Join our fan page

- Views:

- 21436

- Rating:

- Published:

- 2010.01.26 11:17

- Updated:

- 2016.11.22 07:32

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

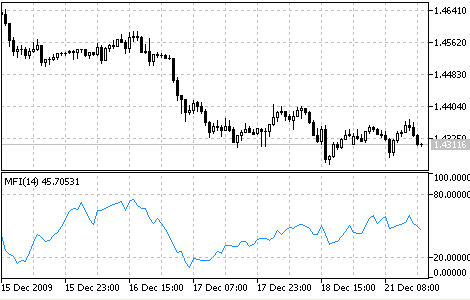

Money Flow Index (MFI) is the technical indicator, which indicates the rate at which money is invested into a security and then withdrawn from it.

Construction and interpretation of the indicator is similar to Relative Strength Index with the only difference that volume is important to MFI.

When analyzing the money flow index one needs to take into consideration the following points:

- Divergences between the indicator and price movement. If prices grow while MFI falls (or vice versa), there is a great probability of a price reversal;

- Money Flow Index value, which is over 80 or under 20, signals correspondingly of a potential peak or bottom of the market.

Image:

Money Flow Index indicator

Calculation:

The calculation of Money Flow Index includes several stages. At first one defines the typical price (TP) of the period in question:

TP = (HIGH + LOW + CLOSE) / 3

Then one calculates the amount of the Money Flow (MF):

MF = TP * VOLUME

If today’s typical price is larger than yesterday’s TP, then the money flow is considered positive. If today’s typical price is lower than that of yesterday, the money flow is considered negative.

POSITIVE MONEY FLOW is a sum of positive money flows for a selected period of time. NEGATIVE MONEY FLOW is the sum of negative money flows for a selected period of time.

Then one calculates the money ratio (MR) by dividing the positive money flow by the negative money flow:

MR = POSITIVE MONEY FLOW / NEGATIVE MONEY FLOW

And finally, one calculates the money flow index using the money ratio:

MFI = 100 - (100 / (1 + MR))

where:

- HIGH - the highest price of the current bar;

- LOW - the lowest price of the current bar;

- CLOSE - close price of the current bar;

- VOLUME - volume of the current bar.

Translated from Russian by MetaQuotes Ltd.

Original code: https://www.mql5.com/ru/code/38

Mass Index

Mass Index

The Mass Index is developed to catch the trend reversal points. It is based on changes between maximum and minimum prices. If the amplitude gets wider, the mass index grows; if it gets narrower, the index gets smaller. The mass index was created by Donald Dorcy.

ColorCandlesDaily

ColorCandlesDaily

The ColorCandlesDaily indicator draws candles with different colors depending on the day of the week.

Momentum

Momentum

The Momentum Technical Indicator measures the amount that a security’s price has changed over a given time period.

On Balance Volume (OBV)

On Balance Volume (OBV)

The On Balance Volume Indicator (OBV) is a momentum technical indicator that relates volume to price change.