You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Hello everyone!

Happy Holy Resurrection Day!

//------------------------------------------------------------------

It's a sin to work on Christ's resurrection. But a little brainwashing might be in order...

Let's look at the cereals. All those who are interested in the matter noticed a considerable fall in prices on Wednesday, at the exit of the report...

//----------------------------------------------------

"US wheat "collapsed" under pressure from seeding data and corn and soybean stocks.

US wheat exchanges collapsed on Wednesday following the release of the US Department of Agriculture's wheat, corn and soybean planting acreage forecast as well as estimates of these crops' stocks as of March 01. Traders assessed new data on wheat as relatively neutral, but figures on corn and soybeans were exclusively bearish. Under pressure from these two markets, wheat quotations fell sharply.

Yesterday's USDA forecast of wheat, corn and soybean planting areas and stock estimates for these crops on 01 March was not only of purely American but also of international significance. European wheat exchanges also reacted with a decline.

Additional pressure on the soybean market has been and will continue to be exerted by the news from Argentina that an agreement has been reached to end the port workers' strike. This will mean the reopening of the ports and an increase in the volume of Argentina's record soybean crop and derived products on the world market.

The fall in the US agricultural markets is dragging the European markets down as well...." (from, 01/04/2010)

ZW(syn) - wheat, ZC(green) - corn, ZS(red) - soybean, ZM(brown) - soybean meal, ZL (azure) - soybean oil

However :

" Amajor drop in the U.S. wheat market on Wednesday was followed by some recovery. Traders felt the market was too "oversold". On closing short positions, the coming May US wheat quotations rose slightly.

...Decline in grain prices on the world market will result in fewer acres planted in 2010/11 MY - this was one of the conclusions reached by the US Department of Agriculture in its new report released on 31st March. The northern hemisphere countries are the most affected.

The region in question includes the USA, two-thirds of Africa, Europe and Asia. Here the sowing campaign starts in May-June and the prolonged price downward trend is hardly encouraging optimism among farmers. Grain prices have fallen consistently since the overproduction crisis - the world is oversupplied with grain and supply exceeds demand...

In other words, it seems reasonable to maintain the bearish ZM/ZL (ZS/ZL) spread for another week.The reopening of ports in Argentina following the end of a 10-day dockers' strike will result in an additional significant increase in soybean and meal exports from South America.

As for soybean oil exports, its growth is not so evident due to China's complaints about the quality of oil supplied from Argentina. Recall that China is the world's largest importer of soybean oil and Argentina is the largest exporter with a global export share of over 50%......"(from, 2/04/2010)

//-----------------------------------------------

ZMK0/ZLK0, M30.

I will probably wait for a pullback, which I think will happen, and then I will enter - it corresponds to a seasonal trend, and probably you can enter the spread ZSN0 (buy) - ZMN0 (sell) - it also corresponds to a seasonal trend.

Рекомендуется покупать пару новозеландский доллар/доллар США при падении - BarCap

1 апреля /Dow Jones/. Пара новозеландский доллар/доллар США в четверг снижалась после выхода отчета Международного валютного фонда. Согласно оценкам, содержащимся в отчете, новозеландская валюта на 10%-25% переоценена и может подешеветь, когда Федеральная резервная система начнет повышать процентные ставки. В Barclays Capital отмечают, что, несмотря на снижение в четверг, пара новозеландский доллар/доллар США все еще держится в середине сокращающегося диапазона между 0,69 и 0,7130. В апреле банк рекомендует покупать пару при падении к минимуму диапазона с учетом сезонных особенностей динамики пары. Основываясь на данных с 1971 года, аналитики отмечают, что срединная доходность пары в апреле – одна из самых значительных в году. Сейчас пара новозеландский доллар/доллар США торгуется по 0,7059.

//------------------------------ -------------------

Любопытное замечание по "срединной доходности пары в апреле ..." !

