar line of work.

You’ve been trading Forex and CFDs since 2003. What did you focus on during your first three years?

In my early years, I primarily focused on trading silver. I truly believed it was set to skyrocket and was a big supporter of the precious metals market. I still find success with gold and silver, especially during those rare parabolic price movements. However, my focus has since shifted.

Throughout my trading career, I’ve explored many different areas, from day trading to Forex, indices (which remains a favorite), oil, and even various technical strategies. There’s been a lot of experimentation, but each phase taught me valuable lessons.

Can you walk us through a typical day in your life as a trader?

I tend to wake up early since I live in Thailand for most of the year. The cooler mornings help me start my day at around 4 or 5 AM. I like to fill my mind with something uplifting, often reading books on spirituality or metaphysics, or I’ll meditate.

Afterward, I catch up on the latest global events, particularly political updates from the UK. The markets don’t really heat up until around 2 PM, but I also keep an eye on what’s happening in China.

My primary trading schedule involves checking the charts at 12 PM and 8 PM since I work with 8-hour charts. I follow specific price action strategies, so I need to be present after each session. The rest of my time is spent learning or working on my new trading blog.

What has been your biggest challenge in Forex trading? How did you overcome it?

The biggest hurdle was figuring out my identity as a trader. I went through countless changes in trading methods, constantly flipping between strategies. The turning point came when I decided to stop trading short positions—this was a game-changer for me.

For years, I suffered greater losses from shorting than any other trades, but I’d also occasionally hit big wins, which only kept me attached to that side of trading. Eventually, when I stopped, my profits soared, and my trading improved dramatically. I simply couldn’t handle both sides of the market.

How has trading impacted your life and what has it taught you?

Trading has transformed me in ways beyond money. It has taught me resilience, patience, and how to embrace a more stoic mindset. Over the years, I’ve become a more confident and effective person.

Trading forces you to confront your inner challenges—it’s a battle with yourself. But when you come through it, you emerge as a completely changed individual.

What advice would you give to someone just starting in the market?

My advice for beginners is to fully understand your initial incompetence. In the beginning, you’re essentially cannon fodder for the market, and recognizing this reality helps prevent overconfidence.

Read classics like Market Wizards and Reminiscences of a Stock Operator at least once a year. Also, dive into books on performance psychology like those by Brett Steenbarger and Mark Douglas. And above all, don’t believe that trading more means making more money—focus on quality, not quantity.

How do you deal with the stress of a losing trade?

I used to handle losing trades with a beer—though that didn’t turn out well! Over time, I’ve learned to accept losses as part of the process. I once had a streak of 50 consecutive losing trades, so a single loss now doesn’t bother me as much.

In my earlier days, I had a scarcity mindset, but over time, I adopted a mindset of abundance. This shift made losses feel less significant and helped me become a better trader.

If you could recommend one book and one movie to a trader, what would they be?

For a book, I’d recommend Enhancing Trading Performance by Brett Steenbarger. It profoundly changed my approach to trading and my understanding of the learning process.

For a movie, I’d go with The Big Short. It’s a great illustration of how flawed trading purely on fundamentals can be. The protagonist is right in theory but struggles with timing, which nearly costs him everything—until the market catches on.

What activities do you enjoy when you’re not trading?

When I’m not trading, I enjoy spending time outside the city in Chiang Mai. There are so many great spots for motorbiking, trekking, and walking. It’s incredibly peaceful, and I find that it helps me recharge.

Abdalla Mohamed Mahmoud Taha

But most traders forget the rest of the trading process, including:

1- Risk Management ... (Risk Management)

For example, when to go out when certain signals appear. And when can you determine the appropriate stop for each you want, and also enter to buy or sell with any amount

2- Managing the trading process itself ....

(Trading Management)

That is, for example, you entered and bought and specified a stop and also a profit target, that's it ... Well, if the financial asset went up after the purchase, but before it reached your profit target, the upward momentum began to decrease, what would we do ....??? 🤔

Or even after I bought, the price behavior of the asset changed and began to go down and approach the stop, what would we do ...??? Should I wait until the stop is hit ..?? Or what are the signals that may appear to confirm that the trade may fail ...?? The answers to these questions ... mean managing the trading process. 👌👌

3- Position Size...

I mean, how do we determine the quantity to buy from the beginning...and why...?? And what is the relationship between the quantity we will buy and the amount of liquidity I have.

And also the stop loss location.

4-Trading Psychology...

This is the part that deals with the psychological aspect of the trader and dealing with feelings of fear and greed. For example, how do you commit to the plan you set in the beginning and be firm in implementing stop loss points and take profit points...

How do you control your feelings and control your fear and anger while trading? This is a science we must learn in order to become a successful trader.

5- The last thing in the trading process ... is to determine your exit points .... (Exit Price)

That is, when will you exit the trade if you are losing so that you do not increase your losses and stop them at the lowest cost.... And also when will you exit when you are winning and will you exit in parts or at a specific price for the entire quantity

... You must know exactly what we will do before you buy.

Now it is clear to you that the most important part of trading is not the purchase price, but rather a group of factors that must be available in your trading plan..

What is the part you focus on the most during your trading ...??

And have you thought about having a trading plan that includes the five points mentioned??

1- Risk Management ... (Risk Management)

For example, when to go out when certain signals appear. And when can you determine the appropriate stop for each you want, and also enter to buy or sell with any amount

2- Managing the trading process itself ....

(Trading Management)

That is, for example, you entered and bought and specified a stop and also a profit target, that's it ... Well, if the financial asset went up after the purchase, but before it reached your profit target, the upward momentum began to decrease, what would we do ....??? 🤔

Or even after I bought, the price behavior of the asset changed and began to go down and approach the stop, what would we do ...??? Should I wait until the stop is hit ..?? Or what are the signals that may appear to confirm that the trade may fail ...?? The answers to these questions ... mean managing the trading process. 👌👌

3- Position Size...

I mean, how do we determine the quantity to buy from the beginning...and why...?? And what is the relationship between the quantity we will buy and the amount of liquidity I have.

And also the stop loss location.

4-Trading Psychology...

This is the part that deals with the psychological aspect of the trader and dealing with feelings of fear and greed. For example, how do you commit to the plan you set in the beginning and be firm in implementing stop loss points and take profit points...

How do you control your feelings and control your fear and anger while trading? This is a science we must learn in order to become a successful trader.

