Hit Rate Top Bottom Signal

- Indicators

- Martin Alejandro Bamonte

- Version: 1.0

- Activations: 15

Hit Rate Top Bottom Signal

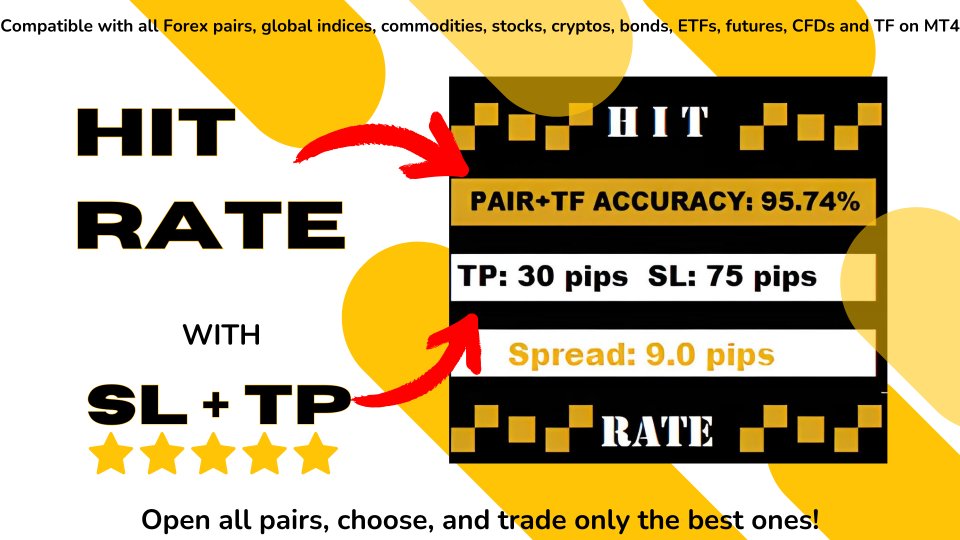

Hit Rate Top Bottom Signal offers a completely innovative approach. It's ideal for those who want to evaluate beforehand how the signal performs with a specific TP-SL and in which PAIRS/TFs it performs best.

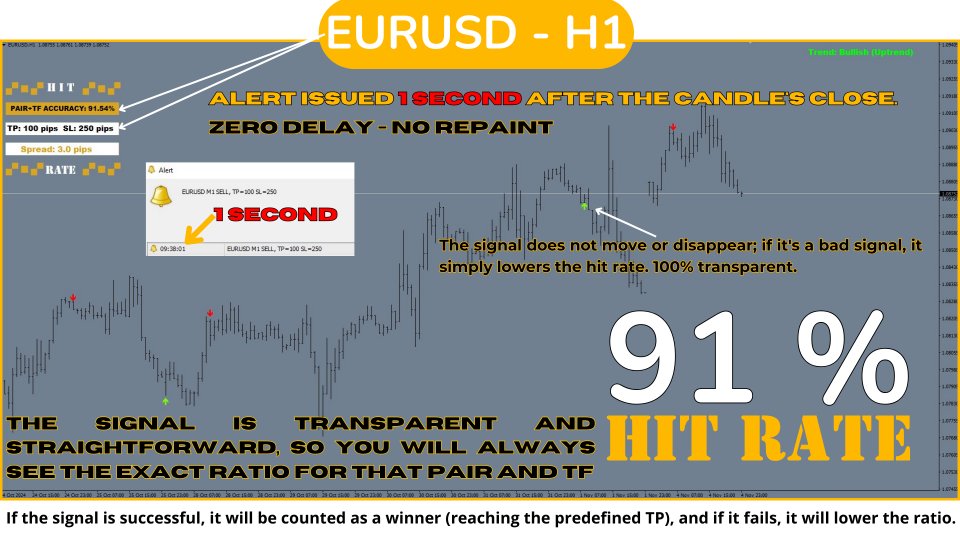

The Hit Rate Top Bottom Signal strategy is a fundamental tool for any trader and any type of trading because it not only emits precise, non-repainting signals, clearly indicating when and in which direction to trade, but also keeps a detailed record of the hit rate percentage for each Pair and TF, with a predefined Take Profit (TP) and Stop Loss (SL). This allows knowing the signal's effectiveness ratio in advance, which is key for good risk management and precise trading.

