Gap Indicator 123 Gap

- Indicators

- Matthew Thomas Paranac

- Version: 1.0

- Activations: 10

Fair Value Gap Indicator (123 Gap): Precision Tool for Identifying Potential Price Targets

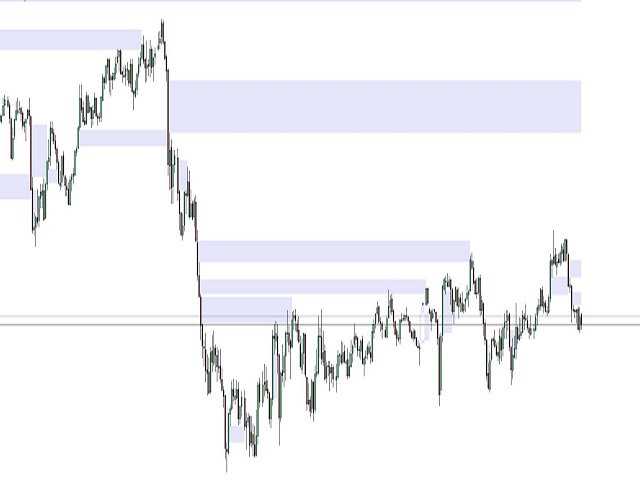

The Fair Value Gap Indicator (123 Gap) is a powerful tool designed to identify high-probability price targets based on market structure. By analyzing sets of three consecutive candles, this indicator pinpoints crucial gaps that often serve as magnets for price action.How It Works

- Continuous Analysis: The indicator scans every set of three consecutive candles on your chart.

- Gap Identification: It calculates the gap between the first and third candles in each set.

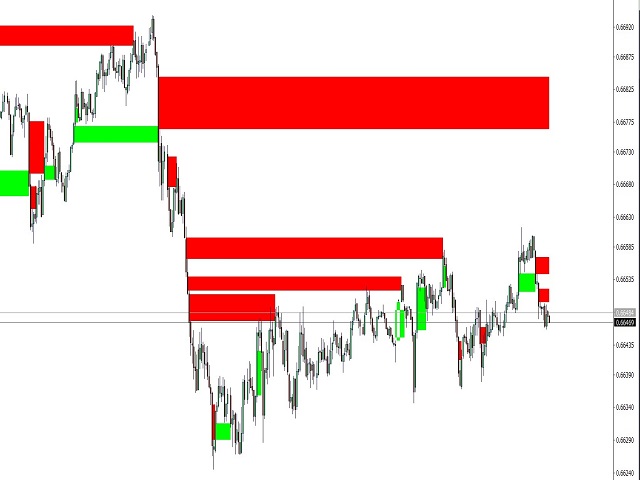

- Visual Representation: Identified gaps are displayed on the chart, color-coded for easy interpretation.

Key Benefits

- Predict Potential Reversals: Highlights areas where price may return after a trend reversal.

- Identify Pullback Targets: Pinpoints levels where price might pause during a pullback.

- Enhance Trade Entries and Exits: Use gap levels to refine your entry and exit points.

Real-World Example

In a downtrend scenario:- First candle's low: 1.0000

- Third candle's high: 0.9950

- The indicator will highlight the gap between 0.9950 and 1.0000 as a potential upside target.

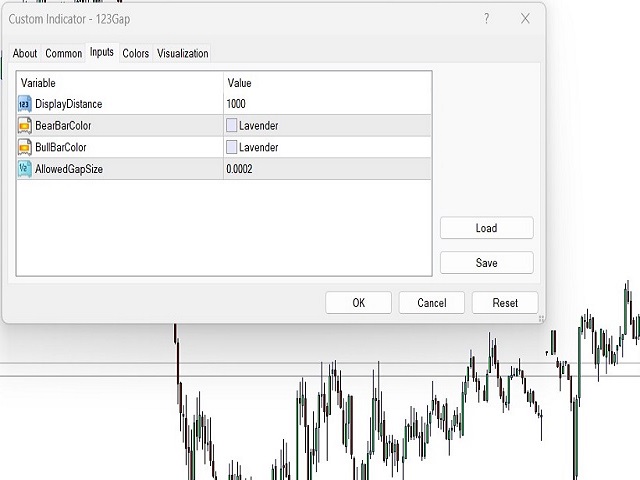

Customizable Settings

- Display Distance: Adjust how far back the indicator looks for gaps.

- BearBarColor: Customize the color for gaps in downtrends.

- BullBarColor: Set the color for gaps in uptrends.

- AllowedGapSize: Define the minimum gap size to be highlighted.

Perfect For

- Swing traders looking for precise entry and exit points

- Day traders seeking to identify intraday reversal levels

- Trend traders wanting to spot potential pullback targets