Roberto Jacobs / Profile

- Information

|

9+ years

experience

|

3

products

|

76

demo versions

|

|

28

jobs

|

0

signals

|

0

subscribers

|

MQL5 Community:

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Roberto Jacobs

Roberto Jacobs

Comment to topic Traders Joking

Roberto Jacobs

2016.02.06

People who do not sleep at night, more knowledge of the person who was fast asleep .. ^_^

Roberto Jacobs

Sergey Golubev

Comment to topic Press review

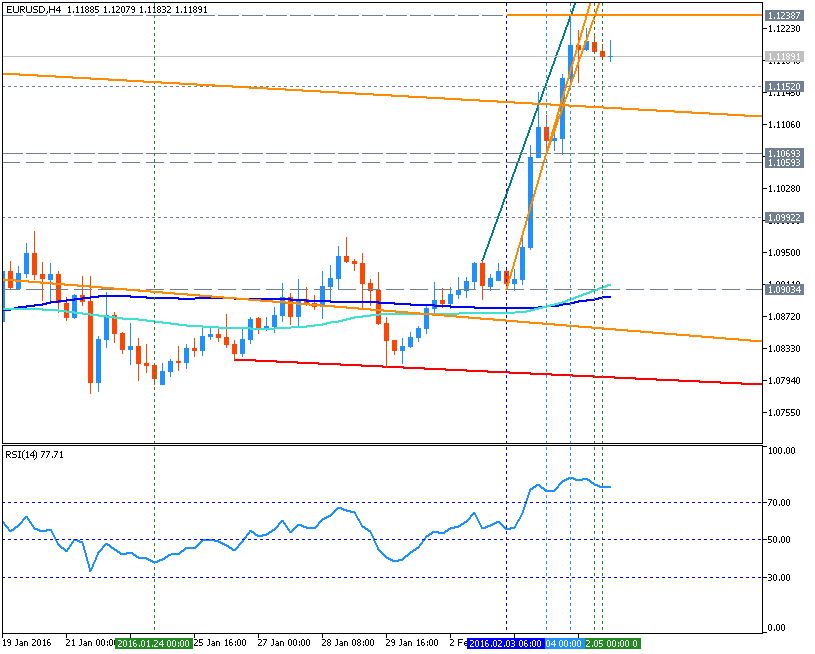

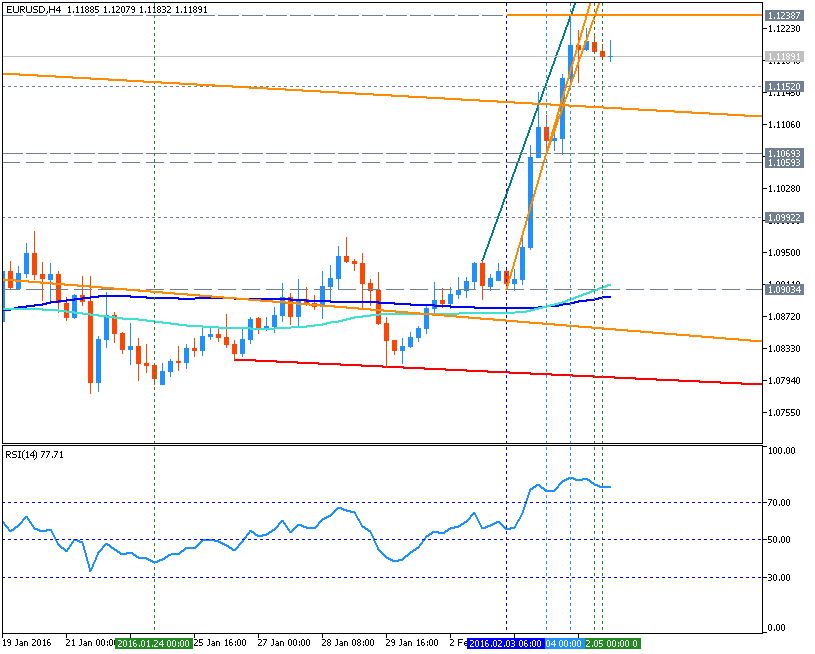

Technical Targets: EUR/USD, GBP/USD, AUD/USD, NZD/USD (based on the article ) EUR/USD : Bullish . Major resistance at 1.1238, waiting for breakout or correction. GBP/USD : Neutral : Closing above

Roberto Jacobs

Published code PricePercentRange

Price(%)Range is the indicator for the MetaTrader 5, which calculates the price movement based on percentage High (Highest) and Low (Lowest) Price on 100 bars.

Share on social networks · 1

8452

2248

Roberto Jacobs

Sergey Golubev

Comment to topic Press review

USD/JPY Intra-Day Fundamentals: BOJ Gov Kuroda Speaks and 11 pips price movement 2016-02-03 02:30 GMT | [JPY - BOJ Gov Kuroda Speaks] past data is n/a , forecast data is n/a , actual data is n/a

Roberto Jacobs

Published code BB_OsMA

BB_OsMA indicator is the OsMA indicator in the form of spheroid, with a deviation as the upper and lower bands.

Share on social networks · 2

5659

1042

Roberto Jacobs

EUR/USD: Wave analysis and forecast for 29.01 – 05.02: The pair is undergoing; the rise in the pair is possible. Estimated pivot point is at the level of 1.0786. Our opinion: Buy the pair from correction above the level of 1.0786 with the target of 1.1150 – 1.1250...

Share on social networks · 2

130

: