Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.30 14:00

EURUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Euro: Neutral-

The Euro’s vulnerability was on full display this week.

- Shifting fundamental momentum sees the Euro losing key support to the Australian and US Dollars.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.31 08:58

2014-03-31 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - German Retail Sales]

- past data is 1.7%

- forecast data is -0.5%

- actual data is 1.3% according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

==========

German Feb Retail Sales Rise Unexpectedly

Germany's retail sales grew unexpectedly in February from the prior month, official data showed Monday.

Retail sales advanced by real 1.3 percent from January, Destatis said. This was the second consecutive rise in retail turnover. Sales were forecast to fall 0.5 percent in February after rising 1.7 percent in January.

Year-on-year, retail sales grew 2 percent, much faster than the 0.9 percent rise posted in January. The rate also exceeded the 0.8 percent increase forecast by economists.

Compared with the previous year, turnover in retail trade was in the first two months of 2014 in real terms 1.5 percent larger than that in the corresponding period of the previous year, Destatis reported.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 8 pips price movement by EUR - German Retail Sales news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.31 06:26

Euro Trades near One-Month Low as Dollar Gains before PMI Data

The euro almost hit a one-month low before Monday’s release of inflation

statistics in the euro zone that show that it slowed down, raising

prospects that the European Central Bank will roll out stimulus measures

when it meets this week.

The dollar traded near a two-week peak against the yen before Tuesday’s

release of U.S. manufacturing statistics by the Federal Reserve Chair

Janet Yellen. The Australian dollar rose 0.5 percent from a four-month

peak as analysts predicted the country’s Reserve Bank won’t lower

interest rates on Tuesday.

“If the euro area’s inflation estimate comes in below consensus, it’ll

feed speculation of further easing,” Toshiya Yamauchi, a Tokyo-based

senior analyst at Ueda Harlow Ltd told Bloomberg. “The euro could drop

below $1.37.”

The euro was trading at $1.3754 by 8.43 a.m. in Tokyo from last week’s

close of $1.3752, when it reached an intraday low of $2.3705. The

currency has changed slightly against the dollar since Dec. 31. It was

trading at 141.52 yen from Friday’s close of 141.40 and is headed for

2.2 percent decline this quarter.

The dollar was trading slightly higher at 102.89 yen from Friday’s

close of 102.83, when it touched a high of 102.98, the highest level in

two weeks. So far, the dollar has declined 2.3 percent against the yen

in 2014. The Aussie dollar was trading at 92.49 U.S. cents, up from a

high of 92.95 last week, the highest such level since Nov. 21.

A Bloomberg survey of economists forecasts that the European Union’s

statistics office will say that consumer prices in the euro zone to

surge 0.6 percent in March from a year ago.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.31 11:58

2014-03-31 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - CPI Flash Estimate]

- past data is 0.7%

- forecast data is 0.6%

- actual data is 0.5% according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

==========

Eurozone Inflation Falls More Than Forecast In March

Eurozone inflation slowed more than expected in March, flash estimates published by Eurostat showed Monday.

Inflation fell to 0.5 percent in March from 0.7 percent in February. The rate was forecast to fall to 0.6 percent.

The figure has been staying below the European Central Bank's target of 'below, but close to 2 percent' for the fourteenth consecutive month.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 26 pips price movement by EUR - CPI Flash Estimate news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.30 15:02

Forex Fundamentals - Weekly outlook: March 31 - April 4The dollar rose to two-week highs against the yen on Friday, as indications that China’s government is prepared to do more to shore up the cooling economy bolstered risk appetite.

Market sentiment was boosted after China's premier Li Keqiang said the country has policies in place to counter economic volatility. The remarks eased concerns over recent signs of a slowdown in the world’s second-largest economy.

Data on Friday showing that U.S. consumer spending rose 0.3% last month after a downwardly revised gain of 0.2% in January also lifted the dollar higher against the yen.

USD/JPY rose 0.64% to end Friday’s session at 102.83, the highest since March 12. For the week, the pair gained 0.57%.

The euro edged up from one-month lows against the dollar following the comments, with EUR/USD inching up 0.07% to settle at 1.3752, recovering from lows of 1.3702. The pair ended the week down 0.61%.

