You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Trading the News: Federal Funds Rate (based on the article)

What’s Expected:

Why Is This Event Important:

Even though Fed Chair Janet Yellen remains largely concerned about the ‘external risks’ surrounding the region, a growing number of Fed officials may look to further normalize monetary policy in the first-half of 2016 especially as the U.S. economy approaches ‘full-employment.’

However, easing confidence along with the slowdown in household spending may dampen Fed expectations for a ‘consumer-led’ recovery, and more of the same from the central bank may drag on the dollar as market participants push out bets for the next Fed rate-hike.

How To Trade This Event Risk

Bullish USD Trade: Policy Statement Highlights Growing Dissent Within FOMC

- Need red, five-minute candle following the rate decision to consider a short EUR/USD position.

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from cost; at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is met, set reasonable limit.

Bearish USD Trade: Fed Votes 9-1 Once Again to Retain Current Policy- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same strategy as the bullish dollar trade, just in the opposite direction.

Potential Price Targets For The ReleaseEURUSD Daily

Interview with Benoît Cœuré, Member of the Executive Board of the ECB, conducted by Alessandro Merli on 25 April and published on 27 April 2016

There are some key point from this interview:

EUR/USD Intra-Day Fundamentals: Federal Funds Rate and 89 pips price movement

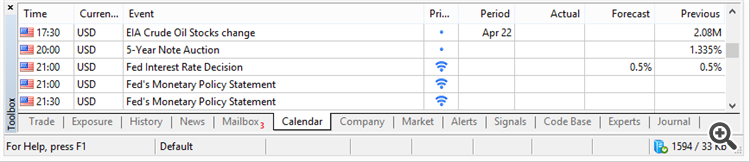

2016-04-27 18:00 GMT | [USD - Federal Funds Rate]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Federal Funds Rate] = Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight.

==========

"Against this backdrop, the Committee decided to maintain the target range for the federal funds rate at 1/4 to 1/2 percent. The stance of monetary policy remains accommodative, thereby supporting further improvement in labor market conditions and a return to 2 percent inflation."

==========

EUR/USD M5: 89 pips price movement by Federal Funds Rate news event :

USD/JPY Intra-Day Fundamentals: Japan Monetary Policy Statement and 289 pips price movement

2016-04-28 03:01 GMT | [JPY - Japan Interest Rate Decision]

if actual > forecast (or previous one) = good for currency (for JPY in our case)

==========

USD/JPY sees a 200-pips fall:

"The yen jolted nearly 200-pips higher versus the American dollar in a knee-jerk reaction to the BOJ policy announcement, as the central bank keeps monetary policy steady, maintains 80 trln Yen base money target and 0.1% negative interest rate. USD/JPY plunged to fresh one-week lows of 108.78 immediately after the BOJ decision, before recovering some ground to now trade around 109.25, still down –2.03% on the day."

"The Japanese currency received a huge boosts as markets were expecting more easing from the BOJ in wake of the recent appreciation in the yen against the greenback and underlying subdued price trends. However, markets were disappointed as BOJ decided to adopt loan support programme only for banks in areas hit by southern Japan quake."

==========

USD/JPY M5: 289 pips price movement by Japan Monetary Policy Statement news event :

What’s Expected:

Why Is This Event Important:

A soft growth figure may encourage the Federal Reserve to retain its current policy throughout most of 2016 amid the ongoing 9 to 1 split within the central bank, but a marked rebound in the core Personal Consumption Expenditure (PCE), the Fed’s preferred gauge for inflation, may put increased pressure on Chair Janet Yellen and Co. to further normalize monetary policy over the coming months especially as the U.S. economy approaches ‘full-employment.’

Nevertheless, the pickup in housing accompanied by ongoing improvement in labor-market dynamics may help to boost economic activity, and a positive development may generate a bullish reaction in the U.S. dollar as it puts increased pressure on the Federal Reserve to further normalize monetary policy sooner rather than later.

How To Trade This Event Risk

Bearish USD Trade: 1Q GDP Report Warns of Slowing Recovery

- Need to see green, five-minute candle following the GDP report to consider a long trade on EURUSD.

- If market reaction favors a bearish dollar trade, buy EURUSD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bullish USD Trade: U.S. Expands Annualized 0.6% or Greater, Core PCE Rebounds- Need red, five-minute candle to favor a short EURUSD trade.

