You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

NZD/USD Intra-Day Fundamentals: RBNZ Inflation Expectations and 28 pips price movement

2016-05-17 03:00 GMT | [NZD - Inflation Expectations]

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[NZD - Inflation Expectations] = Percentage that business managers expect the price of goods and services to change annually during the next 2 years.

==========

Expectations for the next two year edged up to 1.64 percent from 1.63 percent the previous survey. The survey was conducted by the Nielsen Company for the RBNZ.

==========

NZD/USD M5: 28 pips price movement by RBNZ Inflation Expectations news event :

What’s Expected:

Even though Fed officials see scope for two rate-hikes in 2016, signs of a slower-than-expected recovery may push the Federal Open Market Committee (FOMC) to further delay the normalization cycle amid the external risks surrounding the real economy.

How To Trade This Event Risk

EURUSD M5 timeframe

M5 price is located to be above 100 SMA/200 SMA reversal area for the bullish market condition. The price is in ranging within the following key s/r levels:

RSI indicator is estimating the ranging condition to be started.

If the price will break Fibo support level at 1.1310 on close bar so we may see the reversal of the intra-day price movement to the primary bearish market condition.

If the price will break Fibo resistance level at 1.1339 on close bar from below to above so the bullish trend will be continuing.

If not so the price will be on ranging within the levels.

GBP/USD Intra-Day Fundamentals: U.K. Consumer Price Index and 38 pips price movement

2016-05-17 08:30 GMT | [GBP - CPI]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - CPI] = Change in the price of goods and services purchased by consumers.

==========

==========

GBP/USD M5: 38 pips price movement by U.K. Consumer Price Index news event :

EUR/USD Intra-Day Fundamentals: U.S. Consumer Price Index and 14 pips price movement

2016-05-17 12:30 GMT | [USD - CPI]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CPI] = Change in the price of goods and services purchased by consumers.

==========

"The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent in April on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 1.1 percent before seasonal adjustment."

==========

EUR/USD M5: 14 pips price movement by U.S. Consumer Price Index news event :

NZD/USD Intra-Day Fundamentals: NZ Producer Price Index Input and 10 pips price movement

2016-05-17 22:45 GMT | [NZD - PPI Input]

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[NZD - PPI Input] = Change in the price of goods and raw materials purchased by manufacturers.

==========

==========

NZD/USD M5: 10 pips price movement by RBNZ Inflation Expectations news event :

USD/JPY Intra-Day Fundamentals: Japan Gross Domestic Product and 42 pips price movement

2016-05-17 23:50 GMT | [JPY - GDP]

if actual > forecast (or previous one) = good for currency (for JPY in our case)

[JPY - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

Japan's gross domestic product jumped 0.4 percent on quarter in the first quarter of 2016.

==========

USD/JPY M5: 42 pips price movement by Japan Gross Domestic Product news event :

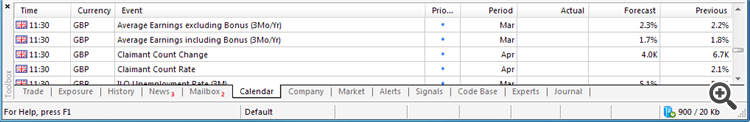

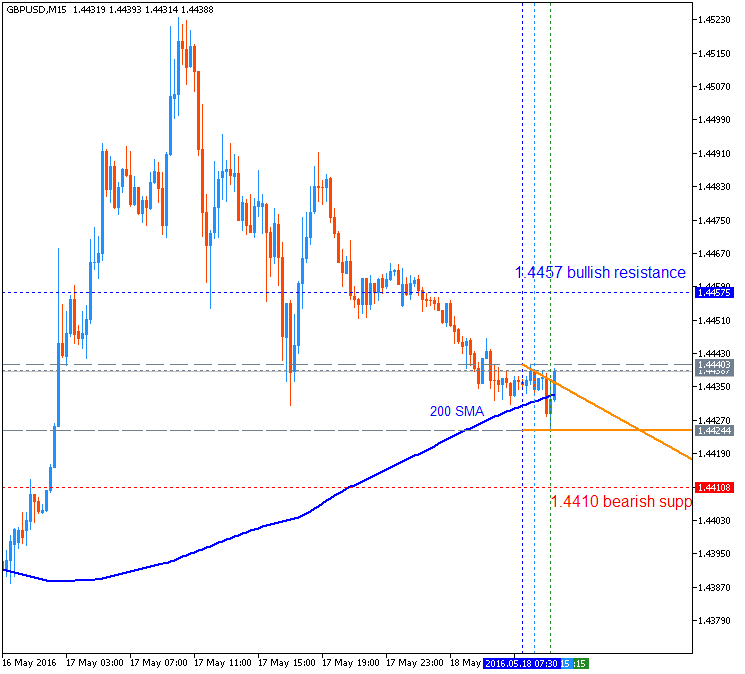

Trading the News: U.K. Jobless Claims Change (based on the article)

What’s Expected:

Why Is This Event Important:

The BoE looks poised to retain its current policy ahead of the U.K. Referendum on June 23, but the central bank may show a greater willingness to remove the record-low interest rate over the coming months as Governor Mark Carney and Co. remain adamant that the next move will be to implement higher borrow-costs.

