Elwave

This is a good topic, but i was expecting the software to be inclused this so one can really follow-up

This is a good topic, but i was expecting the software to be inclused this so one can really follow-up

It is a Copyright software. I cannot "include" the software and i am sure everybody know how to use a search engine like google.com or ask.com. I am using version 7.6 but the last version is v9.1.

...

Buying dip in an up trend or selling rally in a down trend is not completely chaotic. It is to my knowledge the best way to obtain higher then 50% accuracy in trading. But this is only half the equation. The exit is more difficult to pin point, since any pull back bring the trader in a state of fear and makes him get out the trade too early. For long this was my problem. Being able to hold on to a trade until optimal target is the answer to being a profitable trader. Now what time frame to trade is another part of the puzzle i have not yet been able to exactly answer. It is the time frame we fell the most comfortable trading in. It also depends on the spread paid, the leverage, the trading method used, and the ability the trader can distill all these parameter into a comfortable way to trade. This had become a very difficult task because of my lifestyle. I am a married father of two with a demanding job that live in the EST so i am sleeping during 2nd half of asian and the whole European session (too bad) and i am working during the new-york session. Any trading system that does not fit this lifestyle have to be excluded. So this exclude any kind of scalping. So i have to swing trade taking on trade during the first half of Asian session. Fixed target i need to take. But what can be hard is coming back home from work and see that your 100 pips target have been missed by a few pips and that your trade is now in the red. This happened to me more too often. Trailing stop does not work better.

Elliot wave trading was always something to consider since it let me trade the way i needed with fixed Stop and Target. It does not always work but it seems to beet the odds. The problem with Elliot Wave is that put 12 Elliotician in a room and none will come out with the same wave count. But apparently this is Okay! As long as the count is consistent, the odds of accuracy is positive. An Elliot wave software is a tool that greatly help keeping consistent since it is not affected by emotions and count the waves always the same way.

Kenneth have introduced me to Elwave witch is an Elliot Wave tools that i am learning to rely upon with already very interesting results on my account, efficiently being able to identify high risk/reward setups.

In order of keeping the focus on elwave, I am starting this new thread where i want the main subject being Elwave related. If there is enough interest we could post and compare our trades in this thread and support each other in the use of the Elliot wave principle, base on this software tool that is Elwave. My main language is French, so feel free to write in English or French and excuse me if i make errors in my post.

Elwave is a Copyright software. You can findALL

about it using Google.When I begun trading I went Ape over Elliott Wave principle only to make an Idiot out of myself using it for a few trades....

I am happy to see you have started a new thread on Elliott Wave using Elwave. You will have my support and be glad to help in any way, GreatYves. When it comes to trading (whether in stock market or forex), Elliott Wave Theory is my passion, having played around with both Elwave 6.2 and Advanced Get for several years, and even today I still regularly update myself on the EW Theory so that it becomes part of me.

Elwave is a great EW software, and I have no doubt through your analysis contributions and dedication, readers of this new thread will benefit in EW knowledge and hopefully also financially. Sharing your knowledge and experience with other members with similar EW interests will bring you an inner joy that money cannot buy. This was the personal satisfaction I had when I carried on the thread on Advanced Get that was left vacant by another member.

I hope it will not be too taxing on your working life.

My best wishes

Kenneth37

When I begun trading I went Ape over Elliott Wave principle only to make an Idiot out of myself using it for a few trades....

Where is the Ape?

I walk into the same problems as you. It is because that my EW interpretation was flawed and full of errors. I was relying on others interpretations as flawed as mine. Most people do the same errors, trying to apply EW to a single time frame/price movement. Not seeing the bigger picture, simply trying to guess an up or down move upon what they see over the time frame they used to trade. I don't say that your EW wasn't good, maybe you were just not enough persevering into that way, maybe you were risking too much of your account on any trade?

This is why that by using a software such as Elwave, with always the same settings, patiently waiting for proper setup, can only lead us to success. Human interpretation is not advisable unless one is really an expert at it. Witch i am not! This is what this thread is going to try to achieve, proving that methodically following a serious method will lead to succesfull results.

I will periodically propose my next trade base on an Elwave analysis. On the long run we shall all see if EW is a good method or not. If it is proven not profitable, i will abandon this methodology and will try something else, but i firmly believe it is a valid trading way on the long run.

Who knows maybe we will discover even better way to do on the long run but i want to start by this.

I am happy to see you have started a new thread on Elliott Wave using Elwave. You will have my support and be glad to help in any way, GreatYves. When it comes to trading (whether in stock market or forex), Elliott Wave Theory is my passion, having played around with both Elwave 6.2 and Advanced Get for several years, and even today I still regularly update myself on the EW Theory so that it becomes part of me.

Elwave is a great EW software, and I have no doubt through your analysis contributions and dedication, readers of this new thread will benefit in EW knowledge and hopefully also financially. Sharing your knowledge and experience with other members with similar EW interests will bring you an inner joy that money cannot buy. This was the personal satisfaction I had when I carried on the thread on Advanced Get that was left vacant by another member.