5- The last thing in the trading process ... is to determine your exit points .... (Exit Price)

That is, when will you exit the trade if you are losing so that you do not increase your losses and stop them at the lowest cost.... And also when will you exit when you are winning and will you exit in parts or at a specific price for the entire quantity

... You must know exactly what we will do before you buy.

Now it is clear to you that the most important part of trading is not the purchase price, but rather a group of factors that must be available in your trading plan..

What is the part you focus on the most during your trading ...??

And have you thought about having a trading plan that includes the five points mentioned??

Abdalla Mohamed Mahmoud Taha

Breakout

A breakout is when the price moves above a resistance level or moves below a support level.

The price movement of a breakout can be described as a sudden, directional move in price that is typically followed by increased volatility and heavy volume.

Traders who trade breakouts live by the motto, “No price is too high to buy and no price is too low to sell.”

Because not all traders recognize or use the same support and resistance levels, breakouts can be subjective.

Breakouts indicate the potential for the price to start trending in the breakout direction.

There are two types of breakouts:

Upside Breakout

Downside Breakout (“Breakdown”)

A breakout to the upside indicates that the price will start trending higher. This signals traders to possibly go long or exit short positions.

An upside breakout pattern represents a trading range in which prices move sideways between two parallel horizontal lines.

It’s often a pause or consolidation area within an existing trend, although sometimes the breakout results in a reversal to the prior trend.

In either scenario, an upside breakout through the upper resistance line signals an end to the consolidation period and the start of an uptrend.

Once the resistance level is broken, it reverses its role and turns into a support level if price experiences a correction or pullback.

A breakout to the downside, also called a breakdown, hat the price will start trending lower. This signals traders to possibly go short or exit long positions.

Once the support level is broken, it reverses its role and turns into a resistance level if price experiences a correction or pullback.

Breakouts that occur on HIGH volume (relative to normal volume) show greater conviction which means the price is more likely to trend in that direction.

Breakouts that occur on LOW volume (relative to normal volume) show weak conviction and are more prone to failure. Price is less likely to trend in the breakout direction.

How to Trade Breakouts

A breakout occurs because the price has been contained below a resistance level or above a support level, potentially for some time.

The resistance or support level becomes a line in the sand that many traders use to set entry points or place their stop losses.

When the price breaks through the support or resistance level, two things usually happen:

Traders waiting for the breakout jump in.

Traders who had placed their stop losses in this area get stopped out.

This surge in buying and selling will often cause the volume to rise, which shows that lots of traders were interested in the breakout level.

Breakouts are commonly associated with chart patterns, including rectangles, triangles, wedges, and pennants.

These patterns are formed when the price moves in a certain way that support and/or resistance levels develop.

These levels are monitored heavily by traders.

If the price breaks above resistance, traders go long. If price breaks below support, traders go short.

After a breakout, the price may, but not always, retrace to the breakout point before moving in the breakout direction again.

After an upside breakout, the price may retest its previous resistance level, which has now turned into a support level.

A breakout is when the price moves above a resistance level or moves below a support level.

The price movement of a breakout can be described as a sudden, directional move in price that is typically followed by increased volatility and heavy volume.

Traders who trade breakouts live by the motto, “No price is too high to buy and no price is too low to sell.”

Because not all traders recognize or use the same support and resistance levels, breakouts can be subjective.

Breakouts indicate the potential for the price to start trending in the breakout direction.

There are two types of breakouts:

Upside Breakout

Downside Breakout (“Breakdown”)

A breakout to the upside indicates that the price will start trending higher. This signals traders to possibly go long or exit short positions.

An upside breakout pattern represents a trading range in which prices move sideways between two parallel horizontal lines.

It’s often a pause or consolidation area within an existing trend, although sometimes the breakout results in a reversal to the prior trend.

In either scenario, an upside breakout through the upper resistance line signals an end to the consolidation period and the start of an uptrend.

Once the resistance level is broken, it reverses its role and turns into a support level if price experiences a correction or pullback.

A breakout to the downside, also called a breakdown, hat the price will start trending lower. This signals traders to possibly go short or exit long positions.

Once the support level is broken, it reverses its role and turns into a resistance level if price experiences a correction or pullback.

Breakouts that occur on HIGH volume (relative to normal volume) show greater conviction which means the price is more likely to trend in that direction.

Breakouts that occur on LOW volume (relative to normal volume) show weak conviction and are more prone to failure. Price is less likely to trend in the breakout direction.

How to Trade Breakouts

A breakout occurs because the price has been contained below a resistance level or above a support level, potentially for some time.

The resistance or support level becomes a line in the sand that many traders use to set entry points or place their stop losses.

When the price breaks through the support or resistance level, two things usually happen:

Traders waiting for the breakout jump in.

Traders who had placed their stop losses in this area get stopped out.

This surge in buying and selling will often cause the volume to rise, which shows that lots of traders were interested in the breakout level.

Breakouts are commonly associated with chart patterns, including rectangles, triangles, wedges, and pennants.

These patterns are formed when the price moves in a certain way that support and/or resistance levels develop.

These levels are monitored heavily by traders.

If the price breaks above resistance, traders go long. If price breaks below support, traders go short.

After a breakout, the price may, but not always, retrace to the breakout point before moving in the breakout direction again.

After an upside breakout, the price may retest its previous resistance level, which has now turned into a support level.

Abdalla Mohamed Mahmoud Taha

Why do sportsmen have a better chance of success in trading?

Top athletes have several qualities and skills that can help them achieve above average returns in the world of trading. Which ones are they and why don't ordinary traders have them?

Discipline, consistency, emotional control, patience, motivation or curiosity are all qualities that anyone who wants to become a successful trader should acquire. A robust strategy and a good trading plan, or properly set risk management, are things that form a kind of superstructure, which a trader can implement thanks to these qualities.

One group of people who overwhelmingly possess these basic qualities and can use them to their advantage are top athletes.

Discipline and self-control

Athletes are used to following a strict training plan and regime, which is also crucial for successful trading. Trading requires a sound strategy and risk management, while not giving in to emotions is essential. Just as athletes and competitors follow the rules and resist emotional impulses, traders need to respect the rules, such as setting stop loss orders or following a strategy even during unpredictable market fluctuations. Professional sportsmen, in short, have the ability to strictly stick to the plan and not give in to emotions, which they can then evaluate in trading.

