You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

NFP Expectations for April (based on dailyfx article)

- NFP is historically a volatile event

- Last month’s miss caused the EURUSD to decline over 118 pips

- Expectations for this Friday sit at 248k

NFP (Non-Farm Payrolls) figures are released monthly and is one of the markets most highly anticipated events. This event tracks monthly changes in employment in the United States, and gives traders a glimpse into the health of the economy. Also, it should not be overlooked that the FED (Federal Reserve) looks to these employment numbers to influence their decisions regarding monetary policy.Below we can see a series of the 12 previous NFP totals graphically displayed. While these numbers have been mixed, it is important to see what effects they can have on the Forex market. So how can NFP affect the market, and what are the expectations for Friday’s event?

The previous NFP event transpired last month on March 6th. To review, expectations were set at 235k, but on release the figures surprised the market. As seen in the graph above, the total amount of new jobs outside of the agricultural sector came in at 293k. This beat of expectations quickly drove traders to accumulate the US Dollar against the majority of major currencies.

Below we can see the price action for the EURUSD during the March NFP event using a 30 minute chart. Immediately after the announcement, prices formed a new lower high for the week at 1.0988. This rise in price only lasted seconds, as traders began to accumulate US Dollars on the news. This caused prices to drop as much as 118 pips over the next 30 minutes. Not only did the EURUSD decline for the day, this event caused the EURUSD to continue its trend and form a new monthly low in the following trading week.

So what can we expect for Fridays trading?

The next NFP event is set for this Friday April, 3rd at 8:30 am New York time. After reviewing last month’s release, it makes sense for traders to be on their guard for unexpected volatility at this time. Currently expectations are set for 248k. Traders should primarily focus on whether or not NFP beats or misses expectations. By using last month as a model, a beat above expectations could cause another major US Dollar rally. Conversely, if prices miss expectations, it could signal a sell off for the US Dollar against other Major G8 currencies.

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2015.04.03

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 143 pips price movement by USD - Non-Farm Employment Change news event

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2015.04.03

MetaQuotes Software Corp., MetaTrader 5

GBPUSD M5: 112 pips price movement by USD - Non-Farm Employment Change news event

MetaTrader Trading Platform Screenshots

USDJPY, M5, 2015.04.03

MetaQuotes Software Corp., MetaTrader 5

USDJPY M5: 119 pips price movement by USD - Non-Farm Employment Change news event

MetaTrader Trading Platform Screenshots

USDCHF, M5, 2015.04.03

MetaQuotes Software Corp., MetaTrader 5

USDCHF M5: 107 pips price movement by USD - Non-Farm Employment Change news event

EURUSD falls on better US data but finds support (based on forexlive article)

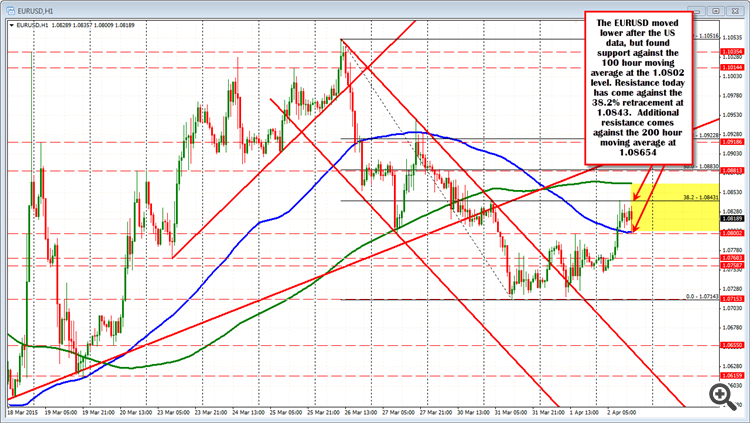

The EURUSD is down testing the 100 hour moving average (at 1.0802) after the better-than-expected US trade data and weekly initial jobless claims.

The pair is nevertheless finding support buyers against the 100 hour moving average (blue line in the chart above at 1.0802).In the earlier rally today, the pair held resistance against the 38.2% retracement of the move down from the January 25 high to the low reached on Tuesday. That level comes in at 1.0843 and that was the high price for trading today.