Никак не могу найти в инете график сезонный тенденции по 6N или NZDUSD за посл. годы!

Может у кого есть?

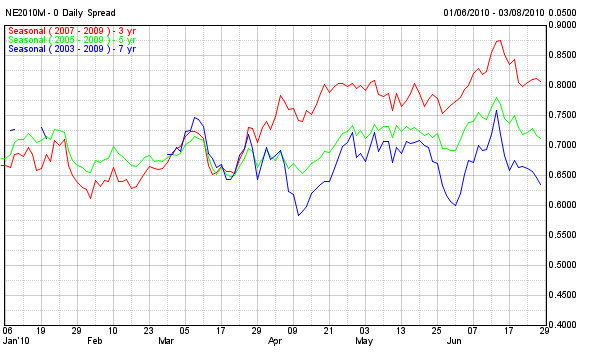

Graph 7-5-3 6NM0

Chart 7-5-3 6NM0

So it should go up in a week or so?!

Hello all.Who has experienced such a thing in broco or other brokers.Opened 8 positions on grains and two of oil.At 20.15 trades on grains are closed and the total profit on all transactions is -1.37 $. I turned off the computer for half an hour, I turn on a total profit has -3.My aim is to see if I can get a good return on my trade after I have stopped trading for half an hour, turn it off and turn back on -3.38$.On oil, because qmk0 and qmm0 were open at different directions, profit remained where they were, but on grains, on one pair from $8 profit fell to $6.75, and on the other from $2.50 to $1.75, although I have closed my trade 40 minutes ago.What could be the problem?

//-----------------------------------------

There is such at grains in B.

Trading is prohibited (trading is over or break), and quotations "walk"...

Understandable - when ticker asks and bids are walking - it's probably orders-orders. But why LUST prices move when trading is forbidden - is unclear to me.

Maybe there at the exchange - "for their own" (quietly) allowed to trade?

Hi all. Who knows why different brokers have different expiry dates for the same instruments. for example broco qmko-16.04, and ibc capital -19.04. What can it be about? and so for many instruments, the difference in 1-4 days.

And in such kitchen DTs - you can trade until the last minute of the expiry day and even after that (!), and this last minute is from a streetlight .....

In his blog, Maltsev openly explained that all CFD contracts are the property of the company and that B... B... trades them at his own risk...

What does this imply? It means that a natural futures and a CFD for that futures only have in common a similar quotation and..., approximate expiration dates... The CFDs are not listed on any exchange and the traders trade between themselves and the kitchen. Under such conditions, it is possible that by the end of the contract life the company loses... What is a company to do...? Have you guessed...? That's right... Let negligent traders trade until the last day, enlarge trading spreads ... and stay in the black anyway. If the profit does not materialize, the contract is left in the terminal beyond the expiry time ... just in case some sheep jumps into the trade and then we get it .... That's what happens... If someone enters trading 2-3 weeks before expiry time - it is unlikely that he will be able to jump out without serious losses...

....то контракт оставляют в терминале сверх срока экспирации..., авось какая овца заскочит в сделку, тут то мы ее и поимеем... Так и происходит... Если кто то войдет в торги за 2-3 недели до срока экспирации - то выскочить без серьезных потерь ему уже вряд ли удастся...

It's true! The tech support thread there is literally full of customer complaints - like "why did the BRN oilspread (asc-bid) widen to over 300 ( !) pips theday before the expiration".

В своем блоге Мальцев открытым текстом пояснял, что все CFD контракты являются собственностью компании, и что Б... тогует ими на свой страх и риск...

CFDs all over the world are an OTC (over-the-counter) product, i.e. an invention of the company that sells/buys it. In fact, it is a betting agreement between the company and the trader to divide the possible profit/loss. Therefore, all is based solely on the trust of the company providing the CFD and the rules set by this company.

The only exception - Australia, there is an exchange-traded CFD, i.e. traded on the stock exchange like normal stocks.