Resistance to stress and ability to work under pressure

Top athletes are used to handling stressful situations - for example, during qualifiers and important matches, where they may face enormous pressure. In trading, where markets can be highly volatile, the ability to remain calm and make quick decisions is crucial, whether markets are suddenly falling or rising sharply. Due to their built-up stress resilience, athletes can stay focused and act analytically, while others may act impulsively in similar situations.

Perseverance, consistency and the ability to learn from failures

Athletes understand that success does not come overnight. This long-term approach is key to trading. While beginners often expect quick profits, the realities of the financial markets require time, continuous learning and adaptation. Professionals know that every hour of practice contributes to long-term improvement, and with their mental toughness and patience, they are ready to accept that success in trading is a gradual process, involving learning from mistakes and overcoming setbacks.

Moreover, sportsmen are able to analyse their mistakes, learn from failures and continuously improve. Mistakes are common in trading - for example, poor timing of trade entry or losses due to unexpected events - but successful traders learn from these mistakes and adapt their strategies accordingly. Just as athletes analyse their losses to perform better next time, traders use mistakes to optimize their approach to the market.

Winner's mentality and failure management

Athletes have a competitive nature and a winner's mentality, which is an ideal combination for trading. Financial markets are competitive environments where every trader competes with others. A winner's mentality is not only the desire to succeed, but also the determination to overcome obstacles and continuously improve. Moreover, they are used to facing losses, which, like losses in the markets, are inevitable, but pros have the ability to recover quickly, assess the situation and move on.

Focus and concentration

Focusing on a specific goal is crucial for athletes, and this skill is just as important in trading. Markets are dynamic and a trader must be able to analyse vast amounts of information, follow charts, react to news and make quick decisions based on the data available. Athletes are used to long hours of intense training with attention to detail, which gives them an edge in an environment where the average person can be distracted by a myriad of different distractions.

Analytical and strategic thinking

Peak sports require not only physical ability, but also strong analytical and strategic thinking. Professional athletes are constantly thinking through tactics, analysing their opponents and adapting their approach in real time during competition. Trading works in a similar way - a trader must constantly evaluate market conditions, adapt his strategy and react to rapidly changing situations. Contestants operating in top competitions are used to this way of thinking, which gives them a distinct advantage.

Ability to set and achieve goals

Athletes have a wealth of experience in setting both long-term and short-term goals. This skill is also essential in trading, where it is crucial to have clear goals - for example, setting a monthly profit or maximum acceptable risk. Sports professionals can break their goals into smaller phases and focus on incremental progress. This approach is very effective in trading because success depends on careful planning and consistent execution of the trading strategy.

High level of personal responsibility

Athletes are used to taking full responsibility for their results. Even if they have coaches and support teams, the final performance is up to them. In trading, the same is true; the trader is solely responsible for his or her decisions. The experience of athletes in accepting responsibility for both mistakes and successes also gives them an advantage in the financial market environment, where they cannot blame poor results on external circumstances. It is always about the trader's right or wrong decisions.

Conclusion

Athletes have many qualities that give them a competitive advantage in trading: discipline, the ability to work under pressure, perseverance, mental toughness and the ability to learn from mistakes. Their competitive attitude, self-control and performance analysis provide them with valuable tools that they can use effectively in the financial markets. In this challenging environment, where competition is fierce and success depends on the ability to keep a cool head and a long-term perspective, athletes are able to perform better than normal people.

Top athletes have several qualities and skills that can help them achieve above average returns in the world of trading. Which ones are they and why don't ordinary traders have them?

Discipline, consistency, emotional control, patience, motivation or curiosity are all qualities that anyone who wants to become a successful trader should acquire. A robust strategy and a good trading plan, or properly set risk management, are things that form a kind of superstructure, which a trader can implement thanks to these qualities.

One group of people who overwhelmingly possess these basic qualities and can use them to their advantage are top athletes.

Discipline and self-control

Athletes are used to following a strict training plan and regime, which is also crucial for successful trading. Trading requires a sound strategy and risk management, while not giving in to emotions is essential. Just as athletes and competitors follow the rules and resist emotional impulses, traders need to respect the rules, such as setting stop loss orders or following a strategy even during unpredictable market fluctuations. Professional sportsmen, in short, have the ability to strictly stick to the plan and not give in to emotions, which they can then evaluate in trading.

Resistance to stress and ability to work under pressure

Top athletes are used to handling stressful situations - for example, during qualifiers and important matches, where they may face enormous pressure. In trading, where markets can be highly volatile, the ability to remain calm and make quick decisions is crucial, whether markets are suddenly falling or rising sharply. Due to their built-up stress resilience, athletes can stay focused and act analytically, while others may act impulsively in similar situations.

Perseverance, consistency and the ability to learn from failures

Athletes understand that success does not come overnight. This long-term approach is key to trading. While beginners often expect quick profits, the realities of the financial markets require time, continuous learning and adaptation. Professionals know that every hour of practice contributes to long-term improvement, and with their mental toughness and patience, they are ready to accept that success in trading is a gradual process, involving learning from mistakes and overcoming setbacks.

Moreover, sportsmen are able to analyse their mistakes, learn from failures and continuously improve. Mistakes are common in trading - for example, poor timing of trade entry or losses due to unexpected events - but successful traders learn from these mistakes and adapt their strategies accordingly. Just as athletes analyse their losses to perform better next time, traders use mistakes to optimize their approach to the market.

Winner's mentality and failure management

Athletes have a competitive nature and a winner's mentality, which is an ideal combination for trading. Financial markets are competitive environments where every trader competes with others. A winner's mentality is not only the desire to succeed, but also the determination to overcome obstacles and continuously improve. Moreover, they are used to facing losses, which, like losses in the markets, are inevitable, but pros have the ability to recover quickly, assess the situation and move on.

Focus and concentration

Focusing on a specific goal is crucial for athletes, and this skill is just as important in trading. Markets are dynamic and a trader must be able to analyse vast amounts of information, follow charts, react to news and make quick decisions based on the data available. Athletes are used to long hours of intense training with attention to detail, which gives them an edge in an environment where the average person can be distracted by a myriad of different distractions.

Analytical and strategic thinking

Peak sports require not only physical ability, but also strong analytical and strategic thinking. Professional athletes are constantly thinking through tactics, analysing their opponents and adapting their approach in real time during competition. Trading works in a similar way - a trader must constantly evaluate market conditions, adapt his strategy and react to rapidly changing situations. Contestants operating in top competitions are used to this way of thinking, which gives them a distinct advantage.

