You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Let's say you've determined the minimum with a "montecarl". HOW LONG does your story have to be? HOW LONG should your story be? Until you show a real way of calculating the optimization cutoff - all said is just a way of SAMOUBMAN and lyricism on common knowledge topics. Equities, I've already said, don't save you from fitting. All your logic leads to only one solution - test on ALL history. Nevertheless, you do limit yourself to this. Why? If you don't need forwards - test on all available history and your "stat validity" will be maximal.

My way is simple, I compare the sum of forwards obtained on the same plot, but with different steps. The best result gives the best testing step. And what are you comparing with?

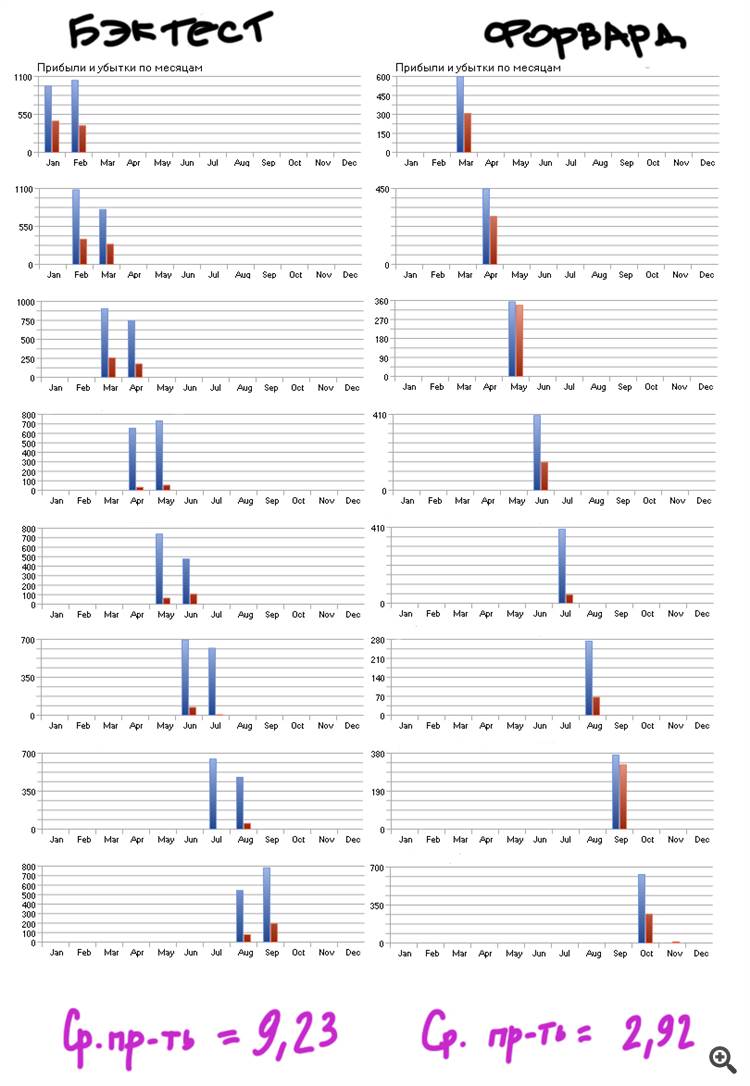

By no means, the type of eqvity is not a sufficient condition. It was shown earlier by me that a posh eqiti, can be the result of a fit. And your forward will miss such a fitted TS. A simple example: forward test with 1 year period this TS will pass, because the overall quality of equity of the strategy is quite high:

Even the semi-annual forward will pass. But this does not make it any sweeter, because the TS is a fitted one.

My method is simple, I compare the sum of the forwards obtained on the same plot but in different steps. The best result gives the best testing step. Since I don't want abstract reasoning, but to maximise profits, I compare the profits that the forwards show. And what are you comparing with?

Hell yes take the glue of the forwards on the whole story and analyse it.

"Gluing the forwards together" is already more interesting. And how are you going to glue the forwards together? By hand? There is no known software that can do it automatically.

By this logic, the best type of optimisation is in the last 20 years. Better yet, over 100. The nature of the price chart tends to change over time. Selecting the depth of history is a separate topic. But there should be plenty of forwards - that's for sure.

My method is simple, I compare the sum of forwards obtained on the same plot but with different steps. The best result gives the best testing step. Since I'm not looking for abstract reasoning, but for maximum profit, I'm comparing the profit which the forwards show. And what are you comparing with?

"Gluing the forwards together" is already more interesting. And how are you going to glue the forwards together? By hand? No software that can do this automatically is known.

I'm not going to :) I get the gluing right away. Yes, it's much harder, yes, you have to write an engine that emulates optimization, but you get results you can trust almost immediately.

The TS itself must adapt to the changing nature of the market. Constant overshooting of parameters will not solve the problem https://www.mql5.com/en/charts/3755939/eurusd-m5-e-global-trade

And what does "emulating" the optimization mean?

This means a mechanism which optimises the required EA parameters right during the backtest according to the principle you want.

As a result, the backtest itself becomes a forward gluing.

This means a mechanism which optimises the required EA parameters right during the backtest according to the principle you want.

As a result, the backtest itself becomes a forward gluing.