You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level. It's the primary gauge of consumer spending, which accounts for the majority of overall economic activity.

==========

U.S. Retail Sales Rebound Less Than Expected In March

After reporting lower U.S. retail sales for three straight months, the Commerce Department released a report on Tuesday showing that sales rebounded in the month of March.

The Commerce Department said retail sales climbed by 0.9 percent in March following a revised 0.5 percent decrease in February.

However, economists had been expecting sales to surge up by 1.1 percent compared to the 0.6 percent drop originally reported for the previous month.

Excluding a jump in sales by motor vehicle and parts dealers, retail sales rose by 0.4 percent in March after coming in unchanged in February. Ex-auto sales had been expected to rise by 0.6 percent.

EUR/USD falls to lowest level in three weeks (based on dailyfx article)

EUR/USD Strategy: Square

if actual > forecast (or previous data) = good for currency (for CNY in our case)

[CNY - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy. It's the broadest measure of economic activity and the primary gauge of the economy's health.

==========

China GDP Rises 7.0% On Year In Q1

China's gross domestic product expanded 7.0 percent on year in the first quarter of 2015, the National Bureau of Statistics said on Wednesday, coming in at 14,066.7 billion yuan.

The headline figure was in line with expectations while slowing from 7.3 percent in the previous three months.

On an annualized quarterly basis, GDP gained 1.3 percent - below expectations for 1.4 percent and down from 1.5 percent in the fourth quarter.

The value added of the primary industry was 777.0 billion yuan, up by 3.2 percent year-on-year; that of the secondary industry was 6,029.2 billion yuan, up 6.4 percent; and that of the tertiary industry was 7,260.5 billion yuan, up 7.9 percent.

The bureau added that industrial production gained just 5.6 percent on year in March - shy of forecasts for an increase of 7.0 percent and down from 7.9 percent in February. Output was up 0.25 percent on month.

Trading The ECB: Possible EUR/USD Reactions (based on efxnews article)

Dovish ECB to Fuel Bearish EUR/USD Outlook- 1.0500 in Focus (based on dailyfx article)

Trading the News: European Central Bank (ECB) Interest Rate Decision

The fresh batch of rhetoric coming out of the European Central Bank (ECB) may heighten the bearish sentiment surrounding the EUR/USD should President Mario Draghi endorse a dovish outlook for monetary policy

However, we may see growing speculation for a ‘taper tantrum’ in the euro-area should Mr. Draghi adopt a more upbeat tone for the region and talk down expectations for more non-standard measures as the recent developments coming out of the monetary union beat market forecasts.

Nevertheless, we may get more of the same from the ECB amid the series of positive data prints coming out of the euro-area, and the single-currency may face a more meaningful correction over the near-term should the central bank implement a more hawkish twist to the forward-guidance for monetary policy.

Bearish EUR Trade: ECB Stays on Course & Talks Down ‘Taper Tantrum’

Bullish EUR Trade: Governing Council Adopts Improved Outlook

if actual > forecast (or previous data) = good for currency (for CAD in our case)

[CAD - Overnight Rate] = Interest rate at which major financial institutions borrow and lend overnight funds between themselves. Short term interest rates are the paramount factor in currency valuation - traders look at most other indicators merely to predict how rates will change in the future.

==========

"The Bank of Canada today announced that it is maintaining its target for the overnight rate at 3/4 per cent. The Bank Rate is correspondingly 1 per cent and the deposit rate is 1/2 per cent.

Total CPI inflation is at 1 per cent, reflecting the drop in consumer energy prices. Core inflation has remained close to 2 per cent in recent months, as the temporary effects of sector-specific factors and pass-through of the lower Canadian dollar have offset the disinflationary forces from slack in the economy.

The Bank expects global growth to strengthen and average 3 1/2 per cent per year over 2015-17, in line with the projection in the January Monetary Policy Report (MPR). This is in part because many central banks have eased monetary policies in recent months to counter persistent slack and low inflation, as well as the effect of lower commodity prices in some cases. At the same time, economies continue to adjust to lower oil prices, which have fluctuated at or below levels assumed in the January MPR. Strong growth in the United States is expected to resume in the second quarter of 2015 after a weak first quarter".

