You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Week Ahead: Economic Data, Financial Sector Earnings, Wells Fargo, Crude Oil (based on the article)

"On the earnings front, the focus is likely to be on the big financial stocks, with JP Morgan Chase reporting before the open on Wednesday; Wells Fargo WFC reporting before the open on Thursday, and Citigroup reporting before the open Friday."

"Oil Up? Stocks Rise Too. After searching for a catalyst earlier last week, the stock market seemed to find one on Friday: Oil. The stock market has been correlated closely with oil most of this year, and some of the strength we saw in equities Friday came in part from rising oil prices. Energy stocks were among the leaders, up more than 1.8% by midday Friday. Oil again could be a big factor in the coming week, and it will be interesting to see what the government says about U.S. stockpiles in its weekly supply report Wednesday as the U.S. heads into the spring and summer driving season. There’s also the planned April 17 supplier meeting, when we’ll find out if key OPEC and non-OPEC suppliers can agree on a production freeze."

Weekly price - as we see from the chart above, the price is on bullish breakout by breaking Ichimoku cloud to be reversed from the primary bearish to the primary bullish market condition. if the price breaks 2074.79 resistance level to 2116.27 target so the bullish breakout will be continuing. Bearish reversal level is 1928.04 so if the price breaks this level to below so the bearish trend will be started on this timeframe.

Daily price is on bullish trend located far above Ichimoku cloud: the price is ranging within the following narrow s/r levels: 2074.79 bullish resistance level and 2027.09 support level. If the price breaks 2074.79 so the bullish trend will be continuing, if the price breaks 2027.09 support level to below so the secondary correction within the primary bullish trend will be started.

H4 price is on ranging correction within the primary bullish market condition: the price is breaking symmetric triangle pattern to below for the secondary correction to be continuing with 2027.09 support level as the bearish reversal target.

AUD/USD Intra-Day Fundamentals: Australian Home Loans and 42 pips price movement

2016-04-11 01:30 GMT | [AUD - Home Loans]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Home Loans] = Change in the number of new loans granted for owner-occupied homes.

==========

==========

AUD/USD M5: 42 pips price movement by Australian Home Loans news event :

Forecast of Forecasters: the long-term forecasts for the banks shares prices (related to the banks which are making a long-term forex forecasts).

Many people know the banks which are making forecast for forex (for example - here). Those are very significal financial instituations, they are very well-known banks:

So, let's evaluate their shares - bearish or bullish?

=======

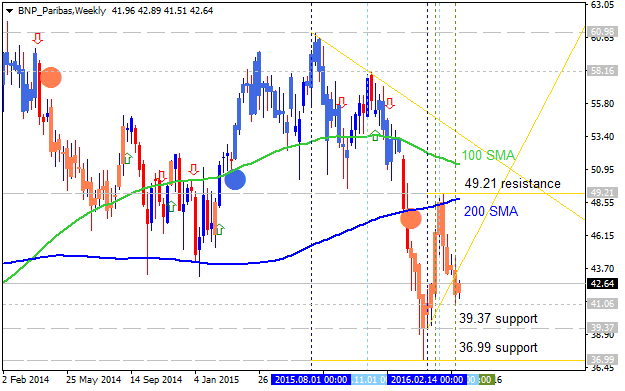

BNP Paribas: Long-term bearish condition with the secondary ranging. The shares price is located below 100/200 SMA ranging reversal area for the primary bearish market condition. The reversal resistance is located at 41.21 which is very far from the market price for now so the most likely scenarios are the following: the price breaks 39.37 support for the bearish trend to be continuing with 36.99 target, or the ranging bearish trend will be continuing.

=======

Commerzbank: Long-term bearish near ranging bullish reversal area. The price is located near and below 200 period SMA for the bearish market condition. Price is ranging within narrow s/r reversal levels: 6.21 support level for the bearish trend to be continuing, and 8.65 resistance level for the bullish reversal to be started. Symmetric triangle pattern was formed by the price to be crossed for direction, and RSI indicator is estimating the ranging bearish condition in the long term situation for the future.

=======

Deutsche Bank: Deep bearish in the long-term. Price is located far below 100 SMA/200 SMA reversal area on the weekly chart with descending triangle pattern to be formed for the bearish trend to be continuing. The most likely scenario is the support level at 13.04 to be broken to below, other wise the price will continuing with ranging within the primary bearish market condition. By the way, the bullish reversal resistance level is located at 18.83 which is too far from the market price and it makes the bullish reversal to be unlikely in 2016 for example.

=======

The Royal Bank of Scotland: Deep long-term bearish. The price is located to be far below 100/200 SMA reversal area with 204.18 support level to be testing for the bearish trend to be continuing. Bullish reversal resistance level is located at 260.73 which is too far for the price to be reversed to the primary bullish condition in this year for example.=======

Bank of America Merrill Lynch: Long-term ranging bearish. The shares price is located below 100/200 SMA area for the primary bearish market condition. The bearish breakdown was started on the weekly open price with support level at 12.73 to be testing for the bearish trend to be continuing with 10.97 level as the next bearish target.=======