- Implement same setup as the bearish dollar trade, just in the opposite direction.

Potential Price Targets For The ReleaseEURUSD Daily

EUR/USD Intra-Day Fundamentals: U.S. Gross Domestic Product and 19 pips range price movement

2016-04-28 12:30 GMT | [USD - GDP]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - GDP] = Annualized change in the inflation-adjusted value of all goods and services produced by the economy.

==========

"Real gross domestic product -- the value of the goods and services produced by the nation’s economy less the value of the goods and services used up in production, adjusted for price changes -- increased at an annual rate of 0.5 percent in the first quarter of 2016, according to the "advance" estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 1.4 percent."

==========

EUR/USD M5: 19 pips range price movement by U.S. Gross Domestic Product news event :

EUR/USD Intra-Day Fundamentals: Spanish GDP and 27 pips range price movement

2016-04-29 07:00 GMT | [EUR - Spanish GDP]

if actual > forecast (or previous one) = good for currency (for EUR in our case)

[EUR - Spanish GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

==========

EUR/USD M5: 27 pips range price movement by Spanish GDP news event :

USD/CAD Intra-Day Fundamentals: Canada Gross Domestic Product and 28 pips range price movement

2016-04-29 12:30 GMT | [CAD - GDP]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

==========

USD/CAD M5: 28 pips range price movement by Canada Gross Domestic Product news event :

Fundamental Weekly Forecasts for Dollar Index, EUR/USD, GBP/USD, USD/CNH, USD/CAD, AUD/USD and GOLD (based on the article)

Dollar Index - "The fading interest in the US monetary policy advantage can be recharged if the event risk can override the market’s skepticism. Both data and Fedspeak will offer an opportunity to shake rate speculation to life. There is a long list of data including sentiment surveys, trade, factory and service activity, housing and credit; but the real weight rests with the April labor report on Friday. The wage figure is where the data still has room to lift the hawks. Fed officials may also maintain their effort to bridge the gap of market skepticism."

EUR/USD - "Expectations for bullishness down-the-road could be well-founded, as we have that recently triggered set of policies out of the ECB mentioned above; and price action is even making a similar case as prices have continued to rise. But the latter of these thesis are likely more-driven by larger overall macro-economic flows (mainly, the US Dollar being extremely weak) than organic, legitimate strength in the Euro."

GBP/USD - "GBP/USD may make a more meaningful attempt to break out of the downward trend carried over from last August especially as the Relative Strength Index (RSI) preserves the bullish formation from earlier this year. A close above near-term resistance around 1.4620 (50% expansion) to 1.4660 (50% retracement) may fuel a further advance in the exchange rate, with the next topside region of interest coming in at 1.4800 (61.8% retracement)."

USD/CNH - "Chinese regulators have introduced tightened rules on commodity trading this past Wednesday in the effort of curbing excess speculation. Following the introduction of the new rules, the upward trend for major commodities had temporarily stopped. Yet, two days after those policies were rolled out commodities began to regain its earlier momentum. Cooking coal and iron ore hit the increased limit-up levels under the new rule while other commodities saw significant increase as well. With this aggressive price action, traders will want to keep a close eye on the commodity market in case of any major change in capital flows."

USD/CAD - "There are three components that have led to a Canadian Dollar surge since the end of January in Oil, US Dollar, and Canadian Economic Data. However, if you would like to boil these factors down to one market to watch, the closing of the gap in 2Y sovereign yields between the United States and Canada is great."

AUD/USD - "While the Fed has made steady progress on the employment side of its mandate, nailing down price growth has proved tricky. The pace of wage expansion is critical here because a steady pickup would signal rising structural inflation pressure, a welcome sign that the underlying trend is heading in the right direction independently of flighty oil- and FX-inspired price swings."

GOLD (XAU/USD) - "Will the US economy add jobs as expected? That is a question to be answered on Friday May 6. US Non-Farm Payrolls are set to be released and the market is anticipating that 215k jobs were added. If the market sees the jobs report as an inflationary number, then we may see gold price sell off. This, in my opinion, would be the resulting recognition that inflation is trying to bubble up and rate hikes may come sooner. If the market sees the jobs report as a disinflationary figure, Gold prices may continue to bump higher."

Forex Weekly Outlook May 2-6 (based on the article)