The euro remained under pressure after European Central Bank officials indicated earlier in the week that they are considering fresh policy options to stave off the risk of deflation in the region.

ECB governing council member and Bundesbank head Jens Weidmann said Tuesday that a negative deposit rate could be an appropriate way to address the impact of strong gains in the euro.

The same day ECB President Mario Draghi that the central bank stood ready to act if inflation slipped lower than the ECB expected.

Data on Friday showing that the annual rate of inflation in Spain slipped 0.2% in March fuelled concerns that deflation could threaten the economic recovery in the euro area. A separate report showed that the annual rate of inflation in Germany slowed in March.

The dollar was lower against the pound on Friday, with GBP/USD up 0.185 to 1.6640 at the close of trade.

Sterling remained supported after a report on Friday showed that U.K. fourth quarter growth was left unrevised at 0.7% for the final three months of 2013. Another report showed that the U.K. current account deficit came in at a larger-than-expected 22.4 billion pounds in the fourth quarter.

Elsewhere, the Australian dollar rose to a four-month high of 0.9295 against the greenback on Friday, before trimming back gains slightly to settle at 0.9247. AUD/USD ended the week with gains of 1.33%.

The Aussie was boosted as recent reports indicated that the economy is picking up, while hopes for fresh stimulus measures from China also supported the Australian’s dollar’s gains. Meanwhile, NZD/USD edged down 0.18% to 0.8654 at the close on Friday, after hitting two-and-a-half year highs of 0.8696 earlier in the session. The pair ended the week with gains of 1.31%.

In the week ahead, investors will be looking to Friday’s U.S. nonfarm payrolls report for March for further indications on the strength of the labor market, while Monday’s euro zone inflation report will also be in focus, ahead of the ECB policy meeting and press conference on Thursday.

Monday, March 31

- Japan is to release preliminary data on industrial production.

- New Zealand is to produce private sector data on business confidence, while Australia is to publish data on private sector credit.

- Switzerland is to publish its KOF economic barometer.

- The U.K. is to release data on net lending to individuals.

- The euro zone is to produce preliminary data on consumer price inflation, which accounts for the majority of overall inflation.

- Canada is to publish the monthly report on gross domestic product, the broadest indicator of economic activity and the leading indicator of economic growth.

- Japan is to publish its Tankan manufacturing and non-manufacturing index, as well as data on average cash earnings.

- China is to release data on manufacturing activity.

- The Reserve Bank of Australia is to announce its benchmark interest rate and publish its rate statement, which outlines economic conditions and the factors affecting the monetary policy decision.

- The euro zone is to release data on the unemployment rate. Germany is release data on the change in the number of people unemployed, while Spain and Italy are to release reports on manufacturing activity.

- Switzerland is to release its SVME manufacturing index.

- The U.K. is to release data on manufacturing activity.

- Later Tuesday, the Institute of Supply Management is to publish a report on U.S. manufacturing growth.

- Australia is to produce data on building approvals, a leading indicator of future construction activity.

- The U.K. is to produce private sector data on house price inflation, as well as official data on construction activity.

- In the euro zone, Spain is release data on the change in the number of people unemployed.

- The U.S. is to release the ADP report on private sector job creation, which leads the government’s nonfarm payrolls report by two days. The U.S. is also to release data on factory orders.

- Australia is to release data on retail sales and the trade balance, the difference in value between imports and exports.

- China is to produce data on service sector activity.

- The euro zone is to release data on retail sales, the government measure of consumer spending, which accounts for the majority of overall economic activity. Spain and Italy are to publish data on service sector activity.

- The U.K. is also to release data on service sector growth, while the Bank of England is to announce its benchmark interest rate.

- Later in the day, the European Central Bank is to announce its benchmark interest rate. The announcement is to be followed by a press conference with President Mario Draghi.

- Both the U.S. and Canada are to publish data on the trade balance, and the U.S. is also to publish the weekly report on initial jobless claims. Meanwhile, the ISM is to publish a report service sector activity.

- Germany is to publish data on factory orders.

