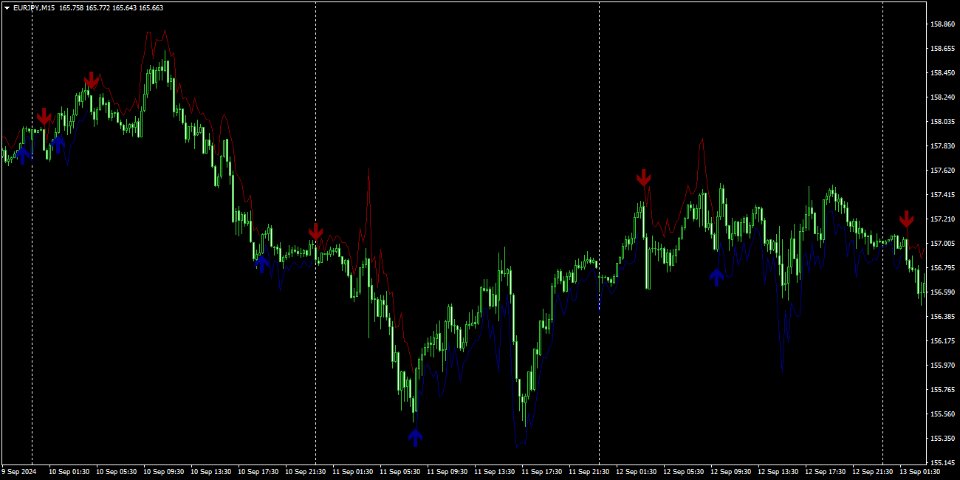

Volatility Breakout Indicator

- Indicators

- Vitalyi Belyh

- Version: 1.0

- Activations: 8

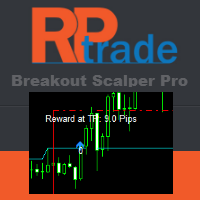

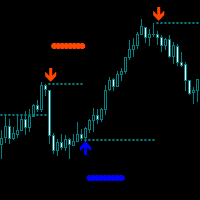

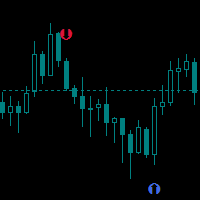

Volatility Breakout Indicator is a trend indicator that determines reversal points. The indicator's operating principle is based on finding the initial points of trend reversal,

since it is based on ATR volatility indicators, it does not wait for the price to reverse and travel some distance as in the case of line intersections. It determines a trend change by reversing indexed volatility by ATR.

Can be used on any financial instruments and timeframes.

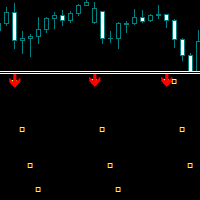

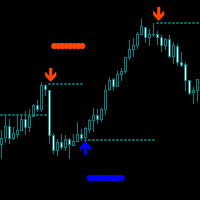

Arrows appear only after the candle closes and never change color.

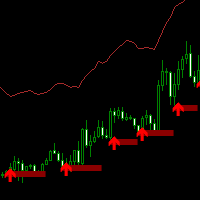

Can be used as a standalone indicator on one or two timeframes, to determine the trend on H1 - H4 timeframes and to open orders on M5 - M15.

Contains several types of alerts for arrows.

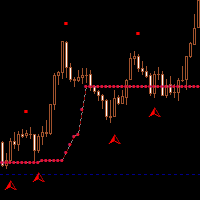

Blue arrows - up reversal, Red arrows - down reversal. You can enable the display of lines.

The indicator operation is regulated by 2 parameters that need to be changed to adapt to trading instruments and time frames:

since it is based on ATR volatility indicators, it does not wait for the price to reverse and travel some distance as in the case of line intersections. It determines a trend change by reversing indexed volatility by ATR.

Can be used on any financial instruments and timeframes.

Arrows appear only after the candle closes and never change color.

Can be used as a standalone indicator on one or two timeframes, to determine the trend on H1 - H4 timeframes and to open orders on M5 - M15.

Contains several types of alerts for arrows.

Blue arrows - up reversal, Red arrows - down reversal. You can enable the display of lines.

The indicator operation is regulated by 2 parameters that need to be changed to adapt to trading instruments and time frames:

- Volatility Index (0,8-2) - regulates the frequency of trend reversal (from maximum frequency to minimum)

- ATR period (1-100) - what ATR period to use in calculations (a longer period adds smoothing)