[Archive] Learn how to make money villagers! - page 539

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

What are you saying. A load of 300% is a brutal drawdown, as Load = Collateral / Funds * 100%.

Collateral is constant, so a high load value indicates extremely low funds, which are three times less than collateral.

Example: A trader opens a 1 lot oira position. At a leverage of 100 and the current oirobucks rate the deposit is approximately 1280 quid. The load will become 300% when the funds are equal to about 1280/3 ~ 427 quid.

What are you saying? That's what I'm saying, there seems to be no desire on the part of the manager to open it.

there is a risk of losing the account altogether.

these drawdowns jagged down are with open positions. Closed positions are the horizontal line.(at least a slice).

What makes you think that these drawdowns jagged downwards are with open positions?

Immediately after all positions are closed, a new one(s) is opened, so there is no horizontal line.

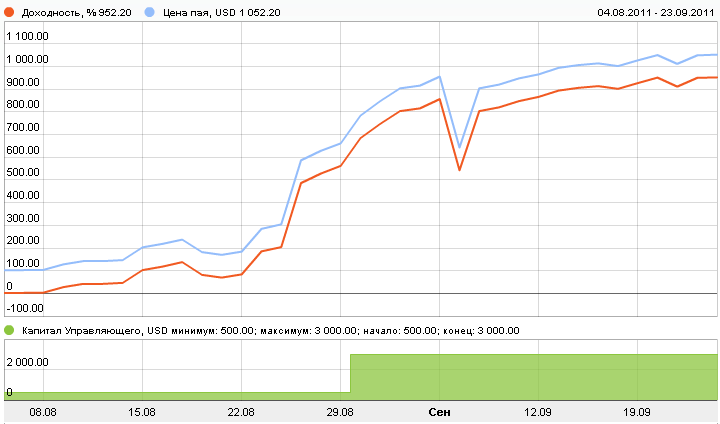

Here is another example of a PAMM on a Martin with high returns in a short period of time, read the details of the system here - http://forum.alpari.ru/thread64991.html

Red BOX:205808(RR) http://www.alpari.ru/ru/pamm/info/id/205808/

What makes you think that these drawdowns jagged downwards are with open positions?

Immediately after all positions are closed, a new one(s) is opened, so there is no horizontal line.

Here is another example of a PAMM on a Martin with high returns in a short period of time, read the details of the system here - http://forum.alpari.ru/thread64991.html

Red BOX:205808(RR) http://www.alpari.ru/ru/pamm/info/id/205808/

No, it's already being done carefully now, look at the hourly load, it's in the region of 9%. And yet one is of course quite aware that a year and a half of work can be drained in a couple of days.

Has anyone tried to simulate depositing/withdrawing from a deposit on their Ilanian EAs - and display a graph of the total balance after all the withdrawals, top-ups and withdrawals?

the system did not work so no one trades the original system

What are you saying. A load of 300% is a brutal drawdown, as Load = Collateral/Assets * 100%.

Collateral is constant, so a high load value indicates extremely low funds, which are three times less than collateral.

Example: A trader opens a 1 lot oira position. At a leverage of 100 and the current oirobucks rate the deposit is approximately 1280 quid. The load will become 300% when the funds are equal to about 1280/3 ~ 427 quid.

Yes I'm wrong here, I admit it.

That's right:

Loading up to 300% or more can be the result of additions to an open profitable position(s) and when there is a large drawdown.

A loading of 500% corresponds to a stop out (leverage 1:100)

Forced closing https://www.mql4.com/go?http://www.alpari.ru/ru/help/forex/?tab=1&slider=leverage

for micro.mt4, classic.mt4, classic.systematic, micro.mt4.swapfree, classic.mt4.swapfree, classic.systematic.swapfree, pamm.mt4, pamm.systematic - when the Equity in the trader's terminal falls below 20% of the required margin (Margin);

for accounts classic.ndd.mt4, pamm.ndd.mt4, pro.ecn.mt4, pamm.ecn.mt4 and pro.direct - when the Equity value in the trader's terminal falls below 60% of the required margin (Margin). On NDD and ECN accounts during an hour before the closing of the trading session on Friday there is a change of Stop Out level from 60% to 100%. After the trading session closes, the level is restored to the stated level.

The percentage ratio of Equity to Margin is called Margin level, calculated using the formula (Equity / Margin) * 100%.

where on the line? (closing and opening new ones)