PipChart

- Experts

- Faithful Kelechukwu Onyiriuka

- Version: 6.2

- Activations: 5

In today’s fast-paced forex markets, precision and strategy are crucial for success. PipChart is an advanced trading robot designed to automate trade execution, enhance accuracy, and improve risk management using a powerful combination of technical indicators.

Unlike basic trading bots, PipChart integrates Moving Average of Oscillators, RSI, ADX, and CCI to identify high-probability long and short trade entries. For trade exits, it employs the Stochastic indicator to optimize timing.

With built-in stop-loss (SL) and take-profit (TP) mechanisms, PipChart ensures disciplined trading while adapting to market conditions. This detailed overview explains PipChart’s functionality, technical indicators, trade execution methods, and risk management strategies.

PipChart is designed to:

Automate Trading: Execute trades based on well-defined technical conditions.

Enhance Trade Accuracy: Use multiple indicators to confirm entry and exit signals.

Adapt to Market Trends: Dynamically adjust based on real-time price action and ADX strength.

Implement Strong Risk Management: Ensure disciplined trading through stop-loss and take-profit strategies.

With its multi-indicator approach, PipChart is ideal for day traders and swing traders looking for a systematic trading strategy.

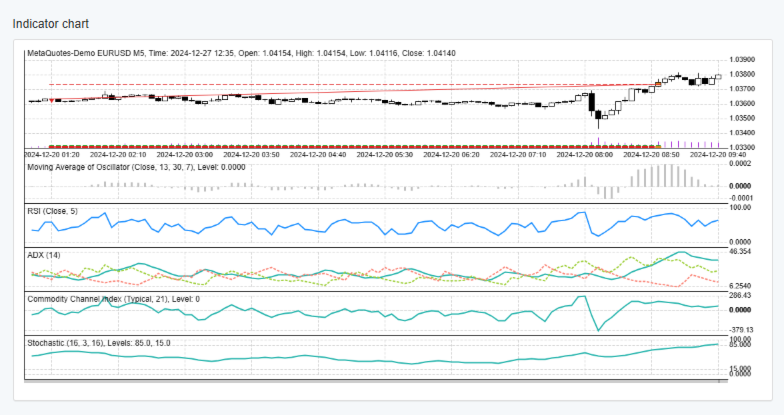

. Indicators and Strategies Used

A. Entry Indicators: Moving Average of Oscillators, RSI, ADX, and CCI

To determine trade entries, PipChart uses a four-indicator confirmation system:

1. Moving Average of Oscillators (MAO) – Identifies market momentum shifts.

2. Relative Strength Index (RSI) – Detects overbought and oversold conditions.

3. Average Directional Index (ADX) – Confirms trend strength.

4. Commodity Channel Index (CCI) – Further validates price movements.

Entry Conditions:

For long & Short entry is when:

MAO signals.

RSI indication.

ADX changes direction.

CCI moves.

By using multiple confirmations, PipChart reduces false signals and ensures high-probability trade entries.

B. Exit Indicator: Stochastic

To maximize profit potential and avoid premature exits, PipChart uses the Stochastic indicator to determine optimal trade exits.

1. If the Stochastic reaches the overbought zone (above 80), the robot exits long trades.

2. If the Stochastic reaches the oversold zone (below 20), the robot exits short trades.

. Risk Management Strategies

Because PipChart is a powerful trading algorithm, proper risk management is essential to maintain consistency and protect capital.

A. Stop-Loss & Take-Profit Implementation

Stop-Loss (SL): Prevents excessive losses by setting SL at logical support/resistance levels.

Take-Profit (TP): Locks in profits when a predefined price target is reached.

SL and TP Adjust Dynamically: Adapts based on market volatility and trend strength.

B. Position Sizing

Users can customize lot size based on account size and risk tolerance.

Example: Risking 1-2% per trade ensures capital protection.

C. Avoiding Overtrading

PipChart does not enter trades unless ADX gives confirmations, preventing unnecessary trades.

A built-in filter ensures only high-probability trades are executed.

D. Managing Market Volatility

Trade sizes adjust automatically during high volatility to prevent excessive risk.

Avoids trading during uncertain market conditions.

These risk management features make PipChart a reliable and disciplined trading tool.

. Customization and User Control

A. Adjustable Indicators

Users can modify RSI, CCI, MAO, and Stochastic settings to suit their trading style.

B. Manual Override Option

Traders can manually close positions if needed.

A pause function allows temporary suspension of trading.

