Stock Index Hedge EA

- Experts

- LEE SAMSON

- Version: 1.2

- Updated: 20 December 2023

- Activations: 10

Take advantage of the opening volatility of the major stock indexes and profit from the sudden moves created at those times when the market breaks away at the opening bell. The strategies' goal is to simply benefit from those days when the market moves fast and hard in one direction at the open and bank that move. If the market opens weak and directionless, the EA locks in a hedge loss and waits for the market to decide on a direction before exiting the positions. The stock index hedge EA analyses the range before the open and looks for an ideal tradeable distance to try and cash in as soon as the market opens with a fast move in either direction. This strategy works on any stock index like the DAX, DOW, NAS, S&P500 or FTSE. If the pre-market ranges are too large or small, it will skip the pre-market price action and attempt to take a break of the initial 5-minute opening range. This functionality helps to create ideal trading conditions at the open to avoid whipsaws where possible on ranges that are too tight or the possibility of not being able to achieve a target if ranges are too wide. Testing has determined that the ideal trading range is no less than 10% of ADR and no more than 20% of ADR to create the highest chance of a clean breakout and achievable target at the open.

MT5 Version is available here: https://www.mql5.com/en/market/product/106376/

Manual & Strategy Explanation here: https://www.mql5.com/en/blogs/post/754385/

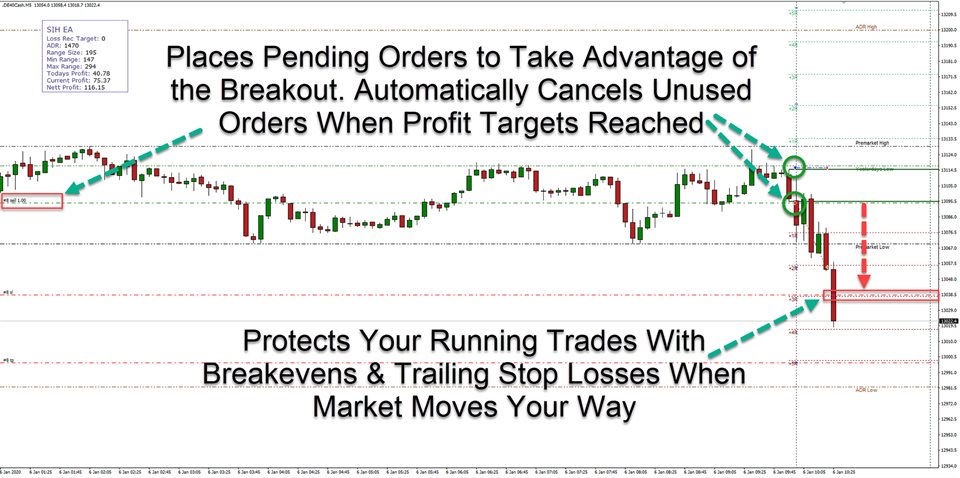

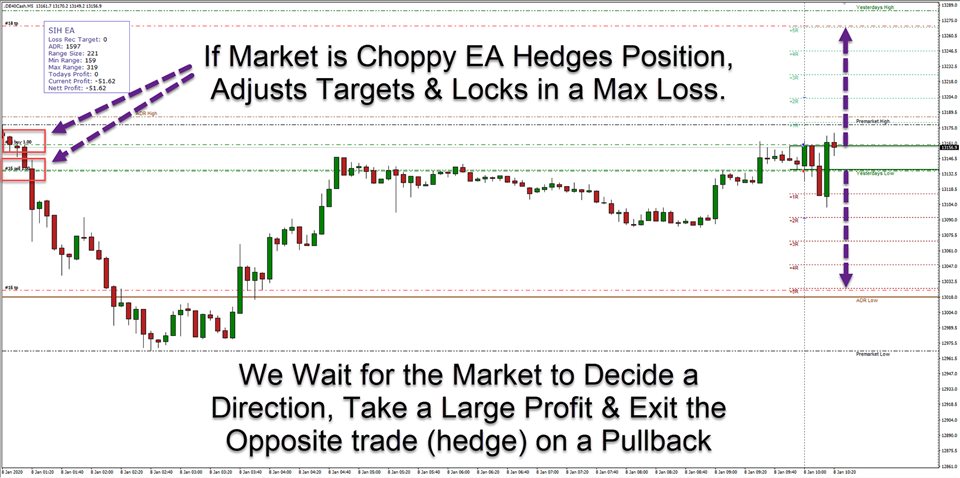

The EA takes 2 trades at the open and if successful, the EA takes profit on the first at a R:R ratio of your choosing and then protects the 2nd trade while attempting to get a runner to benefit from trend days. If the pre-market ranges are too small, it will repeat the process using the first 5-minute candle at the open and repeat the process of analysing that range to make sure it's not too large or small to trade. If the open is choppy and the market does not produce a clean break, the EA will hedge the position and attempt to exit later in the session when price decides on a direction by exiting one direction's trades and then waiting for a pullback to exit the incorrectly positioned trade with a small profit.

