Learn how to create an Expert Advisor based on the Break of Structure (BoS) forex trading strategy - a Smart Money Concept (SMC) approach. Hope you will find it enjoyable, clear, easy to understand and knowledgeable. Welcome.

Really,great thanks a lot ,useful code

Thank you for the provided code base, it is actually very good.

With minimal changes I have adapted/changed.

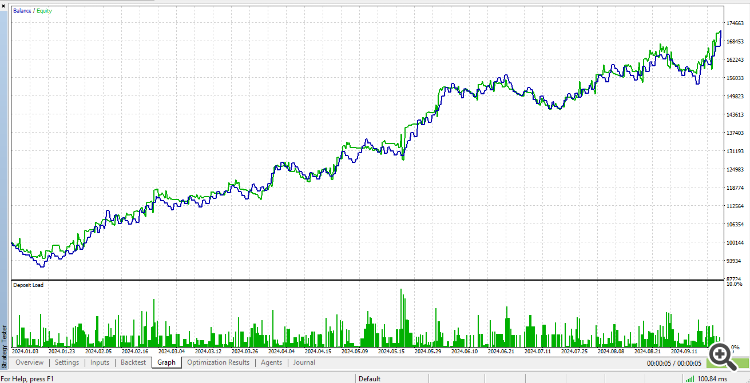

The initial result without any filter added are really impressive.

I read it diagonally.

in the code, it caught my eye:

void function() {

const int localConst = 5; //

// some code follows

}

you can't do that. This is a disguise for "magic" constants

Author, I don't understand you. Your screenshot, which shows the upward trend, has HH and HL levels. But the screenshot that comes next creates confusion. Look:

So how to choose the right level to break?

Author, I don't understand you. Your screenshot, which shows the upward trend, has HH and HL levels. But the screenshot that comes next creates confusion. Look:

So how to choose the right level to break?

All such strategies work (and that is not a fact) only on days.

They do NOT work inside the day with its regular and sharp volatility spikes.

But it is convenient to select screenshots on intraday.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Check out the new article: A Step-by-Step Guide on Trading the Break of Structure (BoS) Strategy.

A comprehensive guide to developing an automated trading algorithm based on the Break of Structure (BoS) strategy. Detailed information on all aspects of creating an advisor in MQL5 and testing it in MetaTrader 5 — from analyzing price support and resistance to risk management.

We are going to explore the definition, types, trading strategy applications, and development in MetaQuotes Language 5 (MQL5) for MetaTrader 5 (MT5) as we delve into the nuances of the Break of Structure. The Break of Structure notion is a useful tool for traders to learn in order to increase their ability to predict market moves, make better decisions, and eventually become proficient in risk management. Using the following subjects, we shall accomplish the above:

Author: Allan Munene Mutiiria