Ability to set and achieve goals

Athletes have a wealth of experience in setting both long-term and short-term goals. This skill is also essential in trading, where it is crucial to have clear goals - for example, setting a monthly profit or maximum acceptable risk. Sports professionals can break their goals into smaller phases and focus on incremental progress. This approach is very effective in trading because success depends on careful planning and consistent execution of the trading strategy.

High level of personal responsibility

Athletes are used to taking full responsibility for their results. Even if they have coaches and support teams, the final performance is up to them. In trading, the same is true; the trader is solely responsible for his or her decisions. The experience of athletes in accepting responsibility for both mistakes and successes also gives them an advantage in the financial market environment, where they cannot blame poor results on external circumstances. It is always about the trader's right or wrong decisions.

Conclusion

Athletes have many qualities that give them a competitive advantage in trading: discipline, the ability to work under pressure, perseverance, mental toughness and the ability to learn from mistakes. Their competitive attitude, self-control and performance analysis provide them with valuable tools that they can use effectively in the financial markets. In this challenging environment, where competition is fierce and success depends on the ability to keep a cool head and a long-term perspective, athletes are able to perform better than normal people.

Abdalla Mohamed Mahmoud Taha

Peace be upon you and God's mercy and blessings

This is a journey I made (from $5 to $50,000) I started the first day today

Ok, what makes the difference in this journey 🥱

First, trading live on YouTube daily, God willing

We talk to each other and discuss opportunities

Second: Managing a specific capital

You must know that speculation is sharp and whoever is afraid will go out 😂

Third: Daily risk of 20% of the total balance, for example, starting with $5, working on the mt4 wallet with only $1 and so on every day and the profit is open, we can make 400% in one day, anyway, we will not lose more than 20% 💪

Fourth: And perhaps the most important thing, God willing, we will enter together into the accounts of successful people who have actually made millions in profits on different sites such as mql5 and myfxbook and see how they made millions in profits and study their method of work, whether technical entry points or their method In capital management.

* Whoever thinks the idea is good and is excited like me, subscribe to the channel and write to me if you see a good opportunity in the market or have a question or positive criticism 😍

This is a journey I made (from $5 to $50,000) I started the first day today

Ok, what makes the difference in this journey 🥱

First, trading live on YouTube daily, God willing

We talk to each other and discuss opportunities

Second: Managing a specific capital

You must know that speculation is sharp and whoever is afraid will go out 😂

Third: Daily risk of 20% of the total balance, for example, starting with $5, working on the mt4 wallet with only $1 and so on every day and the profit is open, we can make 400% in one day, anyway, we will not lose more than 20% 💪

Fourth: And perhaps the most important thing, God willing, we will enter together into the accounts of successful people who have actually made millions in profits on different sites such as mql5 and myfxbook and see how they made millions in profits and study their method of work, whether technical entry points or their method In capital management.

* Whoever thinks the idea is good and is excited like me, subscribe to the channel and write to me if you see a good opportunity in the market or have a question or positive criticism 😍