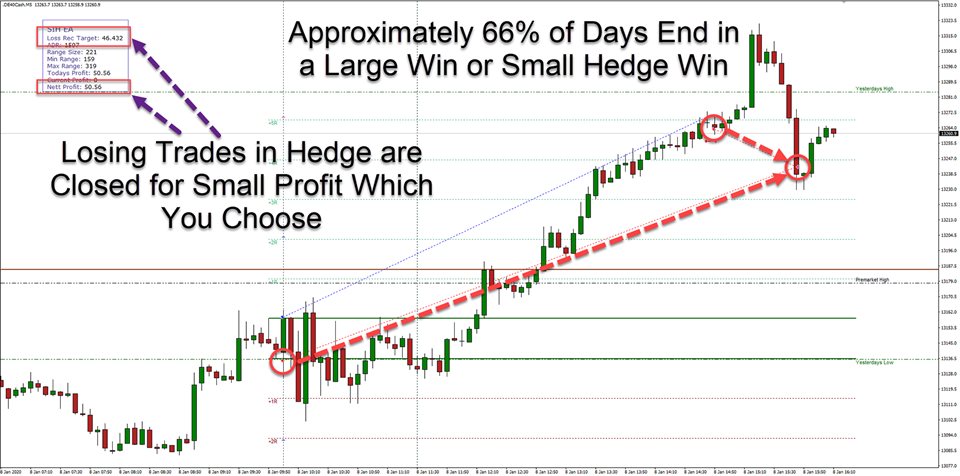

Hedging stops traders over-trading when they are wrong with trades and get stopped out, which is one of the biggest causes for traders failing. By hedging, you are buying time for the market to make up it's mind as to direction, which gives you a second chance to make a profit once the session's move is underway. This strategy ensures on clean break days (around 35% of the time) you just get in and out and are done for the session within around 15-20 minutes typically. On range bound days, you are forced to wait for the market to decide a direction before looking for a level to exit on a bounce, ensuring over-trading is kept to a minimum or eliminated completely.

The EA can be used on full auto and will attempt an exit on a large move to your 2nd TP target but identifying good levels of support and resistance intraday once the direction is established can make it even more successful for traders able to read price action and find good levels to exit. The market often bounces from daily levels or gets exhausted at the average daily range of the index being traded, so these levels are drawn on the chart automatically, so you can easily identify where price may be heading before bouncing.

NOTE: This strategy and EA is not suitable for brokers that force 1.00 or 0.10 lot increments. Ensure your broker allows you to trade 0.01 lot increments (the vast majority do).

FEATURES:

- Automatic calculation of pre-market range and initial opening range to find optimal range sizes to trade, preventing trades that are less likely to work out.

- Hedging positions to lock in fixes losses on rangebound days giving opportunity to exit on support and resistance bounces.

- Auto adjustment of targets and stops to lock in profit, minimise risk and let the market breathe.

- Define risks by percentage of account or fixed lots.

- Auto drawing of key intraday and daily levels for target adjustments manually as required.

- Information display panel to show current and closed profit for the instrument being traded.