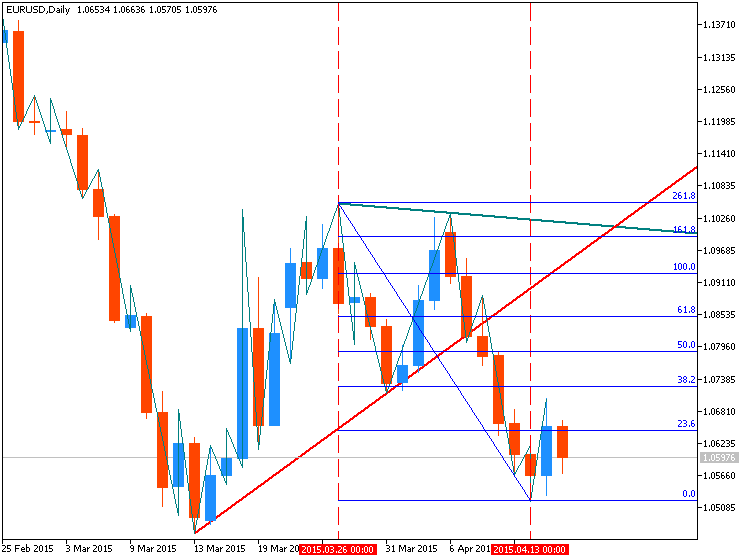

EURUSD ECB Support and Resistance Update (based on dailyfx article)

The EURUSD has opened the day moving towards support in early London trading. However, despite the ECB holding its banking rate announcement today, the pair has yet to breakout. Currently price is found near range support at the S3 Camarilla pivot near 1.0606. In the event that price remains supported, traders will begin to look for a bounce in price towards levels of resistance, including the R3 pivot found today at a price of 1.0702.

Despite price opening inside of a 96 pip range, statements from the ECB still have the ability to progress price to a breakout point. A EURUSD decline below the S4 pivot at 1.0557 would suggest a return to USD strength and raise the possibility of the creation of future lower lows. Conversely, if price moves back through its trading range, and breaches the R4 pivot at 1.0751, this would open the market for a potentially broader bullish move.

EUR/USD: Temp Bounce; Parity Call Still Intact For Q3 (based on efxnews article)

President Draghi continued to distance himself from verbally jawboning the EUR, continued to rule out another rate cut, continued to say the ECB is rule-based when asked how long they can support Greece, said he saw no signs of a bond bubble, and continued to avoid saying anything to suggest tapering is a concept they have even thought about at this stage, notes TD.

"So overall, the ECB continues to be optimistic on the impact of its measures and likes the improvement it is seeing in the data and lending surveys, but not enough to significantly shift their overall message. There was no mention of a review to broaden the assets eligible for SSA purchases, but this may still follow in the non-policy meeting later this month," TD adds.

"Overall, this provided minor support to both fixed income (no bubble means buy bonds) and EURUSD (uncertain passthrough of weaker currency to inflation means maybe weaker EURUSD doesn’t help), TD argues.

"Nothing here changes our view that bunds should continue to trade in a range capped at around 30bps for the next 3-6 months and EURUSD should trade below parity by 2015Q3," TD projects.

AUDIO - Traveling The World with Brandon Wendell

The Road Warrior, Brandon Wendell joins Merlin for a look at his recent classes, travels, and more importantly. Trading! Merlin and Brandon answer several questions that relating to the Euro and specific trade setups on the Euro, Swiss Franc, and US Dollar. Brandon also talks about his All Asset Class Mastery XLT as well.

if actual < forecast (or previous data) = good for currency (for AUD in our case)

[AUD - Unemployment Rate] = Percentage of the total work force that is unemployed and actively seeking employment during the previous month. Although it's generally viewed as a lagging indicator, the number of unemployed people is an important signal of overall economic health because consumer spending is highly correlated with labor-market conditions.

==========

Australia March Jobless Rate Falls To 6.1%

"The unemployment rate in Australia came in at a seasonally adjusted 6.1 percent in March, the Australian Bureau of Statistics said on Thursday.

That beat forecasts for 6.3 percent, which would have been unchanged from the February reading.

The Australia economy added 37,700 jobs in March to 11,720,300 - also beating expectations for adding 15,000 following the gain of 15,600 jobs in the previous month."