Deriv Volatility Bot

- Experts

- Israel Pelumi Abioye

- Version: 1.0

- Activations: 5

Deriv Volatility Bot is a powerful and easy-to-use trading algorithm designed specifically for Deriv’s Volatility Index assets. After extensive backtesting and real-market use, this EA has been fine-tuned to handle the unique characteristics of synthetic indices.

While it is optimized for Deriv's Volatility Index assets, it can also be used for other instruments like currency pairs and gold. However, due to its specialized design, it performs best on Deriv’s synthetic indices.

The EA is extremely user-friendly, requiring only four input parameters, making it accessible to beginners and experienced traders. These parameters allow users to backtest with different settings to determine the optimal configuration for specific assets. However, the default settings were used for the screenshots attached to this description.

Input Parameters:

- How Many Dollars ($) Per Trade? – Defines how much you want to risk per trade in dollar terms.

- RRR (Risk-Reward Ratio): – Sets the ratio between risk and potential reward for each trade. For example, an RRR of 1:2 means you are risking 1 unit to potentially gain 2 units.

- Do You Allow Trailing Stop? – Determines whether a trailing stop will be used to lock in profits as the trade moves in your favor.

- Activate Trailing Stop at RRR (0 - RRR): – Specifies at what risk-reward ratio the trailing stop should activate. Setting it to 1, for instance, means the trailing stop kicks in once the trade reaches a 1:1 risk-reward level.

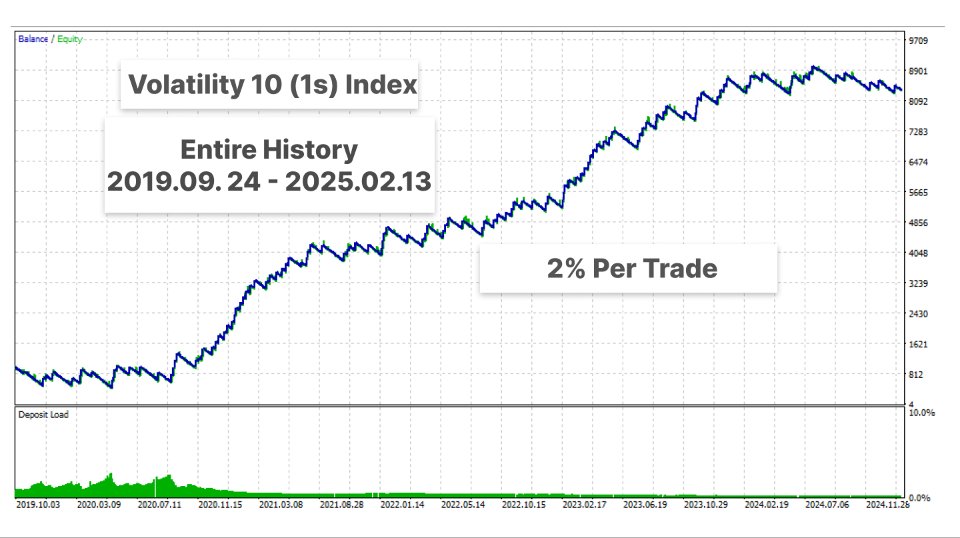

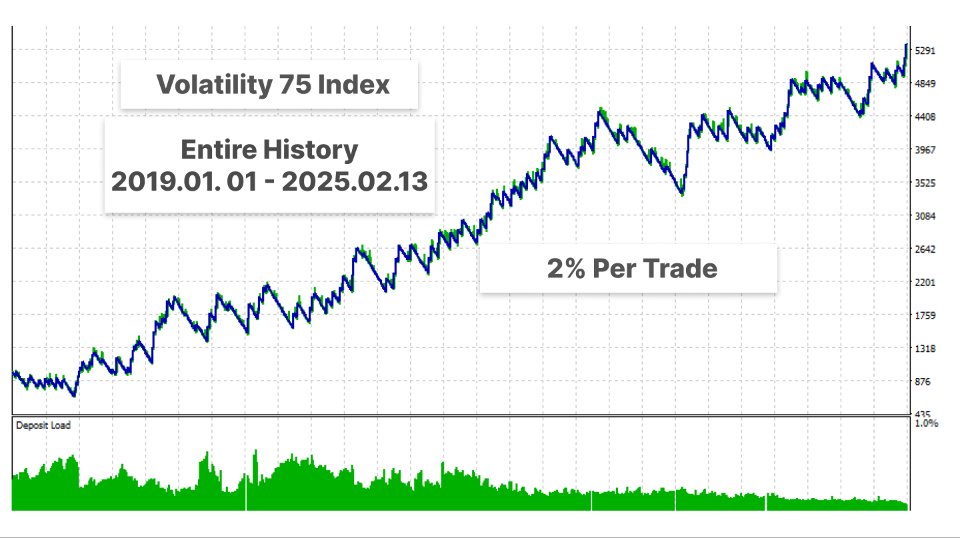

The screenshots provided in the description showcase backtests spanning the entire history of the assets, ensuring full transparency. No manipulation was done—both winning and losing periods are shown rather than selectively displaying only the best-performing phases.

Recommendations:

- I recommend risking a maximum of 2% per trade and never trading with money you cannot afford to lose.

- MQL5 VPS is the best option to ensure the EA catches all trade entries without interruptions.

- Thoroughly backtest the EA with different settings to see if it aligns with your trading style before purchasing.

- After purchasing, feel free to reach out to me for guidance on how to set it up properly.

To maintain the exclusivity and effectiveness of this EA, the price will increase by 50% after every 10 purchases. This prevents too many traders from using the same strategy and ensures the EA remains valuable for its users.

Finally, remember that no trading strategy or EA is perfect. Always trade responsibly and manage your risk effectively!