With the pair trading between support and resistance from a technical perspective, I would expect that the market will simply lean against the level with stops on breaks. On a move higher the next target will look toward the 200 hour MA ( green line in the chart above). That level comes in at 1.08654 currently.

On a move lower, the 1.0759 – 68 area will be eyed. The 1.0768 level was the spring low going back to March 23. The 1.0759 level was the low going way back to September 2003 (a blast from the past).

Long time banking professor and Austrian economist, Patrick Barron joins Merlin Rothfeld and John O’Donnell for a look at the deterioration situation going on in Europe. Professor Barron sees some radical changes facing the EU, some which he is all but guaranteeing will happen over time! What does this mean for your long term holdings? Tune in and find out.

Forex Weekly Outlook April 6-10 (based on forexcrunch article)

The US dollar had a rough week, making gains in Q1 but erasing them in the wake of Q2, especially towards the end. US ISM Non-Manufacturing PMI, rate decision in Australia, Japan and the UK, FOMC Meeting Minutes, US unemployment claims, Canadian employment data are the major market movers on Forex calendar. Here is an outlook on the highlights of this week.

Initial good figures and end-of-quarter adjustments helped the greenback. However, the US Non-Farm Payrolls missed expectations with a smaller than expected job addition of 126,000 in March, much worse than expected and coupled with downwards revisions. The rise in wages and the drop in the “real unemployment rate” didn’t compensate. While some blame the weather and say it is a one-off, others see the weak economy finally hitting jobs. In the euro-zone, the Greek issues still weigh, while politics also impact the pound. The fall in commodity prices hit the Aussie but the loonie was resilient in the face of the deal with Iran, which could hurt oil prices. What’s next after Easter?

EURUSD Technical Analysis (based on dailyfx article)

AUDUSD Technical Analysis (based on dailyfx article)

GBPUSD Technical Analysis (based on dailyfx article)

US Dollar Fundamentals (based on dailyfx article)

Fundamental Forecast for Dollar: Bearish

There is little doubt that the US Dollar maintains a fundamental advantage over most of its counterparts. However, that doesn’t make the currency immune to periodic speculative rebalancing. Following a record, nine consecutive months of advance (by the ICE Dollar Index’s and EURUSD’s ccount); the currency has stumbled for three straight weeks. Consolidation itself wouldn’t pose a serious concern as periods of respite are common as larger trends unfold. Yet, the market’s speculative appetite for the curency’s run may have over-reached the more modest fundamental means. With the market’s interest in FOMC timing intensified and the broader market pulling back on over-leveraged positions, the Greenback is at increased risk of a meaningful correction.

If we were to rank the fundamental themes that have proven the most influential for establishing direction and feeding momentum in the currency market, relative monetary policy would lead the pack by a wide margin. With the Fed closing the tap on its QE efforts – now just reinvesting capital from maturing assets – and weighing a time frame for a first rate hike, the Dollar is heading in the opposite direction to some of its most liquid counterparts. Whether the eventual rate hike is June, September or December; the US central bank remains on course to tighten where most others are easing. That said, throttling back on the hawkish march may still require the bullish crowd to pull back on their exposure.

This past week, the economic docket delivered the perfect mix of labor data to mirror a view of a Dollar supported by an underlying trend but perhaps stretched by speculation. In the Bureau of Labor Statistics’ March report, the principal statistics supported the trend of improvement these past years. The unemployment rate held at its 7-year low 5.5 percent and wage growth firmed modestly to a 2.1 percent clip. Yet, the statistic that stands out was the 126,000-payroll figure that was nearly half the forecast. While a miss – even of that magnitude – will not change the fundamental trend of employment, it does temper its tempo.

Given a heightened sensitivity to the timing of the first rate hike after the FOMC withdrew its verbal buffer on discussing the shift (the market associated the term ‘patient’ as a 3 month freeze on tightening), this miss has not gone unnoticed. While the Dollar dropped in wake of the news, the critical levels (the USDollar’s trend channel, 1.1000 for EURUSD, 1.5000 for GBPUSD, etc) still stood. Holiday liquidity conditions likely contributed to that hold, but the unfavorable turn will not be forgotten over the weekend. When the speculative pool fills back out next week, investors will reevaluate their valuation for the Greenback.

