Position Trader EA

- Experts

- LEE SAMSON

- Version: 2.10

- Updated: 25 February 2025

- Activations: 10

Turn any trading strategy into a position trading strategy or trade the proven RSI & ADR based position trading strategies, including automated drawdown control system for positions that move against you. This EA is an evolution and a simplification of the MRA EA that has been used for position trading strategies taught on the Market Structure Trader website for many years. See my profile for a link to the website, free position trading course and other products.

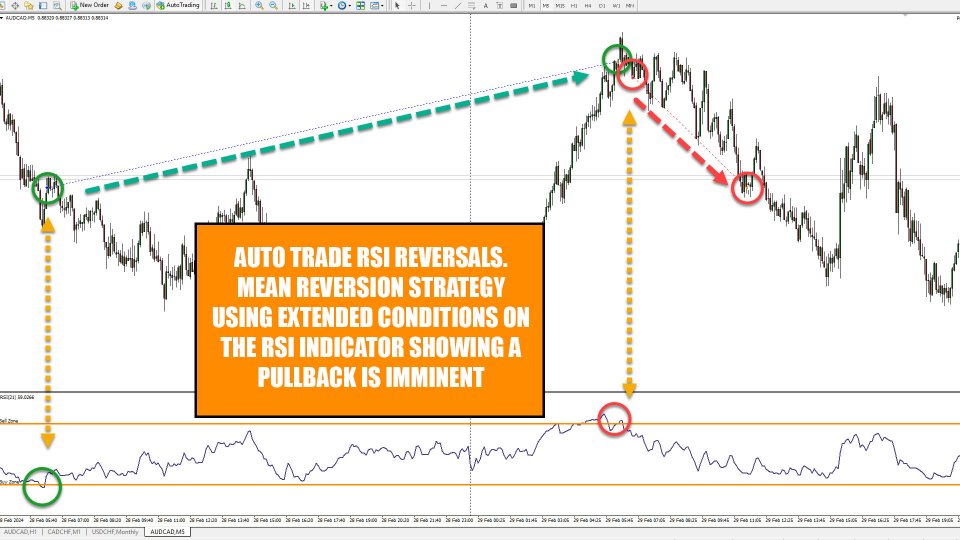

The EA will automatically scale into market structure moves using "elastic band theory" and mean revert moves taken by the banks and institutions using either the RSI indicator or extensions of the average daily range (ADR) of any forex instrument you want to trade. Position trading is a method of entering the market using small risk and multiple entries, meaning the accuracy of the initial trade entry is less important than the way the trade is managed by the EA after entry. Markets are unpredictable and virtually impossible to time movements in with any kind of accuracy that is sustainable long term, this is why the majority of trading strategies and traders fail. You can also convert virtually any strategy you currently trade or have traded in the past into a position trading strategy by simply taking an initial market entry using the quick trading buttons on the EA. Once this initial trade is taken, the EA will then either auto close the trade when at a designated profit level or turn the trade into a position trade by scaling in on the next leg of the market structure move for you.

The inputs for the EA and full manual are here: https://www.mql5.com/en/blogs/post/756484

MT5 Version Available Here: https://www.mql5.com/en/market/product/115359/

What's New in Version 2.0!

- Added average price line option so you can see the average of positions plotted on the chart to aid with targeting.

Main Functionality:

