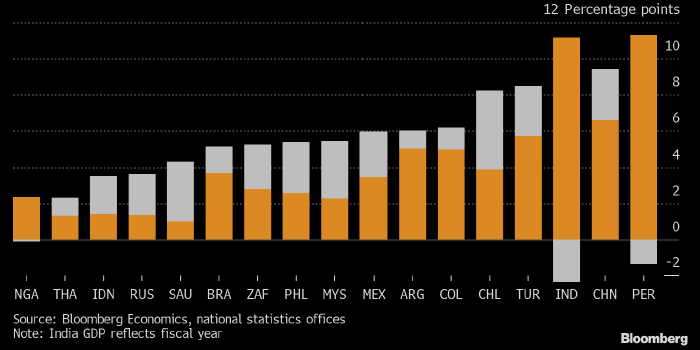

Bloomberg Economics' forecast for EM growth in 2021: orange indicates the share of the low base effect and grey indicates growth within 2021. Source: Bloomberg

Overall, developing countries have fully recovered from last year's economic collapse and their aggregate GDP has surpassed pre-crisis levels, Bloomberg writes. However, within this group of countries, the economic recovery has been uneven and is highly dependent on pandemic success, trade, commodity prices, capital flows and low-base effects.

The economies of major developing countries will grow by 8% this year after contracting by 1.1% in 2020, Bloomberg Economics predicts. The company's experts note that excluding the low-base effect, GDP of commodity-exporting countries like Chile and Saudi Arabia should show outperforming growth rates.

When it all collapses

When something collapses, something is bound to grow.

There is no other way around it.

The S&P 500 and Nasdaq hit record closing highs after minutes from the Federal Reserve's June meeting showed that officials were probably not yet ready to tighten policy.

Federal Reserve officials last month believed that substantial further progress in the US economic recovery was "not yet largely achieved". They agreed, however, that they should be prepared to act if inflation or other risks materialise, the minutes of the regulator's June meeting released on Wednesday showed.

"I perceive it (the Fed minutes) as a set of dovish notes simply because they (management) don't feel they have enough confidence to make any changes," said Brad McMillan of the Commonwealth Financial Network.

The Dow Jones index closed up 0.3% to 34,681.79 points and the S&P 500 index was up 0.34% to 4,358.13 points, while the Nasdaq was little changed and closed at 14,665.063 points.

US-listed Didi shares fell 4.6% after collapsing almost 20% a day earlier after China's market regulator fined the company, along with other Chinese giants Tencent and Alibaba, for failing to report merger deals.

When will it ever crash?

daytime goaf - waiting for the end - what do the connoisseurs have to say where we go ?

go to 65

Going on 65

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use