This strategy stands out because it focuses on detecting reversal points within impulses, rather than complete moves, making the emitted signals more frequent than the traditional Top-Bottom by focusing on

key moments within each significant market swing.

This ability to display, in percentage terms, the historical effectiveness of the signal combined with an SL/TP ratio makes this strategy the best option for secure trading, enabling traders to make data-backed decisions. By relying on a signal that is not only clear and direct but also has a proven history, we are looking at one of the best strategies available.

How to trade with this system?

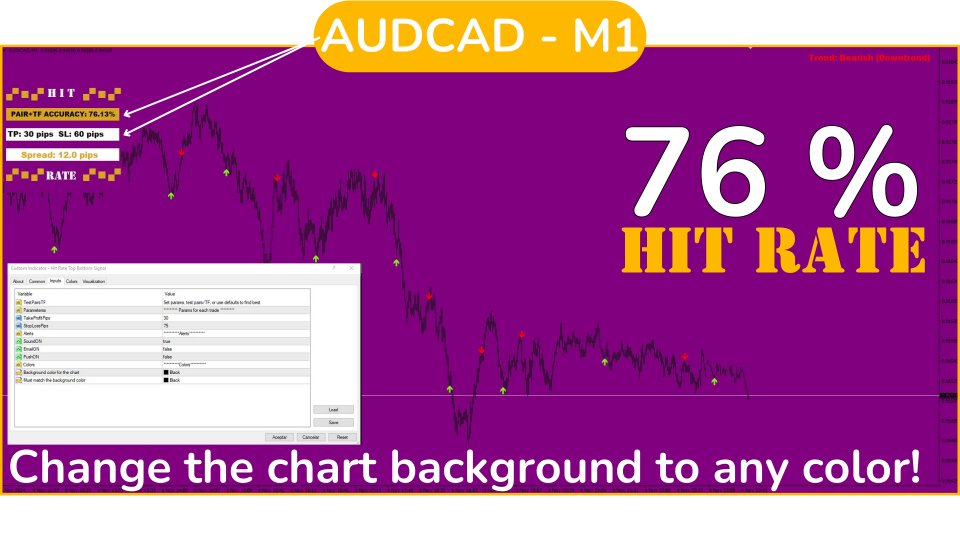

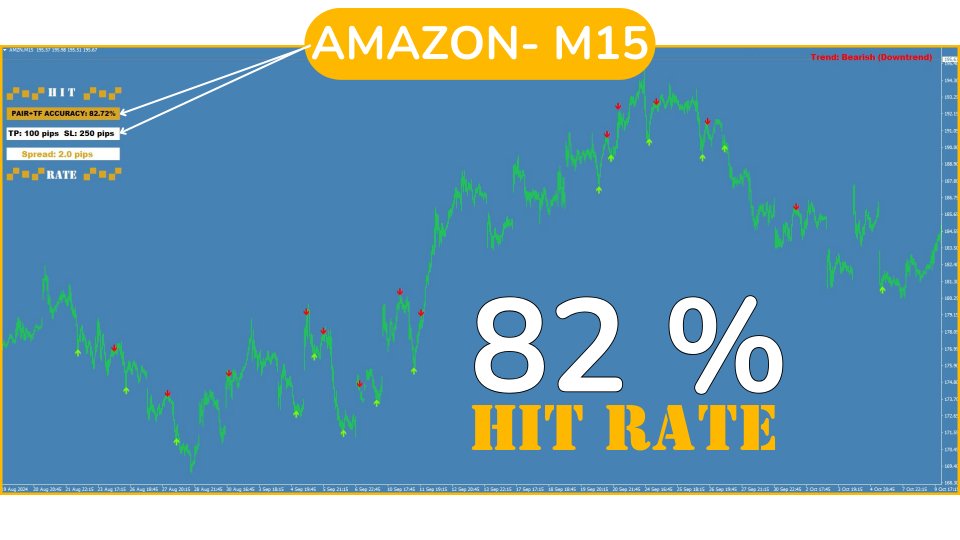

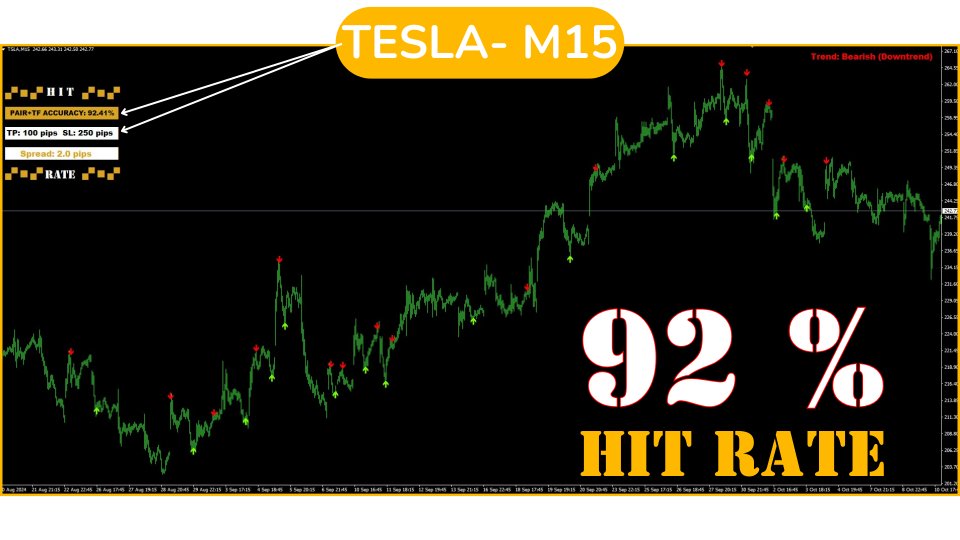

Open several pairs and load the indicator on each one of them. Now, analyze each pair to identify in which pairs and in which TF (timeframe) the signal performs best, and focus on those. (SEE IMAGES)

The signal has a default TP of 100 pips and an SL of 250 pips, but you can set the values you want to trade with or leave the default ones.

Keep in mind that a 250 pips SL is not the same in H1 as it is in M1, but don't worry: by manually updating the SL and TP parameters, the signal's hit rate percentage for those new parameters will be recalculated, allowing you to know the anticipated results with those parameters.

This way, you can adjust each pair's specific parameters to "optimize" the strategy on that pair and TF, and thus know the signal's hit rate in that context. This process is recommended to be done once a day, always before trading, to identify the pairs/TFs with the highest effectiveness at the current time. Default parameters work best in TFs such as M30 or H1, depending on the pair.

Step by Step:

- Choose a pair and check each TF. Verify in which one it has the highest hit rate percentage, for example, above 85-90% (if you are using the default TP and SL settings). Select that TF. To understand which ratio is optimal for your strategy if you do not use the default TP and SL, please read below "Ratios between SL/TP and the Hit Rate Percentage".

- Repeat the procedure with all pairs available; the more you have open, the greater the trading opportunities you will obtain.

- Now just wait for the signals and open trades as soon as a signal is issued, respecting the predefined SL and TP.

- If you wish to choose the TP and SL you want to trade with, you must first modify the data in the "Inputs" tab and set the values for each pair, always in pips. Then check each TF of that pair, choose the best-performing one, and stay attentive to the signals.

