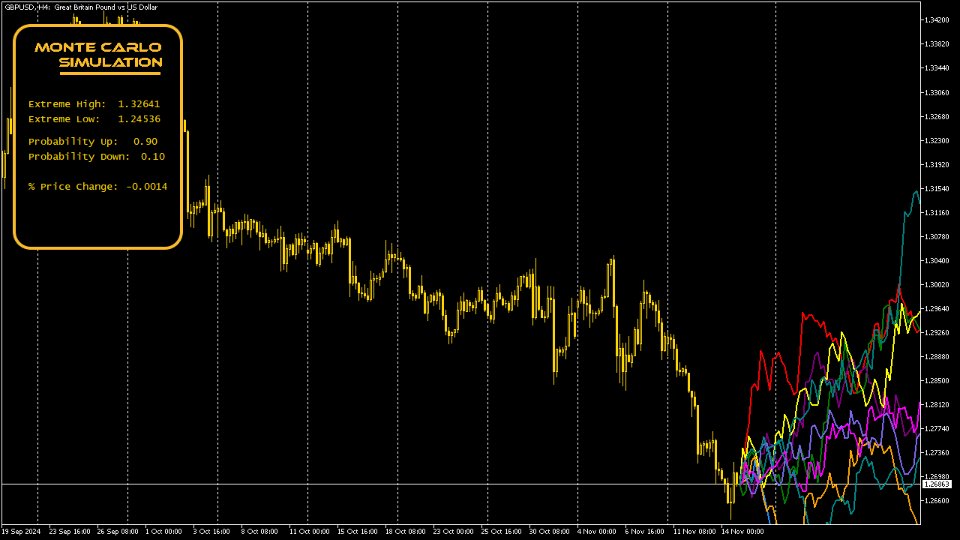

MonteCarlo Simulation

- Indicators

- Omega J Msigwa

- Version: 2.0

- Updated: 15 November 2024

- Activations: 5

About the Indicator

This indicator is based on Monte carlo simulations on the closing prices of a financial instrument. By definition, Monte carlo is a statistical technique used to model the probability of different outcomes in a process that involves random numbers based on previously observed outcomes.

How does it Work?

This indicator generates multiple price scenarios for a security by modelling random price changes over time based on historical data. Each simulation trial uses random variables to account for the closing price fluctuations effectively mimicking possible market movements for the future over a given timeframe.

Advantages of Monte carlo Simulation

- Monte Carlo simulations helps analyze the risk of various trading strategies by testing them against multiple possible future scenarios.

- It helps in identifying how strategies perform under different market conditions, including rare extreme events (tail risk).

- Instead of relying on a single-point forecast, Monte Carlo offers a range of potential outcomes with associated probabilities. This helps to understand the likelihood of profit or loss.