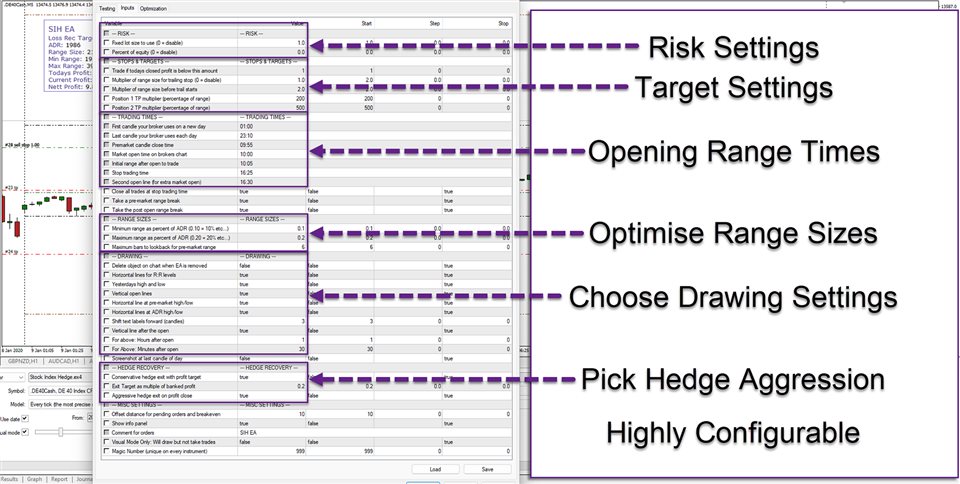

SETTINGS:

Risk - Choose from either a fixed lot size entry or percentage of your account balance based on the range being traded.

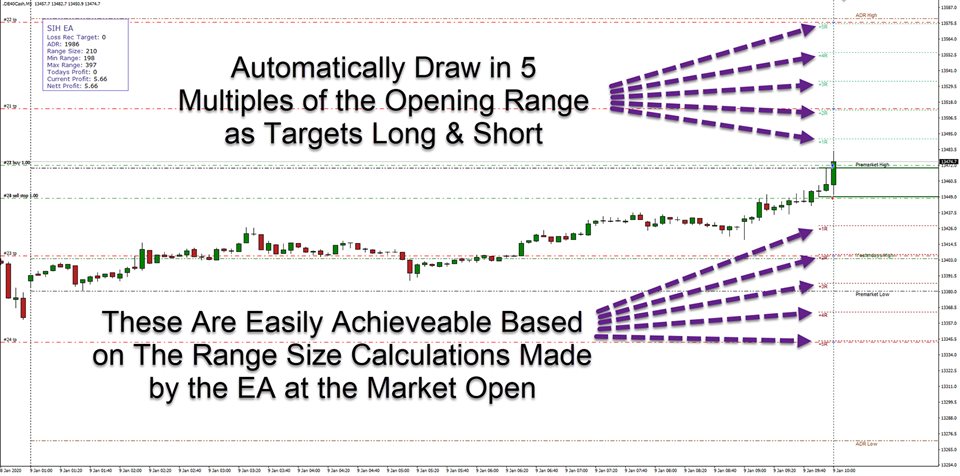

Targets - Choose 2 seperate targets which are R multiples of the range being traded. Once a quick profit at the open, the 2nd a runner for a larger profit if you catch a trend day.

Stops - Trailing stops trigger automatically and can be fine tuned as multiples of the risk being taken. Auto breakeven kicks in to protect your runner position automatically when the initial TP is hit.

Trading Times - Fully adjustable trading times so you can choose what ranges to trade on each instrument.

Auto Exit - The EA can automatically exit the position if it gets hedged at either the end of day or end of trading session at a time you choose. This will just take whatever loss is hedged in if it's not been able to exit. Locking in a maximum loss for the trading session/day, controlling your risk for you.

Range Sizing - Choose how large or small you want the ranges to be. This stops you taking trades when there is a particularly highly volatile pre-market move or open meaning you will struggle to hit a R:R ratio for that session.

Drawing - The EA will draw in key important levels automatically so you can use them to adjust targets if you choose. These include the highs and lows of the pre-market session, yesterdays high and low and the ADR (average daily range) high and low of the instrument. It will also draw in the open and a set time after the open of your choice, each can be enabled or disabled by you.

Screenshot - You can set the EA to automatically take a screenshot at the end of the day, great for analysis of your trades.

Hedge Recovery Options - Set the EA to either attempt a conservative exit where it gets out on a normal pullback if hedged or an aggressive exit where the EA will attempt to DCA (Dollar cost average) into a reversal to get you out faster but with slightly more risk.

Info Panel - Displays the key metrics of P&L and range sizing information on the chart for you so you can make decisions to close out your trades manually if you wish when you have an overall profit on multiple stock indexes if trading more than one at a time. Perfect for those trading the DOW, NAS & S&P during the NY session or the DAX and FTSE during the Frankfurt/London session.

Visual Only Mode - For those wanting to use the EA as an indicator only to draw in the levels and ranges at the open you can make the EA work as normal but without it taking any trades for you if you wish to trade manually.

This is a fantastic EA if you know how to trade!