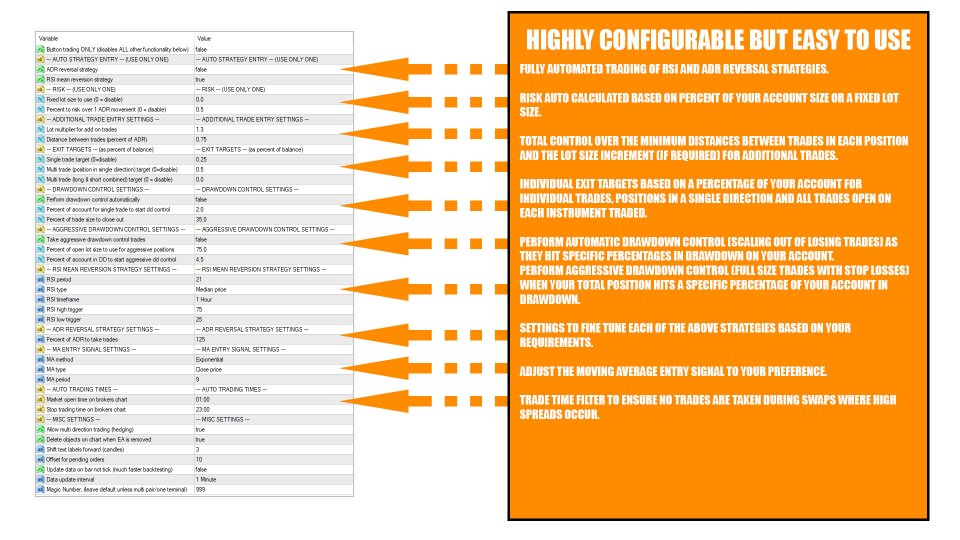

- Fully automated trading of RSI based mean reversion strategy.

- Fully automated trading of ADR based mean reversion strategy.

- Settings to fine tune each of the above strategies based on your requirements.

- Simple, configurable entry condition using any moving average to trigger trades when strength is detected in the direction the strategy will trade.

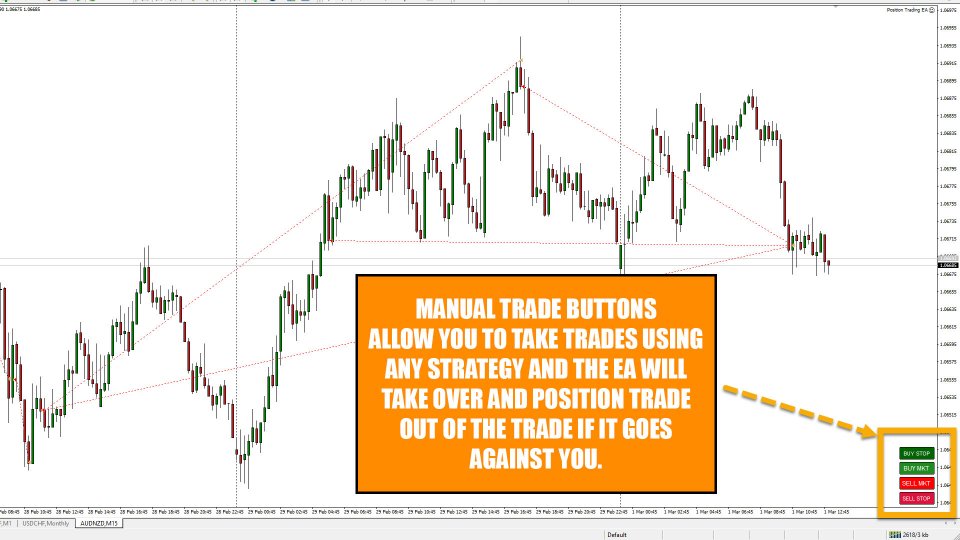

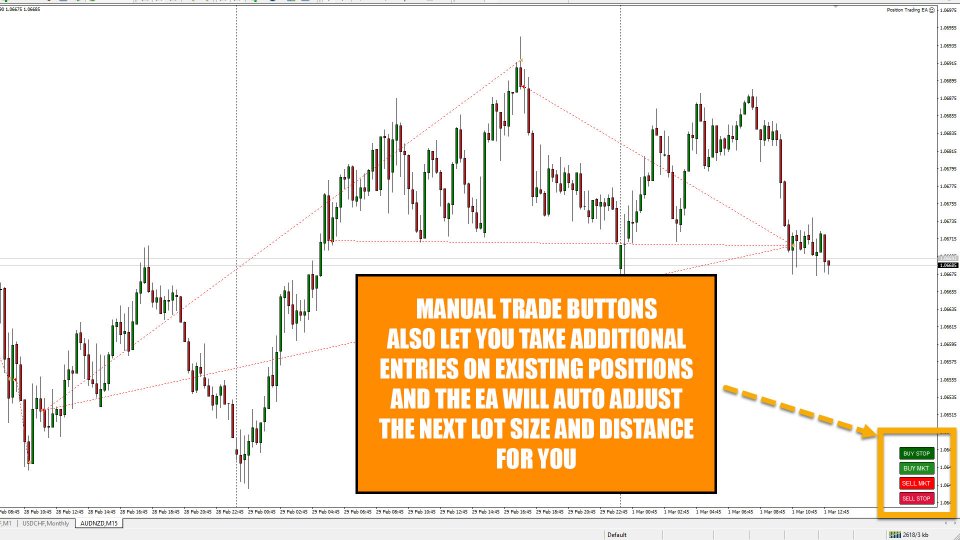

- Manual trade buttons to take initial entries or place manual additional trades in any existing position as well as close out trades.