Abdalla Mohamed Mahmoud Taha

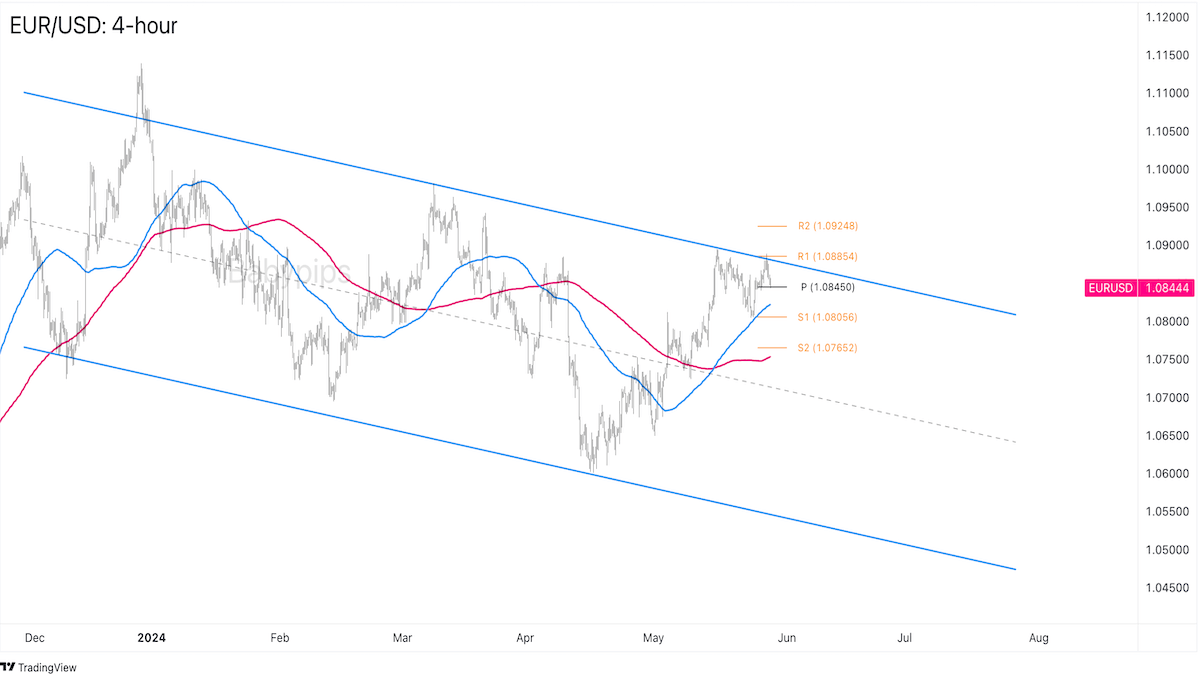

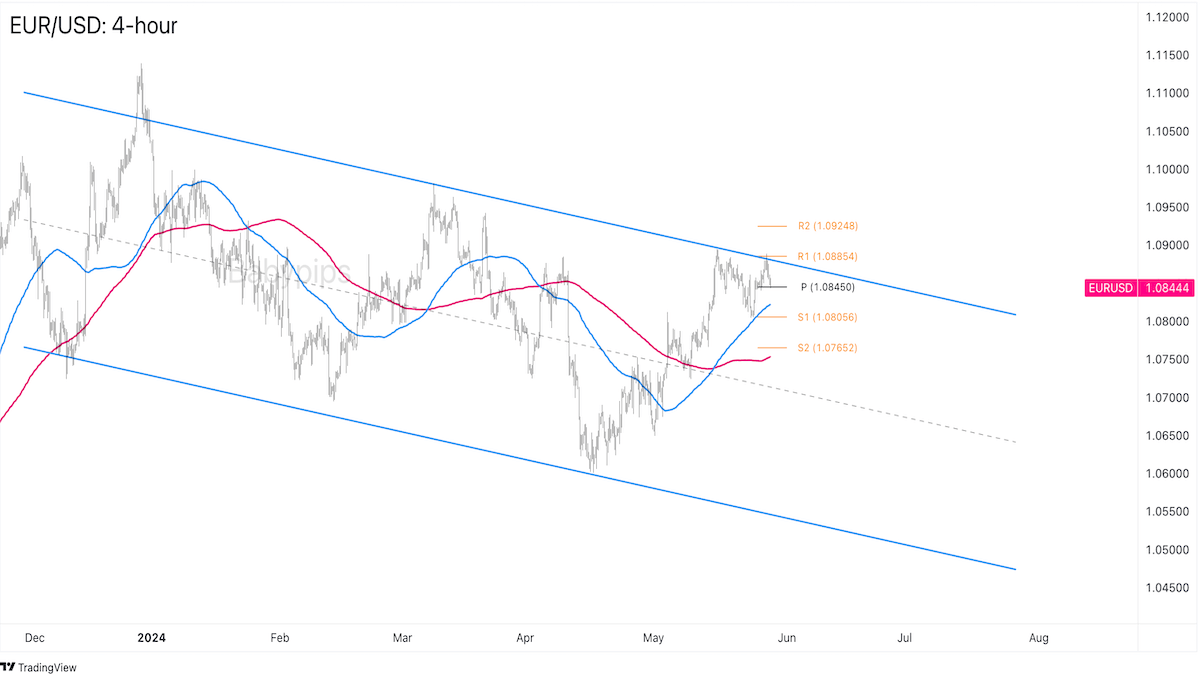

بتدور على تحليل لزوج اليورو دولار متوسط المدى ؟

لقد بدأ امس زوج اليورو دولار الانخفاض من عند المقاومة الرئيسية فهل سيواصل الزوج اتجاهه الهبوطي طويل المدى في الأيام القليلة القادمة؟

لقد تم صد الزوج عند المستوى النفسى 1.0900 للمرة الثانية هذا الشهر حيث يبدو ان مستوى المقاومة هناك شديد

يتم تداول الزوج حاليًا بالقرب من خط النقطة المحورية 1.0840 والذي يقع أسفل قمة مقاومة القناة الهابطة الموجودة منذ بداية عام 2024

والسؤال الان هل ستكون الاخبار الاقتصادية لهذا الاسبوع تشجيعا لمزيد من عمليات بيع الزوج ؟! إذا أدت تقارير هذا الأسبوع إلى توسيع الدولار الأمريكي لمكاسبه مقابل نظرائه الرئيسيين من العملات ، فقد يكتسب زوج يورو/دولار زخمًا هبوطيًا بعد رفضه من منطقة المقاومة الفنية.

حينها قد يعيد زوج يورو/دولار زيارة منطقة الدعم السابقة (1.0806) او يخترقها ويصل الى الدعم الثانى (1.0765) .

* ولكن إذا شجعت تحديثات الأخبار هذا الأسبوع المشاعر المؤيدة للمخاطرة والمعادية للدولار الأمريكي فقد يعيد زوج اليورو / دولار زيارة أعلى مستوياته السابقة عند 1.0900 ويخترقها

لقد بدأ امس زوج اليورو دولار الانخفاض من عند المقاومة الرئيسية فهل سيواصل الزوج اتجاهه الهبوطي طويل المدى في الأيام القليلة القادمة؟

لقد تم صد الزوج عند المستوى النفسى 1.0900 للمرة الثانية هذا الشهر حيث يبدو ان مستوى المقاومة هناك شديد

يتم تداول الزوج حاليًا بالقرب من خط النقطة المحورية 1.0840 والذي يقع أسفل قمة مقاومة القناة الهابطة الموجودة منذ بداية عام 2024

والسؤال الان هل ستكون الاخبار الاقتصادية لهذا الاسبوع تشجيعا لمزيد من عمليات بيع الزوج ؟! إذا أدت تقارير هذا الأسبوع إلى توسيع الدولار الأمريكي لمكاسبه مقابل نظرائه الرئيسيين من العملات ، فقد يكتسب زوج يورو/دولار زخمًا هبوطيًا بعد رفضه من منطقة المقاومة الفنية.

حينها قد يعيد زوج يورو/دولار زيارة منطقة الدعم السابقة (1.0806) او يخترقها ويصل الى الدعم الثانى (1.0765) .

* ولكن إذا شجعت تحديثات الأخبار هذا الأسبوع المشاعر المؤيدة للمخاطرة والمعادية للدولار الأمريكي فقد يعيد زوج اليورو / دولار زيارة أعلى مستوياته السابقة عند 1.0900 ويخترقها