When weighing the Dollar’s fundamental advantage, we should consider the surveys and assets that establish expectations. The FOMC did lower their year-end forecast for interest rates last month, but that outlook still stood at a premium to the market’s expectations. After the NFPs release, the December Fed Fund futures contract (an instrument used to hedge interest rate changes) dropped to its lowest closing basis in the contract’s life – and tipping the market’s confidence below a certainty that at least once hike will be realized in 2015. At the same time, two-year Tresaury yields dropped 11.7 percent.

It is difficult to establish at what level the Dollar’s rally has over-reached its fair value as the Fed’s timetable contrasts its ECB and BoJ peers so definitively. However, there are speculative measures that may offer scale to the market’s appetite to exploit a consistent trend rather than follow due diligence on fundamental value. We have seen the US Dollar’s net speculative futures positions measured by the CFTC’s COT report soar these past 9 months. Having seen the Greenback position level out and some major counterparts (like Yen and Aussie dollar) rebound, we are seeing early stages of rebalancing. This is not unique to the Dollar nor just the FX market. Speculative excess is seen in most markets; and if deleveraging takes traction, the Dollar could suffer as well…until we hit panic levels.

USDJPY Fundamentals (based on dailyfx article)

Fundamental Forecast for Japanese Yen: Neutral

The Bank of Japan (BoJ) interest rate decision may heighten the appeal of the Japanese Yen and spur a further decline in USD/JPY should Governor Haruhiko Kuroda continue to endorse a wait-and-see approach following the April 8 meeting.

It seems as though the BoJ will preserve its current policy stance throughout the first-half of 2015 in light of the recent rhetoric from Mr. Kuroda, and the central bank head may largely retain his pledge to achieve the 2% inflation target over the policy horizon especially as the committee sees the downward pressures from the sales-tax hike dissipating.

However, the BoJ appears to be under increased pressure to further embark on its easing cycle as Kozo Yamamoto, an advisor to Prime Minister Shinzo Abe, argues that ‘further monetary easing is absolutely essential’ to combat the downside risks surrounding the Japanese economy and insists that the central bank should offer additional monetary support at the April 30 meeting. As a result, a material shift in the forward-guidance for monetary policy may highlight a growing dissent within the central bank and dampen bets for a further decline in the exchange rate as its U.S. counterpart, the Federal Reserve, remains on course to normalize monetary policy in 2015.

In turn, more of the same from the BoJ may generate a larger correction in USD/JPY and the pullback from 120.35 may open the door for a test of the March Low (118.32) into the 61.8% Fibonacci retracement (118.20) as the pair carves a series of lower-highs in March. At the same time, we will also keep a close eye on the monthly opening range going into the first full week of April as full market participation returns on Tuesday following the extended holiday weekend, and the recent wave of U.S. dollar weakness may continue to take shape next week as the dismal data prints dampens bets for a mid-2015 Fed rate hike.

GBPUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for British Pound: Bearish

The British Pound finished the week almost exactly where it began, first falling versus the US Dollar until a sharp USD sell-off sent the GBP/USD through key levels. A relatively quiet week ahead may produce much of the same absent a surprise from a Bank of England policy meeting.

Traders look to an upcoming Bank of England Monetary Policy Committee meeting for any surprises, but low FX volatility prices suggest few expect officials will make changes to policy or release a post-meeting statement. Economic releases will be limited to UK Markit PMI figures, Trade Balance data, and Industrial Production growth reports. It would take a material surprises out of any of these reports to force a meaningful reaction across GBP pairs.

Markets remain indecisive as we’re now just a month away from the UK General Election, and current polling shows no single party is likely to take an overall majority following the May 7 vote. In effect, the United Kingdom could remain without an effective government for six weeks. The British Pound is likely to suffer amidst such uncertainty.

Derivatives show that FX options traders are paying a substantial premium for bets on/hedges against GBP/USD weakness in two months’ time—the exact timeframe for the post-election uncertainty. And indeed, risks seem weighed to the downside for the British Pound through the foreseeable future. A recent US Dollar sell-off has kept the GBP/USD above key support, but the UK currency may continue to underperform against broader G10 counterparts.