(Use these to trade any strategy and let the EA automatically turn trades that don't work into position trades).

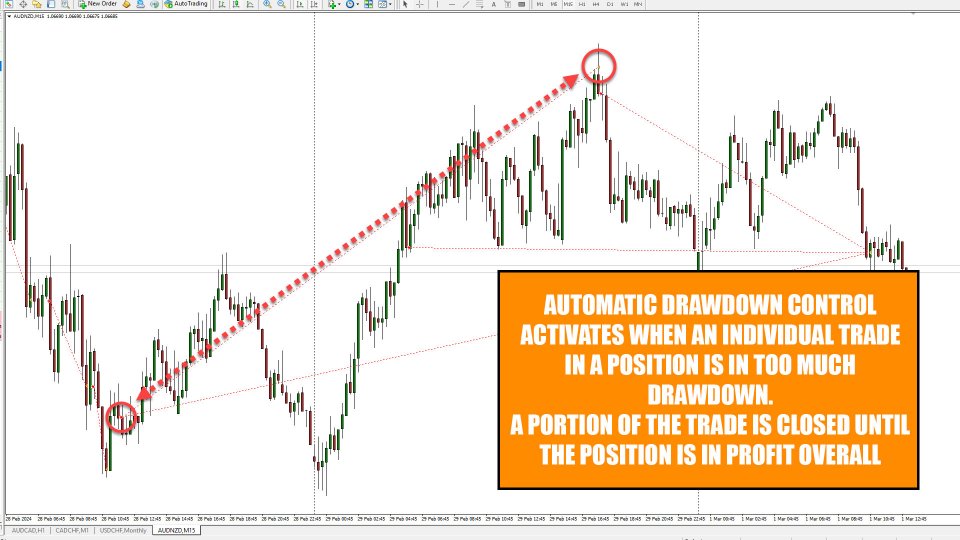

v1.2 - Buttons now work in the strategy tester too! - Perform automatic drawdown control (scaling out of losing trades) as they hit specific percentages in drawdown on your account.

- Perform aggressive drawdown control (full size trades with stop losses) when your total position hits a specific percentage of your account in drawdown.

- Total control over the minimum distances between trades in each position and the lot size increment (if required) for additional trades.

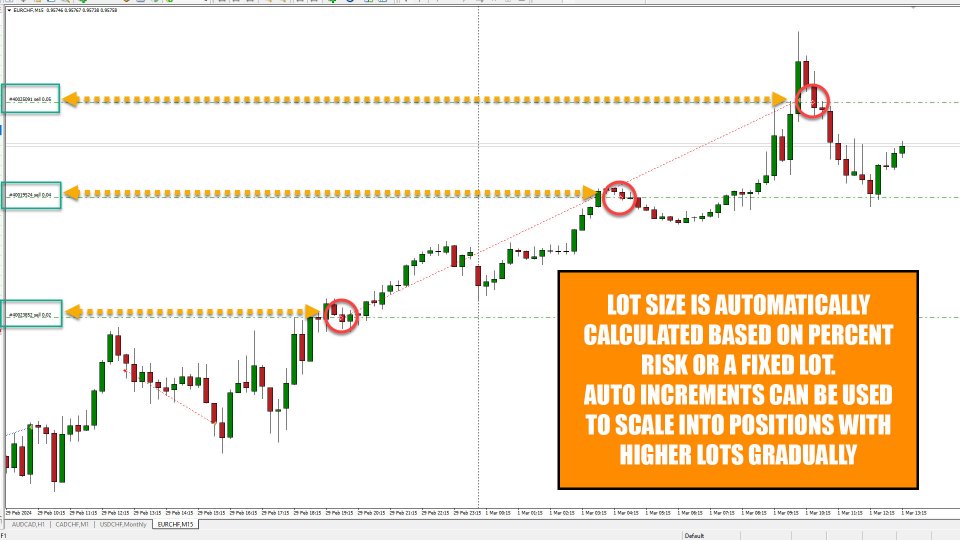

- Risk auto calculated based on percent of your account size or a fixed lot size.