Abdalla Mohamed Mahmoud Taha

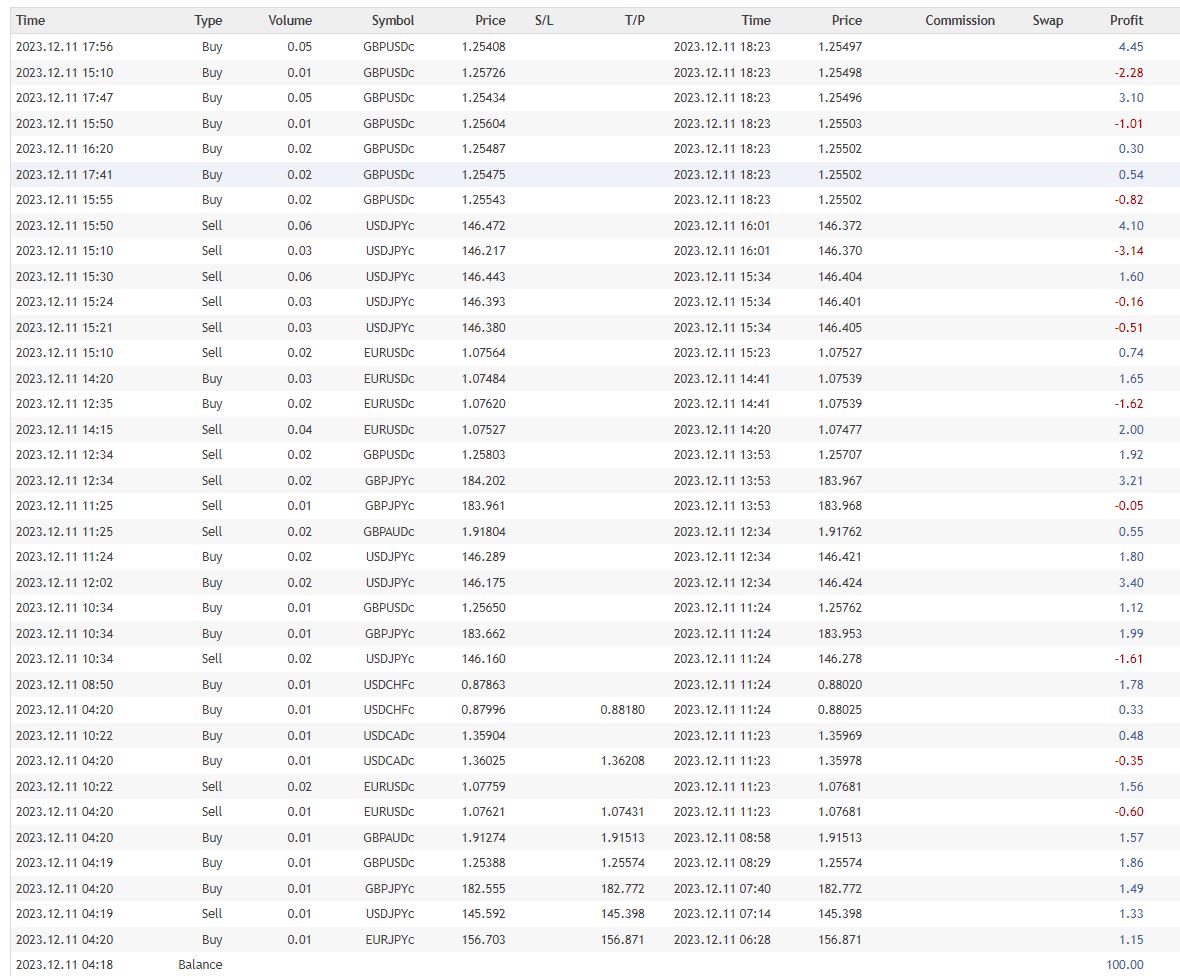

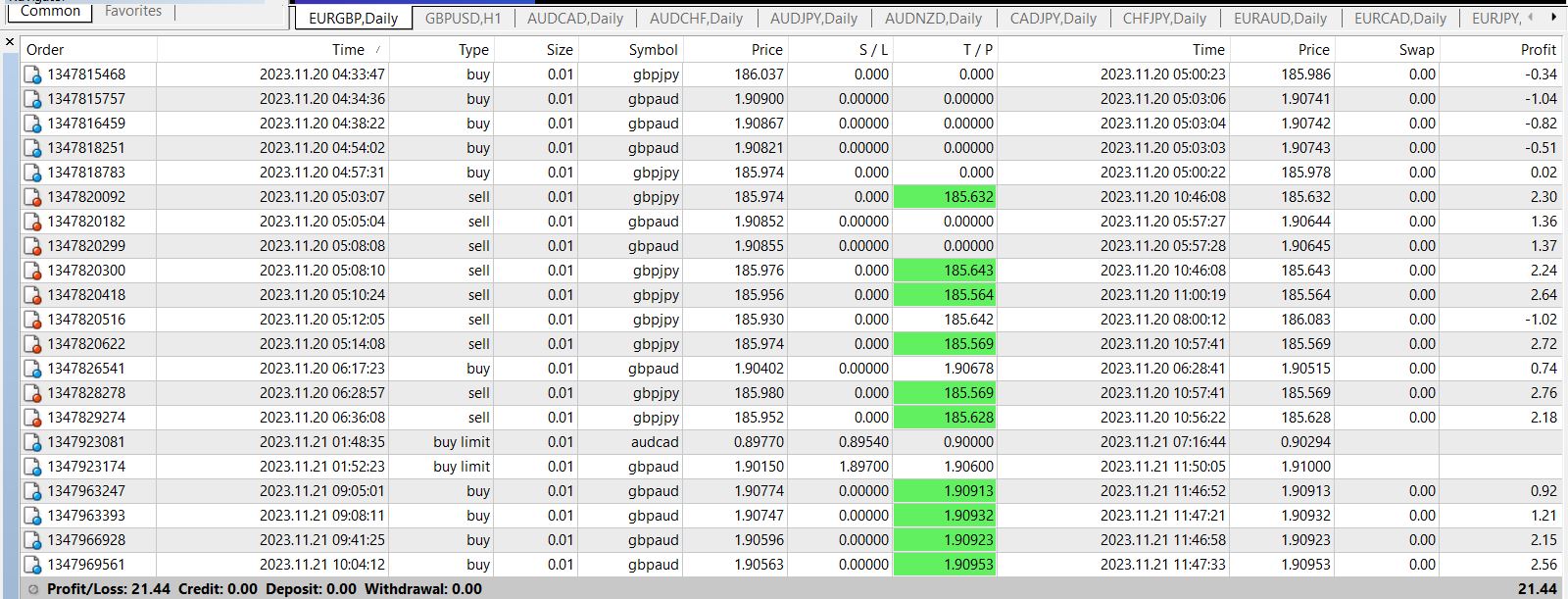

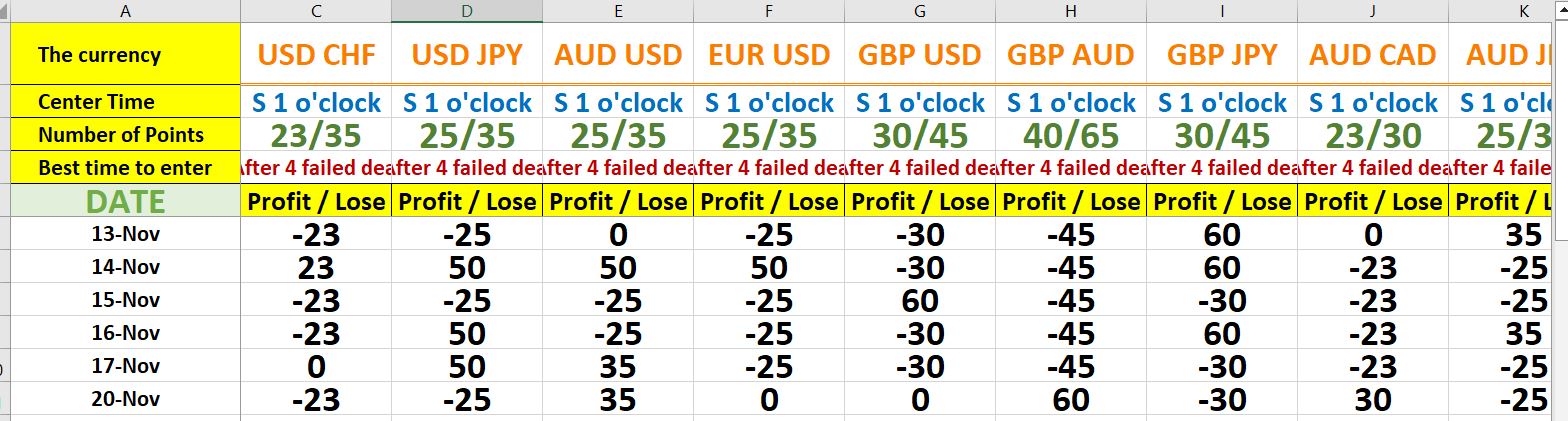

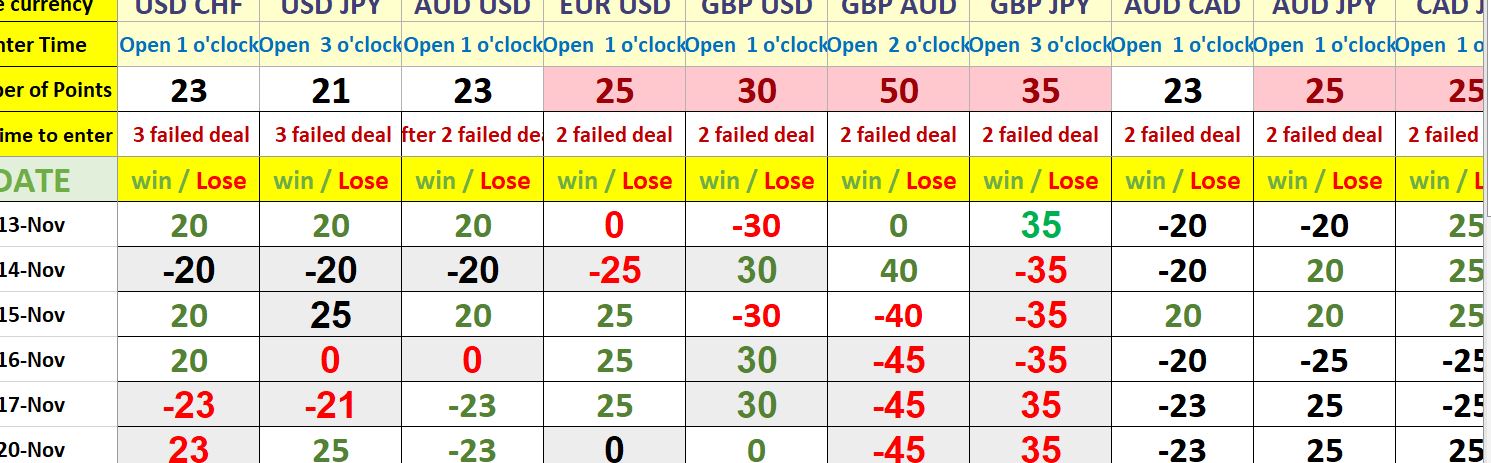

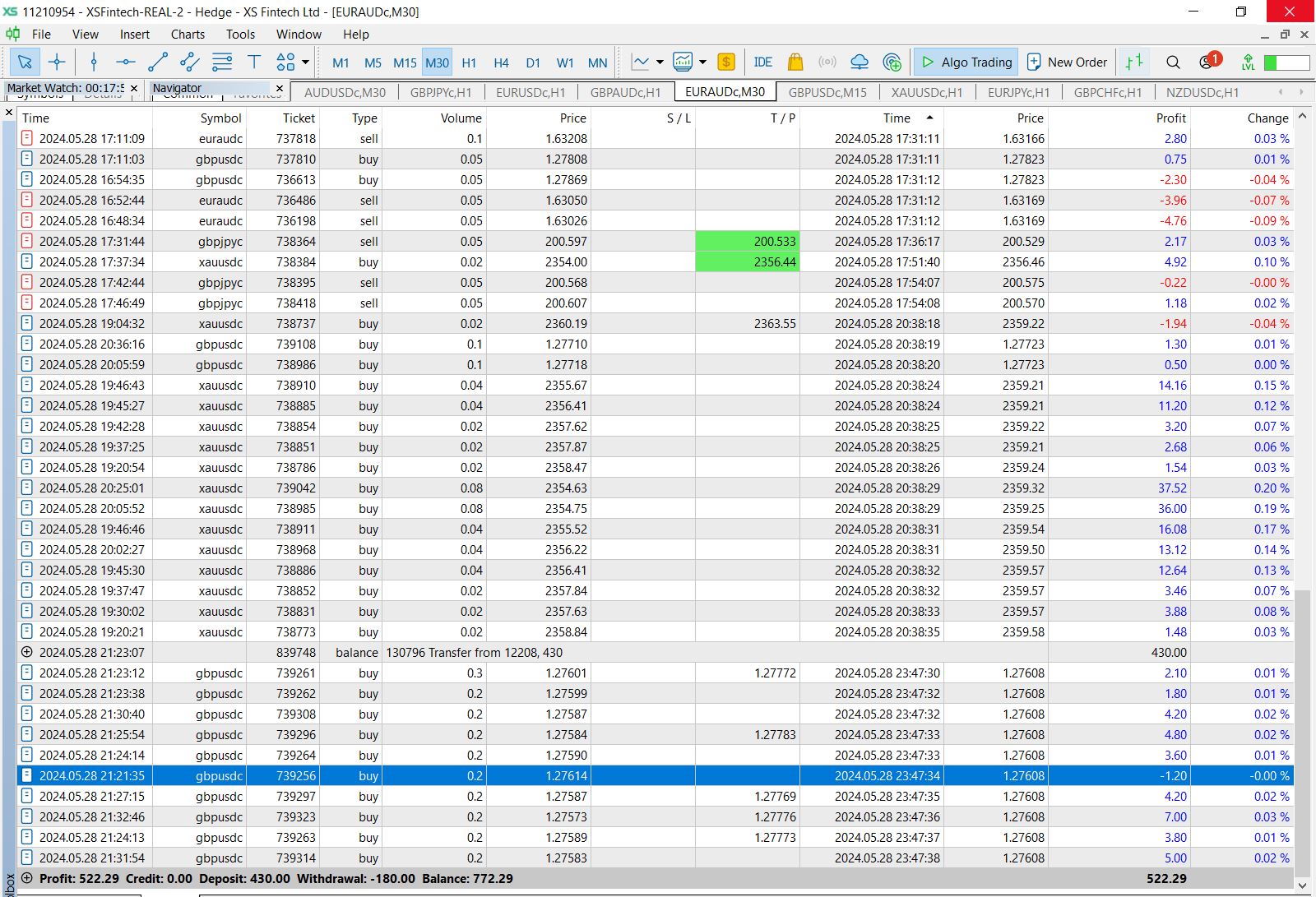

سجل التداول اليومى 28 مايو 2024

real account

leverage 1:1000

type cent

لفتح حساب حقيقى والتمتع ب 50 % كاش باك اسبوعى + خدمة نسخ مجانية 👇

https://my.xs.com/links/go/1192

لفترة محدودة 🥰

real account

leverage 1:1000

type cent

لفتح حساب حقيقى والتمتع ب 50 % كاش باك اسبوعى + خدمة نسخ مجانية 👇

https://my.xs.com/links/go/1192

لفترة محدودة 🥰

Abdalla Mohamed Mahmoud Taha

https://www.facebook.com/profile.php?id=61558785526960

this is my fb account i will make live show with live tradding

this is my fb account i will make live show with live tradding

Abdalla Mohamed Mahmoud Taha

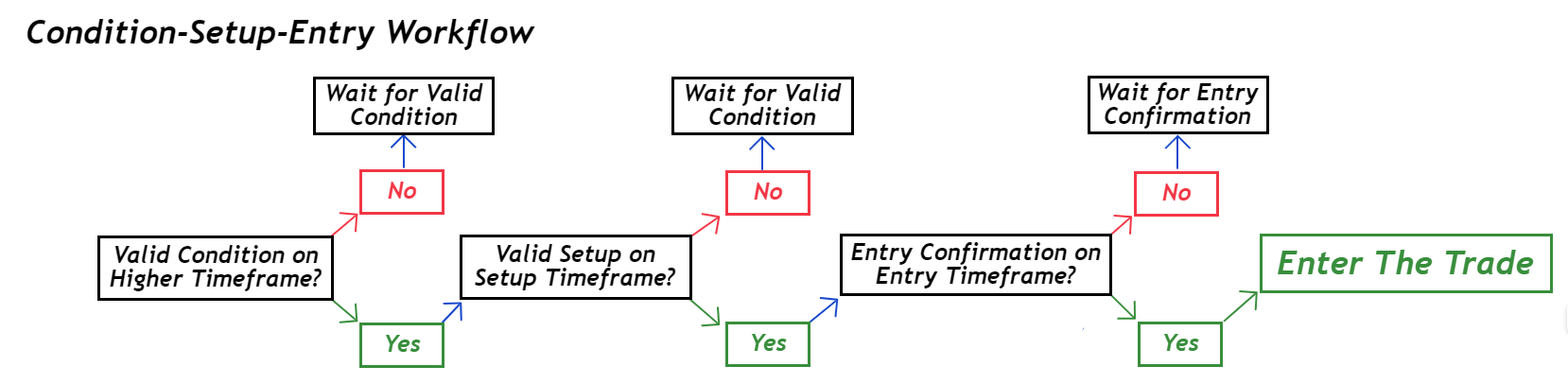

The “Condition-Setup-Entry” Trade Model

Condition-Setup-Entry Box

The condition is the container for the setup and the setup is the container for the entry, thus an entry cannot be valid if it is not within a valid setup, and a setup cannot be valid if it is not within a valid condition.

