In very simplistic terms,

- Reward = Take Profit (absolute size) = | 1.09277 - 1.09539 | = 262 points

- Risk = Stop Loss (absolute size) = | 1.09647 - 1.09539 | = 108 points

Risk : Reward = 108 : 262 ≈ 1 : 2.426

In very simplistic terms,

- Reward = Take Profit (absolute size) = | 1.09277 - 1.09539 | = 262 points

- Risk = Stop Loss (absolute size) = | 1.09647 - 1.09539 | = 108 points

Risk : Reward = 108 : 262 ≈ 1 : 2.426

The other way round. The correct order is to divide the potential profit or reward of an investment or transaction by the potential loss or risk.

262 : 108 ≈ 2.4 : 1

108 : 262 ≈ 0.4 : 1

You can delete this comment after the correction. ;-)

No!

The question is Risk to Reward ratio, not Reward to Risk ratio!

The answer is correct — the Risk to Reward ratio is 1 to 2.426

No!

The question is Risk to Reward ratio, not Reward to Risk ratio!

The answer is correct — the Risk to Reward ratio is 1 to 2.426

In any case 108 : 262 = 0.412 not 2.426

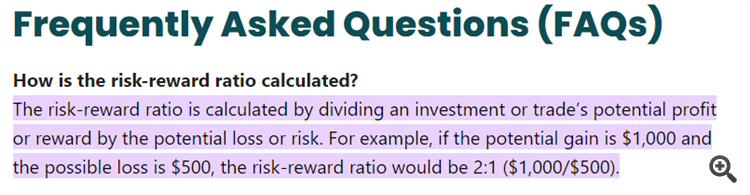

The truth is that there are many examples on the internet that calculate it both ways.

262 : 108 ≈ 2.4 : 1 (Reward to Risk ratio) You earn $2.4 for every $1 you lose.

108 : 262 ≈ 0.4 : 1 (Risk to Reward ratio) You lose $0.4 for every $1 you earn.

According to this calculation: Risk : Reward = 108 : 262 ≈ 1 : 2.426 for every $1 lost you would be earning $2.4. The calculation is correct, but not mathematically, because 108 divided by 262 is 0.412.That "FAQ" is is mixing the two up. This is basic language and maths. The ratio is expressed in the way you read it:

- Risk/Reward Ratio: What It Is, How Stock Investors Use It

- What is the Risk-Reward Ratio? Definition from TechTarget

- What Is the Risk/Reward Ratio? (TheBalanceMoney)

- What is the Risk-Reward Ratio? (WallStreetMojo)

- What Is the Risk/reward (RR) ratio? How to use it in crypto trading? | BOTS

- Risk:Reward Ratio And Probability | XTB's Trading Academy

That "FAQ" is is mixing the two up. This is basic language and maths. The ratio is expressed in the way you read it:

- Relación riesgo/recompensa: qué es, cómo la usan los inversores en acciones

- ¿Qué es la Relación Riesgo-Recompensa? Definición de TechTarget

- ¿Qué es la relación riesgo/recompensa? (El dinero del saldo)

- ¿Qué es la Relación Riesgo-Recompensa? (WallStreetMojo)

- ¿Qué es la relación riesgo/recompensa (RR)? ¿Cómo usarlo en el comercio de criptomonedas? | BOTS

- Relación riesgo:recompensa y probabilidad | Academia de comercio de XTB

What I'm getting at is that mathematically dividing 108 by 262 does not yield 2.426.

The OP will never understand that division.

262 : 108 ≈ 2.4 : 1 (Reward to Risk ratio) You earn $2.4 for every $1 you lose.

108 : 262 ≈ 0.4 : 1 (Risk to Reward ratio) You lose $0.4 for every $1 you earn.

From a link you posted.

108 : 262 ≈ 0.4 : 1 (Risk to Reward ratio) You lose $0.4 for every $1 you earn.

Risk : Reward = 108 : 262 ≈ 1 : 2.426 ?? 2.426 ??

I understand your point...for every $1 you lose you gain $2.4. But the division is not mathematically correct.

108 / 262 does not give 2.4 as a result.

Risk : Reward = 108 : 262 ≈ 1 : 2.426 ≈ 0.412 : 1

In maths it is more common to express a ratio or a fraction, "1 : a" or "a : 1" where "a > 1". It is not common to express it where "a < 1".

So the normalised way to express it is — Risk : Reward ≈ 1 : 2.426

Risk : Reward = 108 : 262 ≈ 1 : 2.426 ≈ 0.412 : 1

In maths it is more common to express a ratio or a fraction, "1 : a" or "a : 1" where "a > 1". It is not common to express it where "a < 1".

So the normalised way to express it is — Risk : Reward ≈ 1 : 2.426

If an OP asks how to calculate it do you really think that if you tell him 108 divided by 262 and he does that calculation on a calculator, the calculator will give him 2,426?

Let's explain things so that others can understand us. The ratio or faction, everyone puts it where they want. MQ and many brokers say leverage 500:1 and others say 1:500.

I insist, the OP does not understand fractions and what is correct or not in the world of mathematics, he is only asking how it is calculated, and if he asks for the risk/reward and makes the division the result is 0.4 loss for every 1 gained.

I for one would delete all this talk.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hello Community,

I have been trying to beter understand Risk to Reward Ratios (RR), as I've realised it's something important but i'm not getting. Say for example...

I have a balance of $6000, and place a sell trade for the EUR/USD pair and the market price is 1.09539. The lot size that I used is a 1.0 lot size. The price hits my Take Profit (TP) target of 1.09277 which is good. I also place a Stop Loss (SL) target of 1.09647. Now the question is looking at this trade what is my Risk to Reward Ratio? How do I go about calculating it?