You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Here's a news story like this :)

Meta (Facebook) shares collapsed after Zuckerberg named his goat Bitcoin https://eadaily.com/ru/news/2022/02/03/akcii-meta-facebook-ruhnuli-posle-togo-kak-cukerberg-dal-svoemu-kozlu-imya-bitcoin

Who writes such nonsense, and for whom?

It's the period of major company reports from last year, which is what investors are focused on.

And other sources are writing about it too:

Meta Platforms papers have faced a sell-off after the company's disappointing fourth quarter report,

the first since the company rebranded and refocused on the meta-universe.

Net income fell 8% to $10.28bn.

Earnings per share fell 5% to $3.67 against expectations of $3.84, according to a Refinitiv survey.

Revenue was higher than expected, rising 20% to $33.67 billion.

Analysts had forecast $33.4 billion.

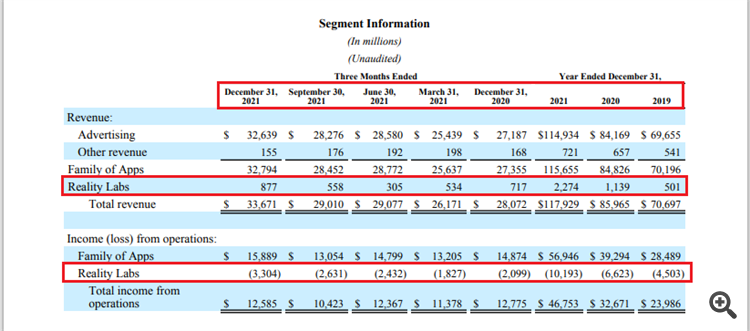

The company separately disclosed the financial results of its Reality Labs division,

which invests in the meta universe and virtual reality, reporting an operating loss of $3.3 billion.

And a close look at the report, at theReality Labs division's first disclosed financial results,

reveals thatthe Reality Labs division shows only losses, every quart

Even though it's on the plus side overall, but apparently investors didn't like the new information.

So much for the goat ))

Isvalue stock growth a short-term trend?

nvesting.com - In January this year, value stocks posted the biggest breakaway from growth securities since the dot-com bubble in 2001. Markets Insider writes this, citing data from Bank of America (NYSE:BAC).

The Russell 1000 Value stock index outperformed the Russell 1000 Growth index by 6.2 p.p., the best relative performance for the index since March 2001.

Barron'snoted that value stocks were boosted by the growing economy. Among them, energy companies were the biggest gainers, with the sector rising 19% in January on the back of oil demand, outperforming the S&P 500, which lost about 5%.

Analysts say we can expect value stocks to rise further given that they are still trading below historical levels. FactSet predicts a 10.5% increase in earnings per share for value stocks in 2022, compared with 7% for growth fund earnings per share, RBC wrote.

But the positive times for value stocks may not last long, Barron's noted. Investments in value stocks are more like a short-term deal rather than a long-term bet, the publication's experts point out

.

Text prepared by Yana Shebalina

Oil rises above $90 a barrel amid US cold snap

SINGAPORE (Reuters) - Oil prices rose on Friday, maintaining gains from the previous session, as freezing weather in much of the United States threatened to further disrupt oil supplies.

Brent crude futures rose 0.4% to $91.47 a barrel by 09:49 MSK, whileWTI crude rose 0.59% to $90.8 a barrel.

Both benchmarks are poised to show a seventh consecutive week of gains.

"WTI is trading above $90 after arctic cold weather reached Texas and led to a halt in oil production in the Permian Basin," said OANDA's Edward Moya.

A strong winter cyclone swept through central and northeastern US states on Thursday, bringing heavy snow and icy conditions, leading to power outages and school closures in some states.

Geopolitical tensions in Eastern Europe and the Middle East have contributed to a sharp rise in prices since the start of the year, with Brent crude futures up 17% since January 1 and WTI crude futures up 20%.

U.S. intelligence officials believe Russia has developed a plan to create a pretext for an invasion of Ukraine, possibly by producing propaganda videos showing a staged attack, a senior Biden administration official said.

The Organisation of Petroleum Exporting Countries and allies led by Russia agreed earlier this week to stick to a moderate 400,000 bpd production increase as the cartel tries to meet existing targets and, despite pressure from major consumers, ramp up production at a faster pace.

(Roslan Khasavneh. Translated by Anna Bakhtina. Editor Anna Kozlova)

already 92

Russian stock market shows strong gains

As of 10:00 Moscow time,the Moscow Exchange Index rose 0.83% to 3,499.86 points.

TheRTS index rose 0.93% to 1,445.35 points at the same time.

Western European stock markets fell sharply yesterday after European Central Bank (ECB) Governor Christine Lagarde refused to rule out a rate hike in 2022.

The US stock market ended trading lower for the first time in 5 sessions.

Asian stock markets are rising today, but exchanges in mainland China remain closed.

Oil continues to appreciate after a price spike the day before, withBrent trading above $91 a barrel andWTI above $90.

If we are lower in 2022, we should not rush to go in, we could end up much lower.

And if it's higher, you have to hurry to get in, it might turn out to be much higher?

And if it's higher, you have to hurry to get in, it might be much higher?

That's not a fact at all.

If we go lower in 2022, we should not rush to enter, we may be much lower.

This is not a fact at all.