- Canada is to publish data on the change in the number of people employed and the unemployment rate. The nation is also to publish its Ivey PMI

- The U.S. is to round up the week with the closely watched government data on nonfarm payrolls and the unemployment rate.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.30 17:22

EURUSD Fundamentals - weekly outlook: March 31 - April 4The euro inched higher against the dollar on Friday, pulling back from one-month lows as market sentiment was bolstered by indications that China is prepared to do more to shore up the cooling economy.

EUR/USD edged up 0.07% to settle at 1.3752, recovering from lows of 1.3702. The pair ended the week down 0.61%.

The pair was likely to find support at 1.3702 and resistance at 1.3800.

Risk appetite was boosted after China's premier Li Keqiang said Friday the country has policies in place to counter economic volatility. The remarks eased concerns over recent signs of a slowdown in the world’s second-largest economy.

The common currency remained under pressure after European Central Bank officials indicated earlier in the week that they are considering fresh policy options to stave off the risk of deflation in the region.

ECB governing council member and Bundesbank head Jens Weidmann said Tuesday that a negative deposit rate could be an appropriate way to address the impact of strong gains in the euro.

The same day ECB President Mario Draghi that the central bank stood ready to act if inflation slipped lower than the ECB expected.

Data on Friday showing that the annual rate of inflation in Spain slipped 0.2% in March fuelled concerns that deflation could threaten the economic recovery in the euro area. A separate report showed that the annual rate of inflation in Germany slowed in March.

Elsewhere, the euro was higher against the yen on Friday, with EUR/JPY advancing 0.71% to 141.40, up from an almost one-month trough of 139.95.

In the week ahead, investors will be looking to Friday’s U.S. nonfarm payrolls report for March for further indications on the strength of the labor market, while Monday’s euro zone inflation report will also be in focus, ahead of the ECB policy meeting and press conference on Thursday.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, March 31

- The euro zone is to produce preliminary data on consumer price inflation, which accounts for the majority of overall inflation.

- The euro zone is to release data on the unemployment rate. Germany is release data on the change in the number of people unemployed, while Spain and Italy are to release reports on manufacturing activity.

- Later Tuesday, the Institute of Supply Management is to publish a report on U.S. manufacturing growth.

- In the euro zone, Spain is release data on the change in the number of people unemployed.

- The U.S. is to release the ADP report on private sector job creation, which leads the government’s nonfarm payrolls report by two days. The U.S. is also to release data on factory orders.

- The euro zone is to release data on retail sales, the government measure of consumer spending, which accounts for the majority of overall economic activity. Spain and Italy are to publish data on service sector activity.

- Later in the day, the ECB is to announce its benchmark interest rate. The announcement is to be followed by a press conference with President Mario Draghi.

- The U.S. is to publish data on the trade balance, as well as the weekly report on initial jobless claims. Meanwhile, the ISM is to publish a report service sector activity.

- Germany is to publish data on factory orders.

- The U.S. is to round up the week with the closely watched government data on nonfarm payrolls and the unemployment rate.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.01 10:02

2014-04-01 07:15 GMT (or 09:15 MQ MT5 time) | [EUR - Spanish Manufacturing PMI]

- past data is 52.5

- forecast data is 52.4

- actual data is 52.8 according to the latest press release

if actual > forecast = good for currency (for EUR in our case)

==========

Spanish Manufacturing Sector Maintains Momentum

Spain's manufacturing sector maintained growth momentum in March with rates of expansion in both output and new orders accelerating from February, data from Markit Economics showed Tuesday.

The seasonally adjusted Purchasing Managers' Index rose to 52.8 in March from 52.5 in February. The reading pointed to a fourth consecutive monthly strengthening of business conditions.

Total new orders rose at the sharpest pace in almost four years in March. With new orders continuing to rise, manufacturing firms in Spain increased their production levels.

Staffing levels were broadly unchanged, however, following modest rises in the previous two months. Input costs decreased for the second time in the past three months during March. In turn, firms lowered their prices charged.

"The recent pick-up in the Spanish manufacturing sector continued in March, finishing off a solid first quarter," Andrew Harker, senior economist at Markit and author of the report, said.

