You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.04.19 08:11

Technical Intra-Day Targets for EUR/USD by United Overseas Bank (based on the article)

EUR/USD: ranging within 1.1233 and 1.1331

H4 price is located near and below 100 period SMA (100 SMA) and above 200 period SMA (200 SMA) for the ranging market condition: the price is testing 1.1331 level to above for the bullish reversal, alternative - if the price breaks 1.1233 support level to below so the bearish reversal will be started.

Anyway, UOB is still looking for the bearish trend for this pair in intra-day basis, for example:

"There is no change to our bearish view but as highlighted previously, downward momentum is not very strong and the downside potential is likely limited to 1.1145. Stop-loss remains unchanged at 1.1395 but 1.1350 is already a strong short-term resistance."

RSI indicator is estimating the ranging bullish trend to be continuing.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.04.19 10:24

EUR/USD Intra-Day Fundamentals: ECB Current Account and 12 pips range price movement

2016-04-19 08:00 GMT | [EUR - Current Account]

if actual > forecast (or previous one) = good for currency (for EUR in our case)

[EUR - Current Account] = Difference in value between imported and exported goods, services, income flows, and unilateral transfers during the previous month.

==========

EUR/USD M5: 12 pips range price movement by ECB Current Account news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.04.19 14:54

EUR/USD Intra-Day Fundamentals: U.S. Building Permits and 16 pips price movement

2016-04-19 12:30 GMT | [USD - Building Permits]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Building Permits] = Annualized number of new residential building permits issued during the previous month.

==========

EUR/USD M5: 16 pips price movement by U.S. Building Permits news event :

Ahead of ECB Interest Rates: EUR/USD Intra-Day Technical Analysis

H4 price is located between 100 period SMA and 200 period SMA in the ranging market condition waiting for direction: the price is ranging within the following key erversal support/resistance level:

RSI indicator is estimating the bearish reversal trend to be started in the near future.

SUMMARY : ranging

TREND : waiting for directionForum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.04.21 14:00

EUR/USD Intra-Day Fundamentals: ECB Minimum Bid Rate and 23 pips price movement

2016-04-21 11:45 GMT | [EUR - Minimum Bid Rate]

if actual > forecast (or previous one) = good for currency (for EUR in our case)

[EUR - Minimum Bid Rate] = Interest rate on the main refinancing operations that provide the bulk of liquidity to the banking system.

==========

"At today’s meeting the Governing Council of the ECB decided that the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.40% respectively."

==========

EUR/USD M5: 23 pips price movement by ECB Minimum Bid Rate news event :

Ahead of ECB Interest Rates: EUR/USD Intra-Day Technical Analysis

H4 price is located between 100 period SMA and 200 period SMA in the ranging market condition waiting for direction: the price is ranging within the following key erversal support/resistance level:

RSI indicator is estimating the bearish reversal trend to be started in the near future.

SUMMARY : ranging

TREND : waiting for directionThe price (H4 timeframe) is testing 1.1387 resistance on open bar for now. If this level will be broken to above by close H4 price (if new H4 candle will be opened above 1.1387 level) so the bullish trend will be continuing, otherwise - ranging within-and-around 100/200 SMA ranging reversal area for waiting for direction of the trend.

By the way, 1.1387 resistance level is not only resistance for the price on the way to the bullish trend to be started and continued - there are few more resistance levels above 1.1387 and some of them are very strong one:

Seems we need few more high impacted news event in the near future for those strong resistance levels to be broken by the price for real uptrend for example :)

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.04.22 17:42

EUR/USD Intra-Day Fundamentals: Markit U.S. Manufacturing PMI and 24 pips price movement

2016-04-22 13:45 GMT | [USD - Manufacturing PMI]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry.

==========

"At 50.8 in April, down from 51.5 in March, the seasonally adjusted Markit Flash U.S. Manufacturing Purchasing Managers’ Index™ (PMI™) signalled the weakest upturnin overall business conditions since September 2009. The flash PMI index, which is based on approximately 85% of usual monthly survey replies, was only marginally above the crucial 50.0 no-change threshold."

==========

EUR/USD M5: 24 pips price movement by Markit U.S. Manufacturing PMI news event :

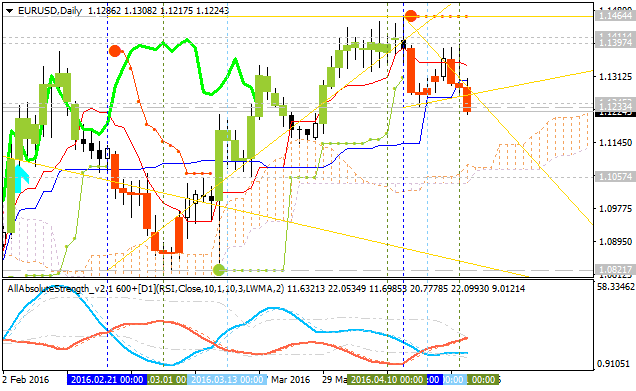

EURUSD Technical Analysis 2016, 24.04 - 01.05: secondary correction to the bearish reversal breakdown

Daily price is on bullish market condition located to be above Ichimoku cloud: the price is breaking 1.1233 support level for the secondary correction to be started with crossing the symmetric triangle pattern to below with Chinkou Span line to be breaking the price for the good possible breakdown. There are the following key support/resistance levels for the price:

Chinkou Span line is crossing the price to below on open daily bar for the possible breakdown, and Absolute Strange indicator is evaluating the price movement as the secondary correction.

If D1 price will break 1.1233 support level on close bar so the secondary correction within the primary bullish will be started.

If D1 price will break 1.1057 support level on close bar from above to below so we may see the reversal of the price movement from the ranging bullish to the primary bearish market condition.

If D1 price will break 1.1464 resistance level on close bar so the primary bullish trend will be continuing.

If not so the price will be on ranging within the levels.

SUMMARY : primary bullish

TREND : secondary correctionForum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.04.25 10:10

EUR/USD Intra-Day Fundamentals: German Ifo Business Climate and 11 pips range price movement

2016-04-25 08:00 GMT | [EUR - German Ifo Business Climate]

if actual > forecast (or previous one) = good for currency (for EUR in our case)

[EUR - German Ifo Business Climate] = Level of a composite index based on surveyed manufacturers, builders, wholesalers, and retailers.

==========

EUR/USD M5: 11 pips range price movement by German Ifo Business Climate news event :