Trading from your phone freely:

This "Step by Step" process should be configured from the computer, but then you can receive trade notifications on your phone. How? Make sure to have your phone set to receive push messages on your MT4 terminal and allow notifications on your terminal from your phone.

When a signal is issued, you will receive on your phone: PAIR - TF - SIGNAL TYPE (BUY/SELL) - and the TP and SL values that were previously configured for that pair.

In this way, you won't need to be constantly in front of the computer since you can open trades from your phone, set the pair's SL and TP, and stop worrying about constant monitoring.

But of course, for those who prefer to trade from their computers, the sound and visual signal with the same data (PAIR - TF - SIGNAL TYPE and TP and SL values) will appear on your screen every time a signal is issued on a pair.

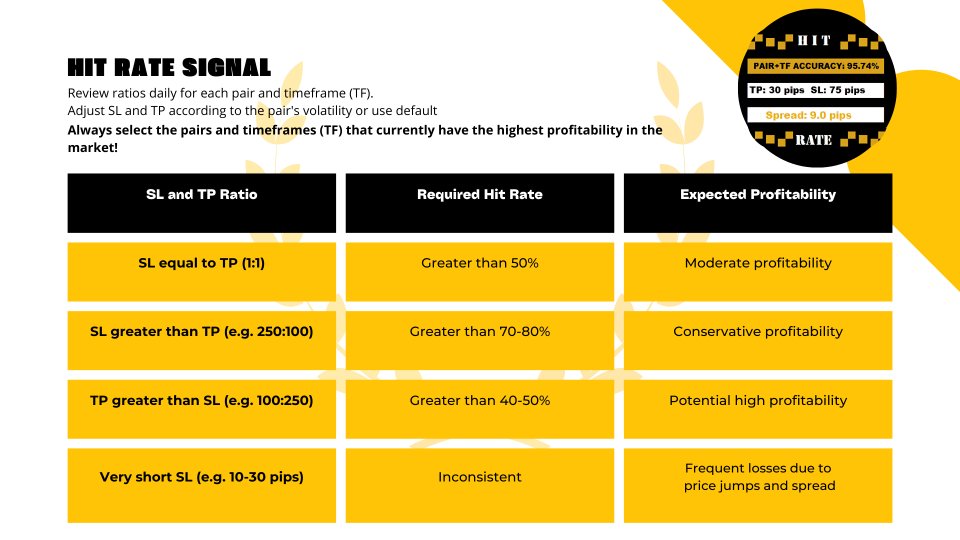

Understanding the Ratios between SL/TP and the Hit Rate Percentage

The success of a trading strategy depends on two key factors: on the one hand, the ratio between the Stop Loss (SL) and the Take Profit (TP), and on the other, the signal's hit rate percentage. Each one plays a fundamental role in the profitability of the strategy, and understanding how they work together is essential for optimizing the system.

1. SL/TP Ratio:

- SL/TP Ratio of 1:1: The TP size is equal to the SL (for example, SL: 100 pips and TP: 100 pips). In this case, the strategy needs a hit rate percentage higher than 50% to be profitable, as you would win and lose similar amounts.

- SL larger than TP: (for example, SL: 250 pips and TP: 100 pips), you need a much higher hit rate percentage to offset the losses when the SL is hit. In this case, a hit rate percentage above 70% or 80% is ideal.

- TP larger than SL: (for example, TP: 250 pips and SL: 100 pips), the strategy can be profitable even with a lower hit rate percentage, as each win would cover several losses. Here, a 40-50% hit rate would be sufficient to generate profits.

In all cases!! Always keep in mind that if an SL is very "tight", for example, 10-30 pips, it will likely be constantly triggered (take into account the Spread), resulting in constant losses in trades that would otherwise be winners. Be cautious and always give the price enough room to move (a generous SL).

