You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

EURUSD Technical Analysis 2016, 24.04 - 01.05: secondary correction to the bearish reversal breakdown

...If D1 price will break 1.1233 support level on close bar so the secondary correction within the primary bullish will be started.

If D1 price will break 1.1057 support level on close bar from above to below so we may see the reversal of the price movement from the ranging bullish to the primary bearish market condition.

If D1 price will break 1.1464 resistance level on close bar so the primary bullish trend will be continuing.

If not so the price will be on ranging within the levels.

New daily bar was opened below 1.1233 and the price is testing 1.1217 support level for now for the secondary correction to be continuing. Chinkou Span line broke the price to below on cl;ose daily bar for good possible breakdown with the correction to be continuing but in fully ranging way. Thus, we may see the ranging correctional trend for this pair for a week for example (good for martingale systems, for scalping, for counter-trend systems and similar, and not good for any trend following systems for example).

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.04.26 12:09

Technical Targets for EUR/USD by United Overseas Bank (based on the article)

EUR/USD: ranging, or bearish reversal by 1.1143 level to be broken

H4 price is located below 100 period SMA (100 SMA) with near and above 200 period SMA (200 SMA) for the ranging market condition waiting for direction within the following key reversal support/resistance levels:

If the price breaks 1.1397 level to below so we may see the bullish trend on intra-day chart, and if the price breaks 1.1217 level to below so the bearish trend will be continuing.

Daily price is located above 100/200 SMA for the bullosh market condition with the ranging within 1.1464 bullish Fibo resistance level and 50.0% Fibo support level at 1.1143. If the price breaks 1.1143 to below so the veresal of the price movement to the primary bearish market condition will be started.

Anyway, United Overseas Bank is considering the EUR/USD intra-day price to be in bearish condition, and the daily price to be turned to the bearish condition as well by breaking 1.1143 level (1.1145 by UOB) to below. But UOB estimated this level as the very strong one so the ranging market condition for this pair is having good probability in the future as well.

"The downward momentum is not as impulsive as we would like. Furthermore, the target of 1.1145 is a strong support and EUR would likely struggle to move clearly below this level. Those who are short should look to take partial profit at 1.1145."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.04.26 14:50

EUR/USD Intra-Day Fundamentals: U.S. Durable Goods Orders and 36 pips price movement

2016-04-26 12:30 GMT | [USD - Durable Goods Orders]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Durable Goods Orders] = Change in the total value of new purchase orders placed with manufacturers for durable goods.

==========

EUR/USD M5: 36 pips price movement by U.S. Durable Goods Orders news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.04.27 16:18

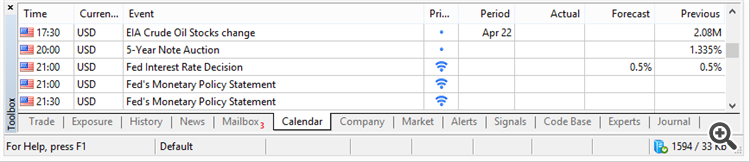

Trading the News: Federal Funds Rate (based on the article)

What’s Expected:

Why Is This Event Important:

Even though Fed Chair Janet Yellen remains largely concerned about the ‘external risks’ surrounding the region, a growing number of Fed officials may look to further normalize monetary policy in the first-half of 2016 especially as the U.S. economy approaches ‘full-employment.’

However, easing confidence along with the slowdown in household spending may dampen Fed expectations for a ‘consumer-led’ recovery, and more of the same from the central bank may drag on the dollar as market participants push out bets for the next Fed rate-hike.

How To Trade This Event Risk

Bullish USD Trade: Policy Statement Highlights Growing Dissent Within FOMC

- Need red, five-minute candle following the rate decision to consider a short EUR/USD position.

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from cost; at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is met, set reasonable limit.

Bearish USD Trade: Fed Votes 9-1 Once Again to Retain Current Policy- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same strategy as the bullish dollar trade, just in the opposite direction.