I hope it will not be too taxing on your working life.

My best wishes

Kenneth37Thank you Kenneth, without you i wouldn't even know about Elwave, i am honored that you wish to help me in this thread. As for my working life, i will keep at it as usual, i don't intend to go banana over this thread. I will mostly post my trade and keep track of them in a spread sheet, and if we can get some more dedicated to help i will be more then happy.

Ok, so far i haven't been trading Elwave's signals for a long time, but I have been successful at it. I had a tremendous first two week where i grow up my account 40% never risking more then 3% on any trade, then last week was 1 win and 2 loss but still i have grow my account another 8%. It's because i only take high Risk/Reward trade. And i must say that the 2 loss were due to my impatience in waiting the proper set.

I export hourly .CSV history files of all the pairs i have on my Mt4 demo account. Then the Scan Inspector module in Elwave analyze all of them and then Scan all the results so we can come up with the best pair(s) to trade. It is a simple process that should be done at least once a week to see which are the interesting pairs. After i re-analyze interesting pairs once a day to keep me updated.

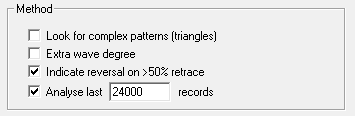

About the setting, In Options/Analisys i use these settings. In order that we all have same wave count, it is important that we all use exactly these setting. You may experiment with other settings but only those should be taken into account in this thread, until further notice.

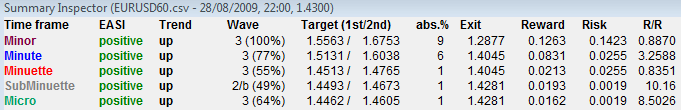

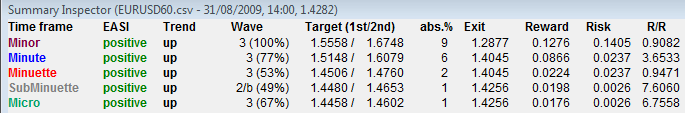

So this week i come up with 4 interesting pairs. USDCHF and USDMXN are bearish, AUDUSD and EURUSD are bullish.

EURUSD show even show 5 positive consecutive wave degrees! The Micro wave degree offer an interesting low risk high reward trade with stop at 4281 and target at 4462. See summary below.

So my intention is to enter this trade as soon as the spread get lower on my Oanda account with a 3% risk. My stop will be 5 pips lower at 4276 and TP1 at 4457.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Buying dip in an up trend or selling rally in a down trend is not completely chaotic. It is to my knowledge the best way to obtain higher then 50% accuracy in trading. But this is only half the equation. The exit is more difficult to pin point, since any pull back bring the trader in a state of fear and makes him get out the trade too early. For long this was my problem. Being able to hold on to a trade until optimal target is the answer to being a profitable trader. Now what time frame to trade is another part of the puzzle i have not yet been able to exactly answer. It is the time frame we fell the most comfortable trading in. It also depends on the spread paid, the leverage, the trading method used, and the ability the trader can distill all these parameter into a comfortable way to trade. This had become a very difficult task because of my lifestyle. I am a married father of two with a demanding job that live in the EST so i am sleeping during 2nd half of asian and the whole European session (too bad) and i am working during the new-york session. Any trading system that does not fit this lifestyle have to be excluded. So this exclude any kind of scalping. So i have to swing trade taking on trade during the first half of Asian session. Fixed target i need to take. But what can be hard is coming back home from work and see that your 100 pips target have been missed by a few pips and that your trade is now in the red. This happened to me more too often. Trailing stop does not work better.

Elliot wave trading was always something to consider since it let me trade the way i needed with fixed Stop and Target. It does not always work but it seems to beat the odds. The problem with Elliot Wave is that put 12 Elliotician in a room and none will come out with the same wave count. But apparently this is Okay! As long as the count is consistent, the odds of accuracy is positive. An Elliot wave software is a tool that greatly help keeping consistent since it is not affected by emotions and count the waves always the same way.

Kenneth have introduced me to Elwave witch is an Elliot Wave tools that i am learning to rely upon with already very interesting results on my demo account, efficiently being able to identify high risk/reward setups. I plan to seriously fund a live account (again)

only after having quadruple the demo account

. If i attain this objective, Elwave will become my main trading system for life. It is an experiment i want to seriously achieve here within this thread.

In order of keeping the focus on elwave, I am starting this new thread where i want the main subject being Elwave related. If there is enough interest we could post and compare our trades in this thread and support each other in the use of the Elliot wave principle, base on this software tool that is Elwave. My main language is French, so feel free to write in English or French and excuse me if i make errors in my post.

Elwave is a Copyright software. You can find

ALL

about it using Google.As per Jan 23 2011. Quadrupling an account have not been achieved. I am still evaluating Elwave but my focus is now somewhere else. I had some very interesting results in nov-dec 2010 (>100%) using mostly trendlines. Maybe i will elaborate on this later in a new thread.

Discretionary Forex Trading BLOG.