LT Super Trend

- Indicators

- Sie Samuel Roland Youl

- Version: 1.25

- Updated: 5 August 2023

The Super Trend indicator is a popular technical analysis tool used by traders to identify the direction of a trend and potential entry and exit points in the market. It is a trend-following indicator that provides signals based on price action and volatility.

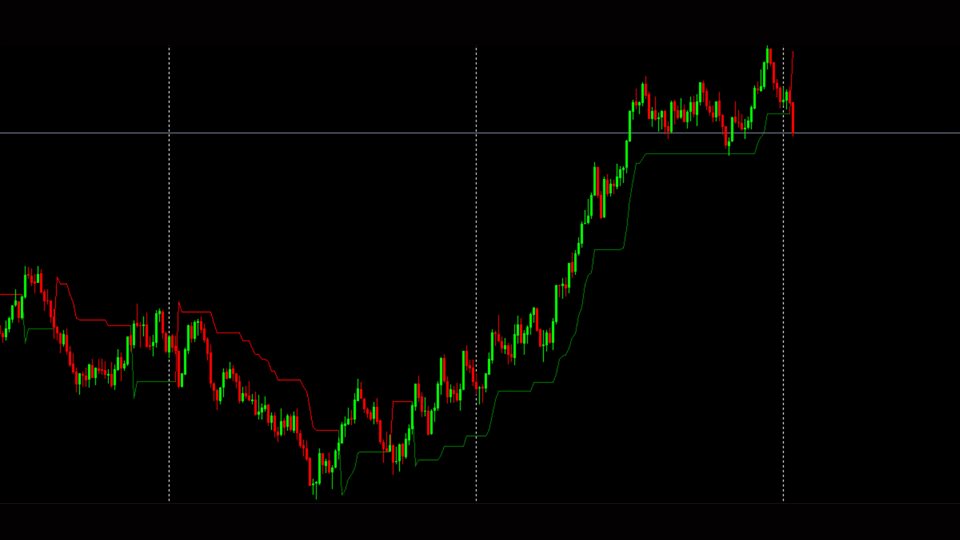

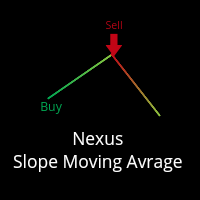

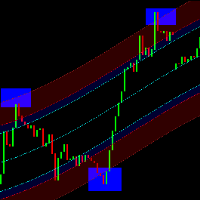

The Super Trend indicator consists of two lines - one indicating the bullish trend (usually colored green) and the other indicating the bearish trend (usually colored red). The lines are plotted above or below the price chart, depending on the trend direction.

To use the Super Trend indicator effectively, follow these steps:

1. Identify the Trend Direction: Look for the Super Trend line to determine whether the market is in an uptrend or a downtrend. A green line indicates an uptrend, while a red line indicates a downtrend.

2. Entry Signals: Consider entering a trade when the Super Trend line changes its color, signaling a potential trend reversal. For example, if the Super Trend line changes from red to green, it suggests a shift from a downtrend to an uptrend, signaling a possible buy opportunity.

3. Exit Signals: Use the Super Trend indicator to determine when to exit a trade. If you are in a long position and the Super Trend line turns from green to red, it may be an indication to close the trade and take profit. Similarly, if you are in a short position and the Super Trend line changes from red to green, it could signal a potential exit point.

4. Setting Stop Loss: Use the Super Trend line as a guide for setting your stop-loss level. For long positions, place the stop-loss below the Super Trend line, and for short positions, place it above the line.

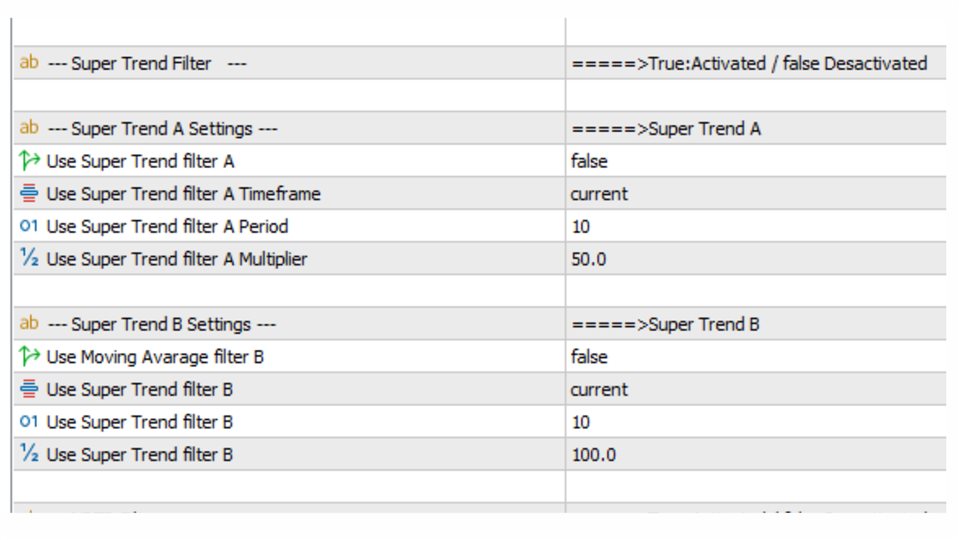

Keep in mind that like any indicator, the Super Trend may generate false signals in choppy or sideways markets. Therefore, it is essential to use it in conjunction with other technical indicators and price analysis to confirm trade signals and improve overall accuracy. Practice using the Super Trend indicator on a demo account before applying it to live trading.

ok