How To Trade This Event Risk

Bearish GBP Trade: U.K. Employment Report Disappoints

- Need red, five-minute candle following the print to consider a short GBP/USD trade.

- If market reaction favors selling sterling, short GBP/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bullish GBP Trade: Job/Wage Growth Exceed Market Forecast- Need green, five-minute candle to favor a long GBP/USD trade.

- Implement same setup as the bearish British Pound trade, just in reverse.

Potential Price Targets For The ReleaseGBPUSD Daily

-----

Anyway, if we look at GBP/USD chart so the price is located near 200 period SMA waiting for direction.

If the price breaks 1.4457 resistance to above on close bar so the bullish trend will be continuing;

If the price breaks 1.4410 support level to below so the bearish reversal will be started;

If not so the price will be on ranging condition within the channel of the levels.

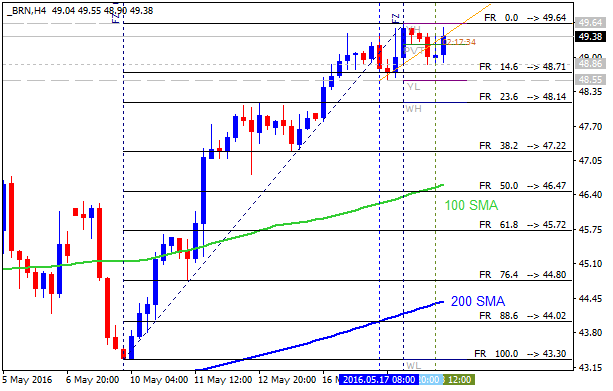

U.S. Commercial Crude Oil Inventories news event: intra-day ranging bullish within narrow levels

2016-05-18 14:30 GMT | [USD - Crude Oil Inventories]

[USD - Crude Oil Inventories] = Change in the number of barrels of crude oil held in inventory by commercial firms during the past week.

==========

"U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 1.3 million barrels from the previous week."

==========

Crude Oil M5: ranging. The price is ranging around 100 SMA/200 SMA area from 49.53 Fibo bullish level to Fibo bearish support level at 48.90.

Crude Oil H4: bullish ranging within narrow s/r levels. The price is located above 100 SMA/200 SMA area on the ranging within 49.64 resistance and 46.47 support levels.

If the price breaks 49.64 level to above so the bullish trend for intra-day price movement will be continuing.

If the price breaks 46.47 support level to below so the reversal of the price movement to the primary bearish condition will be started.

If not so the price will be moved within the channel for ranging bullish.

EUR/USD Intra-Day Fundamentals: FOMC Meeting Minutes and 66 pips price movement

2016-05-18 18:00 GMT | [USD - FOMC Meeting Minutes]

[USD - FOMC Meeting Minutes] = Record of the FOMC's most recent meeting, providing in-depth insights into the economic and financial conditions that influenced their vote on where to set interest rates.

==========

"Participants agreed that their ongoing assessments of the data and other incoming information, as well as the implications for the outlook, would determine the timing and pace of future adjustments to the stance of monetary policy. Most participants judged that if incoming data were consistent with economic growth picking up in the second quarter, labor market conditions continuing to strengthen, and inflation making progress toward the Committee's 2 percent objective, then it likely would be appropriate for the Committee to increase the target range for the federal funds rate in June. Participants expressed a range of views about the likelihood that incoming information would make it appropriate to adjust the stance of policy at the time of the next meeting. Several participants were concerned that the incoming information might not provide sufficiently clear signals to determine by mid-June whether an increase in the target range for the federal funds rate would be warranted. Some participants expressed more confidence that incoming data would prove broadly consistent with economic conditions that would make an increase in the target range in June appropriate. Some participants were concerned that market participants may not have properly assessed the likelihood of an increase in the target range at the June meeting, and they emphasized the importance of communicating clearly over the intermeeting period how the Committee intends to respond to economic and financial developments."

==========

EUR/USD M5: 66 pips price movement by FOMC Meeting Minutes news event :

AUD/USD Intra-Day Fundamentals: Australian Employment Change and 38 pips price movement

2016-05-19 01:30 GMT | [AUD - Employment Change]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Employment Change] = Change in the number of employed people during the previous month.

==========

==========

AUD/USD M5: 38 pips price movement by Australian Employment Change news event