2. Hit Rate Percentage:

- The hit rate percentage indicates how often the system correctly predicts. A system with a high hit rate percentage (e.g., 90%) is more reliable and allows for wider SL/TP ratios (SL larger than TP).

- However, a low hit rate percentage does not necessarily mean losses, as long as the TP is much greater than the SL. With a larger TP, even if you win infrequently, the gains will cover the losses.

THIS IS WHY KNOWING THE HIT RATE PERCENTAGE OF THE SIGNAL IN ADVANCE IS FUNDAMENTAL, SO THAT TOGETHER WITH GOOD CAPITAL MANAGEMENT (SL+TP), AN OPTIMAL RESULT IS ACHIEVED.

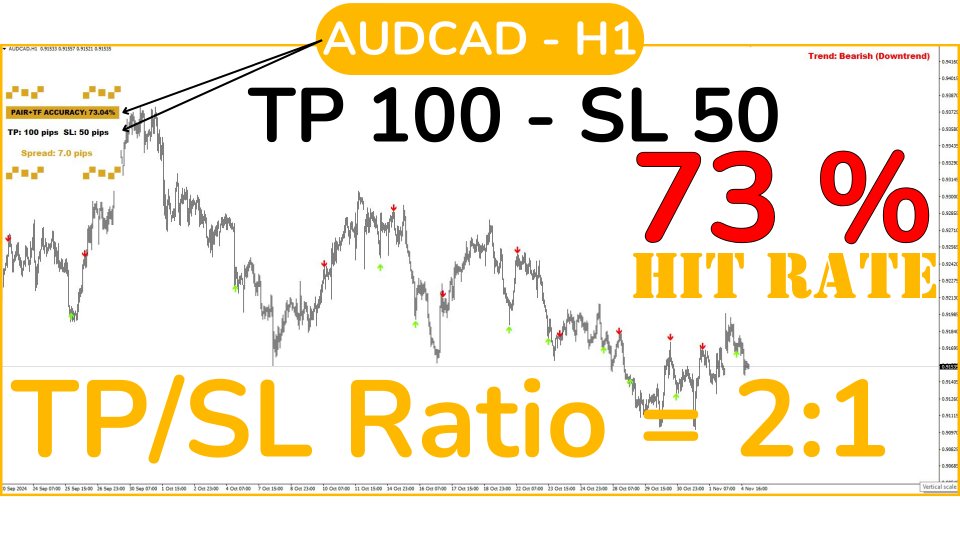

3. Optimization according to Pair and TF:

Each pair and timeframe can respond differently to the same SL/TP ratio, so it is important to adjust the SL and TP according to the pair's and TF's performance. For example, on volatile pairs or higher TFs, it might be advisable to use a wider TP.

Test different SL and TP settings on each pair and TF, and observe the hit rate percentage for each one. This will help you find the optimal balance to maximize profits and minimize losses.

Profitability Evaluation Example:

Imagine a strategy with an SL of 250 pips and a TP of 100 pips. For this configuration to be profitable, the hit rate percentage should be IDEALLY ABOVE 70%-80%, depending on the pair's specific volatility and behavior, so that gains cover losses incurred when the SL is reached.

However, if the ratio is inverted to an SL of 100 pips and a TP of 250 pips, a hit rate percentage of 40-50% could be enough, as each winning trade would offset multiple losses.

Summary:

- SL larger than TP: A high hit rate percentage is needed (ideally above 70%).

- TP larger than SL: It can work with a lower hit rate percentage, around 40-50%.

- Daily Optimization: Check daily that the chosen ratio holds in each pair and TF for optimal performance, and if you notice that a pair's performance drops, repeat the "step-by-step" process and rescan for the optimal configuration.

It's essential to understand that since this strategy can be used on all Forex pairs, Gold, Silver, Stocks, Indices, and even Crypto if your broker allows it, as well as on any TF, it's unnecessary to stick with pairs that: 1-Have too high a Spread 2-Do not have the ratio we are looking for, choose from the best!