Sharper rises in both new and existing orders suggest that further growth of output is likely in the near-term, added Harker.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 21 pips price movement by EUR - Spanish Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.02 10:08

2014-04-02 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - Spanish Unemployment Change]

- past data is -1.9K

- forecast data is -5.3K

- actual data is -16.6K according to the latest press release

if actual < forecast = good for currency (for EUR in our case)

==========

Spanish unemployment change March m/m -16,620 vs -5,300 exp

- -1,900 prev

- m/m -0.35%

- second straight month of declines

- largest monthly fall for March since 2006

- total jobless 4.8 mln

EURUSD lower at 1.3810 though with some EURGBP selling going through. Cable up to 1.6645

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 10 pips price movement by EUR - Spanish Unemployment Change news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.04.02 14:42

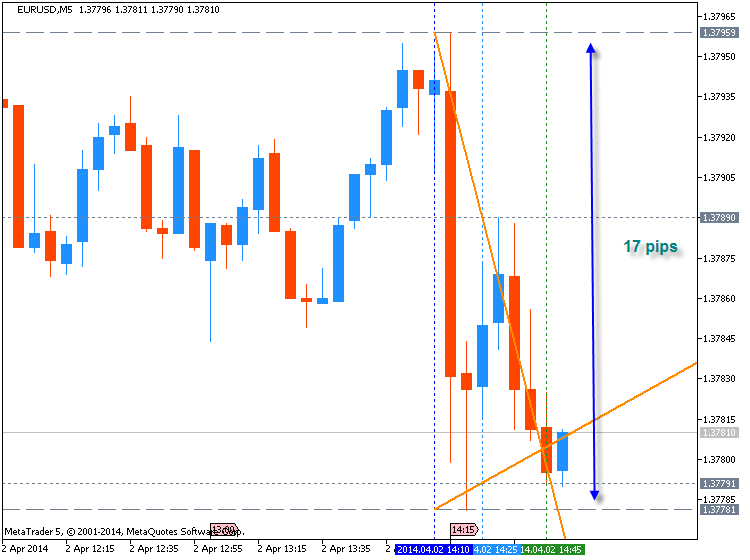

2014-04-02 12:15 GMT (or 14:15 MQ MT5 time) | [USD - ADP Non-Farm Employment Change]

- past data is 178K

- forecast data is 195K

- actual data is 191K according to the latest press release

if actual > forecast = good for currency (for USD in our case)

==========

U.S. Private Sector Job Growth Falls Just Of Estimates In March

Employment in the U.S. private sector showed a notable increase in the month of March, according to a report released by payroll processor ADP on Wednesday, with the report also showing a substantial upward revision to the job growth in the previous month.

ADP said private sector employment increased by 191,000 jobs in March following an upwardly revised increase of 178,000 jobs in February.

While the job growth in March came in slightly below estimates for an addition of 195,000 jobs, the job growth in February was well above the previously reported increase of 139,000 jobs.

EURUSD M5 : 17 pips range price movement by USD - ADP Non-Farm Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

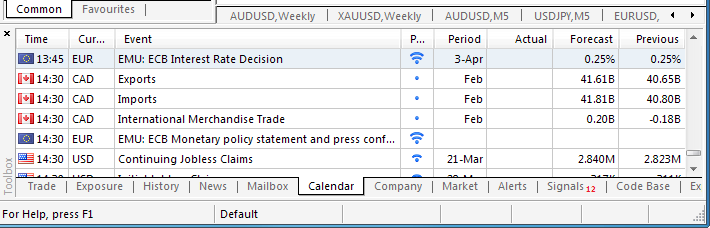

newdigital, 2014.04.03 10:44

Trading the News: European Central Bank Interest Rate Decision (adapted from dailyfx article)

- European Central Bank (ECB)to Hold Benchmark Interest Rate at 0.25%.

- ECB President Mario Draghi to Deliver Policy Statement at 12:30 GMT.

According to a Bloomberg News survey, 54 of the 57 economists polled see

the European Central Bank (ECB) sticking to the sidelines in April, but

the market speculation (rate cut, negative deposit rates, verbal

intervention, unsterilized bond purchases, Long-Term Refinancing

Operation) surrounding the interest rate decision may spark increased

volatility in the EUR/USD as market participants weigh the outlook for

monetary policy.