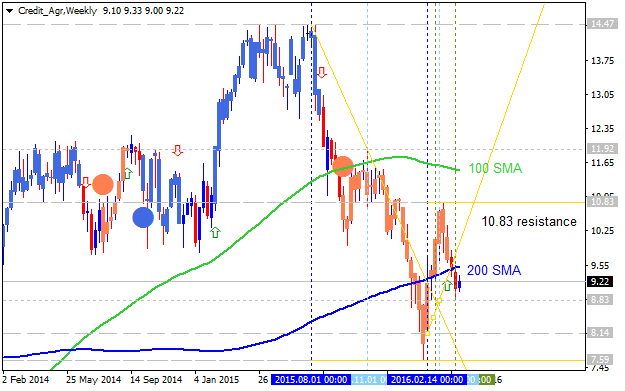

Credit Agricole: bearish reversal. The shares price is on the bearish reversal by breaking 200 SMA to below. If the price breaks 8.83 support on close weekly bar so the bearish trend will be started, if the price breaks 10.83 resistance level to above so the price will be reversed back to the bullish market condition.=======

ANZ Bank: Long-term bearish breakdown. The price is on bearish breakdown by breaking 21.99 support level for the bearish trend to be continuing. The 100/200 SMA bullish reversal area is located to be too far for the price which makes the bullish reversal to be unlikely during this year.=======

EUR/USD Intra-Day Fundamentals: Federal Reserve Bank of New York President William Dudley speech and 49 pips price movement

2016-04-11 13:25 GMT | [USD - FOMC Member Dudley Speaks]

[USD - FOMC Member Dudley Speaks] = to speak about community development at the Association for Neighborhood and Housing Development's annual conference.

==========

"The Federal Reserve has the twin objectives of maximum sustainable employment and price stability. Achieving the first of our objectives requires that every individual has the opportunity to achieve her full potential in life. Where you happen to be born should not determine your chance of living the American Dream. Research is highlighting possible key determinants of economic opportunity and income mobility. More research is necessary to inform future policy choices in this critical area."

==========

EUR/USD M5: 49 pips price movement by Federal Reserve Bank of New York President William Dudley speech news event :

AUD/USD Intra-Day Fundamentals: NAB Business Confidence and 30 pips price movement

2016-04-12 01:30 GMT | [AUD - NAB Business Confidence]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - NAB Business Confidence] = Level of a diffusion index based on surveyed businesses, excluding the farming industry.

==========

"The latest Survey provides strong evidence that the Australian business environment has not only weathered global uncertainties, but appears to have strengthened. There are also signs that the non-mining recovery is becoming a little more broad-based. Consequently, our outlook for the economy remains fundamentally unchanged, with no more cash rate cuts expected, although recent statements from the RBA reinforced the point that were the non-mining sector to show any signs of weakening, lower inflation and AUD strength has increased the RBA’s willingness to lower rates."==========

AUD/USD M5: 30 pips price movement by NAB Business Confidence news event :

What’s Expected:

Why Is This Event Important:

-

"Even though the Monetary Policy Committee (MPC) is widely expected to

preserve the record-low interest rate ahead of the U.K. Referendum in

June, heightening price pressures may prompt Governor Mark Carney to

adopt a more hawkish tone over the coming months as the BoE sees a risk

of overshooting the 2% inflation-target over the policy horizon."

-

"Nevertheless, U.K. firms may increase their efforts to draw domestic

demand amid the slowdown in private-sector lending accompanied by the

weakening outlook for the global economy, and a soft inflation report

may spur a near-term selloff in the sterling as market participants push

out bets for a BoE rate-hike."

How To Trade This Event RiskBullish GBP Trade: Headline & Core Inflation Upticks in March

- Need green, five-minute candle following the print to consider a long GBP/USD trade.

- If market reaction favors buying sterling, long GBP/USD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bearish GBP Trade: U.K. CPI Report Falls Short of Market Expectations- Need red, five-minute candle to favor a short GBP/USD trade.

- Implement same setup as the bullish British Pound trade, just in reverse.

Potential Price Targets For The ReleaseForum on trading, automated trading systems and testing trading strategies

Forecast for Q2'16 - levels for GBP/USD

Sergey Golubev, 2016.04.08 11:19

GBP/USD M5: pips price movement by U.K. CPI news event :

IMF Lowers 2016 Global Growth Forecast (based on the article)

The International Monetary Fund cut the global economic growth forecast for this year to 3.2 percent from 3.4 percent projected in January. "Lower growth means less room for error," IMF Economic Counsellor and Director of Research Maurice Obstfeld said. "Persistent slow growth has scarring effects that themselves reduce potential output and with it, demand and investment."

"If national policymakers were to clearly recognize the risks they jointly face and act together to prepare for them, the positive effects on global confidence could be substantial," Obstfeld added.

EUR/USD Intra-Day Fundamentals: U.S. Federal Budget Balance and 26 pips price movement

2016-04-12 18:00 GMT | [USD - Federal Budget Balance]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Federal Budget Balance] = Difference in value between the federal government's income and spending during the previous month.

==========

EUR/USD M5: 26 pips price movement by Federal Budget Balance news event :

AUD/USD Intra-Day Fundamentals: Westpac-Melbourne Institute Consumer Sentiment and 18 pips price movement

2016-04-13 00:30 GMT | [AUD - Westpac Consumer Sentiment]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Westpac Consumer Sentiment] = Change in the level of a diffusion index based on surveyed consumers.

==========

It's hard to stay ahead of the markets, which is why Westpac Chief Economist Bill Evans and his team produce this bite-sized roundup of the week's economic news and events, with clear analysis and insight plus the outlook for the week ahead. It's all you need to stay one step in front.==========

AUD/USD M5: 18 pips price movement by Westpac-Melbourne Institute Consumer Sentiment news event :