These customization options make PipChart highly flexible for different market conditions.

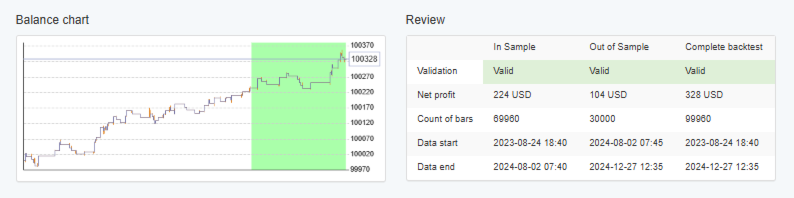

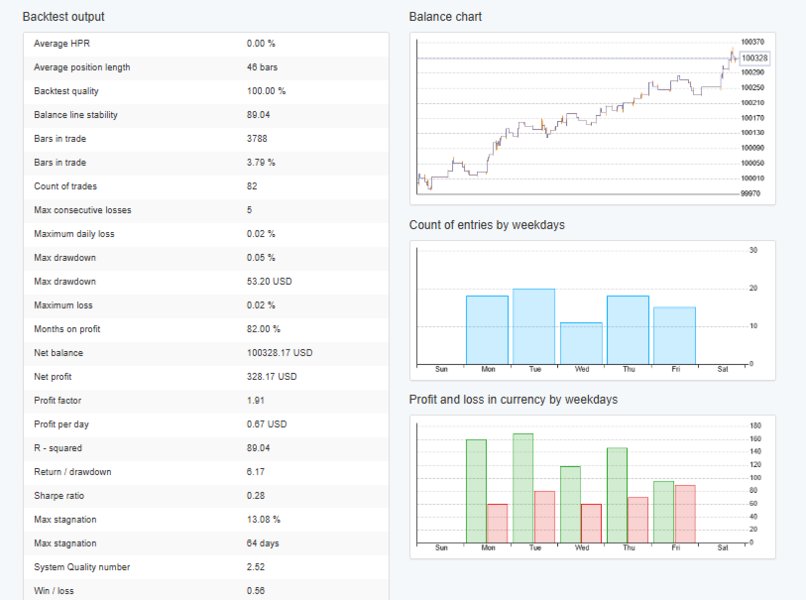

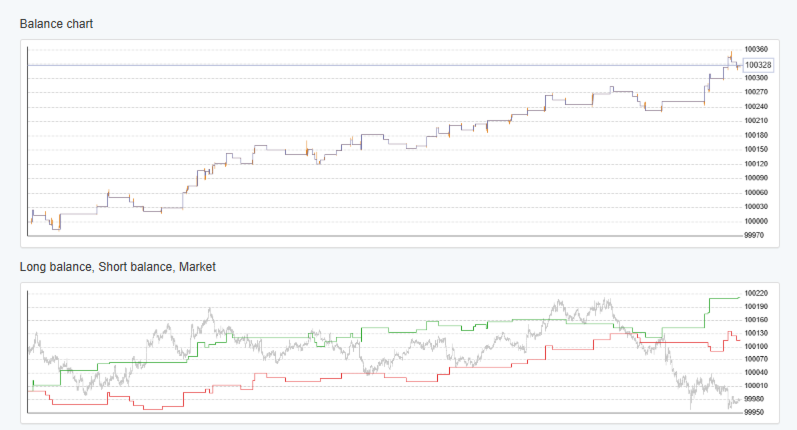

. Performance and Backtesting

Before live deployment, PipChart undergoes extensive backtesting to validate its strategy.

A. Historical Data Analysis

Tested on years of forex market data to measure effectiveness.

Evaluated under trending, ranging, and volatile conditions.

B. Forward Testing & Demo Trading

Users can test PipChart in a simulated demo environment before live trading.

Backtesting ensures that PipChart’s strategy is reliable across various market conditions.

PipChart is a highly intelligent and disciplined forex trading robot that combines Moving Average of Oscillators, RSI, ADX, and CCI for trade entries, while Stochastic ensures well-timed exits.

With built-in stop-loss and take-profit mechanisms, PipChart enforces strict risk management while dynamically adapting to market conditions.

By strategically using PipChart, traders can:

✅ Enhance accuracy with multi-indicator confirmation

✅ Automate trading and remove emotional decision-making

✅ Implement disciplined risk management for long-term profitability

PipChart is an ideal trading companion for traders seeking systematic, rule-based forex trading with strong risk control.