What’s Expected:

Why Is This Event Important:

The EUR/USD may push higher over the remainder of the week should the ECB merely reiterate the policy statement from the March 6 meeting, but the single currency may continue to give back the rally from earlier this year should central bank President Mario Draghi lay the groundwork to implement more non-standard measures across the monetary union.

Indeed, the heightening risk for deflation may put increased pressure on the ECB to further embark on its easing cycle, and the EUR may face a larger decline in the coming days should the central bank take additional steps to shore up the ailing economy.

However, President Mario Draghi may retain a rather neutral tone for

monetary policy amid the positive developments coming out of the

euro-area, and the EURUSD may continue to carve a series of higher highs

& higher lows as the central bank remains reluctant to move away

from its current policy.

How To Trade This Event Risk

Trading the ECB interest rate decision may not be as clear cut as some

of our other trade setups as the press conference with President Draghi

ends with a Q&A session

Bearish EUR Trade: ECB Implements More Easing/Draghi Adopts Dovish Tone

- Need red, five-minute candle following the decision/statement to consider a short Euro trade

- If market reaction favors a short trade, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from cost; at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is met, set reasonable limit

- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same strategy as the bearish euro trade, just in the opposite direction

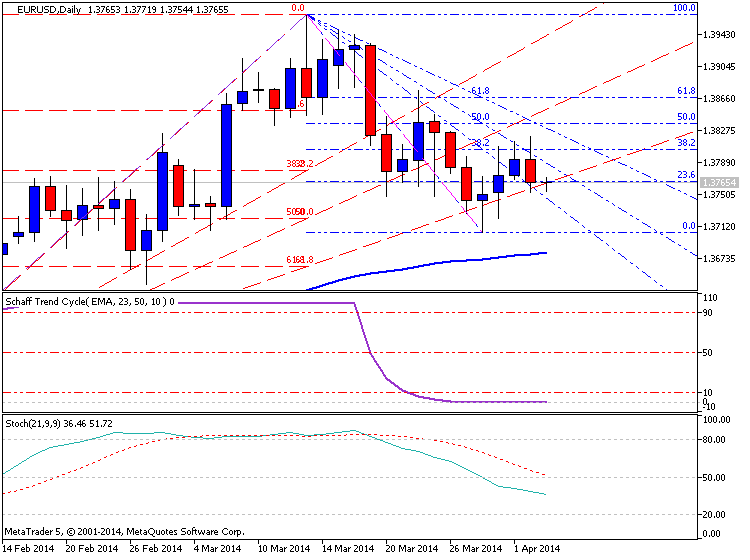

Potential Price Targets For The Rate Decision

- Looking for Higher Low, But Break Below 1.3500 Would Negative Bullish Trend

- Interim Resistance: 1.3960-70 (61.8 expansion)

- Interim Support: 1.3600 Pivot to 1.3620 (23.6 retracement)

European Central Bank (ECB) March 2014 Interest Rate Decision

EURUSD M5 : 46 pips price range movement by EUR - Interest Rate news event :

