You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

I'm depressed now too ;)

But whether there is a crisis or not - I do not understand, where to invest - also nytt ferrshteen

Back in the summer it was possible to get into Gazprom shares. It could be a good sell now. But it is too late to buy.

I knew it, but decided not to play the market this summer and to have a rest. And I always do that)).

That way you get nothing at all.) Except for the losses. The futures themselves cost money, though. Learn the theory.))

"hedge funds are worthless. you should go to the factory" © transcendreamer

Buy a stock and sell a stock futures. You won't depend on the price movements of the stock, and the dividends will drip.

That's how hedge funds work.

Not only that, the intrinsic value of the futures will also drip to you. But that's not serious.

In that case it is better to sell options.

well then hedge funds are run by morons. they need to stop doing it and go to the factory.

"hedge funds are worthless. you have to go to the factory" © transcendreamer

I'd say not all of them.

and I understand hedge funds in my own way, especially hedge funds.

there is a willingness to create it, only there is no capital ;)

I'd say not everyone

I understand hedge funds in my own way and hedge funds even more so.

to create its readiness is there, only there is no capital ;)

It's not capital that's needed here, it's clients and clients' money.)

I found it, there's nothing unusual there.

only the bank will know about the reversal.

The reversal will be known only to the bank, and one should not get carried away and wear rose-coloured glasses:

https://www.ecb.europa.eu/mopo/implement/omo/html/index.en.html

It is not easy to figure out how this happens and how banks get such decent returns, but it is worthwhile. Personally I have it behind me, but I will not tell you about it, because I have spent more than one year on it, due to the obscurity of the trading mechanism.

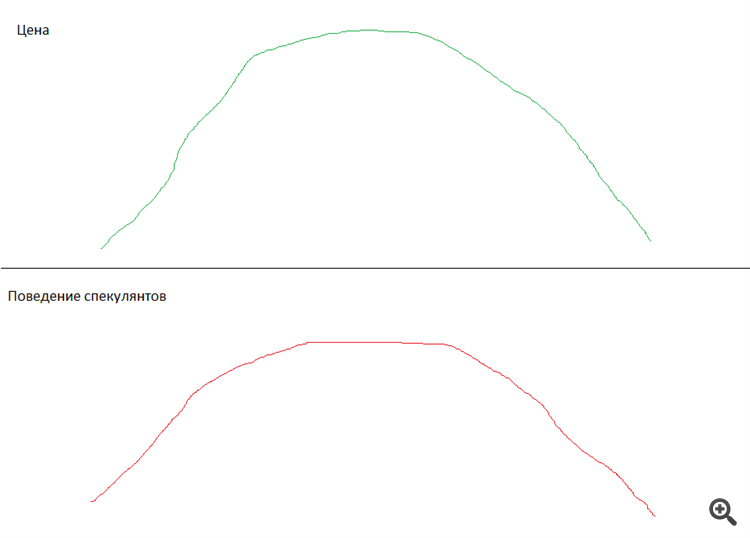

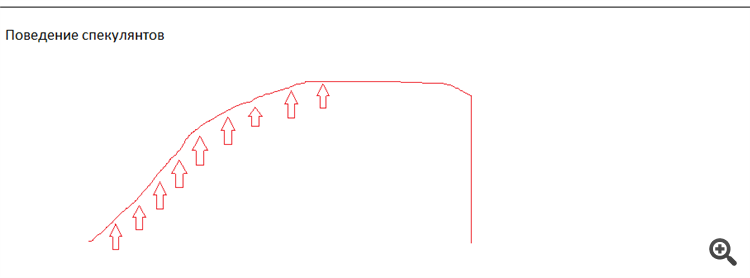

From this picture...

We can see that speculators are following the market, but the nature of this movement is not clear.

