You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

USD/CAD Intra-Day Fundamentals: Canadian International Merchandise Trade and 76 pips price movement

2016-05-04 12:30 GMT | [CAD - Trade Balance]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - Trade Balance] = Difference in value between imported and exported goods during the reported month.

==========

==========

USD/CAD M5: 76 pips price movement by Canadian International Merchandise Trade news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.05.04 13:36

Trading the News: ISM Non-Manufacturing (based on the article)...

EUR/USD M5: 35 pips price movement by ISM Non-Manufacturing PMI news event :

Crude Oil Intra-Day Price Action Analysis - breakdown with the bearish reversal in the near future

2016-05-04 14:30 GMT | [USD - Crude Oil Inventories]

[USD - Crude Oil Inventories] = Change in the number of barrels of crude oil held in inventory by commercial firms during the past week.

==========

"U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 2.8 million barrels from the previous week. At 543.4 million barrels, U.S. crude oil inventories are at historically high levels for this time of year."

==========

Crude Oil M5: bearish breakdown reversal. The price broke 200 SMA/100 SMA to below to be reversed from the primary bullish to the primary bearish market condition. The price was bounced from 44.61 support level for the ranging bearish within 45.14 resistance and 44.61 levels waiting for the primary bearish trend to be continuing.

==========

Crude Oil H4: ranging bullish. The price is located above 200 period SMA (200 SMA) for the bullosh condition and near 100 period SMA 9100 SMA) for the secondary ranging within 44.60 support level and 45.99 resistance level. The level for the bullish trend continuation without ranging is 48.25, and the level for the bearish reversal is 42.53 which is the value of 200 SMA for now.

SUMMARY : bullish

TREND : rangingAUD/USD Intra-Day Fundamentals: Australian Trade Balance and 19 pips price movement

2016-05-05 01:30 GMT | [AUD - Trade Balance]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Trade Balance] = Difference in value between imported and exported goods and services during the reported month.

==========

==========

AUD/USD M5: 19 pips price movement by Australian Trade Balance news event :

Crude Oil Forecast: daily bullish reversal, weekly bear market rally (based on the article)

"The Support Zone in focus after Thursday’s blast-off is the Wednesday low at $43.20. Wednesday's low is above the next level of support by ~$0.70 barrel at $42.48, which is the April 26 low that printed before pushing up to $46.75 to close the month. Below $42.48, there could be a quick drop to the 200-DMA, which would take a strong move lower down to ~$40/bbl. Given the significance of the Intermarket factors that have shifted since Oil broke above $40/ 200-DMA, only a move below there would change my bullish model."

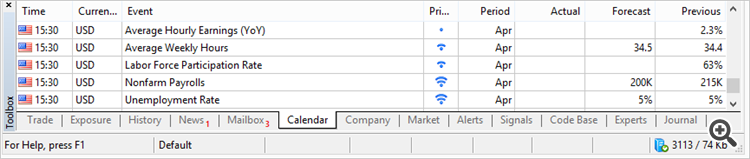

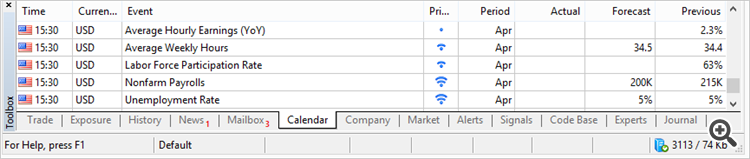

Trading the News: U.S. Non-Farm Payrolls (based on the article)

What’s Expected:

Why Is This Event Important:

With the U.S. economy approaching ‘full-employment,’ a further improvement in the labor market paired with signs of stronger wage growth may put increased pressure on the Federal Open Market Committee (FOMC) to raise the benchmark interest rate at the next quarterly meeting in June as the central bank risks falling behind the curve.

Nevertheless, waning business confidence along with the slowdown in household consumption may prompt U.S. firms to scale back on hiring, and a dismal employment report may drag on the U.S. dollar as market participants push out bets for higher borrowing-costs.

How To Trade This Event Risk

Bullish USD Trade: NFP Expands 200K+, Jobless Rate Narrows

- Need red, five-minute candle following the NFP print to consider a short trade on EUR/USD.

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bearish USD Trade: U.S Employment Report Falls Short of Market Expectations- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same setup as the bullish dollar trade, just in the opposite direction.

Potential Price Targets For The ReleaseEURUSD Daily

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.05.06 12:01

Trading the News: U.S. Non-Farm Payrolls (based on the article)

What’s Expected:

Why Is This Event Important:

With the U.S. economy approaching ‘full-employment,’ a further improvement in the labor market paired with signs of stronger wage growth may put increased pressure on the Federal Open Market Committee (FOMC) to raise the benchmark interest rate at the next quarterly meeting in June as the central bank risks falling behind the curve.

Nevertheless, waning business confidence along with the slowdown in household consumption may prompt U.S. firms to scale back on hiring, and a dismal employment report may drag on the U.S. dollar as market participants push out bets for higher borrowing-costs.

How To Trade This Event Risk

Bullish USD Trade: NFP Expands 200K+, Jobless Rate Narrows

- Need red, five-minute candle following the NFP print to consider a short trade on EUR/USD.

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bearish USD Trade: U.S Employment Report Falls Short of Market Expectations- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same setup as the bullish dollar trade, just in the opposite direction.

Potential Price Targets For The ReleaseEURUSD Daily

EUR/USD M5: 75 pips range price movement by Non-Farm Employment Change news event :

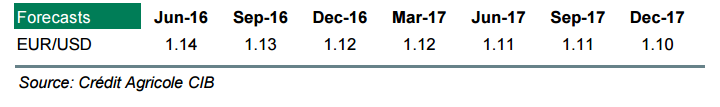

EUR: Gentle Downtrend; AUD: New Targets - Credit Agricole (based on the article)

EUR:

AUD:

Week Ahead: Dollar Index Technical Analysis - daily ranging bearish, weekly ranging near reversal; what's next? (based on the article)

---

Daily price is located below SMA with period 100 (100 SMA) and SMA with the period 200 (200 SMA) for the bearish market condition: the price is ranging within 91.92 support level and 94.81 resistance level with RSI indicator estimating the ranging bearish trend to be continuing in the near future. Bullish reversal resistance level is 96.40, and if the price breaks this level to above so the reversal of the price movement to the primary bullish market condition will be started.

---

Weekly price is on secondary correction within the primary bullish trend: the price is testing 93.01 support level together with 100 SMA to below on close weekly bar for the secondary correction to be continuing and with 82.51 as the next bearish reversal target. But if the price breaks 100.51 resistance to above on close weekly bar so the primary bullish trend will be continuing, otherwise - ranging near reversal levels.

Forex Weekly Outlook May 9-13 (based on the article)

Graeme Wheeler’s speech, US Crude Oil Inventories, rate decision, Mark Carney’s speech, US Unemployment Claims, Retail sales, Producer Prices and consumer sentiment. These are the main events on Forex calendar.