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

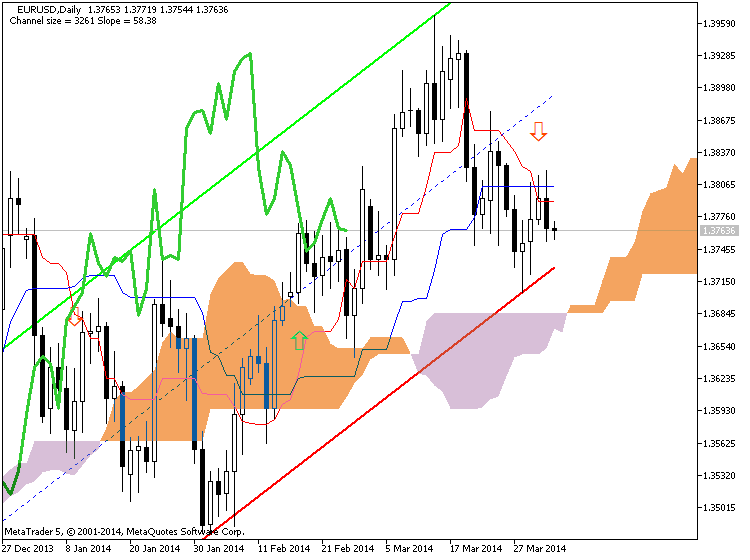

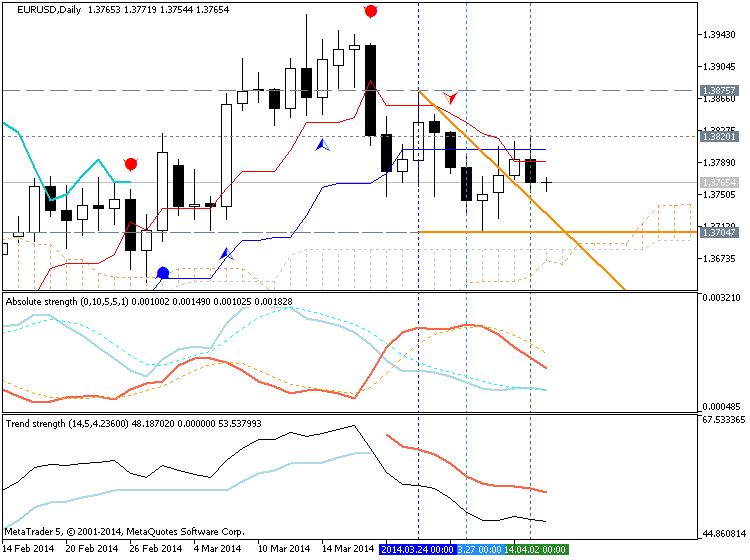

The correction within primary is still going on for D1 timeframe, and price is trying to break 1.3728 support level for the correction to be continuing. Chinkou Span line is trying to cross historical price from above to below on open bar for good breakdown.

If D1 price will break 1.3728 support level on close bar from above to below together with Chinkou Span line of Ichimoku indicator to be crossed with historical price so we may see good breakdown and the correction within the primary bullish to be continuing (good to open sell trade).If not so EURUSD D1 price will be on ranging market condition floating between 1.3704 support and 1.3875 resistance levels.

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2014-03-31 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - German Retail Sales]

2014-03-31 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - CPI Flash Estimate]

2014-03-31 13:45 GMT (or 15:45 MQ MT5 time) | [USD - Chicago PMI]

2014-03-31 13:55 GMT (or 15:55 MQ MT5 time) | [USD - Fed Chair Yellen Speech]

2014-04-01 01:00 GMT (or 03:00 MQ MT5 time) | [CNY - Manufacturing PMI]

2014-04-01 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Final Manufacturing PMI]

2014-04-01 07:15 GMT (or 09:15 MQ MT5 time) | [EUR - Spanish Manufacturing PMI]

2014-04-01 07:55 GMT (or 09:55 MQ MT5 time) | [EUR - German Unemployment Change]

2014-04-01 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - Unemployment Rate]

2014-04-01 14:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]

2014-04-02 07:00 GMT (or 09:00 MQ MT5 time) | [EUR - Spanish Unemployment Change]

2014-04-02 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - GDP]

2014-04-02 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - PPI]

2014-04-02 12:15 GMT (or 14:15 MQ MT5 time) | [USD - ADP Non-Farm Employment Change]

2014-04-03 01:00 GMT (or 03:00 MQ MT5 time) | [CNY - Non-Manufacturing PMI]

2014-04-03 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - Retail Sales]

2014-04-03 11:45 GMT (or 13:45 MQ MT5 time) | [EUR - Interest Rate]

2014-04-02 12:30 GMT (or 14:30 MQ MT5 time) | [EUR - ECB Press Conference]

2014-04-03 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Trade Balance]

2014-04-03 14:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Non-Manufacturing PMI]

2014-04-04 10:00 GMT (or 12:00 MQ MT5 time) | [EUR - German Factory Orders]

2014-04-04 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movementSUMMARY : bullish

TREND : correction

Intraday Chart