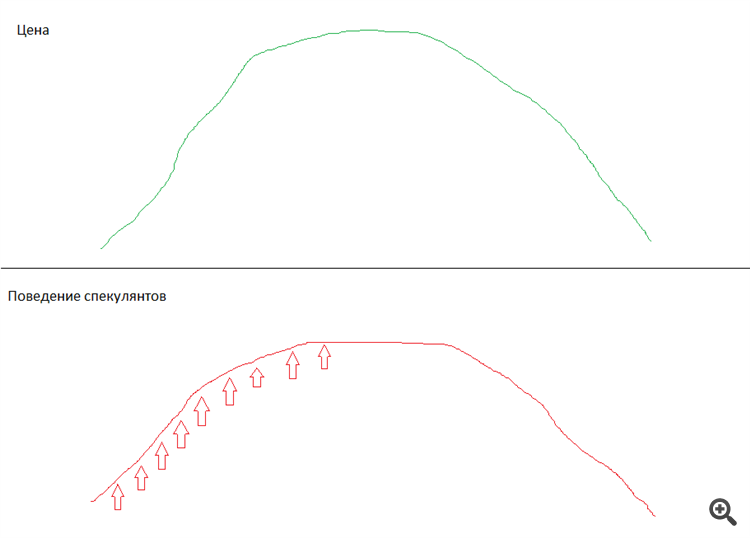

Let's draw a simplified graph of price and a simplified graph of the traders' behavior.

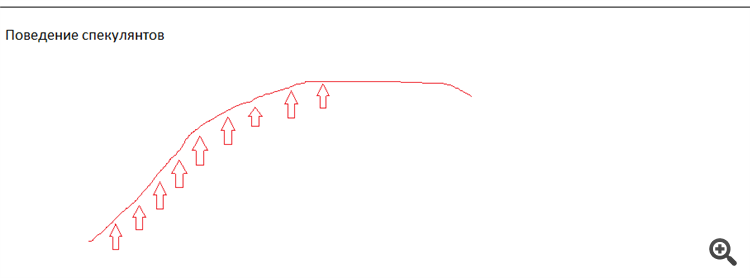

When the price rises, what happens in the market?

speculators place their trades upwards.

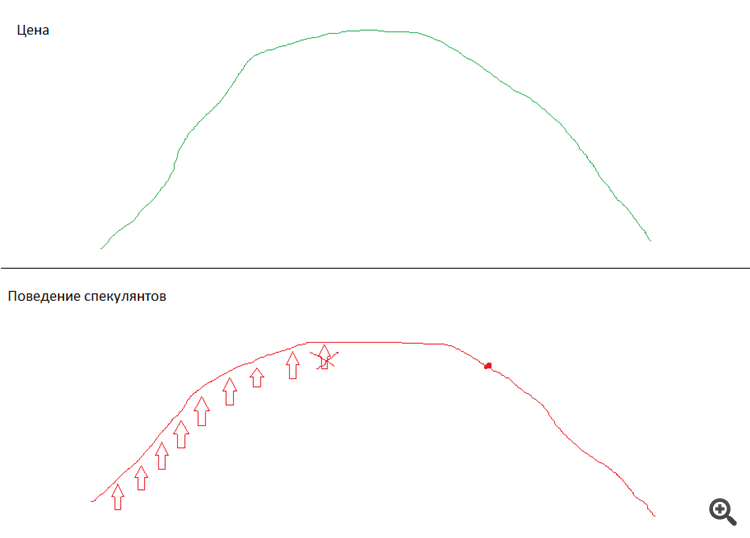

And when the price goes down, what happens?

Why does the chart fall? Do speculators start closing their trades little by little?

But if the downward movement closes the trades that remained up, we will incur losses.

Suppose, during a move downwards, speculators start to open trades downwards.

Exactly all the trades will be blocked and only the topmost one will remain.

i don't know how the deal is closed when the price starts moving down.

It's not clear how the crowd acts when the price starts moving down.)

on this picture...

huge misconception

when the price goes up, speculators sell and merchants buy

;)

huge misconception

when the price goes up, speculators sell and traders buy

;)

and we're talking about CME here, not forex.

The price reversal has started, why aren't all the speculators closing abruptly?

If they did, the chart would fall precipitously.

But we don't see that in the market. the chart is changing very smoothly.