Potential Price Targets For The ReleaseEURUSD Daily

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.04.27 20:51

EUR/USD Intra-Day Fundamentals: Federal Funds Rate and 89 pips price movement

2016-04-27 18:00 GMT | [USD - Federal Funds Rate]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Federal Funds Rate] = Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight.

==========

"Against this backdrop, the Committee decided to maintain the target range for the federal funds rate at 1/4 to 1/2 percent. The stance of monetary policy remains accommodative, thereby supporting further improvement in labor market conditions and a return to 2 percent inflation."

==========

EUR/USD M5: 89 pips price movement by Federal Funds Rate news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.04.28 10:56

Trading News Events : U.S. Gross Domestic Product (GDP) (based on the article)What’s Expected:

Why Is This Event Important:

A soft growth figure may encourage the Federal Reserve to retain its current policy throughout most of 2016 amid the ongoing 9 to 1 split within the central bank, but a marked rebound in the core Personal Consumption Expenditure (PCE), the Fed’s preferred gauge for inflation, may put increased pressure on Chair Janet Yellen and Co. to further normalize monetary policy over the coming months especially as the U.S. economy approaches ‘full-employment.’

Nevertheless, the pickup in housing accompanied by ongoing improvement in labor-market dynamics may help to boost economic activity, and a positive development may generate a bullish reaction in the U.S. dollar as it puts increased pressure on the Federal Reserve to further normalize monetary policy sooner rather than later.

How To Trade This Event Risk

Bearish USD Trade: 1Q GDP Report Warns of Slowing Recovery

- Need to see green, five-minute candle following the GDP report to consider a long trade on EURUSD.

- If market reaction favors a bearish dollar trade, buy EURUSD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bullish USD Trade: U.S. Expands Annualized 0.6% or Greater, Core PCE Rebounds- Need red, five-minute candle to favor a short EURUSD trade.

- Implement same setup as the bearish dollar trade, just in the opposite direction.

Potential Price Targets For The ReleaseEURUSD Daily

EURUSD Technical Analysis - bullish reversal breakout with 1.1367 target for the intra-day bullish trend to be continuing

H4 price is on breakout - the price broke Ichimoku cloud to above for the reversal from the primary bearish to the primary bullish market condition to be stopped near 1.1367 resistance level. Chinkou Span line broke the price to above for the bullish breakout to be continuing, Trend Strength indicator is estimating the bullish trend, and Absolute Strength indicator is estimating the ranging bullish market conditipon to be started in the near future.

If H4 price will break 1.1367 resistance level on close bar so the bullish trend will be continuing up to 1.1398 level as the nearest bullish target.

If not so the price will be ranging within the levels.

- Recommendation for long: watch close H4 price to break 1.1367 for possible buy trade

- Recommendation to go short: watch H4 price to break 1.1271 support level for possible sell trade

- Trading Summary: bullish

SUMMARY : bullishTREND : breakout

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.04.28 14:45

EUR/USD Intra-Day Fundamentals: U.S. Gross Domestic Product and 19 pips range price movement

2016-04-28 12:30 GMT | [USD - GDP]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - GDP] = Annualized change in the inflation-adjusted value of all goods and services produced by the economy.

==========

"Real gross domestic product -- the value of the goods and services produced by the nation’s economy less the value of the goods and services used up in production, adjusted for price changes -- increased at an annual rate of 0.5 percent in the first quarter of 2016, according to the "advance" estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 1.4 percent."

==========

EUR/USD M5: 19 pips range price movement by U.S. Gross Domestic Product news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.04.29 10:25

EUR/USD Intra-Day Fundamentals: Spanish GDP and 27 pips range price movement

2016-04-29 07:00 GMT | [EUR - Spanish GDP]

if actual > forecast (or previous one) = good for currency (for EUR in our case)

[EUR - Spanish GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

==========

EUR/USD M5: 27 pips range price movement by Spanish GDP news event :