You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Check out the new article: Experiments with neural networks (Part 7): Passing indicators.

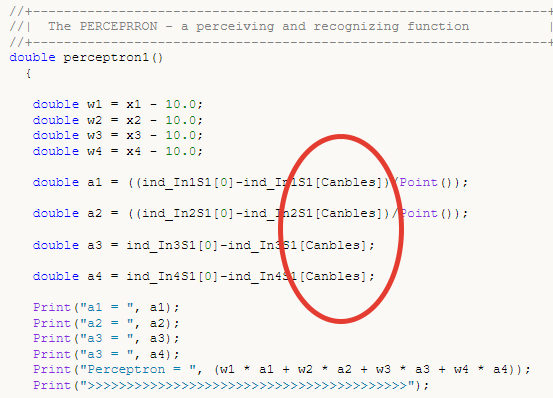

Examples of passing indicators to a perceptron. The article describes general concepts and showcases the simplest ready-made Expert Advisor followed by the results of its optimization and forward test.

Reading a large number of articles on this topic, I constantly observe a sad picture of the direct results of trading systems based on neural networks. Many good ideas and algorithms do not bring the desired results.

The same picture is always observed while passing input parameters. For example, direct passing of the oscillator values, which, in my opinion, has nothing in common with the price of an asset. Oscillators have a well-known problem - the so-called divergence. These are the values of Open, Close, High and Low prices that, when passed directly, do not carry any meaning, but bring into the system incomprehensible noise. These values are not tied to anything and have a significant spread over time. As an example, open the daily chart of any currency pair and look at the range of Close price fluctuations.Author: Roman Poshtar