- Individual exit targets based on a percentage of your account for individual trades, positions in a single direction and all trades open on each instrument traded.

- Trade time filter to ensure no trades are taken during swaps where high spreads occur.

- Can trade on any timeframe using the RSI mean reversion strategy (M5 timeframe recommended for ADR strategy)

EA Functionality & Logic:

The EA monitors the market for extended conditions on RSI or ADR depending on the strategy you are trading and will then, once the conditions for a trade are met, monitor the timeframe it is running on for an entry into the market. The entries are all taken using a moving average on the timeframe the EA is running on. e.g. if you run the EA on the M5 timeframe it will take a trade when the price closes above or below the MA you set in the inputs on that timeframe. The moving average entry logic is that price needs to open above the moving average and close below it to take a short entry and the opposite for longs. The EA monitors the last candle closed. When a trade is placed the EA will then auto calculate a level above shorts or below longs based on average daily range and get ready to add additional trades if price exceeds this level. The lot size of the next trade is also auto calculated by the EA, this level and the lot size are determined by the inputs you select. The EA automatically monitors the current profit and drawdown of each trade and the total position (all trades in the same direction) and will automatically close either complete trades or partial size based on the inputs for drawdown control and profit targets.

Recommended Setup For The EA:

The strategies for the EA was developed on forex markets as they have a very rhythmic movement and market structure is often clearly defined so you should be able to run the EA on any forex pair but any other instrument will also work so test! As with all EAs it is advisable to have the EA running on a machine that is left on 24/7 so the EA can work constantly and monitor the market for you. It is recommended to run the EA on the M5 timeframe for the ADR strategy and if you are trading using RSI it is advisable to also use M5 or M15, assuming you are monitoring RSI levels on the H1 and H4 timeframes. The EA enters the market using a moving average as the entry signal and that is on the timeframe it is running on. Bear in mind if you set the EA to manual mode where it uses the trading buttons only, it will still manage any entries you take with the buttons on the version of the EA running on your VPS/trading PC. Run each strategy you trade on a seperate terminal and seperate trading account so the EA doesn't not get confused with multiple entries using multiple strategies on the same account/terminal. This is best practice for all trading.

My setup: I have multiple terminals running on my own VPS, each terminal is logged into a different trading account and each account is only running one strategy. This way I know exactly what is and is not working at any time. Each terminal has every chart I want to trade opne (all FX pairs in my case) and the EA is set on each chart on the M5 timeframe and will auto enter for me based on RSI or ADR depending on which acocunt it is.

On my trading PC that I use for analysis in my office I also have the EA running on a chart but set to "button trading only" mode. This means I can manually add trades into a position and then the EA running on that chart on my VPS will take over, adjust the next entry level and lot size for me.

Recommended Pairs:

The EA is predominently designed to trade the FX markets but the concept of position trading will work on most instruments that have regular predicatable movement. To limit exposure it's advisable to only trade a limited amount of currency pairs so you do not get over exposed to any one currency too many times as this would harm your account during a squeeze on that currency.

As a guide a good range or forex pairs to trade would be AUDCAD, AUDNZD, EURGBP, EURNZD, GBPUSD, NZDCHF, USDCAD, USDCHF. JPY pairs trend hard at times making position trading more difficult but you can trade this pair but be ready to do drawdown control should a squeeze occur! CHF pairs are also tricky at times as this currency is used as a safe haven so if you want to be super safe you can also avoid pairs crossed with that. Other crosses which perform well and you could incorporate would include AUDCHF, CADCHF, EURAUD, EURCAD, EUFCHF, GBPNZD, NZDCAD and NZDUSD.

Excellent EA. Lee's support is great as always, and he's using the same tools every day on the livestreams.