It may seem obvious that a sell setup should occur within bearish conditions in order to have a higher probability of success but sometimes confirmation bias clouds our vision causing us to consider buy setups in a seller’s market. This is a technique for framing entry confirmation within a setup and framing a setup within the appropriate market conditions.

Condition-Setup-Entry Workflow

Identify the current market direction on the Higher Time Frame (HTF) (ex. Daily or H4) to identify if a Buying or Selling Condition is present. Identify areas of imbalance and supply & demand points of interest (POIs) within the most recent impulsive wave that created a BOS. I reference supply & demand because I use that in my trading, but this applies to any rules based method of trading.

Look for a valid setup on the Setup Time Frame (STF) (ex. H4 or H1) within the context of a HTF buy or sell condition as long as the HTF buy or sell condition is valid. If there is a valid STF setup within a valid HTF condition, proceed to step 3. If not, wait for a valid STF setup to form within a valid HTF condition.

Wait for an Entry Confirmation on the Entry Timeframe (ETF) (ex. M15 or M5) and execute the trade when you have entry confirmation within a valid setup.

Condition-Setup-Entry Box

The condition is the container for the setup and the setup is the container for the entry, thus an entry cannot be valid if it is not within a valid setup, and a setup cannot be valid if it is not within a valid condition.

It may seem obvious that a sell setup should occur within bearish conditions in order to have a higher probability of success but sometimes confirmation bias clouds our vision causing us to consider buy setups in a seller’s market. This is a technique for framing entry confirmation within a setup and framing a setup within the appropriate market conditions.

Condition-Setup-Entry Workflow

Identify the current market direction on the Higher Time Frame (HTF) (ex. Daily or H4) to identify if a Buying or Selling Condition is present. Identify areas of imbalance and supply & demand points of interest (POIs) within the most recent impulsive wave that created a BOS. I reference supply & demand because I use that in my trading, but this applies to any rules based method of trading.

Look for a valid setup on the Setup Time Frame (STF) (ex. H4 or H1) within the context of a HTF buy or sell condition as long as the HTF buy or sell condition is valid. If there is a valid STF setup within a valid HTF condition, proceed to step 3. If not, wait for a valid STF setup to form within a valid HTF condition.

Wait for an Entry Confirmation on the Entry Timeframe (ETF) (ex. M15 or M5) and execute the trade when you have entry confirmation within a valid setup.

: