You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Manov had only 3 days of drawdown on eurusd - at the end of the championship closing does not count - there could have been trades not closed post-strategy

What do you mean by drawdown? A slippage in the balance? Well, it does not mean anything - once again, Manov's Equity was always in deficit against the balance, and the latest closing just confirms this fact and this drop has been quite large and this is characteristic of the averaging.

At the same time, the trader has really got lucky: if the Championship had ended in a slightly less favourable period for his current trades, he could have fallen much lower or even into the red at closing.

But it's better to wait out the drawdown than to get a margin call

At the end of the day the size of the no-failure move can be modelled on the history (maximum movement on the eudusd is 1.22 to 1.6), and the continuous movement to 2.0 will not happen

it's definitely not a martin - averaging and working in the counter-trend (i'm here on the branches "old-timers" discuss but their entries by indicators (wpr)) - but manov is immediately visible in the trades is simply entering at levels equal to the lot (0.1) but each successive level is closer to the previous one. -But with manov it is immediately visible on the transactions simply entry points at levels of equal lot (0.1) but each successive level is closer to the previous - I think a very interesting approach - one would think who knows where the trend will start

1. But it is better to sit out a drawdown by strategy than to get a margin call

2. At the end of the day the amount of non-failure movement can be simulated (look) on the history (maximum movement on the eudusd is 1.22 to 1.6), and the continuous movement up to 2.0 will not happen.

1. Unfortunately, sitting out is not always enough of a deposit and drawdowns turn into MCs. Unless you expect profitability of 1-3% per annum, but even that does not guarantee success. Better to put in a bank.

2. We have modeled many times. Hence the conclusions. If you do not use cunning tester techniques, there is no fish here.

loss is a foregone conclusion

A little by the book, as averaging losses - I agree, will be a sinking, think, and what will work if the TS which at a large number of transactions within the day, on a long history ALWAYS get breakeven, ie one day 10-15 transactions, the total profit is about equal to the total loss

this is the system that can be rocked by Martin

A little by the book, as averaging losses - I agree, will be a sinking, think, and what will work if the TS which at a large number of transactions within the day, on a long history ALWAYS get breakeven, ie one day 10-15 transactions, the total profit is about equal to the total loss

this is the system that can be rocked by martin

I do not want to analyze the real state (Manov).

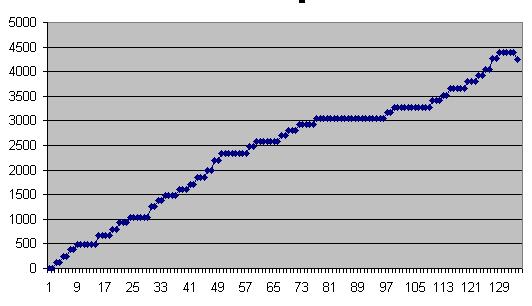

I'll paste a picture (EURUSD) - no eqivity, only balance - but only one losing trade (the last one)

Critical here is the maximum number of losing trades in a series.

I will insert a picture (EURUSD) - yes there is no liquidity only balance - but only one losing trade (and that was the last one)

It's an amusing discussion